Dongfeng and Changan Plan Restructuring, Potentially Becoming New Leaders in China's Auto Industry

![]() 02/10 2025

02/10 2025

![]() 384

384

TEAM

Typesetting: Yuni Mashu

Images: From the internet, please delete if infringement

Produced by Qiancheng Digital Intelligence (Effect Marketing Intelligence Agency)

Following the merger of China Shipbuilding Industry Corporation by China Heavy Industries and the business integration of China Baobian Electric with China Electrical Equipment Group Corporation, the trend of mergers and acquisitions among state-owned enterprises has now extended to the automotive sector.

On February 9, two major state-owned automakers issued simultaneous announcements, both indicating that their controlling shareholders are planning to restructure with other state-owned enterprise groups.

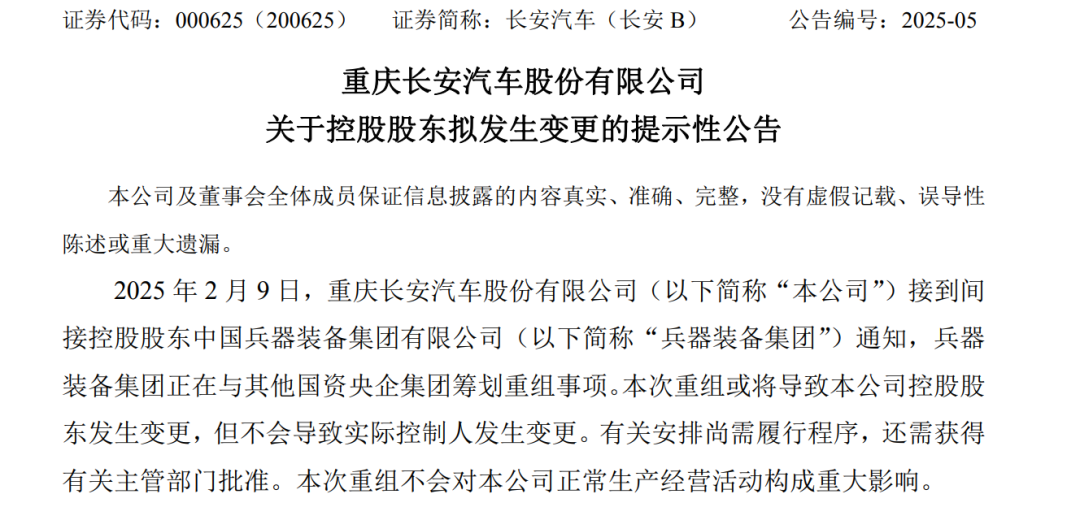

Specifically, Changan Automobile announced that its indirect controlling shareholder, China South Industries Group Corporation, is contemplating a restructuring with other state-owned enterprises, which could lead to a change in the company's controlling shareholder but would not alter the actual controller. This matter still requires procedural completion and approval from relevant authorities, and it is anticipated that it will not significantly impact the company's normal production and operation activities.

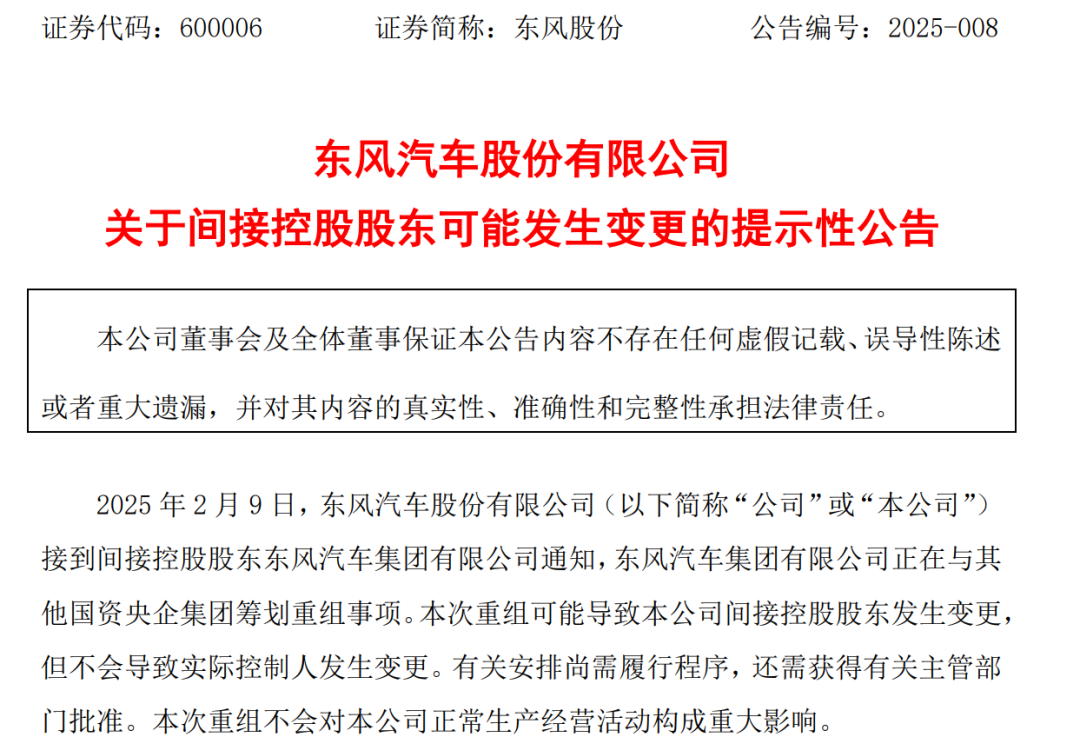

Dongfeng Motor Corporation's Dongfeng Motor and Dongfeng Technology also disclosed announcements, stating that the company has received notification from its indirect controlling shareholder, Dongfeng Motor Corporation, that Dongfeng Motor is planning a restructuring with other state-owned enterprise groups. Both companies noted that this restructuring may lead to a change in the company's indirect controlling shareholder but will not result in a change in the actual controller.

This move marks a critical turning point in the development history of these two automakers and a significant milestone in the reform process of state-owned enterprises. It aligns with the direction of optimizing the layout and structural adjustment of the state-owned economy in the reform and promotes the concentration of state capital in the crucial field of the automotive industry. Simultaneously, it explores a new path for the high-quality development of state-owned automakers.

Mergers and acquisitions among state-owned enterprises are poised to become a trend in 2025. Zhu Huarong, Chairman of Changan Automobile, stated, "In the next 3-5 years, 80% of China's gasoline vehicle brands will 'shut down, merge, and transfer.' In the future, mergers and acquisitions, shutdowns, mergers, and transfers will become the norm in the new energy vehicle industry."

On January 17 of this year, Lin Qingmiao, Director of the Enterprise Reform Bureau of the State-owned Assets Supervision and Administration Commission, emphasized the focus on continuing to establish new companies, intensifying efforts to promote strategic restructurings, advancing specialized integrations in depth, and further strengthening integration and fusion in three aspects.

Why did Dongfeng and Changan take the lead in initiating changes? Behind this lies the country's significant expectations for state-owned enterprises.

As the backbone of the automotive industry, Dongfeng and Changan have achieved remarkable accomplishments in their respective development histories. However, amidst fierce competition in the global automotive market and the wave of new energy transformation, they also face numerous challenges.

"Not as good as Tesla, not as good as BYD." On March 5, 2024, at the first "Minister's Channel" of the Second Session of the 14th National People's Congress, Zhang Yuzhuo, Director of the State-owned Assets Supervision and Administration Commission, publicly acknowledged that in the field of new energy vehicles, state-owned automakers have not developed as rapidly as anticipated.

He believes that the State-owned Assets Supervision and Administration Commission will adjust policies and conduct separate assessments of the new energy vehicle businesses of the three central auto enterprises, including technology, market share, and the future development of the enterprises.

The three "central auto enterprises" are FAW Group, Dongfeng Group, and Changan Automobile Group.

In 2024, Changan Automobile's annual sales exceeded 2.68 million vehicles, with a year-on-year increase of 5.1%, achieving positive year-on-year growth for five consecutive years and setting a new high in the past seven years. In the field of new energy, annual sales reached 734,000 vehicles, with a year-on-year increase of 52.8%.

Although Changan Automobile performed commendably in 2024, there is still considerable room for improvement compared to BYD. Data shows that in 2024, BYD's total sales reached 4.2721 million vehicles, with a year-on-year increase of 41.26%, making it the undisputed "triple champion" by winning the titles of top auto enterprise sales, top brand sales in the Chinese auto market, and top sales in the global new energy vehicle market.

Dongfeng Group and FAW Group saw declines in joint venture brand sales and profit margins in 2024. Data indicates that Dongfeng Group's cumulative sales for the entire year of 2024 were 2.48 million vehicles, a slight year-on-year increase, but its joint venture brands faced challenges, with sales of Dongfeng Nissan, Dongfeng Honda, and Dongfeng Peugeot Citroen all declining year-on-year. In 2024, FAW Group's sales declined by 240,000 vehicles, showing an overall downward trend, with operating revenue declining by approximately 75 billion yuan.

This necessitates enterprises to seek new breakthroughs and development paths. At this juncture, planning for restructuring becomes an inevitable choice in line with the development of the times.

It is noteworthy that if the restructuring of these two major state-owned automakers is successfully completed, it will generate substantial synergistic effects.

In terms of scale, taking 2024 as an example, the combined sales of these two state-owned enterprises will reach 5.16 million vehicles, surpassing BYD to become China's largest automaker and ranking fifth among global auto groups. This will not only enhance the company's discourse power in the domestic market but also strengthen its competitiveness in the international market.

In terms of parts integration, the procurement scale will significantly expand after the merger of the two state-owned enterprises, enhancing their bargaining power with parts suppliers and reducing procurement costs. This will further improve the efficiency and competitiveness of the overall supply chain. If both parties integrate in parts technology, it will enhance the technical content and performance of vehicle parts.

Most importantly, if the two state-owned enterprises restructure, they will become the "new leaders" in the global automotive market. Currently, Dongfeng has factories in Central Asia and Africa, while Changan has already established a market in Southeast Asia. After their merger, overseas production capacity may increase rapidly, providing strong support for expanding overseas markets and enhancing supply capabilities in the international market.

Many auto industry leaders have recognized that the Chinese auto market in 2025 will be a year of extreme turbulence but also full of opportunities. To compete with enterprises from around the world, ending "involution" is inevitable, and going overseas is the only way forward. Behind this lies the need for Chinese enterprises to unite their strengths, enhance their capabilities, and achieve a magnificent transformation from "Made in China" to "Created in China."

However, will it be a restructuring of the two major automakers? What about the subsequent development? The official response is, 'Based on the current announcement content, it is still in the planning stage.'