25% Surge! Major State-Owned Enterprise Reorganization! The Necessity Behind Dongfeng and Changan's Union

![]() 02/11 2025

02/11 2025

![]() 378

378

A potential new automotive giant may soon emerge in China.

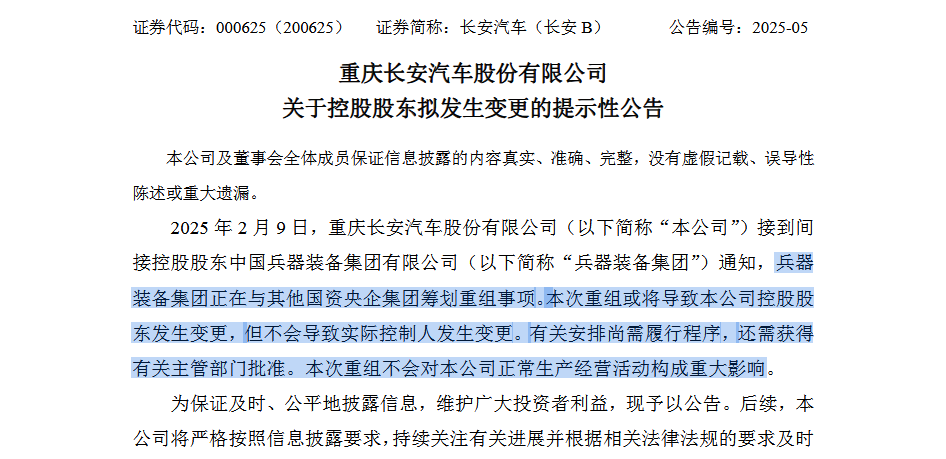

On February 9, Changan Automobile (00625.SZ) and Dongfeng Automobile (600006.SH) issued nearly identical announcements: The companies are planning a reorganization with other state-owned and central enterprises. This reorganization may lead to changes in the company's indirect controlling shareholder but will not alter the actual controller. Relevant arrangements are subject to procedural approval from competent authorities. The reorganization is not expected to significantly impact the companies' normal production and operational activities.

The industry generally interprets this joint announcement as a merger and reorganization between the two companies. In response to this news, on February 10, Hong Kong-listed Dongfeng Group Co., Ltd. (00489.HK) surged by 85% at one point and closed up 25.7%. A-share listed Dongfeng Motor Corporation Limited (600006.SH) and Dongfeng Technology Co., Ltd. (600081.SH) closed at the daily limit of 10%.

So, what is the significance of this reorganization between Dongfeng and Changan?

How valuable will the new China's No.1 be after the reorganization?

Public data shows that in 2024, Changan Automobile sold 2.6837 million vehicles, while Dongfeng sold 2.4806 million, totaling 5.1643 million vehicles. This volume surpassed SAIC Motor's 4.639 million and BYD's 4.27 million vehicles. Globally, it will compete closely with Stellantis Group's 5.42 million vehicles, replacing BYD as the world's fifth largest. BYD will drop to sixth place globally.

This means that if the two companies merge, China's largest auto company in terms of sales will shift from SAIC Motor and BYD to the new entity formed by Dongfeng and Changan's reorganization. So, how valuable will this new China's No.1 be?

From a sales composition perspective, in 2024, Dongfeng sold 1.372 million vehicles under its independent brands, accounting for 55.3% of the group; Changan sold 2.231 million vehicles under its independent brands, accounting for 83.13% of the group. Together, the independent brands of both companies sold 3.603 million vehicles, accounting for 69.76% of their total sales. This is highly significant. Although this volume trails BYD's 4.27 million vehicles, it still holds a substantial advantage over second-tier groups like SAIC Motor, Chery Group, Geely Automobile Group, and Great Wall Motor.

In 2024, SAIC Motor sold 2.741 million vehicles under its independent brands, Chery Group sold 2.6039 million, Geely Automobile Group (Geely, Lynk & Co, and Zeekr brands) sold 2.1765 million, Great Wall Motor sold 1.23 million, and FAW sold 819,000 vehicles under its independent brands. If Changan and Dongfeng merge, they will secure the second position in terms of independent brands.

An interesting phenomenon is that among the top 8 auto companies in China in terms of sales, Dongfeng, SAIC, Changan, Chery, and FAW are state-owned enterprises, while BYD, Geely, and Great Wall are private enterprises. Based on the sales volume of 17.4434 million vehicles (excluding joint ventures) of these 8 major companies' independent brands, state-owned enterprises account for 55.99%. This indicates that state-owned enterprises still dominate China's independent brands, reflecting the resilience of China's state-owned auto enterprise groups in this round of market competition.

Joint ventures have retreated to the second tier, and Changan and Dongfeng are actively transforming.

Another intriguing phenomenon is that for decades, China's "Big Three" – FAW, Dongfeng, and SAIC – have heavily relied on joint venture brands for sales and profits. However, this scenario has undergone significant changes in recent years.

Taking Changan Automobile as an example, its two joint venture companies, Changan Ford and Changan Mazda, sold 247,000 and 75,600 vehicles respectively in 2024, with their proportion in Changan Automobile dropping to an all-time low of about 12%.

Dongfeng Motor Corporation also presents a similar situation. Its joint venture companies Dongfeng Nissan, Dongfeng Honda, Zhengzhou Nissan, and Dongfeng Peugeot Citroen saw sales declines of 12.7%, 29.2%, 13.5%, and 15% respectively in 2024 compared to the previous year.

SAIC Motor also faces a similar situation. In 2024, SAIC Volkswagen and SAIC GM, which used to account for a large proportion of sales, declined by 5.51% and 56.54% respectively.

In contrast, emerging independent brands under these enterprises, such as Deep Blue, HOVO, and IM Motors, have shown rapid growth. HOVO Auto saw a year-on-year growth of 59.3% in 2024, and IM Motors grew by 71.24% in 2024.

This signifies that China's "Big Three" are rapidly transforming from being dominated by joint venture businesses to independent brands, and they have largely succeeded in this transition.

How will Dongfeng and Changan merge? Who will lead?

The critical question is that both Changan and Dongfeng have numerous brands under their umbrella. Before the official announcement, there is limited external information on how exactly they will integrate, which brands will be retained, and which will be discarded.

Sources reveal that the integration of Dongfeng and Changan may not involve complete vehicles but will focus on parts, particularly in the battery sector. Another media outlet pointed out that the sales volume of new energy vehicles is a pivotal factor in determining Dongfeng and Changan's discourse power in the reorganization.

In fact, there have been multiple rumors of reorganization between Changan, Dongfeng, and previously FAW, but they have often remained more talk than action, highlighting the integration challenges.

But time waits for no one.

According to data from the China Association of Automobile Manufacturers, China's auto production and sales reached 31.282 million and 31.436 million vehicles respectively in 2024, up 3.7% and 4.5% year-on-year. Among them, new energy vehicle production and sales reached 12.888 million and 12.866 million vehicles respectively, up 34.4% and 35.5% year-on-year. This means that new energy vehicles' sales share has reached 40%. It is anticipated that this proportion will exceed 50% in 2025. However, whether it's Dongfeng or Changan, their new energy vehicles' sales share is far below this benchmark.

Data shows that in 2024, Dongfeng sold 860,000 new energy vehicles, and Changan sold 730,000. Neither Changan's new energy flagship Avita nor Dongfeng's new energy flagship HOVO is growing as rapidly as Xiaomi Auto, which only started deliveries in April 2024.

Public data shows that Xiaomi Auto delivered 135,000 vehicles in 2024, while Dongfeng HOVO sold 80,116 vehicles in 2024, and Avita sold only 73,606 vehicles for the entire year. Why are HOVO and Avita, both backed by major companies, unable to compete with Xiaomi Auto, an "outsider" in the auto industry? This is likely an important source of pressure for the senior management of Changan and Dongfeng.

Moreover, as early as March 2024, Zhang Yuzhuo, director of the State-owned Assets Supervision and Administration Commission of the State Council of China, stated in an interview that state-owned auto enterprises are not developing fast enough in the field of new energy vehicles, "not as good as Tesla, not as good as BYD". The SASAC will adjust policies and conduct separate assessments of the new energy vehicle business of the three central auto enterprises (FAW, Dongfeng, and Changan). The assessment items include technology, market share, and the future development of the enterprises. Now, promoting the integration of Changan and Dongfeng at the beginning of 2025 may be a continuation of this consideration.

In terms of new energy vehicle brands, besides the high-end new energy brand HOVO, Dongfeng has established two other brands, Dongfeng E-π and Dongfeng Nano, in recent years. Changan Automobile also has three new energy brands: Avita, Deep Blue, and Qiyuan. The establishment times of these six brands are highly similar. Avita and HOVO were both founded in 2018, which is different from the auto new forces represented by "NIO, Xpeng, and Li Auto", which were generally founded in 2014-2015. These two brands are obviously somewhat "latecomers". This relatively serious lag indicates that Changan and Dongfeng lack insight into cutting-edge technology fields.

Changan Deep Blue was established in 2022, while Dongfeng E-π, Dongfeng Nano, and Changan Qiyuan were established in 2023. The positioning of these major brands is also highly similar. This means that as enterprises under the central SASAC, Changan and Dongfeng have very scattered brands, which is not conducive to concentrating advantageous resources to participate in market competition and to a certain extent requires "internal consumption" – competing with related brands of sibling enterprises. This is obviously not what the SASAC wants to see. In this context, consolidating and integrating these brands is probably the focus of this integration and acquisition between Dongfeng and Changan.

Final thoughts:

Therefore, the question arises: Besides the existing traditional fuel vehicle brands, is it better for Dongfeng and Changan to integrate their new energy brands or let them operate independently? The author believes that in today's global auto industry that emphasizes integration and cooperation, where even European and Chinese enterprises are adopting cooperation in the field of new energy to jointly conduct research and development of new energy vehicles, as enterprises under the SASAC, before successfully creating any relatively successful new energy brands, it is a better choice for Changan and Dongfeng to integrate advantageous resources to focus on creating 1-2 rather than 5-6 new energy brands.