Canadian Auto Market | Q1 2025: Slight Year-on-Year Increase of 3.7%

![]() 04/21 2025

04/21 2025

![]() 530

530

In the first quarter of 2025, Canada's new car market exhibited robust growth, with March sales surging 11.4% year-on-year to 185,000 units, and total Q1 sales rising 3.7% year-on-year to 431,000 units.

Light trucks commanded 88.1% of the market share, whereas passenger cars accounted for just 11.9%. General Motors emerged as the leader among major manufacturers with a 17.3% increase, while Ford, Hyundai-Kia, and other brands exhibited mixed performances.

01

Canadian Market

Sales Overview and Brand Performance

● The Canadian new car market witnessed moderate growth in Q1 2025, with total sales reaching 431,000 units, marking a 3.7% increase year-on-year.

March sales stood at 185,000 units, up 11.4% year-on-year, recording the best March performance since 2018.

The Seasonally Adjusted Annual Rate (SAAR) rose from 1.74 million units in March 2024 to 2.02 million units in March 2025, indicating robust demand in the Canadian automotive market. The market structure continued to favor light trucks, which captured 88.1% of the share, while passenger cars accounted for only 11.9%, reflecting consumers' preference for SUVs and pickup trucks.

● Major Brand Sales Performance:

◎ General Motors: Led the market with sales of 74,005 units, a 17.3% increase year-on-year, maintaining its position as the top OEM. Its Chevrolet (36,076 units, +14.8%) and GMC (25,734 units, +8.2%) brands performed robustly, and Cadillac (4,881 units, +63.5%) also achieved significant growth. GM's success was primarily fueled by strong demand for light trucks and SUVs, such as the Chevrolet Silverado and GMC Sierra.

◎ Ford: Sold 61,637 units, up 1.8% year-on-year, ranking second. The Ford brand (59,538 units, +1.9%) sustained its market leadership, with the F-Series pickup trucks as the mainstay performing impressively.

◎ Hyundai-Kia: Totaled sales of 52,529 units, up 4.4% year-on-year, surpassing Toyota to rank third. Hyundai (30,678 units, +11.4%) outperformed Kia (20,281 units, -4.4%), benefiting from the popularity of SUVs like the Tucson and Kona.

◎ Toyota: Sold 50,835 units, down 11.2% year-on-year, showing weak market performance. The Toyota brand (43,138 units, -15.0%) and Lexus (7,697 units, +17.6%) exhibited contrasting trends, with the significant decline in RAV4 sales being the primary drag.

◎ Nissan/Mitsubishi: Sold 38,539 units, up 0.2% year-on-year, demonstrating stable performance. Nissan (29,124 units, +3.8%) benefited from the explosive growth of the Kicks, while Mitsubishi (8,164 units, -8.5%) showed slight weakness.

◎ Honda: Sold 32,925 units, up 8.9% year-on-year, with stable sales of the CR-V and Civic supporting growth.

◎ Stellantis: Sold 26,466 units, down 18.2% year-on-year, showing weak performance. Sales of Ram (11,659 units, -29.1%) and Jeep (8,363 units, -24.1%) declined significantly.

● Highlights of Other Brands:

◎ Tesla: Estimated sales of 10,075 units, up 49.3% year-on-year, standing out in the electric vehicle segment with the Model Y as a top-seller.

◎ Mazda: Sold 16,538 units, up 21.5% year-on-year, with models like the CX-5 being well-received in the market.

02

Vehicle Sales and Competitive Landscape Analysis

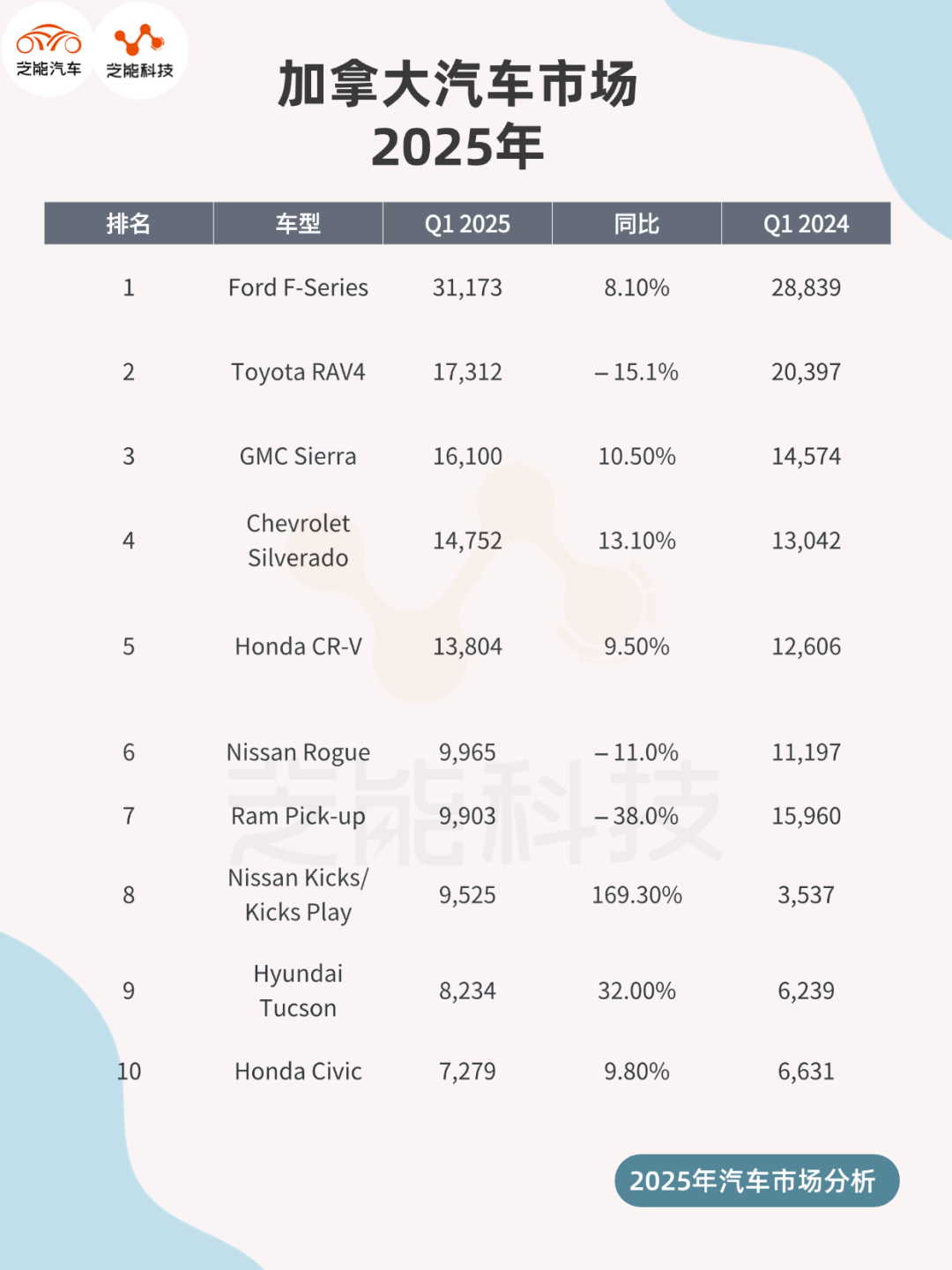

● Sales of the top 25 models in the Canadian market in Q1 2025 underscore the dominance of light trucks and SUVs:

◎ Ford F-Series (31,173 units, +8.1%): Remained atop the charts, continuing to consolidate its position as Canada's best-selling pickup truck.

◎ Toyota RAV4 (17,312 units, -15.1%): Despite ranking second, sales declined significantly, indicating weakened competitiveness in the compact SUV market.

◎ GMC Sierra (16,100 units, +10.5%): Ranked third, showcasing excellent performance and reflecting consumer demand for premium pickup trucks.

◎ Chevrolet Silverado (14,752 units, +13.1%): Ranked fourth, with significant year-on-year growth, contributing to GM's market leadership.

◎ Honda CR-V (13,804 units, +9.5%): Stable sales performance positioned it as a benchmark in the compact SUV segment.

◎ Nissan Rogue (9,965 units, -11.0%): Ranked sixth, still benefiting from the decline of Ram Pickup despite declining sales.

◎ Ram Pick-up (9,903 units, -38.0%): Saw a substantial decline, reflecting Stellantis' struggles in the pickup truck market.

◎ Nissan Kicks/Kicks Play (9,525 units, +169.3%): Exhibited explosive growth, entering the top ten, indicating strong demand for small SUVs.

◎ Hyundai Tucson (8,234 units, +32.0%): Ranked ninth, with significant growth, highlighting Hyundai's competitiveness in the SUV market.

◎ Honda Civic (7,279 units, +9.8%): As one of the few passenger cars on the list, it demonstrated resilience in the compact car market.

● Competitive Landscape

◎ The Canadian market's competitive landscape is heavily concentrated in light trucks and SUVs, with pickup truck models like the Ford F-Series, GMC Sierra, and Chevrolet Silverado dominating, reflecting consumers' preference for large, versatile vehicles.

◎ The compact SUV market is fiercely competitive, with Honda CR-V, Hyundai Tucson, and Nissan Kicks performing strongly, while Toyota RAV4's decline presents opportunities for competitors.

◎ The passenger car market continues to shrink, with only a few models such as the Honda Civic and Hyundai Elantra maintaining some competitiveness.

◎ GM and Ford dominate with their robust pickup truck and SUV product lines, while Hyundai-Kia is rapidly rising due to price advantages and a diverse SUV lineup.

◎ Toyota's decline may be attributed to its slower product update cycle and the waning competitiveness of the RAV4, with the overall market still dominated by traditional fuel vehicles.

◎ External factors such as the implementation of a 25% tariff in the US and the cancellation of the Canadian carbon tax will further shape the market landscape. The tariff may increase the prices of imported models, affecting the entry of Japanese and Korean brands, as well as potential Chinese brands, while the cancellation of the carbon tax may stimulate demand for fuel vehicles, posing challenges to electric vehicle sales.

Summary

In Q1 2025, Canada's new car market achieved robust growth, primarily driven by light trucks. General Motors led the market thanks to the outstanding performance of the Chevrolet Silverado and GMC Sierra. Ford, Hyundai-Kia, and other brands demonstrated varying degrees of competitiveness, with pickup trucks and SUVs dominating the market and intense competition in the compact SUV segment.