Lifan: A Bygone Era

![]() 02/14 2025

02/14 2025

![]() 553

553

After decades of market battles, Lifan, founded by legendary businessman Yin Mingshan, is set to be erased from the capital market. Yesterday, Lifan Technology announced its renaming to Qianli Technology effective February 18th. The once-proud "first private automotive stock" has undergone bankruptcy reorganization and emerged from the ashes, but all ties to founder Yin Mingshan's family have been severed.

A New Name, a New Era

From Lifan Co., Ltd. to Lifan Technology, and now to Qianli Technology, the brand painstakingly built by Yin Mingshan is about to vanish from the capital market.

Yesterday, Lifan Technology (601777.SH) issued an announcement stating that the company's board of directors and extraordinary general meeting of shareholders have approved the change of the company's name from Lifan Technology (Group) Co., Ltd. to Chongqing Qianli Technology Co., Ltd. Effective February 18th, the securities abbreviation will change from "Lifan Technology" to "Qianli Technology," with the securities code remaining unchanged.

The company explained that post-bankruptcy reorganization, the automotive business has gradually recovered, and overall operations have stabilized. The name change aims to enhance the brand image.

Post-bankruptcy reorganization, the Lifan brand has indeed faded into the background.

In June 2020, due to an inability to pay a 560,000 yuan payment on time, supplier Chongqing Jiali Jianqiao Lighting Co., Ltd. applied to the court for the reorganization of Lifan Co., Ltd. Subsequently, multiple suppliers followed suit due to unpaid debts by Lifan's subsidiaries.

Upon assessment, Lifan Co., Ltd.'s total assets at the time were 3.84 billion yuan, while its total debt exceeded 10 billion yuan, clearly indicating insolvency.

At the end of 2020, Lifan Co., Ltd. finally received a lifeline. A consortium comprising Liangjiang Fund, affiliated with Chongqing Liangjiang New Area, and Li Shufu's Geely conducted a comprehensive reorganization of Lifan Co., Ltd. in terms of funds, industrial resources, and other aspects.

According to the reorganization plan, Manjianghong Fund, controlled by Liangjiang Fund, acquired 1.35 billion shares of capital increase stocks and invested 3 billion yuan for operational transformation, the purchase of operating assets, and mergers and acquisitions of listed companies. After the reorganization, Manjianghong Fund became the controlling shareholder of Lifan Co., Ltd., with the fund's GP Manjianghong Enterprise Management replacing the Yin Mingshan family as the actual controller of the listed company.

Another 900 million shares of capital increase stocks were used to introduce Chongqing Jianghehui, controlled by Li Shufu. As an industrial investor, Chongqing Jianghehui accepted these shares without cash consideration but promised to introduce high-quality industrial resources to the listed company.

Post-reorganization, Lifan Technology (renamed from Lifan Co., Ltd.) operated with a lighter load, and its net profit attributable to shareholders of the parent company has been profitable for consecutive years.

During this period, as a significant indirect shareholder, Geely contributed both financially and operationally to Lifan Technology, even providing direct business.

In 2022 alone, Lifan Technology's related procurement amounted to nearly 5 billion yuan, with over 4 billion yuan from Geely-affiliated companies, accounting for 50.36% of the company's total procurement for the period.

Simultaneously, the company sold its products to related parties in large quantities. In 2022, total related sales amounted to 3.867 billion yuan, accounting for 44.68% of the company's annual revenue. Sales to Hangzhou Yineng Battery and Hangzhou Youxing Technology, both Geely-affiliated enterprises, were 1.727 billion yuan and 1.388 billion yuan, respectively. Hangzhou Youxing operates Caocao Zhuanche.

In 2022, Jirun Automobile, a subsidiary of Geely, jointly established RDI Automobile with Lifan Technology to build the RDI automobile brand.

Currently, automobiles remain the core business segment of Lifan Technology. In the first half of last year, the company's main new energy products on the domestic market included the Caocao 60 and Maple Leaf 60S targeting the online car-hailing market, the Maple Leaf 80VL for the intercity passenger transport market, the smart rear-wheel-drive coupe RDI 7, and the SUV RDI 9. Additionally, there were multiple fuel vehicle models targeting overseas markets.

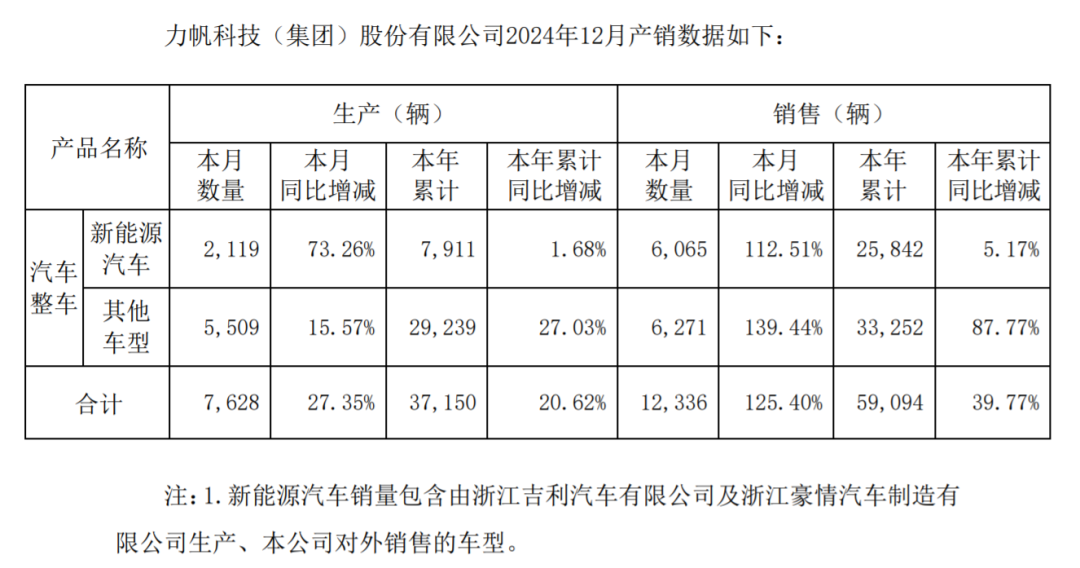

In 2024, the company sold a total of 59,094 complete vehicles, a 39.77% year-on-year increase, with 25,842 being new energy vehicles, up 5.17% year-on-year.

In the first three quarters, the company reported operating revenue of 4.815 billion yuan, a 11.19% year-on-year increase; net profit attributable to shareholders of the parent company was 39.95 million yuan, a 35.34% year-on-year decrease.

The Legend of Yin Mingshan

All of today's developments are no longer tied to Lifan's founder, Yin Mingshan. Although Lifan Holdings, with a 13.68% stake, remains the third-largest shareholder of the listed company post-reorganization, Lifan Holdings has also undergone reorganization and is no longer owned by the Yin family.

Even so, Yin Mingshan's entrepreneurial journey remains a legend in Chinese business history.

Born in 1938, Yin Mingshan began fending for himself at 12. Due to 18 years of imprisonment, he did not embark on his entrepreneurial path until he was 41.

During his labor reform, he self-studied English and worked as an English translator, teacher, and publisher editor after his release. At 47, he founded a book and periodical company, earning his first significant fortune.

In 1992, at 54, Yin Mingshan abandoned his thriving book and periodical publishing business to venture into the motorcycle manufacturing industry. Under his leadership, Lifan carved a niche among the "Chongqing Motorcycle Gang" and became a motorcycle industry leader.

At 66, he led Lifan into the automotive sector, creating another entrepreneurial miracle at an advanced age.

In 2010, Lifan Co., Ltd., with the distinction of being "the first private automotive stock," listed on the Shanghai Stock Exchange's main board, making Yin Mingshan Chongqing's richest man overnight.

For decades, Yin Mingshan was the anchor steadily guiding Lifan, this business giant. It was not until 2017, when he was nearly 80, that he stepped down from the listed company and handed over the reins to the professional manager team led by Mou Gang.

By then, China's automotive industry had reached an inflection point, and Lifan, lacking a scale advantage, felt the chill early on.

During his tenure, Yin Mingshan set the tone for Lifan, stating that if the company failed in new energy, it might be eliminated. Unfortunately, this prophecy came true.

With decades of business experience, Yin Mingshan had a business acumen unlike others. As early as 2006, he led Lifan into the new energy vehicle field. However, they were early starters but late arrivers.

After Yin Mingshan stepped down, the company's operating conditions deteriorated rapidly. In 2018 and 2019, operating revenue plummeted, and the total loss of non-deductible net profit exceeded 6.5 billion yuan.

During this period, the company attempted to exchange a car manufacturing license for strategic cooperation with Chehexia, hoping to achieve complementary advantages between new and old automotive forces. Later, the company sold its related assets but only gained a brief respite.

Struggling to survive until 2020, the company's liquidity crisis erupted fully, and the Yin Mingshan family was unable to save it.

In 2023, the then-85-year-old Yin Mingshan made his final media appearance. With a head full of silver hair, he officially moved into a nursing home and retired completely.