Is the Chinese Auto Industry at Risk in Russia?

![]() 02/17 2025

02/17 2025

![]() 508

508

Introduction

Sales of three automobile brands have been suspended as Russia targets Chinese automobiles.

"Our cooperation with Chinese automakers is not due to German manufacturers leaving us, but because China produces better and cheaper products than Europe. We believe the measures taken by Europe and other markets to combat Chinese automakers are absolutely incorrect and harmful to the global auto industry."

Two months after Russian President Vladimir Putin made these remarks, on February 5, Anton Alyakhanov, the Minister of Industry and Trade of Russia, announced at a State Council meeting that stricter certification and inspection measures would be imposed on Chinese automobiles.

Alyakhanov further elaborated: "Chinese automakers are actively penetrating our market. To restore balance, the Ministry of Industry and Trade is gradually adjusting the recycling fee, but this is not enough. Stricter certification is needed, especially in inspecting the compliance of automobiles."

To illustrate this, Alyakhanov provided an example: "The Ministry of Industry and Trade has conducted a thorough analysis of trucks and found serious defects in trucks from three Chinese brands. These vehicles are simply not allowed on the road."

While specific brands were not named at the meeting, on February 11, the press office of the Federal Agency on Technical Regulating and Metrology of Russia announced that it had decided to suspend the approval of vehicle models for China's Shandeka SX3258 trucks and halt their sales in Russia based on inspection results.

It is understood that the agency has instructed the official representatives of the manufacturer to develop a vehicle recall plan and suspend the sale of these trucks.

These events caught everyone off guard, as Russia had already taken action against Chinese automobiles.

Aggressive Chinese Automobiles

After the outbreak of the Russia-Ukraine conflict in 2022, foreign automakers from South Korea, Japan, and Europe, which had once fiercely competed in the Russian passenger car market, retreated hastily, causing the market size of Russia to plummet. However, Chinese automakers seized the opportunity, quickly entered the market, and firmly grasped this huge potential pie.

Chinese automakers were right to see the potential. In 2024, new passenger car sales in Russia reached 1.571 million units, an increase of 48.4% year-on-year. Meanwhile, according to data from the China Association of Automobile Manufacturers, China exported 5.859 million automobiles in 2024, with a year-on-year growth rate of 19.3%, an increase of nearly one million vehicles compared to 4.91 million in 2023, maintaining its position as the world's largest auto exporter. Russia played a significant role in this achievement.

Russia was not only the country with the largest increase in China's exports in 2024 but also China's largest auto export market. Data shows that China's auto exports to Russia increased by 30.5% to 1.158 million units, accounting for nearly 20% of the total export share.

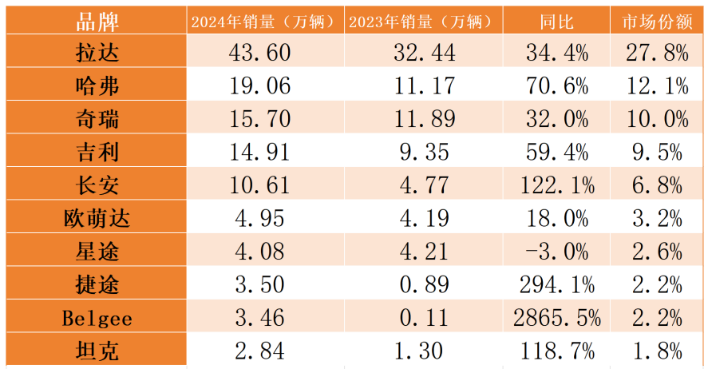

Calculations reveal that the market share of Chinese brands in Russia soared to 62% in 2024, far exceeding the 47% in 2023. Among the top ten brands in terms of sales in Russia, nine are from China.

Specifically, the local Russian auto brand Lada topped the list with sales of 436,100 units, a year-on-year increase of 34.4%. Despite the rapid growth, Lada's market share has fallen below 30%.

In contrast, Chinese brands are showing an unstoppable trend. In 2024, Haval's sales increased by 70.6%, occupying a market share of 12.1%, and jumping to second place in the Russian market. Chery's sales increased by 32%, ranking third with a market share of 10%. If the sales of brands such as Jettour, Omoda, Xingtu, Jettour, Jetour X, Cowin, and Xcite are combined, Chery's sales will approach 300,000 units.

Geely and Changan also performed well in Russia, occupying market shares of 9.5% and 6.8%, respectively. At the same time, emerging brands such as Belgee and Tank have seen particularly rapid growth.

Are Chinese Automobiles in Danger?

As Chinese automobiles aggressively swallow up a large portion of the market, Alyakhanov's statement about imposing stricter certification and inspection measures on Chinese automobiles is seen as a form of protection for the local industry. Are Chinese automobiles in danger?

Yes, but not entirely.

It is undeniable that the local Russian auto industry is facing a difficult situation due to the strong impact of Chinese auto brands. Media reports show that despite a significant increase in sales, some Lada factories are even facing the crisis of production stoppage as their market share continues to be eroded.

"To balance the market, the Ministry of Industry and Trade is slowly adjusting the recycling fee, but this is not enough. We need to be stricter in certification, especially in inspecting whether batches of automobiles are compliant." As Alyakhanov stated, the Russian government is creating buffer space for local enterprises by strengthening inspections of Chinese automobiles in an attempt to revitalize the local auto industry.

As early as 2023, when Russia canceled the preferential tax for parallel imports of Chinese automobiles, it had the intention of increasing the cost of Chinese automobiles and weakening their market competitiveness. Since then, Russia has also announced the imposition of "historical tariffs" on all Chinese automobiles transiting through Central Asia and even increased the scrap tax rate for imported vehicles by 70% to 85%, with adjustments of 10% to 20% each January until 2030.

The most direct impact was that the Russian Customs increased tariffs on foreign imported automobiles in January 2025, with tax rates ranging from 20% to 38%. As a result, Lada's share rebounded to 30% in January, while sales of Geely, Omoda, and Tank declined.

Industry analysts believe that in addition to protecting local brands, Russia's various measures to increase trade barriers for imported automobiles and tighten inspection policies are more aimed at forcing Chinese automakers to strengthen local production, such as building factories and increasing the localization rate of supply chains, to enhance local employment and technology transfer, rather than comprehensively excluding Chinese brands.

On the one hand, after Western automakers withdrew from the Russian market, a large amount of idle capacity was left behind, which was difficult to fully utilize by local auto brands alone.

On the other hand, before the outbreak of the Russia-Ukraine conflict, the local Russian brand Lada had actually become one of the assets of the Renault Group, with most of its new models developed on the platform of the Renault-Nissan Alliance and positioned in the economic market, becoming a representative of cheap sedans. This also limited its technological breakthroughs.

In 2022, with Renault announcing its withdrawal from the Russian market and transferring all shares of AvtoVAZ to the Central Scientific Research Automobile and Automotive Engines Institute, Lada was once again completely under state control. Under the background of continued tightening Western sanctions, Lada faces huge challenges in maintaining the stability of its production supply chain, especially in terms of localization and independent research and development of key components. In addition, the development of new models and technological innovation have become more difficult.

Russia naturally urgently hopes that Chinese brands can build factories locally, driving employment while also improving local supply chains and enhancing their independent research and development capabilities, achieving multiple benefits.

Haval, which sold the best in Russia in 2024, has been producing its own SUVs in the Tula region south of Moscow since 2019. This year, Great Wall Motors has also expanded its assembly line capacity in Russia to 200,000 units in an attempt to expand its market share in the country.

Observers who have been tracking the Russian auto market for a long time believe that the tightening of Russian policies is more like a means of trade bargaining, with a softer effect than a hard one, and it will not directly threaten the progress of Chinese automakers in capturing the market.

On the contrary, the fierce competition among Chinese automakers may pose a threat to the survival of Chinese automobiles in Russia.

Oleg Moseyev, an expert in the Russian auto industry, revealed to the media that in 2025, domestic and foreign automakers plan to sell 1.6 million automobiles in Russia. According to his predictions, another 100,000 automobiles will arrive in Russia through parallel imports. Therefore, he estimates the total sales plan of automobile companies and private importers this year to be 1.7 million automobiles.

According to a report by the Russian analysis company Autostat, under optimistic conditions, passenger car sales in Russia are expected to remain flat at 1.59 million units in 2025 compared to 2024, while under pessimistic conditions, they may fall to 1.27 million units.

The result of too many people chasing too few resources is that those who fail to secure their share will suffer. Competition will intensify, and a more fierce price war may sweep the Russian market. At present, some Chinese brands are already preparing to leave the market in disappointment.

Recent public information from Russian media indicates that the Chinese brand SWM may leave Russia in the near future. Marketing activities at the Russian representative office ceased as early as mid-2024, and an advertising company filed a lawsuit against the automotive company, seeking compensation of nearly 90 million rubles. Now, SWM is trying to quickly clear its warehouses by announcing unprecedented discounts of up to 34%.