“Overseas Expansion Navigation” Series: Sustaining High-Speed Growth for Chinese Automakers in Brazil

![]() 02/19 2025

02/19 2025

![]() 408

408

Lead

Brazil stands not only as the largest automotive market in South America but also ranks sixth globally, making it an indispensable player for major automakers worldwide.

Produced by|Heyan Yueche Studio

Written by|Zhang Dachuan

Edited by|He Zi

Total Words: 2735

Reading Time: 4 minutes

The rapidly burgeoning Brazilian automotive market is a highly coveted prize among leading automakers. According to data released by the National Association of Automobile Manufacturers of Brazil, new car registrations surged by 14.1% year-on-year to 2,634,904 units in 2024, marking a new high in recent years.

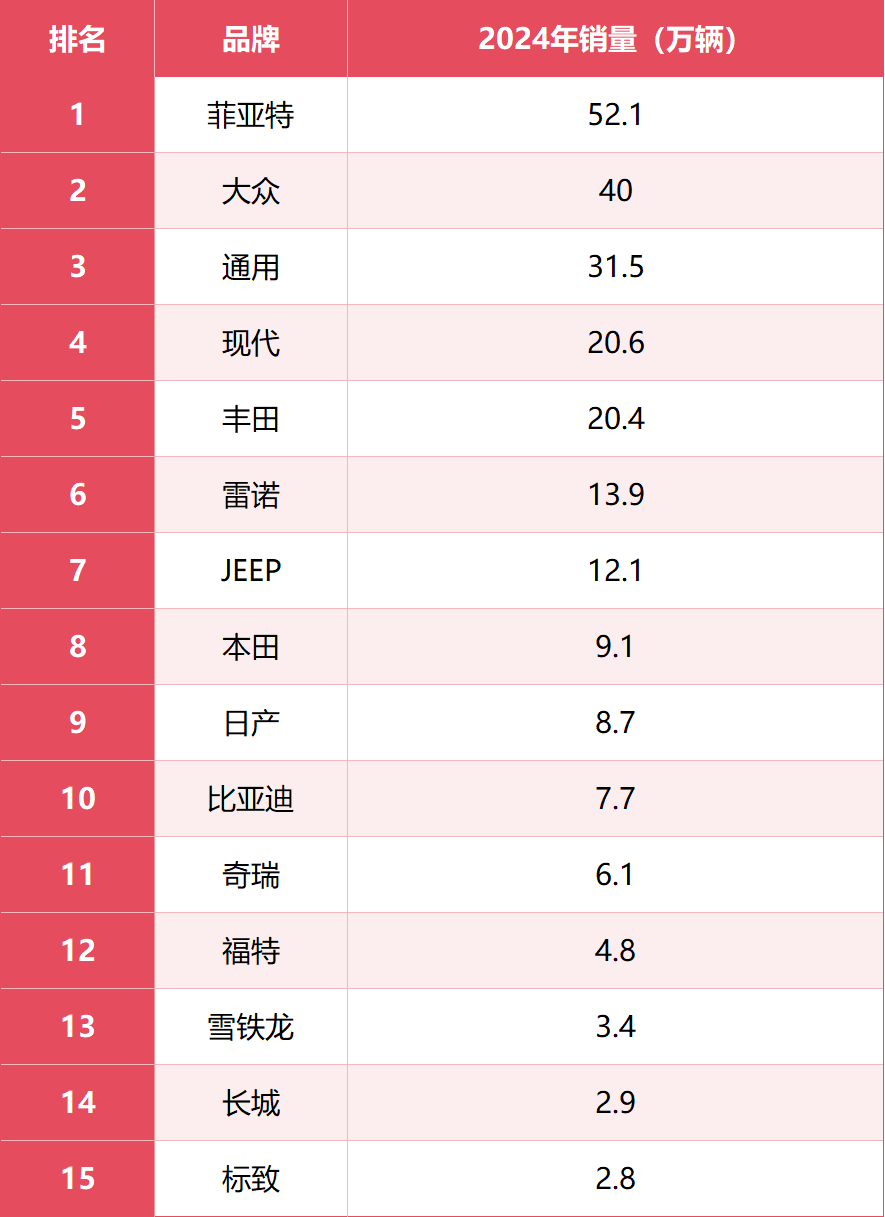

Among these, domestic car registrations rose by 10.8% to 2,168,399, while imported car registrations witnessed a 32.5% increase to 466,505. Within automaker groups, the FCA Group, which encompasses Fiat and JEEP, held a 21.1% share of the passenger car market. Volkswagen and General Motors followed closely in second and third places with shares of 17.2% and 13.3%, respectively.

△Top 15 Brands by Sales in Brazil, 2024

In 2024, the three best-selling passenger car models in Brazil were the Volkswagen Polo, General Motors Onix (domestic Chevrolet Cavalier), and Hyundai HB20, with annual sales of 140,200, 97,500, and 97,100 units, respectively. This underscores Brazilian consumers' preference for compact cars.

△Volkswagen Polo, a representative of small cars, performed exceptionally well in Brazil

In the light commercial vehicle segment, Fiat Strada led the pack with 144,700 units sold. Similar to previous Wuling minivans in China that could carry both passengers and cargo, pickup truck models like the Fiat Strada, which combine commuting and transportation functions, also enjoy significant popularity in Brazil.

△Fiat Strada is highly favored in Brazil

Zero import tax propels the rapid growth of the Brazilian electric vehicle industry

Classified by vehicle power type, flex-fuel vehicles (capable of burning different gasoline and ethanol mixtures) increased by 8.7% year-on-year to 1,967,353 units, accounting for 79.1% of the market. Diesel vehicles rose by 11.4% to 240,458 units, representing 9.7% of the market. Gasoline vehicles surged by 69% to 102,388 units, accounting for 4.1% of the market. Hybrid vehicles grew by 32.4% to 56,193 units, accounting for 2.3% of the market. Most notably, pure electric vehicles saw a 219.2% increase to 61,535 units, accounting for 2.5% of the market.

While the electric vehicle market only comprises 2.5% of the Brazilian automotive market, it is the fastest-growing segment, followed by hybrid vehicles. This situation is closely tied to relevant policies formulated by the Brazilian government.

On the consumer side, the Brazilian government established the Rota2030 plan in 2018. This policy aims to provide incentives such as tax credits, financial subsidies, and credit policies to achieve 30% electric vehicle sales as a proportion of total Brazilian car sales by 2030. To this end, Brazil will provide up to 19 billion Brazilian reais in tax incentives by 2028.

△Based on the Rota2030 plan, Brazil began to vigorously encourage the production and sales of electric vehicles

However, compared to consumer subsidies, the Brazilian government's more significant move was to exempt electric vehicles from the 35% automotive import tariff starting in 2015. Hybrid vehicles are eligible for tariff reductions of up to 7% based on engine displacement and energy efficiency. These measures allow automakers like BYD and Great Wall to export electric vehicles to the Brazilian market seamlessly. Conversely, local European and American multinational automakers in Brazil struggle to compete directly with Chinese electric vehicles due to a lack of competitive and cost-effective models, enabling Chinese electric vehicles to swiftly gain a foothold in the Brazilian market.

Currently, Brazil remains an oil-importing country. In 2023, Brazil imported 290,250 barrels of crude oil per day. At the same time, Brazil boasts a vast territory with significant potential for developing green electricity. If most of the country's vehicles transition from fuel vehicles to electric vehicles, Brazil will no longer need to pay high fees to import oil annually. Therefore, the prospects for encouraging local production of electric vehicles in Brazil and providing certain consumer support policies for electric vehicles remain relatively bright.

△Promoting electric vehicles can help Brazil reduce its dependence on imported oil

Chinese automakers need to deepen their presence in the Brazilian market

With the support of the new energy vehicle policy, Chinese cars have also risen swiftly in the Brazilian market.

BYD's sales reached 76,700 units in 2024, a staggering 327.68% increase compared to 17,937 units in 2023, accounting for 3.1% of the market. Its main sales drivers in the Brazilian market are the Song, Dolphin MINI, and Dolphin models. Among them, the BYD Dolphin Latin America version is the best-selling electric vehicle in Brazil. Additionally, BYD's pure electric buses also enjoy a relatively high market share in Brazil. In the future, BYD's factory capacity in the state of Bahia, Brazil, can be expanded to 300,000 units, becoming a crucial strategic fulcrum for BYD to radiate throughout the South American market.

△The BYD Dolphin Latin America version is the best-selling electric vehicle in Brazil

Chery, which focuses on small SUV models in the Brazilian market, collaborated with CAOA, the largest automotive distributor and manufacturer in Latin America, achieving annual sales of 60,900 units, a 93.6% year-on-year growth rate, nearly doubling sales. Chery was the first Chinese automaker to set up a factory in Brazil, with its Tiggo model being exported there as early as 2009. However, Chery still focuses on fuel vehicles in Brazil. Introducing electric vehicles to Brazil is key for Chery to ensure sustainable growth of its business there.

△Chery was the first Chinese automaker to expand and operate in the Brazilian market

Great Wall Motors also sold 30,000 units in Brazil last year. With the help of the hybrid version of the Haval H6 and the pure electric Ora 03, Great Wall is accelerating its presence in Brazil's high-end new energy vehicle market segment. In 2025, Great Wall Motors' new factory in Iracemápolis (SP) will commence production, which is expected to boost Great Wall Motors' market share in Brazil.

Besides these Chinese automakers, there is also a new force automaker, Leapro, that cannot be overlooked. In the Brazilian market, both Fiat and JEEP are top-ranking brands, and their owner, Stellantis, is also one of Leapro's shareholders. For Leapro, both factories and retail channels are readily available. As long as Stellantis is willing to introduce Leapro into its Brazilian system, Leapro's electric vehicles and extended-range models can be quickly launched in Brazil and then radiated throughout the Latin American market based on Brazil. Moreover, Leapro's models are mostly cost-effective, and their acceptance in Brazil will be higher.

△Leapro can expand into the Brazilian market with the help of Stellantis

Opportunities and challenges coexist for Chinese automakers

While Chinese automakers have made rapid strides in Brazil, they will face increasing adverse factors starting from 2025.

Starting from 2024, Brazil's policy of exempting electric vehicle import tariffs, which has been a significant boon for domestic electric vehicle exports, will be adjusted, and the relevant tax rate will be restored to 35% by 2026. To adapt to this adjustment in Brazil's import tariff policy, Chinese automakers must shift from directly exporting complete vehicles to Brazil to local production. This will pose a significant challenge for Chinese automakers. Previously, BYD's factory in Brazil faced so-called labor issues, which are typical conflicts between Chinese working modes and methods and the actual situation in Brazil.

△BYD's factory construction supplier encountered labor issues in Brazil

In addition to Chinese automakers, Japanese automakers also intend to expand their investment in Brazil. It is reported that Toyota plans to invest 11 billion reais to expand its factory in the state of São Paulo and launch small flex-fuel vehicles; Honda also plans to invest heavily in the production of flex-fuel SUV models, and its decision to hire an additional 1,700 employees underscores its commitment to expanding production in Brazil. In the future, Chinese automakers will also face counterattacks from Japanese and Korean automakers in the Brazilian market.

△Japanese automakers such as Toyota plan to expand investment in Brazil

Furthermore, after starting to produce new models locally in Brazil, Chinese automakers will need to face direct competition from Stellantis, which has a deep presence in Latin America. Its Fiat and JEEP brands have a loyal local following and will not remain passive in the face of the expansion of Chinese automakers. Great Wall Motors, which is also skilled in pickup trucks, plans to compete with its Great Wall Cannon in the market originally dominated by the Fiat Strada. It remains to be seen how much market share it can capture in the future.

△Chinese automakers will inevitably face strong counterattacks from European and American automakers

Commentary

As one of the world's major automotive markets and the largest in South America, the Brazilian automotive market is also pivotal for Chinese automakers. Deepening their presence in the Brazilian market while radiating throughout the South American market will become one of the main strategic directions for many Chinese automakers in the future. However, as the backyard of the United States, Chinese automakers will not only need to compete with established American automakers such as General Motors and Ford but also with Fiat and the entire Stellantis group, which have also operated in South America for many years. Toyota and Hyundai also have a strong fan base in South America.

(This article is originally created by Heyan Yueche and cannot be reproduced without authorization)