From Zeng Qinghong to Feng Xingya: Navigating China's Auto Industry's Transformation Pain at GAC Group

![]() 02/12 2025

02/12 2025

![]() 528

528

The relentless march of time rolls on.

Wu Wei, Investor Network

During the automotive industry's golden decade (2016-2024), Zeng Qinghong, the former chairman of GAC Group (601238.SH), propelled a regional automaker to the forefront of global competition with his astute market insights and decisive leadership. His efforts in sales expansion, independent brand rise, and new energy layout propelled GAC Group into the top ranks of the Fortune Global 500.

However, with industry turmoil and the decline of the joint venture model, GAC Group faced a "double whammy" of declining sales and profits in 2024. Zeng Qinghong's retirement and Feng Xingya's succession as the new chairman marked the end of an era and the commencement of another challenging journey.

This transition from the "golden age" to the "pain of transformation" is not merely about one enterprise's fate but a microcosm of China's auto industry's transformation.

From Joint Venture Glory to Independent Brand Breakthrough

Zeng Qinghong's career is deeply intertwined with GAC Group's rise. He joined in 1997 and became vice chairman and general manager in 2005. When he took over as chairman in 2016, the company's annual sales were 1.65 million units with revenue below 50 billion yuan. Through the "using joint ventures to nurture independent brands" strategy, he drove Honda and Toyota joint ventures' expansion, and in 2023, sales surpassed 2.5 million units with revenue exceeding 100 billion yuan.

However, Zeng Qinghong's true industry stature was cemented by his breakthroughs in independent brands and the new energy sector.

Zeng Qinghong was adept at the "market for technology" logic. The GAC Mitsubishi joint venture project in 2010 introduced SUV technology to fill product gaps, and the 2013 ASX became a segment benchmark. GAC Fiat Chrysler targeted the sedan market, with models like the Viaggio making inroads with European design. Joint venture profits provided financial and technological support for independent brands, and GAC Trumpchi's chassis tuning drew on Mitsubishi's off-road heritage.

After becoming chairman, Zeng Qinghong invested joint venture profits into independent research and development, defying opposition. In 2017, the GAC Intelligent Connected New Energy Vehicle Industrial Park was launched, and in 2020, the "No Technology, No GAC" strategy propelled GAC Trumpchi and GAC AION forward. GAC AION achieved one million units of production and sales in just four years and eight months, with 2022 sales reaching 480,000 units, ranking among the top three in the new energy sector. GAC Trumpchi, with hits like the GS4, achieved growth rates exceeding 85% for six consecutive years, contributing 415,000 units to group sales in 2023.

Under Zeng Qinghong, GAC Group ventured into lithium batteries, creating a vertically integrated energy ecosystem from lithium mining to battery recycling. The InPower battery factory's commissioning and solid-state battery technology release freed GAC Group from CATL dependence. This layout stabilized GAC AION's cost defenses in 2024, maintaining gross margins above the industry average despite declining sales.

From Rapid Development to Strategic Inertia

While Zeng Qinghong's decisions once shone, over-reliance on joint ventures and delayed response to market changes posed hidden dangers for GAC Group.

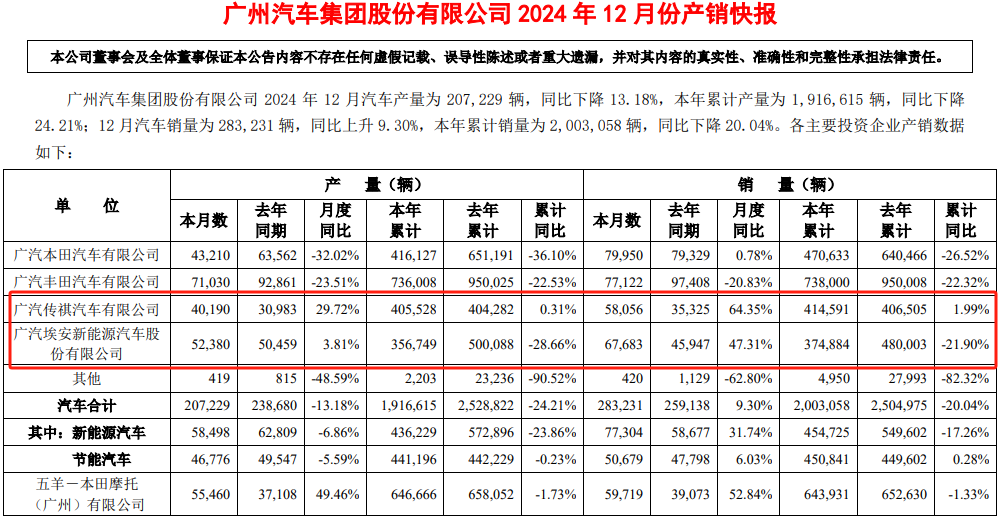

GAC Honda and GAC Toyota have long contributed over 60% of sales, but in 2024, both saw sales decline by 26.5% and 22.3% year-on-year, leading to a more than 72% drop in net profit. The slow electrification of joint venture brands hindered GAC Group's pivot.

While GAC Trumpchi and GAC AION sales climbed, profitability remained a concern. In 2024, with intelligent driving technology's popularization, GAC AION, with slower iterations, saw sales impacted, reaching 375,000 units, a 21.9% year-on-year decline. GAC Trumpchi's "trading volume for price" strategy preserved market share, but profit per vehicle was only one-third that of joint venture models, and under new energy models' impact, 2024 sales increased by only 2% year-on-year.

Data Source: Company Announcements

Zeng Qinghong-led joint ventures with Mitsubishi and deepened cooperation with GAC Fiat Chrysler became GAC Group's Achilles' heel as the domestic auto market changed. GAC Mitsubishi restructured and exited the market in October 2023, leasing factories and equipment to GAC AION for capacity expansion. GAC Fiat Chrysler went bankrupt in 2022, and its Changsha factory remains unsold despite price reductions, failing to sell at auction five times.

Zeng Qinghong's "professional manager system" initially activated efficiency but later exposed issues like lengthy decision-making chains and conservative decision-making. As early as 2019, GAC Group invested in the intelligent driving technology platform WeRide, but due to slow internal approval processes, L3 road tests were not approved until 2024. During this period, intelligent driving became a standard feature and main selling point for emerging brands like Li Auto, AITO, and Xiaomi, with market beliefs that these brands' intelligent driving capabilities already met L3 standards.

From Marching Forward to Difficult Choices

In February 2025, Zeng Qinghong officially retired due to age, and Feng Xingya succeeded him as chairman. Feng Xingya, a GAC Group veteran since 2004, must now address the company's first loss in nearly 20 years, joint venture brands' deceleration, and sluggish new energy vehicle growth.

First, Feng Xingya must tackle the mess left by his predecessor. After GAC Fiat Chrysler's bankruptcy, the Changsha factory failed to sell at auction five times, and its bankruptcy reorganization requires attention. The joint venture brand Hozon Auto established by GAC Group went bankrupt in early 2025, now a burden on the group.

Moreover, with the domestic new energy vehicle industry's rapid development, whether GAC Group will continue to rely on Toyota and tilt resources to areas like hydrogen energy or focus on developing independent brands is a question for Feng Xingya's new management team.

Amid the joint venture model's weakness, GAC Group launched the "Panyu Action" plan, aiming to increase independent brands' sales share to over 60% by 2027, but the current combined share of GAC AION and GAC Trumpchi is less than 40%. Feng Xingya's promoted Integrated Product Development (IPD) system still needs to address two pain points: product definition disconnected from users, and lagging behind industry leaders in solid-state battery mass production and intelligent driving layout.

Recently, under Feng Xingya, GAC Group has bet on generative AI and cloud-end integrated large models, aiming for domestic leadership in intelligent driving technology by 2025. However, compared to competitors like Huawei and Xpeng, GAC Group's smart cabin iteration speed is still behind. After cooperating with Huawei's Intelligent Automotive Solutions BU, whether GAC Group can grasp technological autonomy, bargaining power, and discourse power is a decision it faces.

Zeng Qinghong proved the feasibility of traditional automakers relying on joint ventures to nurture independent brands over eight years but at the cost of lagging behind in transformation. The newly appointed Feng Xingya needs to find a new balance between "disengaging from joint ventures" and "technological self-reliance." This battle's outcome will not only determine GAC Group's return to growth but also test China's auto industry's transformation from "market for technology" to "technology creating the market."

As Feng Xingya said, "We cannot change the wind, but we can adjust the angle of the sail." The adjustment's cost may be another generation of automakers' glory and pain. (Produced by Siwei Finance)■

Source: Investor Network