Restructuring of Changan and Dongfeng Motor: Navigating Changes and Continuities

![]() 02/12 2025

02/12 2025

![]() 434

434

Unlike the intricate merger between Honda and Nissan, domestic automotive industry consolidations often stem from strategic directives following a thorough assessment of the market landscape!

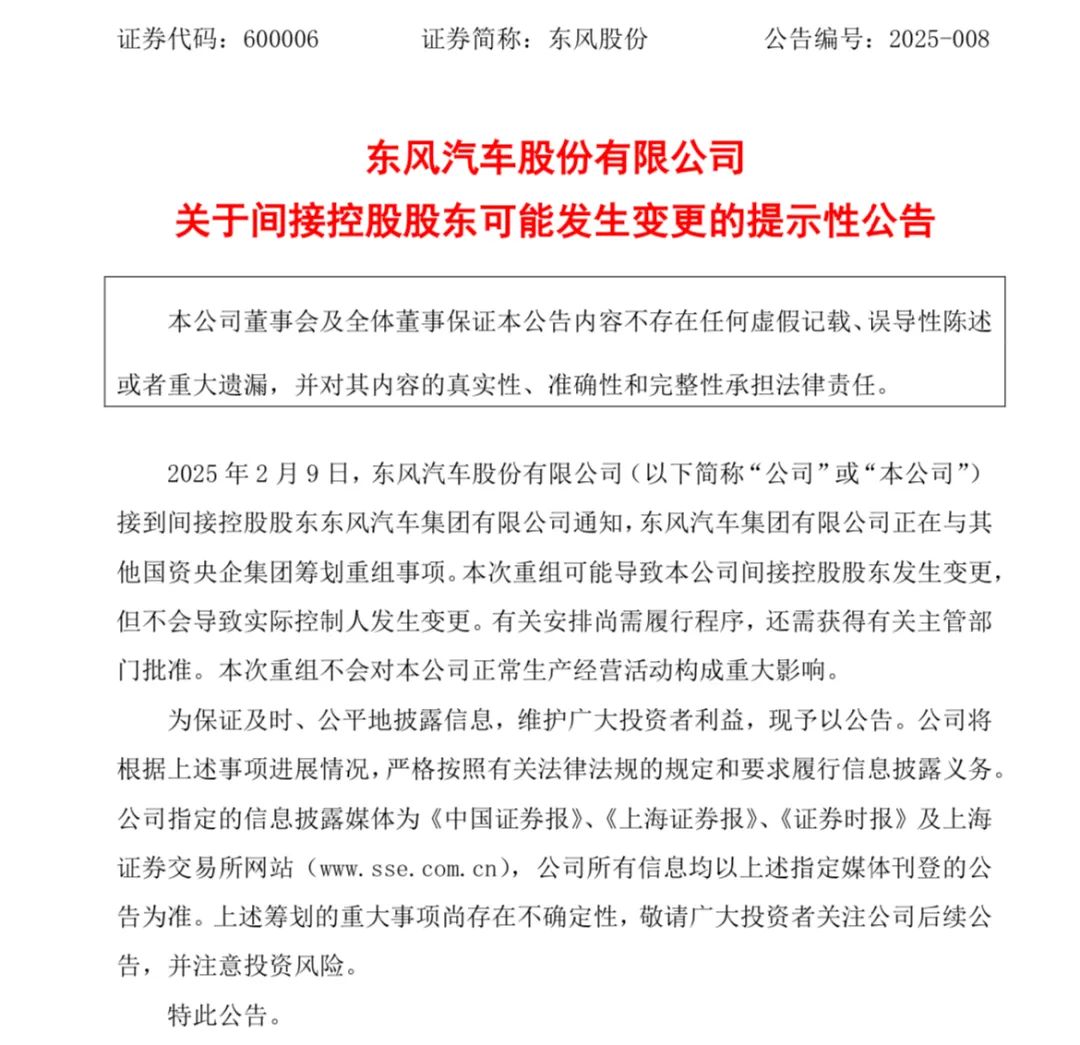

While an official announcement is still pending, multiple announcements from related listed companies, coupled with their timing, suggest a clear trend: Dongfeng Motor Group Co., Ltd. (hereinafter referred to as "Dongfeng Motor Group") and China South Industries Group Corporation Ltd. (hereinafter referred to as "China South Industries Group"), both centrally-administered state-owned enterprises, are poised for strategic reorganization. The specifics, however, remain under active deliberation.

At the heart of this reorganization lies the division of China South Industries Group, of which Changan Automobile Group is a part. The automotive sector will be realigned with Dongfeng Motor Group, primarily focusing on the integration between Changan Automobile and Dongfeng Motor. Market reaction to this news has been palpable, with stocks in the Dongfeng and Changan series generally surging, albeit with Dongfeng experiencing a more pronounced increase, reflecting the market's perception of the reorganization's impact on both automakers.

Multiple State-Owned Auto Groups, Yet Insufficient Strength

As a key player under China South Industries Group, Changan Automobile has sustained a robust growth trajectory amidst intensifying market competition. In 2024, Changan Automobile's terminal sales totaled 2.683 million vehicles, marking the fifth consecutive year of positive year-on-year growth and setting a new high over the past seven years. Notably, sales of independent brands surpassed 2.226 million vehicles, while new energy vehicle sales exceeded 735,000, up by over 52.8% year-on-year.

Despite Changan Automobile's promising development, China South Industries Group recognizes the need to spin off the automotive division to facilitate its long-term international growth and optimize business composition. This strategic move paves the way for the long-rumored integration of FAW, Dongfeng, and Changan, initiating the process with the integration of Changan and Dongfeng to gauge its effectiveness.

Commentators often question why Changan Automobile, with sales surpassing Dongfeng Motor Group, cannot operate independently. This underscores the national trend towards industry consolidation. Among the top ten domestic automakers, large centrally-administered state-owned enterprises and state-owned enterprises dominate, yet their sales hover around 2 to 3 million vehicles. Amidst fierce competition, their overall profits have dwindled. The rapid rise of private automakers like BYD, Geely, and Chery necessitates the integration and adjustment of centrally-administered state-owned enterprises and state-owned enterprises to leverage economies of scale, reduce costs, and enhance efficiency for sustainable development.

Thus, while the Changan-Dongfeng integration involves numerous facets and complexities, it aligns with the long-term vision of a more consolidated domestic automotive industry, driven by both market capacity and full competition.

Navigating Continuities and Changes Post-Reorganization

Amidst the flurry of "unofficial" news regarding the reorganization, competent department officials have clarified that many details are still under discussion. For the majority of employees at both automakers, significant changes or adjustments are not anticipated in the near term. Additionally, "Auto Talk" has confirmed that the launch schedules of various brand models under both companies remain unaffected, and their holding companies and joint ventures continue to operate smoothly.

Currently, a complete integration between the two automakers is not imminent. Instead, a new automotive group headquarters and leadership team will be established, overseeing both entities. In terms of product production, sales, and operations, the existing systems will remain in place, ensuring minimal disruption for users. However, in the long run, the merger's objective extends beyond independent development. Early integrations in research and development, supply chains, and potential optimizations in brands and models are on the horizon.

Analysts predict that this merger will inevitably reshape the domestic automotive landscape. With heightened competition and operational pressures, more domestic automakers may face acquisition or merger. Simultaneously, the implications of this reorganization will have a profound impact on the industry as a whole.