Eight Years of Non-recurring Net Losses Totaling 13.8 Billion Yuan: Can JAC Motors' "Big Bet" on Zunjie Break the Stalemate?

![]() 02/12 2025

02/12 2025

![]() 343

343

Amidst substantial losses, JAC Motors (600418.SH) is grappling with transformation. Can Zunjie turn the tide for them?

Author | Zhang Xinran

Since 2017, JAC Motors has consistently incurred non-recurring net losses, with an estimated loss of approximately 2.74 billion yuan in 2024. Over the past eight years, cumulative losses have soared to 13.8 billion yuan.

The announcement reveals that JAC Motors' performance "storm" was primarily due to the impact of its associated company Volkswagen Anhui and impairments on some of the company's assets.

In terms of sales, JAC Motors' own operations have also faltered. In 2024, the company sold a total of 403,100 vehicles, marking a year-on-year decrease of 7.42%. In January 2025, both production and sales volumes of the company's vehicles declined.

As the automotive industry accelerates its restructuring, JAC Motors continues its transformation efforts to save itself. In November 2024, the Zunjie S800, jointly developed by JAC Motors and Huawei, made its public debut with an expected price range of 1 to 1.5 million yuan.

As Huawei's most premium brand within its "Four Worlds" concept, can Zunjie replicate Thalys' success and rescue JAC Motors?

01

Performance vs. Stock Price Divergence

According to its official website, JAC Motors was founded in 1964. It is a global integrated automotive enterprise group that encompasses the research, production, sales, and service of a comprehensive range of commercial and passenger vehicles, spanning various fields such as automotive travel and financial services. The company has delivered 10 million vehicles of various types to customers worldwide and is a pivotal force driving the rise of China's automotive industry.

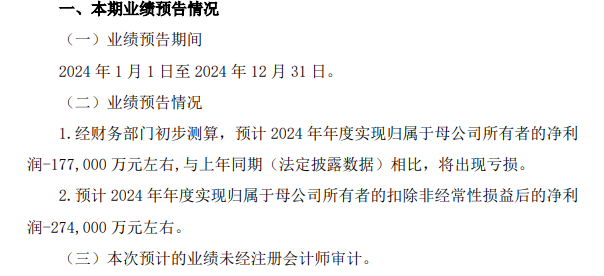

In terms of performance, JAC Motors is deeply mired in losses. On January 25, the company released its 2024 annual performance forecast, expecting a net profit attributable to the parent company's owners (referred to as "net profit") of approximately -1.77 billion yuan for 2024, and a net profit after deducting non-recurring gains and losses attributable to the parent company's owners (referred to as "non-recurring net profit") of approximately -2.74 billion yuan.

Extending the timeline, if the final performance for 2024 aligns closely with the performance forecast, this will mark the eighth consecutive year that JAC Motors has suffered non-recurring net profit losses. From 2017 to 2024, JAC Motors' cumulative non-recurring net profit losses will reach 13.8 billion yuan, with multiple instances of relying on state subsidies to turn net profits positive.

Regarding the primary reasons for the expected loss in 2024, JAC Motors explained that the operating conditions of its associated company Volkswagen Anhui turned negative, resulting in the company's investment income from Volkswagen Anhui being recognized as negative for 2024, approximately -1.35 billion yuan. Simultaneously, some of the company's assets suffered impairment, with asset impairment provisions of approximately 1.1 billion yuan.

As early as 2017, JAC Motors and Volkswagen initiated cooperation, jointly establishing "JAC Volkswagen" and launching a new electric vehicle brand "SOL E20X," but sales of the new car SOL E20X were sluggish, failing to penetrate the new energy vehicle market. In 2020, Volkswagen invested 1 billion euros to acquire a 50% stake in JAC Motors' parent company, while increasing its shareholding in JAC Volkswagen to 75%, obtaining control of the joint venture, which was then renamed Volkswagen Anhui.

At that time, some investors directly accused JAC Motors of "selling itself." However, JAC Motors has always placed high hopes on Volkswagen Anhui. In March 2024, JAC Motors announced that it would jointly increase its capital contribution to Volkswagen Anhui by 6.5 billion yuan with Volkswagen China in proportion to their shareholdings, with JAC Motors contributing 1.625 billion yuan in cash.

In fact, even without the drag of the joint venture, JAC Motors' own market performance has been underwhelming. In 2024, JAC Motors sold a total of 403,100 vehicles throughout the year, marking a year-on-year decrease of 7.42%.

This decline in sales was primarily concentrated in the passenger vehicle sector. JAC Motors' passenger vehicle business is divided into sport utility vehicles (SUVs), multi-purpose vehicles (MPVs), and basic passenger vehicles (sedans). In 2024, the cumulative sales of the above three models were 85,332, 15,472, and 65,959 vehicles, respectively, with year-on-year declines of 19.22%, 19.98%, and 12.02%, respectively.

In January of this year, JAC Motors experienced a double decline in both production and sales of automobiles. Specifically, the company's production volume in January was 35,000 vehicles, a year-on-year decrease of 17.81%; and sales volume was 35,600 vehicles, a year-on-year decrease of 9.39%. Among them, the production volume of new energy passenger vehicles in January was 1,734 vehicles, a year-on-year decrease of 15.29%; and sales volume was 1,113 vehicles, a slight year-on-year increase of 9.01%.

It is worth mentioning that before partnering with Volkswagen, JAC Motors had already signed an OEM agreement with NIO in 2016; however, after seven years of cooperation, JAC Motors transferred assets related to NIO's co-branded models to NIO for 3.16 billion yuan at the end of 2023. From 2024 onwards, JAC Motors' sales will no longer include NIO's sales.

Despite its poor performance, JAC Motors' stock price has shown a robust upward trend. Over the past year, JAC Motors' stock price has continued to rise. As of February 11, 2025, JAC Motors' stock price closed at 43.08 yuan, representing a cumulative increase of 167% compared to 16.13 yuan at the end of 2023, with a total market capitalization of 94.09 billion yuan.

02

Heavy Investment in New Energy Ventures

To adapt to the evolving automotive industry, JAC Motors continues its transformation towards the field of new energy vehicles and has forged a partnership with Huawei.

On February 11, Yu Chengdong, Executive Director of Huawei, Chairman of the Terminal BG, Chairman of the Intelligent Automotive Solutions BU, and Director of the IRB for Intelligent Terminals and Intelligent Automotive Components, posted on social media that the core black technology of Zunjie would be unveiled this month, "together we will see the future of intelligent travel".

Previously, in November 2024, Huawei launched its first "million-yuan luxury car" - Zunjie S800, a luxury sedan jointly developed by Huawei and JAC Motors. Yu Chengdong once described Zunjie as "far surpassing the class of Maybach and Rolls-Royce Phantom." In terms of pricing, the Zunjie S800 is expected to sell for 1 to 1.5 million yuan.

Industry insiders believe that the collaboration with Huawei has brought advanced technical support and market channels to JAC Motors, also enhancing the company's core competitiveness and brand influence. As the first model of the partnership between the two parties, the positioning of Zunjie S800 as a luxury intelligent connected vehicle indicates that JAC Motors will further expand into the high-end market and optimize and upgrade its product structure.

To support this cooperative project, JAC Motors has invested substantial funds in capacity building. In 2024, JAC Motors also stated that it would invest more than 20 billion yuan in research and development over the next five years, launch more than 30 intelligent new energy vehicle products, and continuously strengthen its capabilities in mastering and developing independent core technologies around the intelligent connected new energy vehicle industry chain.

In January of this year, JAC Motors' private placement application was accepted by the Shanghai Stock Exchange. It is reported that JAC Motors plans to raise a total of no more than 4.9 billion yuan for the development of a high-end intelligent electric platform project. Based on JAC Motors' electric vehicle technology, this project integrates intelligent and connected vehicle solutions from Huawei and other high-tech enterprises to develop a new generation of high-end intelligent electric platforms.

JAC Motors' situation is quite similar to that of Thalys. As the first brand created by Huawei's HarmonyOS intelligent travel solution, relying on Huawei's product, technology, brand strength, and channel capabilities, the popularity of AITO has consistently brought positive news to Thalys. After years of losses, Thalys achieved profitability in 2024.

However, it remains to be seen whether the Zunjie S800 can elevate JAC Motors to new heights and replicate Thalys' success.

END

Edited by | Xiao'er

Typeset by | Wu Yue

Chief Editor | Lao Chao

Images sourced from the internet