Honda and Nissan: A Fleeting Alliance

![]() 02/10 2025

02/10 2025

![]() 489

489

A Short-lived Bid for Global Auto Dominance Amid Complex Interests

The Lunar New Year festivities have barely concluded, and the Japanese automotive industry has been rocked by an unexpected turn of events. Honda and Nissan, which officially announced merger talks in December of last year, abruptly terminated those discussions just two months later, leaving even officials uncertain as to whether the collapse was a rumor. Consequently, the Tokyo Stock Exchange was forced to suspend trading of Nissan shares.

However, based on interviews with various Japanese media outlets and statements from Nissan, it is evident that the merger's demise has become a reality.

According to 2024 global sales statistics, Honda and Nissan sold 3.81 million and 3.35 million vehicles respectively, ranking eighth and ninth globally. Had the merger proceeded smoothly, they would have combined to become the world's fourth-largest automaker. However, the narrative unfolded like a soap opera, with news of the failed collaboration emerging abruptly.

Upon reflection, this merger resembled an arranged marriage forcibly pushed by certain parties, encountering significant resistance from the outset.

Moreover, the operational challenges faced by Honda and Nissan loom larger than the merger's failure. Both automakers experienced a sharp decline in sales in 2024, with Honda down 20% year-on-year and Nissan down 14%. Notably, these issues were most pronounced in the Chinese market.

The Unavoidable Largest Market

The proposed merger between Honda and Nissan was initially a response to declining sales in the Chinese market and a disadvantaged position in the competition for new energy vehicles.

As the largest automotive market globally, China has always been pivotal for automakers. Since the era of fuel vehicles, establishing a strong presence in the Chinese market has meant securing half the battle for global success.

This remains true in the era of new energy vehicles. After successfully penetrating the Chinese market, Tesla swiftly ascended to become the world's largest electric vehicle manufacturer. Even American and Korean automakers, whose market share in China has been declining, have chosen to stay due to the realization that leaving would make re-entry difficult.

According to the China Passenger Car Association, passenger vehicle sales in the Chinese market reached 27.56 million in 2024, marking a 5.8% year-on-year increase. Amidst global automotive industry uncertainty, China's steady market growth provides a reliable environment for global automakers.

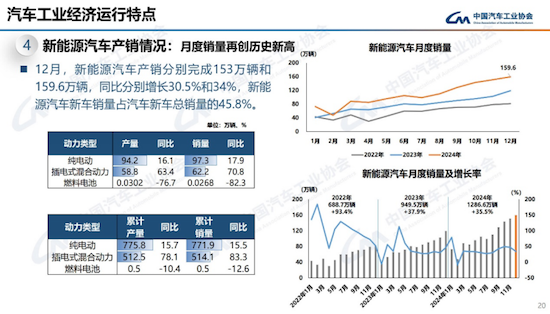

Nevertheless, competition in the Chinese market is fierce. Behind the 5% growth lies a year-long battle. Thanks to the rapid growth of new energy vehicles, the market share of Chinese brands in the local market has continued to climb, reaching 65.2%, a 9.2% increase from the previous year.

As Chinese brands thrive, foreign brands falter, with Japanese brands bearing the brunt of the impact, witnessing their market share plummet to 11.5%, a nearly 20% year-on-year decline.

Honda and Nissan were particularly hard-hit. Official data reveals that Honda sold 852,000 vehicles in China in 2024, marking a year-on-year decline of over 30%, the worst performance since 2014. Nissan, on the other hand, sold 697,000 vehicles in China, a 12.2% year-on-year drop, the lowest since 2008.

More critically, in the realm of new energy vehicles, Honda and Nissan have nearly been excluded from the Chinese market. With the penetration rate of new energy vehicles in China exceeding 40%, sales of these two Japanese automakers' new energy vehicles account for less than 5% of their total sales, heavily reliant on fuel vehicles to sustain sales.

If in 2023 and prior, Honda and Nissan's slow progress in new energy vehicles was attributed to their transition to pure electric technology, 2024 marked their comprehensive defeat.

In 2024, significant changes occurred in the Chinese new energy market. The growth rate of pure electric vehicles, once the mainstay, slowed, while plug-in hybrid models emerged as a new sales growth point, contributing 40% of new energy vehicle sales.

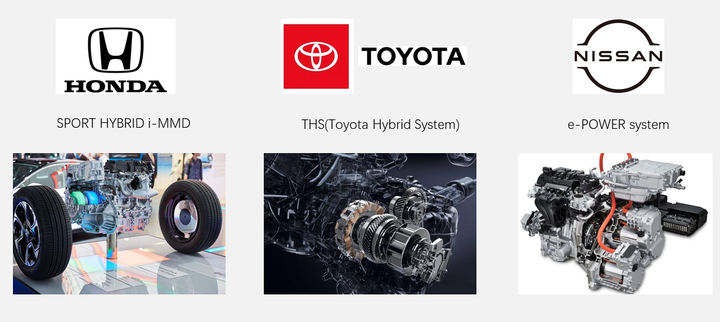

Historically, hybrid technology was the core competence of Japanese automakers. Honda's i-MMD and Nissan's e-Power hybrid technologies were once unassailable technological fortresses. However, neither automaker could keep pace with this shift in momentum. The plug-in hybrid models they launched resembled oil-to-electric models from a decade ago, struggling to compete with similar products on the market.

According to Honda and Nissan's original plan, the two parties would jointly develop new energy vehicle technology to bolster their competitiveness in the Chinese market. With the merger's collapse, Honda and Nissan's path to new energy has become increasingly arduous, and a short-term breakthrough appears unlikely.

To address overcapacity resulting from declining sales, Honda China has shuttered some production lines in Wuhan and Guangzhou, while Nissan plans to lay off 9,000 employees globally, with the Chinese market likely to be severely impacted by these layoffs.

It can be said that without the support of China, the world's largest automotive market, the likelihood of Honda and Nissan staging a comeback has become increasingly unpredictable. The failure of the merger will only exacerbate the challenges facing both companies in the Chinese market over the next two years.

Narrow Perspectives Amid National Interests

Regarding the merger between Honda and Nissan, former Nissan CEO Carlos Ghosn noted that the merger was a 'defensive move by the Japanese economy' aimed at mitigating the impact of Chinese, European, and American automakers. As a legendary figure who led Nissan for years and eventually clashed openly with the entire Japanese government, Ghosn's perspective carries significant weight.

The abrupt announcement of the merger by both parties suggests an invisible force driving events.

From a business logic standpoint, the purpose of a merger is to enhance competitiveness in the global automotive industry. However, Honda and Nissan's global market layouts are strikingly similar, and even their main models and technological paths overlap significantly. A merger would only introduce more redundancy.

Particularly concerning is the low capacity utilization rates of both parties, suggesting that the first major event post-merger would likely be massive layoffs.

This runs counter to the Japanese government's desire to revitalize the automotive industry. Failing to provide a stable employment environment would exacerbate social unrest. After ceding its position as the world's largest automotive exporter, the Japanese government has been eager to rejuvenate the automotive manufacturing industry, a pillar of the economy.

However, mergers are commercial acts and cannot be as straightforward as politicians envision. Both parties aim to derive significant commercial value from the merger and are reluctant to become subservient to the other.

When comparing Honda and Nissan, contradictions arise. Nissan's operating conditions are far inferior to Honda's. According to estimated data, Nissan's operating profit in 2024 plummeted 90% year-on-year, with full-year expected profits of only 150 billion yen, while Honda's profits for the same period reached 1.42 trillion yen.

Given this stark contrast in operating data, Honda deemed a 50-50 partnership wholly inappropriate and began to propose more onerous conditions, demanding to hold more than 50% of the shares and nominate more than half of the directors, or even envisaging operating Nissan as a subsidiary.

Such unequal terms were obviously unacceptable to Nissan, ultimately leading to the abrupt termination of the merger.

Despite the collapse of the Honda partnership, Nissan's senior management remains committed to pushing forward with the restructuring plan to revive the company. Internal sources indicate that the Nissan board has urged CEO Makoto Uchida and other senior executives to submit a more detailed restructuring plan as soon as possible while continuing to seek partners.

Globally, automaker cooperation is no longer confined to traditional enterprise partnerships. Traditional mergers aimed at expanding business scale are no longer effective strategies.

Currently, 'precision alliances' are becoming the norm. Volkswagen and XPeng, as well as Rivian, are strengthening their respective weaknesses through cooperation in electric vehicle architectures and software technologies. In the Chinese market, Audi maintains its competitiveness through collaboration with Huawei.

Currently, Nissan's options for partnership are limited. Honda has already partnered with Sony and launched the electric vehicle AFEELA 1. There are no better internet companies left in Japan for Nissan to choose from. Of course, Nissan may still not consider Foxconn unless absolutely necessary. Some sources suggest that senior executives within Nissan have proposed seeking cooperation with American technology companies.

For Nissan, the termination of the Honda partnership is not necessarily a setback. While market share prices reflect some investors' sentiments, in the long run, as the world's ninth-largest automaker, Nissan can still seek a more favorable partner.

The collapse of the Honda-Nissan cooperation has a more significant impact on the Japanese automotive industry, underscoring that traditional Japanese automakers have substantial issues in their understanding of the Chinese market.

In terms of sales, besides the Chinese market, Honda and Nissan have performed well in their domestic, European, and American markets. However, it is their failure in the Chinese market that has nearly dragged down Nissan and severely wounded Honda, transforming once profitable ventures into loss-making endeavors.

From a global perspective, the Chinese market may seem like just one piece of the puzzle. However, from the standpoint of automotive technology development, the Chinese market is at the forefront of global new energy vehicle advancements. Losing competitiveness in the Chinese market may imply losing the future. For Honda and Nissan, reviving their competitiveness in the Chinese market is currently more crucial than seeking cooperation to rejuvenate the Japanese automotive industry.

Note: Some images are sourced from the internet. Please contact us for removal if there is any infringement.