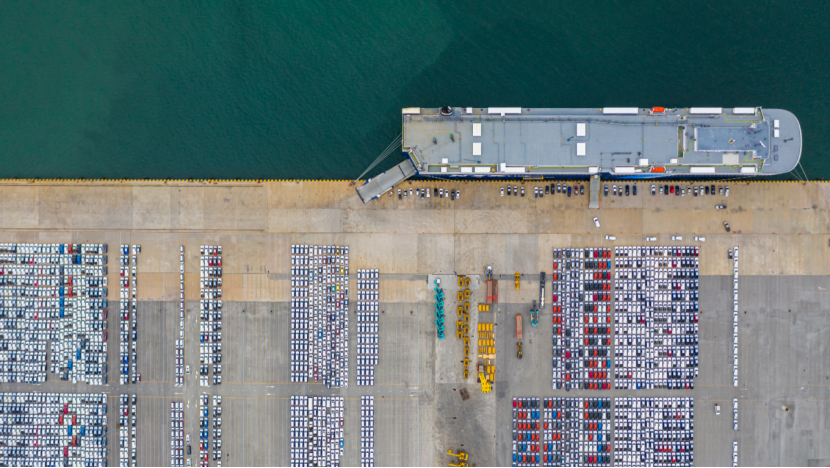

US Tariffs Spark "Earthquake" in Automotive Industry, Global Supply Chain Faces "Great Migration"

![]() 04/07 2025

04/07 2025

![]() 434

434

On the afternoon of April 2 local time, US President Donald Trump signed two executive orders, instituting a 10% "minimum base tariff" for all trading partners and imposing additional tariffs on numerous countries and regions, including China, on top of the 10% base rate. Notably, the "reciprocal tariff" rate imposed on China by the United States stands at 34%, bringing the total tariff rate on Chinese goods to 54%. The ripple effects of this tariff storm swiftly spread, causing the share prices of Germany's three major automakers to plummet, prompting South Korea's Hyundai Motor to urgently announce additional investments in the United States, and accelerating the relocation of production capacity by Chinese automakers to Southeast Asia and Europe.

The implementation of this tariff policy could have a profound impact on the US domestic automotive industry, with automotive manufacturing powerhouses such as Japan, South Korea, and Germany far from unscathed. Economies deeply intertwined with the US supply chain, such as Mexico and Canada, also face the specter of recession. However, the deeper crisis lies in the shift in the US government's policy logic, which has moved from a purely economic game to a systematic undermining of the global trading system. When Tesla CEO Elon Musk admitted that "localization cannot fully offset cost shocks," cracks began to appear in Trump's narrative of "manufacturing return."

As the dividends of globalization are carved up by geopolitics, the balance of cooperation and confrontation hangs in the balance.

▍Tariffs on Japanese, South Korean, and German Automakers May Lead to Employment Crisis

Trump's tariff policy directly targets major global automotive exporters. As the cornerstone of the European automotive industry, German automakers are heavily reliant on the US market. In 2024, the EU's automotive exports to the United States totaled 38.463 billion euros, with Germany's three major automakers (Volkswagen, BMW, Mercedes-Benz) accounting for 73% of this amount. Following the implementation of the tariff policy, the share prices of German automakers plummeted: Volkswagen and BMW fell by 3.1% and 3.7% respectively on the day the policy was announced, while Daimler Truck's share price dropped by 5.8%.

The German Association of the Automotive Industry warned that if tariffs persist, the German automotive industry will suffer a "devastating blow," with Volkswagen alone potentially laying off 15,000 workers. More critically, German automakers' supply chains are deeply embedded in the North American market—popular models such as the BMW X3 and Volkswagen Tiguan are produced in Mexican factories, and these products will face a 25% tariff upon entering the United States.

Japan is also heavily reliant on automotive exports to the United States, which account for 28.3% of its total exports and support over 5 million jobs. Nomura Securities predicts that tariffs may cause Toyota's operating profit to fall by 30% and push Mazda into the red. Nissan's predicament is particularly telling: its Mexican plant accounts for 40% of Japanese automakers' total exports from Mexico, and the QX50 and QX55 models have been forced to halt US order acceptance due to tariffs. In response to the crisis, Honda has decided to cease importing hybrid car batteries from Japan and instead purchase batteries produced by Toyota in the United States, involving the adjustment of supply chains for 400,000 vehicles.

Regarding Korean automaker exports, data reveals that in 2024, Korea's automotive exports to the United States reached 34.7 billion US dollars, accounting for 49.1% of overall automotive exports. In response, Hyundai Motor adopted a strategy of "investing to gain market access," announcing the construction of a new electric vehicle superfactory in Georgia and an additional investment of 2 billion US dollars. This move was interpreted by the outside world as a "friendly gesture" to the US government, but South Korea's Ministry of Trade, Industry, and Energy still plans to file a request for consultations with the WTO, aiming to resolve the crisis through multilateral mechanisms.

Japanese Prime Minister Shinzo Abe bluntly stated that "all countermeasures are on the table." Although Hyundai Motor of South Korea announced a 21 billion US dollar investment in the United States over the next four years to avoid tariffs, the export volume of its domestic factories is expected to decline sharply. The Peterson Institute for International Economics predicts that tariffs may lead to "mass layoffs" in the automotive industry, with Japanese, South Korean, and German automakers and suppliers heavily reliant on the US market bearing the brunt.

The chain reaction of employment has already begun to surface, with Canadian Prime Minister Justin Trudeau setting up a 2 billion Canadian dollar "Strategic Response Fund" to rescue the country's automotive industry, underscoring the crisis of North American supply chain disruption. Ignacio Martínez, a professor at the National Autonomous University of Mexico, pointed out that if tariffs raise the prices of cars produced by US automakers in Mexican factories, ultimately American consumers will foot the bill, but factory closures and worker unemployment in the short term will be unavoidable.

▍Chinese Automakers Attempt to "Circumvent Obstacles"

In response to tariff barriers, global automakers are accelerating adjustments to their production layouts. Hyundai Motor's investment plan is emblematic: it is building a new electric vehicle factory and expanding steel production capacity in the United States, aiming to increase the localization rate to over 70%. This "nearshore outsourcing" model is becoming the norm, and Trump has used this to claim that the "tariff policy has successfully promoted the return of manufacturing."

Chinese automakers face more intricate challenges. Although direct exports to the United States are limited, indirect export channels through Mexico may be severed by tariff policies. For example, if a 25% tariff is imposed on the 180,000 vehicles exported to the United States after assembly in Mexico by Chinese automakers in 2024, costs will soar. In response, BYD, Great Wall, and other companies are accelerating the construction of factories in Southeast Asia and Europe, seeking to circumvent tariff barriers. Simultaneously, Chinese auto parts companies are exploring ways to reduce tariffs by leveraging the proportion of "American content" that meets the standards of the United States-Mexico-Canada Agreement (USMCA).

SAIC Motor, on the other hand, is deploying in Europe, planning to build a factory for the MG brand in Spain; BYD is planning to build its first passenger vehicle assembly plant in Europe to avoid the EU's anti-subsidy tariffs on Chinese electric vehicles. Meanwhile, Chinese automakers are breaking through barriers through technological cooperation: Leapmotor is leveraging Stellantis' overseas factories for rapid production introduction, marking a new phase in the overseas expansion of Chinese automakers from "trade exports" to "localized production."

However, reconstructing the supply chain is no easy feat. The Automotive Policy Council of the United States points out that the integrated North American supply chain has been forged over decades, and forcibly severing it will lead to a permanent increase in production costs. For instance, although American companies such as Ford and General Motors support localization, if the supply of parts from their Mexican factories is disrupted, the efficiency of vehicle assembly will be significantly reduced.

The Peterson Institute for International Economics predicts that tariffs will cause the average price of new cars in the United States to rise by 3,500-10,000 US dollars, potentially decreasing demand for cars from low- and middle-income groups by 25%. This impact is particularly pronounced in the low-priced vehicle market: almost all new vehicles priced below 30,000 US dollars rely on imports. After the implementation of tariffs, automakers such as General Motors and Ford may completely abandon the production of such models, further limiting purchasing options for working-class people. The increase in car prices is likely to result in a decline of about 3 million vehicles in US car sales, accounting for nearly one-fifth of last year's total sales.

The US government's automotive tariff policy is a double-edged sword: it aims to revitalize the US manufacturing industry in the name of "national security" but at the cost of increased consumer burden and strained ally relations. Concurrently, the forced reconstruction of the global supply chain may give rise to a new industrial structure, but the process will affect millions of jobs and global economic stability.

Under the new tariff policy, from the decline in sales and employment risks faced by Japanese, South Korean, and German automakers, to the migration of the industrial chain and strategic adjustments by Chinese automakers, to the rise in car prices and trade friction risks in the United States, the policy's impact is widespread and complex. Industry experts have stated that in the short term, automakers will grapple with issues such as rising costs, declining sales, and shaken market confidence; in the long run, the fragmentation of the global supply chain, differentiation of technical standards, and increased consumer costs will not achieve the prosperity of "manufacturing return" but will instead weaken the global competitiveness of the US automotive industry.

Typesetting | Yang Shuo Image source: Shutu.cn