Oil and Gas Giants Apply the Brakes: A Retreat to Traditional Businesses?

![]() 02/13 2025

02/13 2025

![]() 556

556

British Petroleum (BP) released its financial report for the previous year on Tuesday, revealing a 35% year-on-year decline in full-year profits to $8.9 billion, falling short of analysts' average estimate of $9.21 billion. In the fourth quarter, profits stood at $1.169 billion, marking a 61% year-on-year drop and the lowest level since the fourth quarter of 2020. This underperformance, mainly attributed to declining oil and gas prices and shrinking refinery margins, lagged behind that of other oil giants.

BP CEO Murray Auchincloss announced, "We will fundamentally reset our strategy to achieve growth in cash flow and returns."

According to The Guardian's analysis, Elliott Investment Management, a hedge fund that recently acquired a stake in BP, is expected to leverage its influence to demand significant changes within the company. These potential changes could include the removal of BP Chairman Helge Lund, a board reshuffle, or even the break-up of the 120-year-old company.

BP's poor financial performance may further push the company to abandon its climate commitments. CEO Auchincloss stated that BP has commenced the search for new fossil fuel projects and will reorganize its low-carbon business, "continuing to grow the low-carbon business but in a more capital-efficient manner."

In 2020, BP committed to reducing oil and gas production by 40% by the end of the century. However, less than three years later, the company reversed course, abandoning its production reduction plans and increasing investments in fossil fuels. Last year, BP wrote off $1.1 billion in offshore wind investments and recently expressed a desire to sell other wind assets.

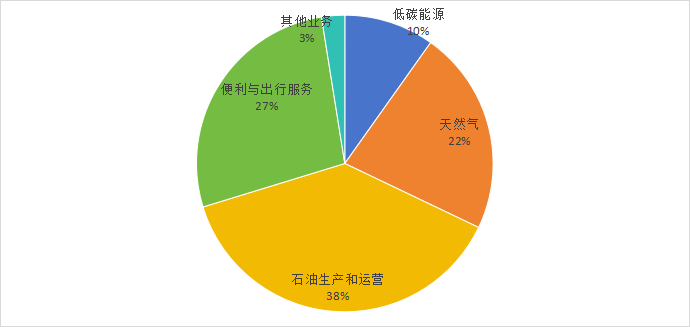

Financial report data shows that BP's capital expenditure on low-carbon energy last year amounted to only $1.6 billion, accounting for just 10% of its total annual expenditure of $16.2 billion and less than half of its expenditure on oil and gas. This represents an increase of only about $340 million compared to the previous year.

BP's capital expenditure by business segment in 2024

Source: BP financial report

After reaping windfall profits from the European energy crisis, major oil and gas giants have witnessed a decline in global oil and gas prices, resulting in a sharp drop in profits. According to the American Petroleum Institute (API) report, as of the week ending February 7, U.S. crude oil inventories increased by 9.4 million barrels, exceeding market expectations. The market is oversupplied, and there are concerns that multiple tariffs implemented or threatened by the U.S. may limit global economic growth, thereby affecting energy demand and putting pressure on oil prices.

The U.S. Energy Information Administration released its monthly Short-Term Energy Outlook on the 11th, predicting that global oil prices will remain stable in the first quarter of this year due to production cuts by OPEC+ (a group comprising OPEC member countries and non-OPEC oil-producing countries). Prices are expected to decline subsequently due to gradual production increases and relatively weak growth in global oil demand.

To boost performance, oil and gas companies have continued their approach from last year since 2025: scaling back climate actions, abandoning climate commitments, and formulating plans to increase oil and gas production.

A week ago, Norwegian energy giant Equinor announced that it would reduce its investments in renewable energy from $10 billion to $5 billion while increasing oil and gas production by 10%. Citing slow returns and hesitant buyers, the company abandoned its commitment to allocate half of its fixed asset budget to renewable energy by 2030. In November last year, the company announced plans to lay off 20% of its renewable energy division's workforce.

In 2024, Equinor's net profit fell by a quarter to $8.8 billion.

Equinor CEO Anders Opedal said, "We are scaling back our investments in renewable energy and low-carbon solutions because we do not foresee future profitability."

French oil and gas giant TotalEnergies also announced on February 5 that it would reduce its investments in low-carbon energy (primarily for power generation) from $5 billion to $4.5 billion.

The French oil and gas giant reported a net profit of $15.8 billion for 2024, still substantial but down 26% from the previous year. This was about $1 billion lower than analysts' forecasts in surveys conducted by Bloomberg and financial data firm FactSet.

Prior to this, the company had recorded record profits for two consecutive years, reaching $21.4 billion in 2023.

In December last year, Shell exited the offshore wind market, scaled back various climate targets, and focused more on oil and gas to boost profits. CEO Wael Sawan stated that Shell lacked a competitive advantage in renewable energy compared to other participants.

It is evident that as earnings fall short of expectations, European oil and gas companies that had previously made ambitious promises have slowed down their transformation pace. The "2023 Domestic and International Oil and Gas Industry Development Report" reveals that the five major international oil companies—Shell, BP, TotalEnergies, ExxonMobil, and Chevron—significantly increased their investments in upstream businesses by 250% year-on-year in 2023. While investments in low-carbon businesses also increased, these companies shifted their strategic focus from aggressive transformation to prioritizing profits.

Compared to their European counterparts, American oil companies have adopted a different strategy in the energy transition. European companies have been more aggressive in investing in renewable energy, while American companies have focused more on improving the efficiency of their fossil fuel businesses and making limited investments in low-carbon technologies such as carbon capture, utilization, and storage.

ExxonMobil and Chevron have consistently adhered to the expansion of their fossil energy businesses, remaining unwavering even during the pandemic when many competitors shifted to renewable energy. ExxonMobil CEO Darren Woods stated that the company lacks expertise in these areas and instead focuses on hydrogen and lithium, which are closer to its traditional oil business.

Earlier this month, ExxonMobil announced plans to increase oil and gas production by 18% between 2026 and 2030. Chevron's oil and gas production increased by 7% year-on-year, and the company plans to cut spending on low-carbon projects by 25%.

These two companies are planning to enter the power industry, utilizing natural gas-fired power generation to supply energy to AI data centers to meet their growing energy demands.

The renewed market preference for fossil fuels highlights one of the core contradictions in global climate governance: the risks of climate change accumulate over decades, while investors are more focused on short-term profitability.

Compared to wind and solar power, oil and gas extraction offers higher profits. According to S&P Global Commodity Insights' analysis, the median capital return rate of major listed oil companies globally rose from -8% in 2020 to over 11% last year. In contrast, the median return rate for top renewable energy companies remained at around 2% during the same period.

Reuters reports that historically, the return on investment for upstream oil and gas has been around 15%-20%, while most renewable energy projects offer returns of around 8%.

Donald Trump's election further boosted optimism in the oil and gas industry. He announced increased oil and gas drilling, revoked the ban on offshore oil drilling, encouraged energy exploration and production on federal lands and waters, and ended the "Green New Deal," planning to withdraw the $400 billion in green loans used to fund clean energy technologies.

Chris Sepulveda, Vice President of Power and Renewable Energy at Wood Mackenzie, stated that significant tax credit cuts combined with Trump's promised import tariffs could reduce renewable energy investments by up to $350 billion over the next decade, potentially dealing a devastating blow to the entire industry.