Does Shanghai Need Lexus?

![]() 02/12 2025

02/12 2025

![]() 346

346

Yes.

A week ago, Toyota announced a significant development: they have decided to establish a wholly-owned factory for Lexus electric vehicles and batteries in Jinshan District, Shanghai. Scheduled to commence production in 2027, the factory will initially have an annual capacity of 100,000 units, with a total investment of 5 billion yuan.

This move makes Toyota the second foreign automotive giant, after Tesla, to build a wholly-owned factory in China.

The announcement highlighted that the new venture will leverage the advanced and mature industrial chain, logistics network, talent system, and market scale of Shanghai and the Yangtze River Delta region to develop electric models for the Lexus brand, showcasing China's rapid product development capabilities.

While Tesla's localization in 2018 was a demonstration project symbolizing "openness and inclusiveness" amidst the China-US trade war, Lexus's localization now holds greater market significance. After the relaxation of foreign ownership restrictions, Lexus is the first to follow Tesla in taking this bold step.

Notably, Shanghai once again finds itself at the forefront. From early German automakers like Volkswagen and General Motors to Tesla in 2018 and now Lexus, Shanghai has consistently been at the heart of pivotal transformations in the global automotive industry.

Winds of Change

Although Tesla officially announced its localization in China in 2018, it had already begun engaging with local governments as early as 2016 to pave the way for its entry. In May 2016, Hu Chunhua, then Secretary of the Guangdong Provincial Party Committee, led a delegation to the United States and met with Ren Yuxiang, Tesla's Global Vice President and President of the Asia-Pacific Region.

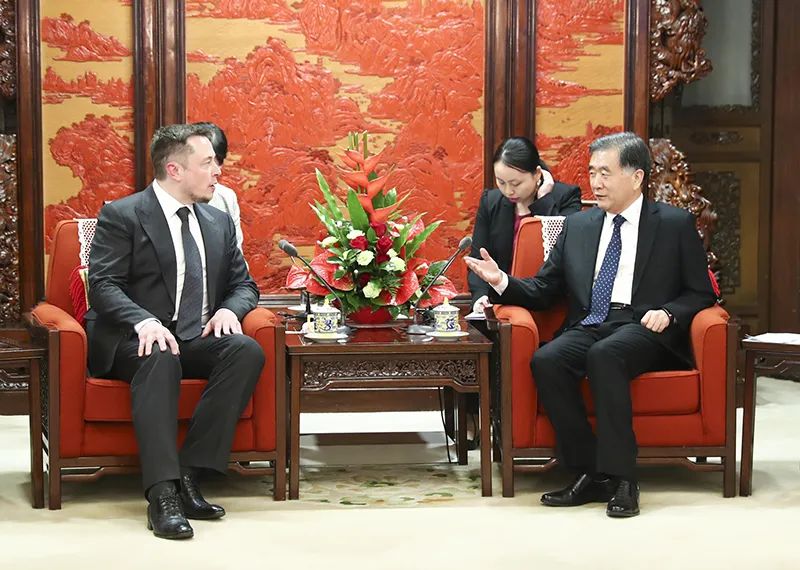

In April 2017, Wang Yang, then Vice Premier of the State Council, met with Musk in Beijing's Ziguangge. Wang, who was previously in charge of Guangdong, also favored placing Tesla's investment in the province.

However, Shanghai fought hard for its chance. On July 10, 2018, Musk arrived in Shanghai and signed an investment agreement for the electric vehicle project with the Shanghai Lingang Management Committee and Lingang Group, putting an end to speculation about the factory's construction.

A later-released agreement clearly outlined the strategic intent of the Shanghai Municipal Government. The agreement stipulated that Shanghai would provide Tesla with a 40 billion yuan low-interest loan (at an interest rate of only 3.9%) and offer 860,000 square meters of land for factory construction at 10% of the market price.

In return, Tesla agreed to pay over 2.2 billion yuan in taxes annually in China.

In fact, Tesla surpassed this target in 2023, reaching 2.33 billion yuan.

This indicates that the "10 billion yuan gamble" by the Shanghai Municipal Government has already yielded initial financial returns, and as Tesla's production capacity gradually expands, future tax revenues will continue to increase.

Beyond boosting local tax revenue, this has also driven the coordinated development of upstream and downstream supply chains. Tesla's component localization requirements have compelled relevant suppliers in Shanghai and its surrounding areas to enhance their technical prowess and production capacity, thereby becoming an integral part of the global electric vehicle industry chain.

From a certain perspective, Tesla, both a catalyst and a formidable competitor, has spurred the explosive growth of China's electric vehicle market and accelerated the elimination of outdated automotive capacity.

This time, with Lexus settling in Shanghai, the outside world is emphasizing Toyota's urgency.

Last June, Akio Toyoda, chairman of Toyota Motor Corporation, visited Shanghai to participate in Toyota's first racing event held in China. The main objective was to negotiate this cooperation project, which was finalized just eight months later, indirectly indicating Toyota's eagerness to leverage China's vast market demand and comprehensive smart electric industry chain to advance its electric transformation.

In this wave of global electrification, Japanese automotive giants represented by Toyota have generally been slow to react, getting an early start but arriving late, with their sales in China continuously declining.

In 2024, amidst fierce market competition, Toyota's sales in China amounted to 1.776 million units, a year-on-year decrease of 6.9%. Lexus, which once required a price increase for purchase, had to join the price war. By prioritizing volume over price, Lexus sold over 180,000 units in 2024, a slight increase of 0.3%, making it the only foreign luxury brand with positive growth last year, but still far below its 2021 peak of 227,000 units.

China accounts for 70% of global battery production capacity and 50% of the market share for motors and electronic controls. The industrial cluster in the Yangtze River Delta region can provide a comprehensive solution from batteries to smart cabins.

After Lexus's localization, tariffs and transportation costs are expected to decrease by 25%, and the localization rate of components is anticipated to reach 95%, enabling product prices to drop by 15%-20%, directly competing in the mainstream market within the 300,000 yuan price range.

Although domestically produced products will not be available until 2027 at the earliest, in the eyes of Lexus, Shanghai is the optimal global choice.

Return to the Peak

Shanghai has always been a significant player in China's automotive industry landscape. From the first Phoenix brand car crafted by workers to the first joint venture company in China's automotive industry to the automotive group consistently ranking first in national sales...

However, over the past 50 to 60 years, Shanghai's role has been as a pioneer in China's automotive industry and a pursuer of world-class automotive technology.

As a traditional automotive hub, Shanghai has actually been on the decline in recent years.

On January 22, 2025, the Shanghai Statistics Bureau revealed that Shanghai's automobile production in 2024 was 1.8075 million units, a year-on-year decrease of 16.2%. This figure is significantly lower than that of Shenzhen, the newly crowned "first city of automobiles" (2.9353 million units), and also lags behind Chongqing and Guangzhou.

Shanghai's "regression" in the automotive industry is primarily due to a sharp decline in the production and sales of SAIC Motor's fuel vehicles, coupled with a slight decrease in Tesla's deliveries. The 2025 Shanghai Government Work Report proposed to cultivate and expand the new energy automotive industry.

In 2024, SAIC Motor's production and sales both decreased by around 1 million units, with a 20% drop. Among them, the most notable decline came from SAIC-GM, which saw a reduction of about 600,000 units in production last year, a decrease of 57%.

In fact, SAIC Motor's overall sales decline has persisted for several years. At its peak in 2018, its annual sales exceeded 7 million units, gradually declining to 4.01 million units in 2024, marking the year with the largest drop.

Without Tesla's localization in 2018, Shanghai's performance would have been even worse.

Among the emerging new forces in this round, many have settled in Shanghai. WM Motor, NIO, HIPHI, JY Auto... Most of them have already collapsed. There is even a joke among the public that Shanghai has become a graveyard for new automotive industry players, with even NIO being picked up by Hefei at a substantial cost. In the field of new energy vehicles, only the wholly-owned Tesla stands out.

It is evident that in the partnership between Lexus and Jinshan, it is not just Toyota that is anxious, but Shanghai is equally eager. They need new energy to revitalize this automotive hub.

Gong Zheng, Mayor of Shanghai, recently mentioned in an interview that Shanghai will accelerate the development of four trillion-yuan industrial clusters, with the automotive industry being one of them. Among these, new energy vehicles and intelligent connected vehicles should be top priorities. Following the technical route of "single-vehicle intelligence as the foundation and vehicle-road-cloud coordination as the key support," Shanghai is constructing an industrial ecosystem for intelligent connected new energy vehicles.

After Lexus settles in Jinshan, Shanghai will have another vehicle production base besides Jiading and Pudong, forming a triangular rivalry. This consolidates its status as an important automotive industry hub amidst the decline of Volkswagen and General Motors.

Jinshan New District is located in the southwest of Shanghai, facing Hangzhou Bay and at the core of the Yangtze River Delta's one-hour economic circle. Although Jinshan New District was not previously a traditional automobile manufacturing base in Shanghai, nor did many large automobile companies build factories there, it is a crucial base for Shanghai's hydrogen energy supply and new material industry.

Lexus building a factory here can ensure the required supporting parts and components are supplied within a four-hour drive, highlighting the obvious advantage of industrial clustering.

Although current public opinion does not favor the future market significance of Lexus, if it is viewed as an export base for Toyota's new energy vehicles, the impact will be quite different.

Tesla's Shanghai factory exported 36% of its global sales in 2024, fully demonstrating the effectiveness of this strategy. Toyota plans to increase its production capacity in China to 2.5-3 million units by 2030 and achieve full electrification of the Lexus lineup. Once the US political cycle shifts, Toyota can rely on the low-cost advantage of China's supply chain to counterattack the North American market with cost-effective products.

Furthermore, Lexus's wholly-owned factory serves as a commendable example for major luxury brands.

Perhaps Porsche, which has also been rumored for many years, will be eager to follow in Lexus's footsteps.

Note: Some images are sourced from the internet. If there is any infringement, please contact us for removal.