Two Key Central Auto Firms Plan for Reorganization!

![]() 02/11 2025

02/11 2025

![]() 428

428

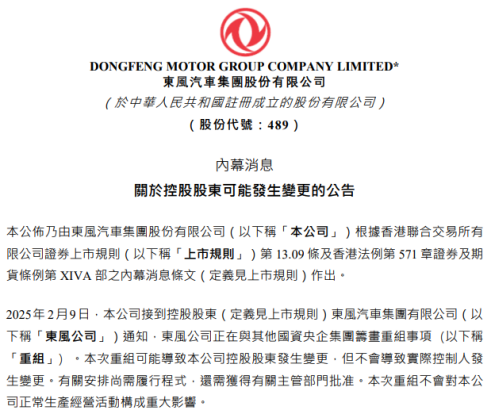

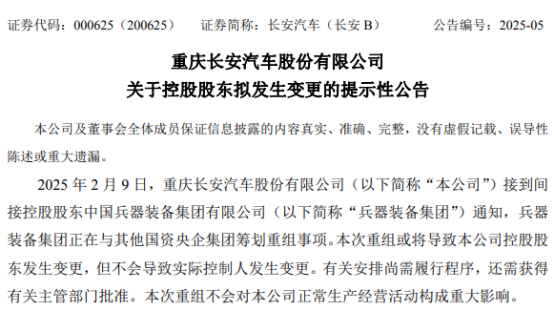

On February 9, Dongfeng Motor Group (00489) and Changan Automobile (000625) both released announcements regarding potential changes in their controlling shareholders.

Dongfeng Motor Group's announcement revealed that it had received a notice from its controlling shareholder, Dongfeng Motor Corporation Limited (hereinafter referred to as "Dongfeng Motor"), indicating plans for a reorganization with other state-owned central enterprises.

Similarly, Changan Automobile announced that it had been informed by its indirect controlling shareholder, China South Industries Group Corporation (hereinafter referred to as "CSGC"), of CSGC's plans for a reorganization with other state-owned central enterprises.

Both companies clarified that this reorganization might lead to changes in their controlling shareholders but would not alter their actual controllers.

This announcement garnered significant market attention and sparked heated discussions. Several analyses suggested that this could be a signal for a joint reorganization between Dongfeng Motor Group and Changan Automobile. However, neither company's announcement specified the parties involved, and the matter remains in the planning stage, with details yet to be disclosed.

Dongfeng Motor Group is one of China's three major central auto companies. Established in 1969 as the Second Automobile Works, it officially became Dongfeng Motor Corporation Limited in 1991. Data shows that in 2024, Dongfeng Motor Group sold 1.8959 million vehicles, a year-on-year decrease of approximately 9.2%. Its parent company, Dongfeng Motor, sold 2.4806 million vehicles, an increase of about 2.5%, while its subsidiary Dongfeng Motor Corporation Limited (600006) sold 155,000 vehicles, also an increase of around 2.5%.

CSGC is a state-owned enterprise directly under the central government and a significant backbone enterprise managed by the central government. It serves as a core force in the defense science and technology industry, with over 60 wholly-owned or controlled subsidiaries and research institutes, including Changan Automobile, Jialing Industrial, Construction Industrial, and China South Industries Research Institute. In 2024, Changan Automobile sold 2.6838 million vehicles, an increase of 5.12% year-on-year.

Apart from Dongfeng Motor Group and Changan Automobile, several listed companies under Dongfeng and CSGC also issued reorganization announcements on the same day, including Dongfeng Technology, Great Wall Military Industry, DAE, and Construction Industrial.

Regardless of whether Dongfeng merges with Changan, the factors driving this situation are noteworthy:

1. In an interview on March 5 last year, Zhang Yuzhuo, Director of the State-owned Assets Supervision and Administration Commission (SASAC) of the State Council of China, stated that state-owned auto companies have not developed fast enough in the new energy vehicle sector, even saying that they "are not as good as Tesla or BYD." He also indicated that SASAC would adjust policies to separately assess the new energy vehicle businesses of three central auto companies, focusing on technology, market share, and future development.

The three "central auto companies" include FAW Group, Dongfeng Motor Group, and Changan Automobile Group.

2. At the China EV100 Forum on March 15 last year, Gou Ping, member of the Party Committee and Deputy Director of SASAC, stated that SASAC would address the gaps and deficiencies of central enterprises in the new energy vehicle sector by increasing resource investment, accelerating transformation, and implementing a strategic emerging industry investment doubling action plan. It would also encourage and support central enterprises to carry out high-quality investments, mergers and acquisitions, and specialized integration through equity investment, fund investment, and other methods.

3. Apart from the gap in the new energy vehicle sector, there is also a profitability gap between domestic auto companies and traditional auto giants.

At the 2024 China Automobile Chongqing Forum, Zeng Qinghong, Chairman of GAC Group, pointed out that Toyota's net profit for its fiscal year 2023 (April 2023 to March 2024) exceeded 200 billion yuan, while only 12 of the 18 domestic listed auto companies were profitable in 2023, with their combined net profit not exceeding 90 billion yuan.

4. The reorganization and integration of central enterprises is a future trend. At a press conference held by the State Council Information Office in January this year, Lin Qingmiao, Director of the Enterprise Reform Bureau of SASAC, clearly stated that SASAC would use the reorganization and integration of central enterprises as a starting point to further promote the optimization of the state-owned economy's layout and structural adjustment. Future efforts would focus on three dimensions: enhancing central enterprises' status in important industries through new company establishments and strategic reorganizations; deepening specialized integration to avoid industry competition and optimize the industrial ecology; and promoting a transition from simple asset integration to deeper business, personnel, and cultural integration, fully releasing synergies and reform dividends.

If Dongfeng and Changan ultimately merge, it will undoubtedly profoundly impact China's automotive industry landscape. According to Xuanyuan Business Review, in the new auto group formed by their merger, the chairman and general manager will come from Dongfeng Motor, namely Yang Qing (current chairman of Dongfeng Motor) and Zhou Zhiping (current general manager of Dongfeng Motor). The executive vice president will be Wang Jun, the current president of Changan Automobile (who was promoted to vice president of CSGC earlier this year). Zhu Huarong, the current chairman of Changan Automobile, will reach retirement age this year.