JD.com and the Quest to Disrupt the Food Delivery Duopoly

![]() 02/21 2025

02/21 2025

![]() 497

497

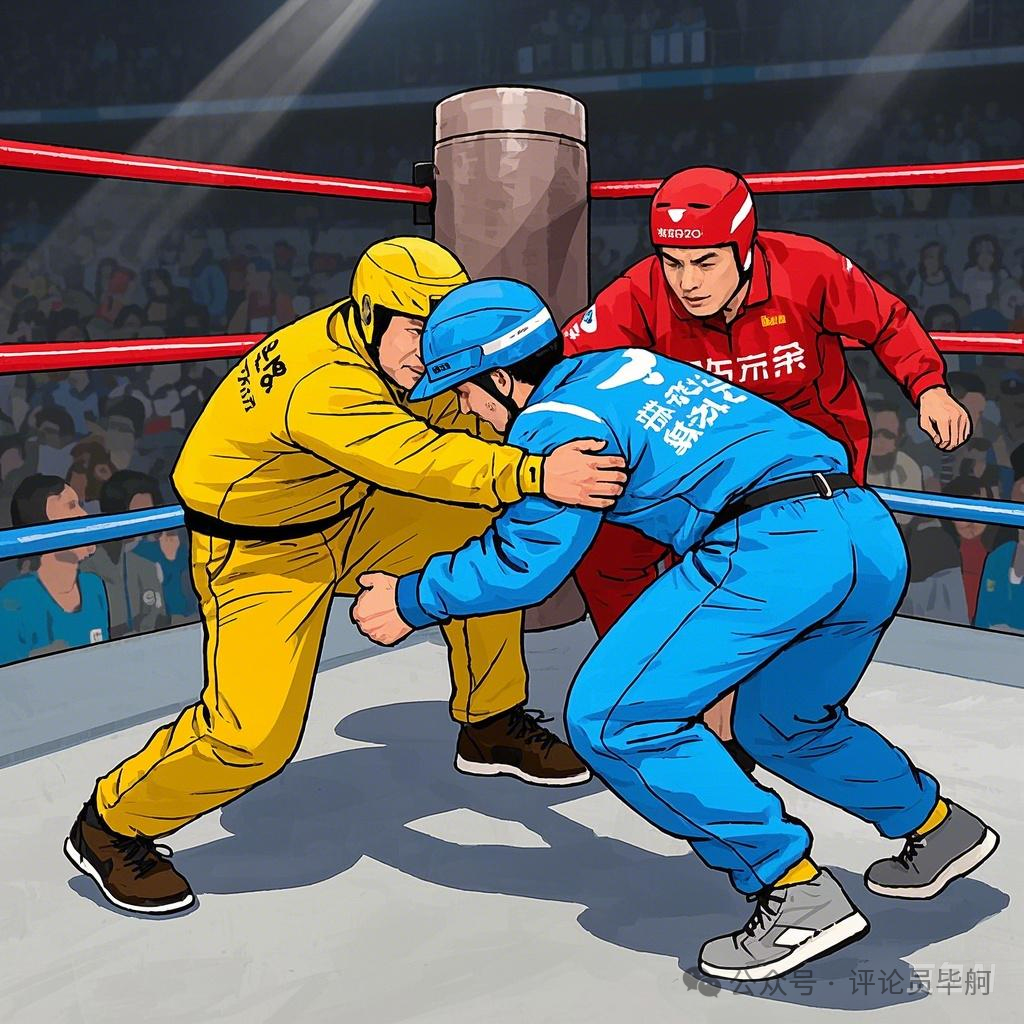

Upon JD.com's announcement of its foray into the food delivery market, who rejoiced the most? Perhaps it was the small and medium-sized merchants, who finally saw a breakthrough in the "either-or" monopoly; the millions of delivery riders, who anticipated new competitors bringing industry standards, including social security contributions; and the consumers, trapped by dynamic pricing and information cocoons. The call for competition heralds a new era of service upgrades and price transparency. As the first crack appears in a market that has been tightening for years, sunlight not only illuminates the food delivery sector but also underscores the self-correcting force of market competition.

The evolution of China's food delivery market epitomizes a profound paradox between technological empowerment and duopoly. By 2023, Meituan and Ele.me commanded 65% and 35% market share, respectively, forming a classic duopoly.

Duopoly, an economic term, describes a market dominated by two major players, also known as "bilateral monopoly." Its key feature is the independence of these giants; when one adjusts output or pricing, it inevitably alters the market, impacting its competitor, who then responds, thereby affecting the initiating firm.

Although duopolists compete, they often tacitly maintain a common price level, through formal or informal agreements forged through market behavior.

The food delivery market exemplifies this duopoly. As of 2023, Meituan held roughly 65% market share, while Ele.me accounted for 35%.

As Meituan's average daily orders surged from 21 million in 2018 to 78 million in 2023, and Ele.me reached 31 million, their scale expansion was accompanied by tightening control over the industry chain.

The duopoly's inherent characteristics foster an environment for systematic oppression. In 2017, Meituan's "cooperation commitment" incident in Jinhua, Zhejiang, set a precedent for forced exclusivity, requiring local merchants to sign exclusive agreements or face penalties like increased commissions or store closures.

This model repeated in Huaian, Jiangsu, in 2018, where Meituan forced merchants to remove their stores from Ele.me, leading to a 70,000 yuan fine. In 2019, Meituan was fined 250,000 yuan for misleading users into uninstalling competing apps in Bazhong, Sichuan.

Even after a 3.442 billion yuan fine and a 1.289 billion yuan deposit refund order from the State Administration for Market Regulation in 2021, disguised exclusivity continued. In 2022, a Meituan agent in Yangzhou was investigated for restricting transactions, and an Ele.me service station in Chuzhou was fined 80,000 yuan for forcing merchant loyalty.

Ele.me also engaged in exclusivity tactics. In 2019, an Ele.me client manager in Wenzhou visited Yuchen Snack Shop to discuss exclusive cooperation, which was rejected. Subsequently, the shop's online store on Ele.me was marked "invalid," preventing orders. After reporting the issue, the store was restored. The Wenzhou Intermediate People's Court ruled that Ele.me must compensate the merchant 80,000 yuan.

In 2021, the Intermediate People's Court of Chuzhou, Anhui, ruled in an unfair competition case that Ele.me's Tianchang delivery station's forcing merchants to choose between platforms disrupted competition, harmed merchants' rights to choose other platforms, violated consumer choice, and constituted unfair competition. The court ordered compensation of 80,000 yuan to Meituan.

These persistent cases reveal that without market competition checks, platforms inevitably abuse their dominant position.

The bidding ranking mechanism turns market competition into a money-burning game for merchants. In 2016, Meituan was exposed for selling homepage recommendations through bidding, allowing an unlicensed merchant to occupy the fifth position by paying 226 yuan, making food safety secondary.

Ele.me's "Spark Plan" required merchants to pay a 3%-5% technical service fee for improved rankings, risking removal for those who refused. This mechanism forced merchants into a paradox: not participating meant sinking, while participating required continuous heavy investment.

In one case, the platform service fee accounted for 25.7% of a 68-yuan order, with some merchants experiencing customers paying 1.75 yuan while merchants subsidized 1.45 yuan. In June 2023, Wei Jia Liang Pi, a northwest chain, closed over 100 stores, becoming the first large restaurant to publicly confront the platform.

The commission system's pressure constitutes the third stranglehold. The platform's commission rate rose from 15% in 2018 to 20% in 2023, exceeding 30% in popular districts, triggering industry turbulence in February 2020. 1,987 Chongqing catering enterprises jointly called for commission reductions, the Hot Pot Association of Nanchong, Sichuan, reported Meituan for suddenly raising commissions, and 220,000 Yunnan catering enterprises issued a joint complaint letter, revealing merchants' survival crisis.

Consumers' freedom of choice also faces systematic deprivation. The apparent abundance of choices is an algorithm-woven information cocoon: first-screen stores relate to the platform's marketing investment, and dynamic pricing normalizes "big data price discrimination" – new users may pay less for the same meal than old users, and office area pricing is generally higher than residential areas. This "price maze" subverts market economy transparency.

Rider groups bear the cost of efficiency exploitation. The average delivery time's compression to 28 minutes reflects the network effect's alienation into a control tool. This convenience-driven revolution has deviated from its original intent.

Breaking the deadlock lies in disrupting the duopoly's closed loop. JD.com's entry triggers a catfish effect, aiming to rebuild a multi-party win-win ecosystem. Drawing from JD.com's experience in breaking the Suning and Gome monopoly in home appliances, its food delivery business may bring triple disruptions: reducing scheduling losses through a self-operated logistics system, increasing riders' effective delivery time to over 90%; leveraging supply chain advantages to create a "quality catering incubation plan" to help small and medium-sized merchants break through homogeneous competition; and using deterministic service standards to break the algorithmic black box – these are the pain points existing platforms have failed to solve in a decade.

Broadly, the food delivery market's catfish effect mirrors China's digital economic transformation. The Ministry of Industry and Information Technology's "Guidance on High-Quality Development of the Platform Economy" emphasizes "preventing the disorderly expansion of capital," essentially calling for a more inclusive competitive ecosystem.

Just as Pinduoduo revolutionized e-commerce by breaking the Alibaba and JD.com duopoly with its billion subsidy campaign, and Douyin emerged as a dark horse in live streaming e-commerce, a healthy market always needs fresh blood to activate innovation potential.

Notably, on the day JD.com announced its entry, Meituan quickly announced social security and housing fund benefits for delivery riders – this stress response itself underscores the catfish effect.

JD.com needs food delivery to enhance its local lifestyle service layout; the food delivery industry needs JD.com and potential future giants to reconstruct the industry ecosystem. What the industry needs is not just new players but a vivid example that the market competition mechanism still works.

When merchants can adjust strategies through visual data dashboards and riders plan to use housing provident fund loans to settle down, these changes will converge into a wave that breaks the monopoly. This battle for choice rights is not just about food delivery market innovation but also points to the evolution of commercial civilization in the digital era – only by establishing an inclusive and diverse competitive ecosystem can we balance technological empowerment and business ethics, creating a truly sustainable digital economy.