Leading Korean car brands absent from 2025 Shanghai Auto Show: Falling behind or playing their cards close to their chest?

![]() 04/21 2025

04/21 2025

![]() 543

543

Author | Zhen Yao

Editor | Li GuozhengProduced by | Bangning Studio (gbngzs)

'Spend money on what matters most, spend money on users. There's nothing special to exhibit right now, so we're not participating.' On April 17, a relevant person in charge of Beijing Hyundai told Bangning Studio in an interview.

Recently, the topic of Korean car brands collectively absent from the 2025 Shanghai Auto Show has sparked speculation in the industry. In the global automotive landscape, Korean car brands occupy an important position that cannot be ignored. This absence marks the first time that Hyundai and Kia have missed a domestic A-class large auto show in the 23 years since they entered China in 2002.

'We are in the midst of intensively preparing the OE electric vehicle project internally. At this stage, it is not yet fully ready, and the team is fully committed to catching up with the schedule.' The aforementioned person further revealed that Korean shareholders require strict confidentiality regarding information on the new platform architecture and the first electric vehicle model, and details will not be disclosed to the outside world.

Although not participating in this year's Shanghai Auto Show, Beijing Hyundai has not stopped its pace in market promotion and brand building. On April 21, Beijing Hyundai will hold a brand strategy communication meeting and the global debut of its first pure electric SUV platform in Shanghai. 'At the event on that day, we will explain to the outside world the reasons for not participating in the Shanghai Auto Show and announce our recent strategic plan.' The person said.

Five days later (April 23), the 21st Shanghai International Automobile Industry Exhibition (abbreviated as '2025 Shanghai Auto Show') will be held as scheduled. As one of the most influential international A-class auto shows in the world, the Shanghai Auto Show is held every two years. It is a stage for global automakers to compete to showcase their strength and attract attention, as well as a wind vane for innovation and development in the automotive industry.

According to the organizing committee, the 2025 Shanghai Auto Show has invited nearly 1,000 well-known Chinese and foreign enterprises from 26 countries and regions to participate, with a total exhibition area exceeding 360,000 square meters. The scope of participating countries is broader, and the scale has reached a new high.

For this automotive feast, some automakers are eagerly preparing and confident, ready to make a big splash at the auto show; while some automotive brands unfortunately miss out on the auto show and can only watch others from the sidelines.

Incomplete statistics show that among foreign and joint venture brands, in addition to Korean car brands, French brands Dongfeng Citroen and Dongfeng Peugeot, as well as SAIC-GM Chevrolet and Subaru, will not participate; among Chinese brands, brands such as Hozon, Nezha, Geely New Energy, and Voyah will also not participate.

Is the absence of these brands from the Shanghai Auto Show a harbinger of being marginalized by the market and facing elimination, or a wise strategy of self-preservation and retreating to advance?

'Spend money on what matters most'

Five months ago, at the 2024 Guangzhou Auto Show, Beijing Hyundai showcased its flagship models, including the fifth-generation Santa Fe, the new Tucson L, the Mufa, the new Elantra, and the N Line series, conveying new breakthroughs in intelligence and electrification, as well as its determination for change and strategic layout.

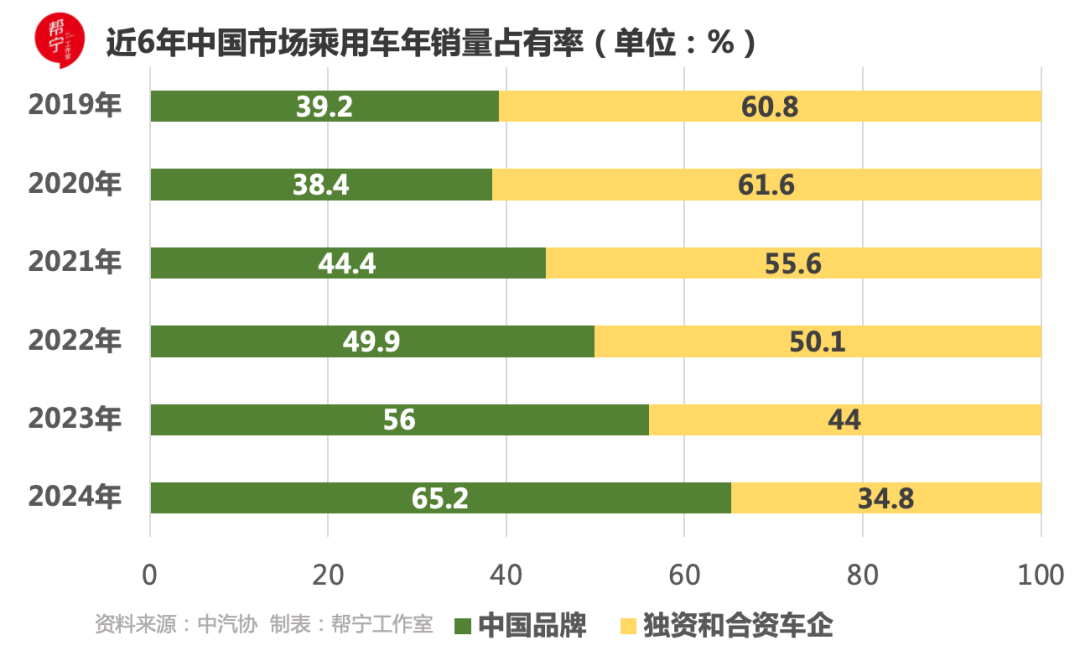

However, in recent years, the domestic market has undergone rapid changes. The sales of Chinese brand passenger vehicles have soared, accounting for 65.2% in 2024, while the market share of joint venture brands has shrunk significantly, retreating to around 35%. Among them, Korean car brands have faced particular difficulties, accounting for only 1.6%.

Specifically for Beijing Hyundai, in its peak year of 2016, sales reached 1.14 million units, but since then, it has fallen into a quagmire of continuous decline. In 2024, its sales were 154,000 units, a year-on-year decrease of 33%.

There has been speculation about whether Beijing Hyundai is in danger. 'This is not the most dangerous moment for Beijing Hyundai.' In February of this year, Wu Zhoutao, chairman of Beijing Hyundai, said in an exclusive interview with Bangning Studio.

'Compared to starting from scratch 20 years ago, we are now in a transformation phase, which is actually an opportunity amidst the crisis.' Wu Zhoutao said that the Chinese automotive market is huge, with annual sales exceeding 20 million units, making it the largest market in the world. At the same time, China's auto exports are also the largest in the world. These are all opportunities that Beijing Hyundai can seize.

Based on this, about a year ago, in April 2024, Beijing Hyundai launched the 'In China, For the World' strategy, embarking on a new round of transformation. The core of the new strategy is to meet the needs of the Chinese market, develop products locally in China, and at the same time, expand the overseas market with high-quality and cost-controllable products.

'In the coming years, we will launch more than 2 electric vehicles each year, covering various types such as pure electric, extended-range, and hybrid.' A relevant person from Beijing Hyundai revealed that these new vehicles will also be included in the export plan.

Last year, Beijing Hyundai exported more than 50,000 vehicles, a fourfold increase year-on-year. This year's export target is set at 80,000-100,000 vehicles, and it is expected to exceed 150,000 vehicles by 2027.

In addition, at the end of 2024, Beijing Hyundai received a 'timely rain', with shareholders BAIC Investment and Hyundai Motor jointly increasing their investment by US$1.095 billion (approximately RMB 8 billion) to help its transformation towards new energy and intelligence.

Car manufacturing is too expensive, and capital is crucial to the survival of enterprises. Eight billion yuan may seem like a lot, but in the 'money-swallowing monster' game of car manufacturing, it is merely a drop in the bucket. Beijing Hyundai must spend every penny on what matters most and not waste a single cent. After all, one must survive first to be eligible to talk about development.

Therefore, faced with the participation costs of the Shanghai Auto Show, which can easily reach tens of millions of yuan, Beijing Hyundai has to weigh the pros and cons.

'The Shanghai Auto Show itself is a battle for traffic. We choose to prepare products and media communication meetings before the auto show, 'traveling off-peak' to seek more effective brand and product exposure.' A relevant person from Beijing Hyundai told Bangning Studio.

Another Korean brand, Yueda Kia, is quietly working hard.

After its reorganization in 2022, Yueda Kia initiated a series of internal changes to promote market localization and global development. Especially after implementing the development strategy of 'parallel development of oil and electricity' and 'synchronized domestic and export sales', Yueda Kia's performance in China has rebounded significantly.

In 2024, Yueda Kia sold over 248,000 vehicles, a year-on-year increase of 49.2%, ranking first in growth among joint venture brands. In the first quarter of this year, its production and sales volumes were 55,800 and 56,600 units, respectively, representing year-on-year increases of 21.8% and 13%.

Each with their own calculations

It is not the first time that Korean and French car brands have 'retreated' from auto shows. In the past, joint venture automakers were the main force at various auto shows, with brand launches one after another. However, at the 2024 Chengdu Auto Show, major joint venture manufacturers such as Toyota, Honda, and Buick did not hold official launches, and the atmosphere on-site was vastly different from the past.

At that auto show, due to the lack of eye-catching new cars, there were few visitors at the Toyota and Honda booths, with almost no one stopping by.

'In the past, automakers often placed more emphasis on face engineering, eager to showcase their brand image and pursue grandeur at auto shows. But now, with increasingly fierce market competition, automakers are beginning to value practical benefits, the so-called 'inside'.' An industry insider said that after all, under the dual pressure of sluggish sales and unreduced costs, automakers are having a hard time.

Why has the attitude towards auto shows changed?

Firstly, the high participation costs are a heavy burden.

A person from an automaker revealed that the participation costs include BTL (offline construction and operation) and ATL (online advertising, live streaming, new media, public relations, etc.) components. The specific costs vary depending on the exhibition area, but the overall investment usually requires tens of millions of yuan. If celebrities are invited to stand on stage, the costs will further increase. For example, according to the estimated participation fee of RMB 2,000 per square meter for a standard booth in the '2023 Shanghai Auto Show Prospectus', the BTL portion alone for some large automakers may reach RMB 20-30 million.

Brands like Nezha, Geely New Energy, and Voyah, which are on the fringes of the market, simply cannot afford such high costs and can only miss out on the auto show.

Secondly, traffic competition is fierce, and the effect of participation is diluted.

During the 2024 Beijing and Guangzhou Auto Shows, tech industry figures such as Zhou Hongyi, Lei Jun, and Yu Chengdong participated, attracting a lot of attention from the media and audiences, which limited the exposure of automakers.

'This time, the Venucia brand did not set up an independent booth and was not displayed alongside Dongfeng Nissan, but was included in Dongfeng's large autonomous system for an overall exhibition.' A relevant person from Dongfeng Nissan Venucia told Bangning Studio that Dongfeng's autonomous sector has formed a unified display style and will be presented collectively at the Dongfeng booth.

He further stated that Venucia's operating strategy is relatively pragmatic. For large auto shows in Beijing, Shanghai, etc., its participation focus is more on showcasing the brand level; while for regional auto shows in Qingdao, Changsha, Wuhan, etc., Venucia attaches great importance to them. Such local auto shows are regarded as important platforms for promoting sales, and Venucia's actions in terminal promotions and market penetration are more intensive.

Thirdly, off-peak launches have become a new choice for automakers to avoid traffic pressure.

To avoid direct competition with others during the auto show, many automakers choose to launch new cars and technologies off-peak. For example, from April 15 to 19, XPeng, GAC Honda, Zeekr, IM Motors, etc., held dense launch events, with a total of more than a dozen. Among them, Huawei's HarmonyOS Smart Drive new product launch and AITO brand night events on April 16 and 17 pushed the traffic competition to a climax.

Through off-peak launches, automakers showcase their products and technologies in a relatively relaxed environment, gaining more attention from the media and consumers.

Auto shows have always been a carnival of industry traffic, products, and technologies. Some automakers spend heavily to create luxurious booths in order to attract attention and grab traffic; while others focus on the long term, putting their energy into in-depth communication with dealers and partners.

Regardless of the strategy, putting aside face-saving, returning to the essence of business, examining input and output with a pragmatic attitude, and refining products and services guided by user needs are the fundamental ways for automakers to achieve long-term development.