Can Feng Xingya Navigate GAC Group's Path to Successful Transformation?

![]() 02/11 2025

02/11 2025

![]() 574

574

The outcome remains uncertain. After all, the challenges confronting GAC Group may be unprecedented.

Body

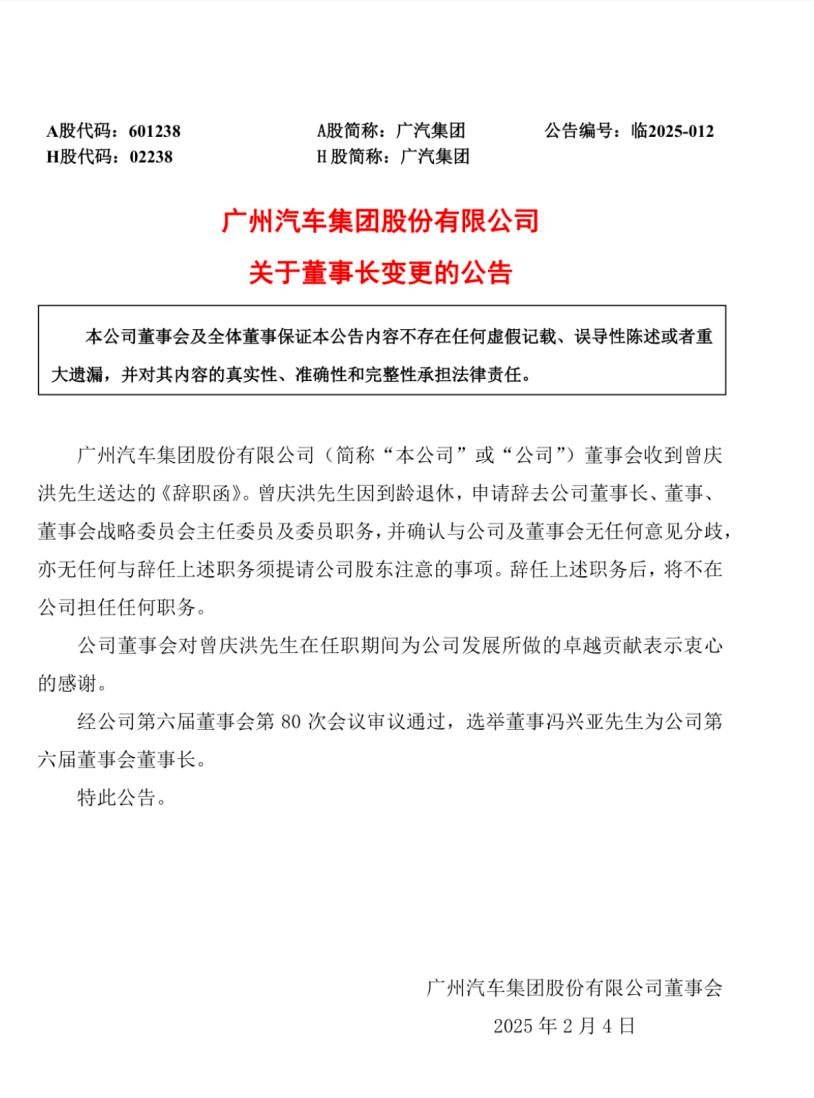

Feng Xingya has assumed his new role.

Rumors have swirled since last year regarding who would become GAC Group's new chairman.

There were even whispers of a potential appointment from FAW Group.

Ultimately, GAC Group opted for a more cautious approach, promoting General Manager Feng Xingya to Chairman.

Perhaps for GAC Group, some issues can only be addressed by insiders.

Why do we say this? Let's delve deeper into GAC Group.

Feng Xingya as the Prime Candidate

Feng Xingya is undoubtedly the most fitting candidate to take the helm at this juncture.

He joined GAC Group in 2004 as a frontline salesperson and was promoted to General Manager in 2016, the same year Zeng Qinghong became Chairman.

Together, they ushered in an eight-year high point for GAC Group.

In 2016, GAC Group sold 1.65 million vehicles with revenue of around 50 billion yuan. By 2023, sales had surged to 2.5 million vehicles, with revenue nearing 130 billion yuan.

These achievements are indeed remarkable.

Crucially, as a 20-year veteran of GAC Group, Feng Xingya likely understands where the company's challenges lie.

In fact, Feng Xingya initiated new actions even before officially taking office.

Firstly, he announced the launch of the "Panyu Initiative," relocating GAC Group's headquarters from the city center to the production frontline in Panyu Automobile City.

According to Feng Xingya, this move aims to bolster independent brands, with the goal of them accounting for over 60% of the group's total sales by 2027.

Secondly, he implemented a new cadre system, introducing competitive appointments based on performance, and fully adopting term limits and contractual management.

This is unusual for a state-owned enterprise.

It signifies that GAC Group is embarking on a path towards marketization, thereby enhancing the group's overall efficiency.

These two initiatives gained significant momentum, paving the way for Feng Xingya's ascension to the chairmanship.

On February 6, just two days after taking office, Feng Xingya lit the third fire in his capacity as the new chairman.

He outlined a clear vision for GAC Group's future, emphasizing three key tasks: "stabilizing joint ventures, strengthening independence, and expanding the ecosystem."

Through a series of consistent actions, Feng Xingya's determination to lead GAC Group's transformation is palpable.

However, success is far from guaranteed.

The challenges facing GAC Group may be unprecedented.

GAC Group's Decline: A Case of Active Stagnation

Feng Xingya inherits GAC Group's first loss in two decades.

And it's a catastrophic one.

GAC Group's 2024 annual performance forecast reveals a year-on-year net profit decline of up to 81% and a net profit after non-recurring items decrease of up to 231%.

These figures are alarming.

The reasons behind this are multifaceted.

On the surface, it's due to waning sales of GAC Group's once-proud joint venture vehicles.

Historically, GAC Group's sales and profits relied heavily on Guangqi Honda and Guangqi Toyota. However, in 2024, sales of "GAC's two Toyotas" plunged by over 20%, dragging down the group's overall profits.

But a deeper dive reveals that GAC Group's issues extend beyond joint venture vehicles.

They are systemic and complex.

The candid remarks of former Chairman Zeng Qinghong provide some insight.

For instance:

'The cost of power batteries accounts for 40-60% of the car. Am I not working for CATL?'

'(Other automakers) if you want to die early, reduce prices sooner and more drastically.'

'We at GAC suggest that government departments consider studying the issue of equal rights for oil and electricity.'

These comments, coupled with GAC Group's performance, suggest a company that has made strategic missteps in the fuel vehicle market, lacks key technologies to compete on price, and has a one-sided brand strategy.

In summary:

As GAC Group's sales and profits declined, it failed to adapt to industry and market changes, neglecting to balance the development of independent and joint venture brands, leading to a comprehensive disconnect within the group.

In essence, GAC Group has actively stagnated.

And Feng Xingya is poised to lead GAC Group on a path of rapid catch-up.

GAC Group: Searching for Its Soul

Public discourse has been abuzz with questions about GAC Group's core identity.

Yet, GAC Group has yet to provide a satisfactory answer.

The high-end new energy brand AION LX stumbled out of the gate, and its future remains uncertain. Meanwhile, AION, which entered the market earliest and boasts the largest sales volume, is undergoing a challenging transition from B to C segments.

Until GAC Group answers this question, its sales will continue to decline.

In January this year, GAC Group's new energy vehicle sales amounted to only 9,905 units, a nearly 50% year-on-year decrease.

Perhaps GAC Group is also actively seeking its soul.

Late last year, GAC Group and Huawei officially announced a new round of deepened cooperation agreements.

They established GH Corporation, planning comprehensive collaboration in product definition, design, development, marketing strategies, and ecosystem to launch a series of intelligent new model products.

However, it's worth noting that Huawei already has four partners: ARCFOX, AITO, Dongfeng HOSEN, and FANGCHENGBEAST.

According to information, this year, SAIC, SAIC-Audi, and FAW-Audi will also introduce models with a high "Huawei content."

If they all embody Huawei's soul, where does GAC Group's advantage lie?

As GAC Group's helmsman, Feng Xingya has stated, 'GAC Group is a seasoned player in the automotive industry. Reform and transformation have always been the cornerstone of our development.'

We have witnessed Feng Xingya's reform and transformation efforts.

However, we remain cautious. With internal operational inertia and intensifying external competition, is it already too late?

We wish Feng Xingya well and eagerly anticipate the transformation of GAC Group under his leadership.