European Auto Market | Norway March 2025: Sales Exceed Expectations

![]() 04/16 2025

04/16 2025

![]() 409

409

In March 2025, Norway's new car market grew by 36.5% year-on-year, with first-quarter sales up 42%.

Pure electric vehicles continue to dominate the market, accounting for 84.1%, but sales of plug-in hybrid vehicles (PHEV) surged due to tax policy adjustments.

Tesla Model Y maintains its lead, but brands such as Volkswagen and Volvo are rapidly rising. Among Chinese brands, BYD and XPeng shone, demonstrating their competitiveness in the electric vehicle field.

This article is written by ChiNeng Tech, analyzing brand and model dynamics in the Norwegian market.

01

Norway Sales Overview and Brand Performance

● In March 2025, Norway's new car market sales reached 13,304 units, up 36.5% year-on-year, reversing the 49.7% decline in March 2024.

● Cumulative sales in the first quarter were 31,596 units, up 42% year-on-year, reflecting strong consumer demand for new cars in Norway.

As the market with the highest electric vehicle penetration rate globally, 11,192 pure electric vehicles were sold in March, up 28.5% year-on-year, with a market share of 84.1%. Although slightly lower than 89.3% in the same period of 2024, it still shows the absolute dominance of electric vehicles.

Sales of plug-in hybrid vehicles (PHEV) surged by 476.2% to 1,210 units, accounting for 9.1% of the market, becoming a new highlight, due to the expectation of tax increases in April.

● Mainstream Brand Performance

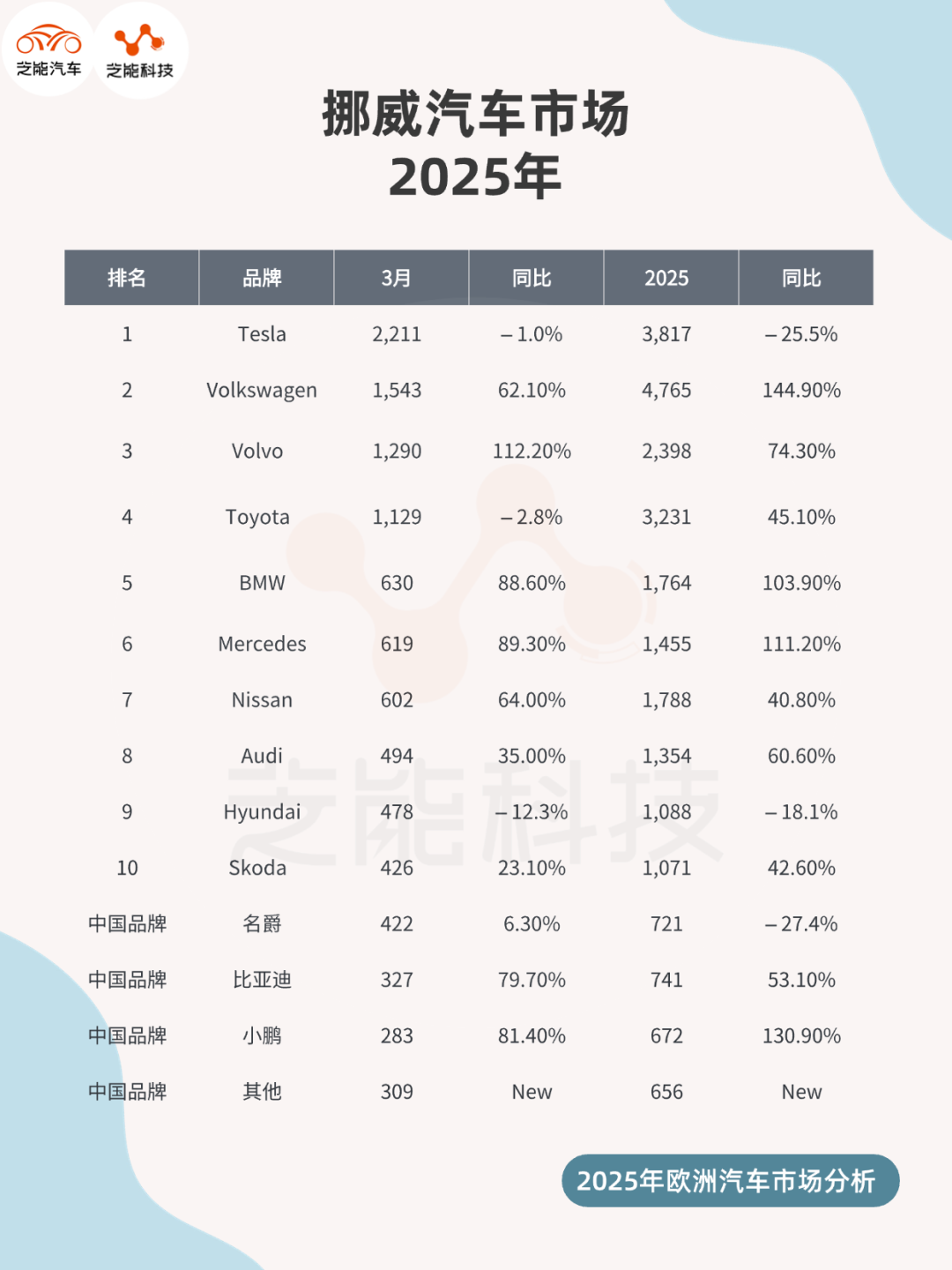

◎ Tesla: Sold 2,211 units in March, down 1% year-on-year, ranking first with a market share of 16.6%. However, with the market growing by 36.5%, Tesla's performance fell short of expectations, with first-quarter sales of 3,817 units, down 25.5% year-on-year.

◎ Volkswagen: Sold 1,543 units, up 62.1% year-on-year, ranking second. Cumulative sales in the first quarter were 4,765 units, up 144.9%, firmly holding the top spot for the year, driven by the popularity of the ID.4 and ID.7.

◎ Volvo: Sold 1,290 units, up 112.2% year-on-year, ranking third with a market share of 9.7%. The PHEV versions of the XC90 and XC60 performed outstandingly, with first-quarter sales of 2,398 units, up 74.3%.

◎ Toyota: Sold 1,129 units, down 2.8% year-on-year, ranking fourth. The bZ4X and Yaris Cross showed mixed performance, with first-quarter sales of 3,231 units, up 45.1%.

◎ BMW: Sold 630 units, up 88.6% year-on-year, ranking fifth. Cumulative sales in the first quarter were 1,764 units, up 103.9%, with the electric i-series performing steadily.

◎ Mercedes: Sold 619 units, up 89.3% year-on-year, ranking sixth. Cumulative sales in the first quarter were 1,455 units, up 111.2%, with the EQA and EQB contributing to the brand's rise.

◎ Nissan: Sold 602 units, up 64% year-on-year, ranking seventh. The popularity of the Ariya has given it a place in the electric vehicle market.

● Chinese Brand Performance

Chinese brands are gradually increasing their penetration in the Norwegian market, demonstrating competitiveness with their electric vehicle products in this highly electrified market:

◎ BYD: Sold 327 units in March, up 79.7% year-on-year, with cumulative sales of 741 units in the first quarter, up 53.1%. The BYD Tang and Atto 3 are favored by Norwegian consumers for their long range and affordable prices.

◎ XPeng: Sold 283 units in March, up 81.4% year-on-year, with cumulative sales of 672 units in the first quarter, up 130.9%. The XPeng P7 and G9 attract consumers with their intelligence and high-end positioning, showing strong growth momentum.

◎ MG: Sold 422 units in March, up 6.3% year-on-year, with cumulative sales of 721 units in the first quarter, down 27.4% year-on-year. The MG4 Electric performs steadily in the compact electric vehicle market but faces pressure from competitors like the Volkswagen ID.3.

◎ Other Chinese Brands: Sold 309 units, all new entrants to the market, with cumulative sales of 656 units in the first quarter. Brands such as Zeekr and NIO are testing the waters in the Norwegian market, demonstrating the expansion ambitions of Chinese automakers.

Chinese brands account for about 10% of total sales, playing an increasingly important role in the Norwegian electric vehicle market. The rapid growth of BYD and XPeng is due to improvements in product strength and localized operations, while MG's slowdown reflects its lack of competitiveness in the high-end market.

02

Top-Selling Models and Competitive Landscape

● Overview of Top-Selling Models

In March 2025, Norway's top-selling models were dominated by pure electric vehicles, with plug-in hybrids emerging due to policy drivers. Here are the key model performances:

◎ Tesla Model Y: 1,822 units, down 8.6% year-on-year, with a market share of 13.7%, ranking first. Cumulative sales in the first quarter were 2,787 units, down 40.8%, still the annual champion. Its spatial advantage and brand effect continue to attract consumers.

◎ Nissan Ariya: 569 units, up 247% year-on-year, ranking second. Cumulative sales in the first quarter were 1,740 units, up 214.6%, making it a dark horse in the compact SUV market.

◎ Volkswagen ID.7: 552 units, up 711.8% year-on-year, ranking third. Cumulative sales in the first quarter were 1,431 units, up 722.4%, highlighted by its high-end positioning and long range.

◎ Volkswagen ID.4: 551 units, up 12.9% year-on-year, ranking fourth. Cumulative sales in the first quarter were 1,893 units, up 104.9%, solidifying its position in the mid-size SUV market.

◎ Toyota bZ4X: 525 units, down 34.4% year-on-year, ranking fifth. Cumulative sales in the first quarter were 2,287 units, up 72.7%, maintaining a leading position in annual sales despite poor monthly performance.

◎ Volvo EX30: 424 units, up 10.4% year-on-year, ranking sixth. Cumulative sales in the first quarter were 898 units, up 25.8%, with a precise positioning as a compact electric SUV.

◎ Tesla Model 3: 386 units, up 75.5% year-on-year, ranking seventh. Cumulative sales in the first quarter were 1,021 units, up 164.5%, with competitiveness recovering after the facelift.

◎ Toyota Yaris Cross: 328 units, up 117.2% year-on-year, ranking eighth. Cumulative sales in the first quarter were 467 units, up 61.6%, with the hybrid version being popular.

◎ Skoda Enyaq: 325 units, up 72.9% year-on-year, ranking ninth. Cumulative sales in the first quarter were 722 units, up 66.4%, performing steadily in the mid-size SUV market.

◎ Volvo XC90 (PHEV): Driven by PHEV policies, sales increased by 3200% year-on-year, ranking among the top, demonstrating the explosive growth of the plug-in hybrid market.

● The competitive landscape in the Norwegian market showed a trend of diversification in 2025.

◎ Although Tesla Model Y still leads, its shrinking market share reflects intensifying competition.

◎ The Volkswagen Group has solidified its market leadership with the synergistic effect of multiple models such as the ID.7, ID.4, and Enyaq. Its success benefits from a rich product matrix and strong localized services.

◎ Volvo has further consolidated its local brand advantage with the explosion of PHEV models and the steady performance of the EX30.

◎ Chinese brands have performed impressively in the Norwegian market. BYD and XPeng have successfully attracted mid-to-high-end consumers with their differentiated positioning and intelligence advantages, especially XPeng's rapid growth showing its potential in the European market. MG has struggled due to slow product updates and increased competition from rivals.

The rise of plug-in hybrid models has added a new variable to the market. The popularity of the Volvo XC90 and XC60 indicates that consumer demand for flexible power systems is increasing.

In the future, competition in the Norwegian market will focus on range, intelligence, and charging infrastructure. Policy adjustments (such as changes in PHEV taxation) will continue to influence market structure, while the continued expansion of Chinese brands will inject more vitality into the market.

Summary

The Norwegian automotive market in March 2025 welcomed new opportunities amidst the electric vehicle boom, with pure electric vehicles maintaining their dominant position and plug-in hybrids emerging due to policy drivers. While Tesla still has an edge, the rise of brands such as Volkswagen and Volvo and the rapid penetration of Chinese brands like BYD and XPeng indicate a shift towards a diversified competitive landscape.