Big Fish in Robotics: ABB's Robotics Business to be Spun Off and Listed

![]() 04/21 2025

04/21 2025

![]() 473

473

Produced by ZhiNeng Technology

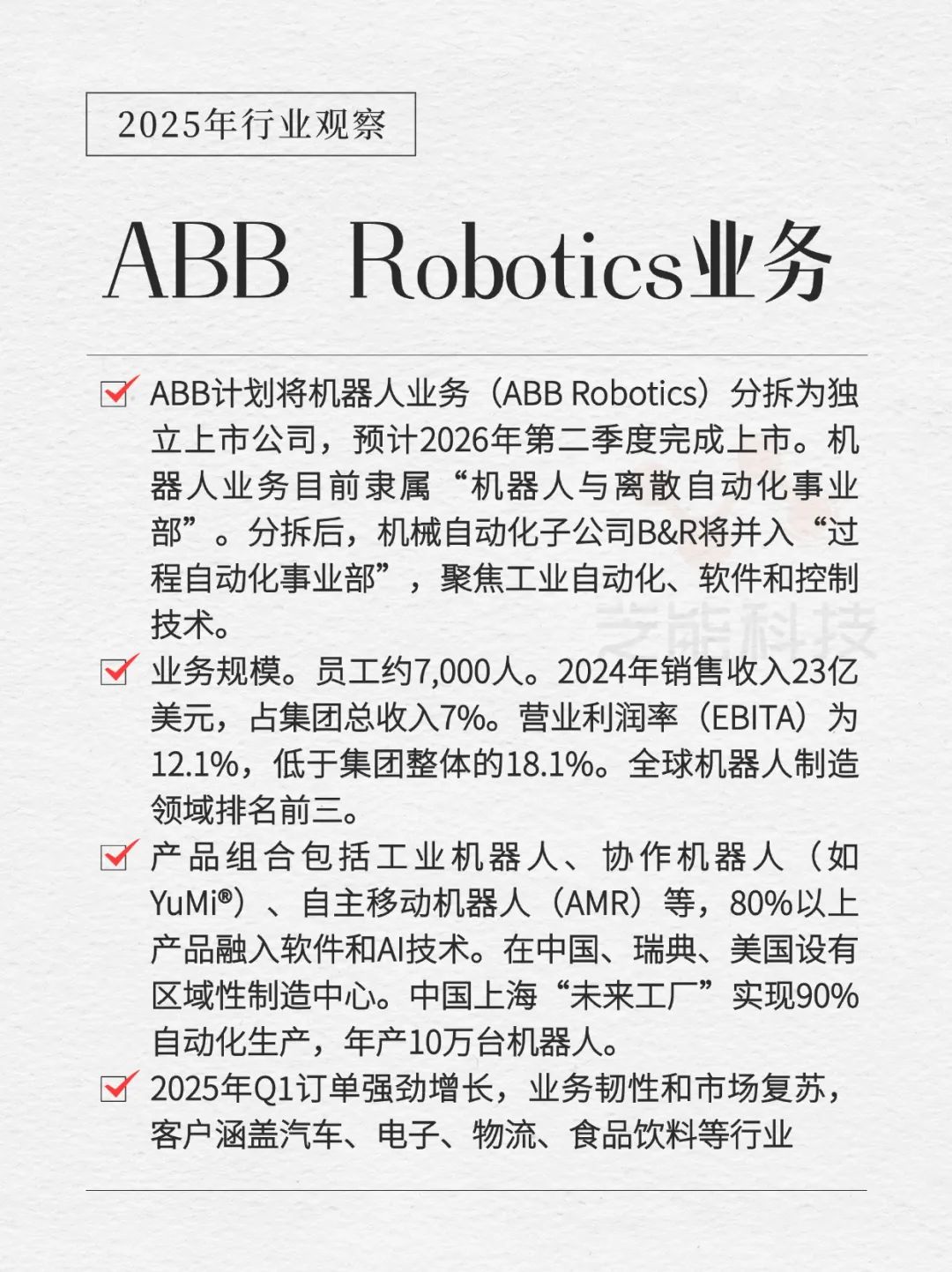

ABB Group has announced its plans to spin off its robotics business, ABB Robotics, as an independent, publicly listed company, with the listing expected to conclude in the second quarter of 2026.

Amidst the growing buzz around robotics, ABB aims to strategically unlock the growth potential of its robotics arm while optimizing the Group's overall value creation capabilities. Despite being a top-three player in the global robotics market, ABB Robotics' synergy with other Group businesses is limited, and it faces challenges posed by industry transformations.

Let's delve into the background, motivations, and strategic importance of ABB's robotics business spin-off, as well as the emerging trends and challenges in the robotics industry. We'll also discuss the profound impact of this spin-off on ABB and the global robotics market.

01

ABB Robotics

Background and Motivations for Business Spin-off

ABB Group, a global leader in power and automation technology, holds a prominent position in industrial robotics manufacturing through its robotics business, ABB Robotics. The decision to spin off and list this business independently stems from strategic adjustments and industry changes. The background and motivations for this move can be analyzed from various angles.

While ABB Robotics ranks among the top three in the global robotics market, its synergy with other Group businesses (such as electrification and process automation) is minimal.

In 2024, the robotics business generated $2.3 billion in revenue, accounting for just 7% of the Group's total revenue. Furthermore, its operating profit margin (EBITA) was 12.1%, significantly lower than the Group's overall margin of 18.1%.

CEO Morten Wierod emphasized that the robotics business faces market demands and customer bases distinct from those of other ABB businesses. For instance, electrification and process automation focus on energy efficiency and large-scale industrial systems, whereas the robotics business prioritizes flexible manufacturing and intelligent automation. The spin-off will enable the robotics business to more effectively address specific market needs.

● The global robotics market is rapidly transforming. According to the International Federation of Robotics (IFR), the market size reached $16.5 billion in 2023, showcasing a trend towards diversification.

◎ Traditional heavy-duty industrial robots continue to dominate, but demand for emerging categories such as collaborative robots (like ABB's YuMi®) and autonomous mobile robots (AMR) is surging. These new areas necessitate more agile R&D, marketing, and supply chain strategies.

◎ ABB Group's comprehensive management structure may hinder the robotics business's rapid response to market changes. Competitors like Fanuc, KUKA, and emerging Chinese manufacturers (such as Estun and Inovance) excel in specific market segments, intensifying competitive pressure.

The spin-off and listing will grant ABB Robotics an independent capital and governance structure, allowing it to allocate capital and make strategic investments more flexibly.

Currently, the robotics business's valuation might be underestimated due to the complexity of the Group's diversified operations. Post-listing, the capital market is expected to reassess its value, unleashing greater growth potential.

ABB plans to distribute shares of the new company to existing shareholders as a special dividend through share allocation. This approach not only incentivizes shareholders to support the spin-off but also ensures the stability of the Group's overall financial structure.

In the first quarter of 2025, ABB Robotics experienced robust order growth, reflecting market demand recovery and business resilience. Despite fluctuations in automotive industry demand, the robotics business achieved stable development through diversified applications in electronics, logistics, and food and beverage.

The spin-off will grant the robotics business greater autonomy, enabling it to seize market opportunities more swiftly, particularly in high-growth areas like collaborative robots and mobile robots.

Concurrently with the robotics business spin-off, ABB has restructured its automation business. B&R, the mechanical automation subsidiary that previously collaborated closely with the robotics business, will be integrated into the Process Automation Division, focusing on industrial automation, software, and control technology.

This adjustment aims to enhance the competitiveness of the process automation business in emerging markets like hybrid manufacturing and improve customer value through software and control technology synergy. By focusing on core businesses and optimizing resource allocation, ABB is bolstering the Group's overall competitiveness and profitability.

02

Trends in the Robotics Industry and Strategic Significance of the Spin-off

ABB's robotics business spin-off is not merely an internal strategic adjustment but also reflects the new trends and challenges in the global robotics industry. The strategic significance of this move lies in helping ABB Robotics better adapt to industry changes while injecting fresh momentum into the Group's overall development.

● The global robotics industry is evolving from a heavy focus on heavy-duty industrial robots to a more diversified landscape.

◎ Collaborative robots, with their safety, flexibility, and human-machine interaction capabilities, have become the preferred choice for small and medium-sized enterprises and emerging industries. ◎ Demand for autonomous mobile robots (AMR) in logistics and warehousing is surging. ◎ AI and software-driven robots are accelerating the adoption of flexible manufacturing. ABB Robotics has integrated 80% of its product portfolio with software and AI technology, such as its FlexPicker and YuMi® robots, demonstrating technological leadership. Post-spin-off, the independent company can focus more on technology R&D and product iteration, accelerating its presence in high-growth areas.

ABB Robotics operates production bases in three major regions globally (China, Sweden, and the United States), reflecting the success of its localization strategy.

Particularly in China, since establishing its robotics R&D center in 1994, ABB has invested in building the world's largest robotics production base. After the "Factory of the Future" in Shanghai commenced operations in 2022, 90% of production is automated, with a capacity to deliver 100,000 robots annually.

Post-spin-off, the independent company will inherit this localization advantage and address trade barriers and geopolitical risks through flexible regional operations. For example, 75%-80% of ABB's products in the U.S. market are locally manufactured, and some products benefit from tariff exemption policies, enhancing market competitiveness.

● The robotics industry's competitive landscape is becoming increasingly complex.

◎ Traditional giants like Fanuc and KUKA dominate the automotive and heavy industry sectors, while emerging players such as Universal Robots (collaborative robots) and Chinese manufacturers excel in cost and localized services. ◎ Post-spin-off, ABB Robotics must consolidate its market position through differentiation strategies, such as increasing investments in AI, vision technology, and cloud platforms to enhance product intelligence. Simultaneously, the independent company may enter new markets through small acquisitions or strategic partnerships, such as in logistics robots or medical robots, to complement its current product portfolio.

The independent listing will provide ABB Robotics with direct financing channels to support increased investments in R&D and market expansion. Currently, the robotics industry's investment boom focuses on AI-driven automation solutions and green manufacturing technologies. The independent company is expected to attract more investors focused on the technology and industrial sectors.

Moreover, strong cash flow and a robust capital structure will provide financial support for mergers and acquisitions and innovation, giving the new company a competitive edge.

● The robotics industry faces multiple challenges, including supply chain fluctuations, labor shortages, and delays in customer investment decisions.

◎ The automotive industry, a significant customer for ABB Robotics, has been impacted by the transition to electrification and demand fluctuations, leading to unstable order patterns. ◎ Post-spin-off, the independent company must diversify its customer base (such as electronics, logistics, and food and beverage) to mitigate risks from a single industry. Simultaneously, changes in the global trade situation (like U.S. tariff policies) may increase import costs, necessitating further optimization of the independent company's global supply chain and localized production to maintain a cost advantage.

● Strategic Adjustment of ABB Group

◎ Spinning off the robotics business will enable ABB Group to concentrate more on its two core areas of electrification and process automation, improving overall profitability and resource efficiency. In the first quarter of 2025, ABB Group's revenue increased by 1% year-on-year to $7.94 billion, with orders rising by 3% to $9.21 billion and an EBITA margin of 20.2%, demonstrating robust operational performance.

◎ Post-spin-off, the Group will further enhance profitability by divesting low-margin businesses and integrating high-growth areas (such as the synergy between B&R and process automation). Additionally, the divestment of non-core businesses like real estate assets has provided additional funds to support the Group's investments in emerging markets such as smart buildings and electric vehicle charging.

Summary

ABB Group's decision to spin off and list its robotics business independently is a positive response to changes in the global robotics industry and a strategic optimization for the Group.

By unleashing the growth potential of ABB Robotics, the independent company will be able to more flexibly address diversified market demands and technological advancements, reinforcing its leading position in high-growth areas like collaborative robots and mobile robots. The spin-off will also enable ABB Group to focus more on electrification and process automation, enhancing overall profitability and market competitiveness.