Tier 1 Giants Implement Layoffs Again: Continental Cuts 3,000 Jobs, Following 7,000 Last Year

![]() 02/19 2025

02/19 2025

![]() 425

425

ZF Also Takes New Steps

Author | Wang Lei

Editor | Qin Zhangyong

Yes, the automotive parts giants are laying off employees once again.

Continental has just announced plans to cut about 3,000 jobs by the end of 2026.

In February last year, Continental had already announced a large-scale layoff and reorganization plan, resulting in the termination of over 7,000 positions globally.

The announcement of another round of layoffs now signals that even more employees will lose their jobs.

On the same day, ZF, another overseas supplier giant, also announced that it would spin off its "Electric Drive Transmission Technology" division and even consider selling the business.

It appears that European parts giants are still tightening their belts in 2025.

01

"Further Layoffs Are Necessary"

Unlike previous instances, the 3,000 jobs that Continental plans to cut this time are not administrative positions but rather core R&D roles.

Currently, Continental's automotive division employs 92,000 individuals, of whom only 31,000 are responsible for R&D work. This means that the proportion of layoffs this time accounts for about 10% of its R&D personnel.

For Continental, R&D differs significantly from administration. Suppliers rely heavily on R&D technology to maintain their market presence. To some extent, cutting technical positions already indicates the challenges faced within Continental.

The primary site of this round of layoffs is Germany, where "more than half" of the layoff plan will be executed, affecting 1,450 people. Among them, factories in Hesse and Bavaria will be hit the hardest, with expected reductions of 12% and 5% of employees, respectively. Due to these layoffs, Continental's Nuremberg factory will even face closure.

Additionally, Continental's factories in Ingolstadt, Regensburg, and Schwalbach will also be impacted, with layoffs ranging from ten to dozens of employees.

Continental's software subsidiary Elektrobit and Continental Engineering Services are also included in the layoffs, with a total of 900 positions being cut, 660 of which are in Germany.

However, Continental also stated that this round of layoffs will largely be achieved not through direct terminations but rather through "natural fluctuations," such as early retirements or internal job transfers.

In addition to laying off some R&D personnel, there is also a simultaneous reduction in the proportion of R&D expenses to revenue. Philipp von Hirschheydt, head of Continental's automotive business, reiterated that the company plans to reduce R&D expenditures to below 10% of turnover by 2028.

In fact, once a company contemplates layoffs, it is difficult to reverse that decision.

At the beginning of last year, in February 2024, Continental announced the initiation of a layoff plan, involving a total of about 7,150 terminations, accounting for approximately 3.6% of its global workforce. About 5,400 administrative positions were also streamlined and optimized.

It has only been a year, and another wave of layoffs has come. According to Continental, "Previous measures were insufficient to achieve the company's goals, and further layoffs are necessary."

Michael Iglhaut, chairman of the Continental Group's General Trade Union, stated in a release: "A strategy that solely relies on layoffs and cost-cutting is not a sustainable development approach." He is also concerned that Continental's significant reduction in the automotive R&D department could escalate into a full-scale wave of layoffs.

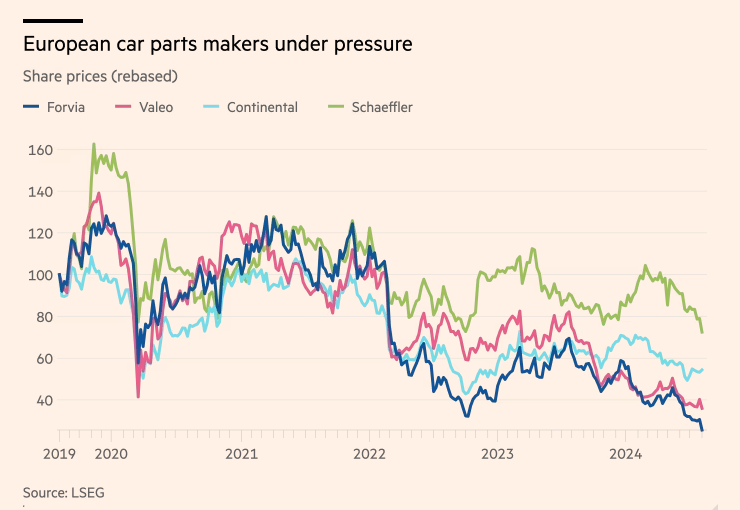

Over the past five years, Continental's market value has plummeted from 50 billion euros in 2018 to 13 billion euros. To boost investor confidence, Continental has undertaken numerous "major surgeries" on its automotive division in recent years, aiming to enhance overall profitability.

In the first half of last year, Continental's total sales amounted to approximately 19.8 billion euros, a year-on-year decline of 4.5%; adjusted EBIT was 900 million euros, a year-on-year decrease of 16.2%; net profit was 252 million euros, a year-on-year decrease of 57.4%.

Among these, the automotive subgroup generated revenue of 9.77 billion euros, a year-on-year decline of 3.72%; adjusted EBIT incurred a loss of 246 million euros, a significant expansion compared to the loss of 24 million euros in the same period last year. Simultaneously, the company also revised downwards its full-year sales and profit margin targets for the automotive subgroup.

02

Paying the Price for Electrification

In fact, most current European parts supply giants are tightening their belts, with layoffs, restructurings, and closures becoming commonplace.

On the same day that Continental announced another round of layoffs, ZF also revealed that it is considering spinning off and divesting its "Electrified Powertrain Technology" division (also known internally as E-Division) within the group, with the spin-off plan to be completed this year.

This spin-off is not a simple business adjustment but directly affects ZF's "lifeblood" as this electric drive division encompasses ZF's entire powertrain business, which includes not only electric drive systems but also internal combustion engines and its core business - traditional transmissions and plug-in hybrid systems.

Revenue from this division alone reached 11.5 billion euros, accounting for a quarter of the company's total sales, and this plan will impact over 32,000 employees, equivalent to one-fifth of the company's workforce.

This means that once the E-Division is spun off, ZF will only have businesses in the areas of chassis solutions, electronics and ADAS (Advanced Driver Assistance Systems), commercial vehicle solutions, and passive safety technology.

Its traditional transmission business will also cease to exist. However, ZF executives are also considering selling the internal combustion engine business and electric drive business in the E-Division separately.

According to the German newspaper "Handelsblatt," sources revealed that potential buyers include representatives from South Korea's Hyundai Group and its supplier Hyundai Mobis, with Foxconn also seen as a top candidate.

However, six months ago, ZF publicly stated that it was only preparing to restructure the division and seek external investment partners.

Behind the desperate measures to survive lies the loss issue within the E-Division. Financial reports indicate that in the first half of 2023 alone, the E-Division's revenue declined by 4.3%. Although orders exceeded 30 billion euros, potential losses reached "billions of euros" due to low-price competition strategies.

On the other hand, while ZF's traditional transmission business performed much better than the electric drive business, the transition to electrification has significantly reduced the demand for transmissions. In the long run, this is detrimental to ZF's core business profitability.

To cope with financial pressure, ZF announced in July last year plans to save 6 billion euros in costs over the next few years and may lay off 11,000 to 14,000 jobs in Germany, accounting for a quarter of the company's total workforce in Germany.

ZF's spin-off of the entire division is merely a microcosm of the transformation undergone by overseas traditional automotive supply chains. In recent years, European supply giants such as Continental and Bosch have slimmed down through spin-offs and layoffs.

Continental has previously spun off Vitesco Technologies and plans to spin off its automotive electronics business. Bosch has also announced multiple rounds of layoffs since last year, affecting tens of thousands of people, and has reduced capacity, delaying its 7% target profit margin by at least one year.

However, the turmoil in the European automotive supply industry does not end here. Giants with "long health bars" can still endure, while small and medium-sized automotive supply chain companies with thin health bars can only face bankruptcy.

Taking Germany as an example, according to data from consulting firm Falkensteg, in the first half of 2024, 20 German automotive parts suppliers with annual revenue exceeding 10 million euros filed for bankruptcy protection, a year-on-year increase of over 60%.

In fact, amidst the once-in-a-century transformation towards electrification and intelligence in the automotive industry, it is not only parts suppliers who are struggling. For traditional automakers, the transformation itself is akin to starting a new business, with a high risk of failure.

When plant closures, large-scale layoffs, salary cuts, and profit warnings have become the norm in the European automotive industry chain, it is worth considering from another angle that this presents an excellent opportunity for the Chinese automotive industry.