US New Energy Vehicle Startups Grapple with Bankruptcy

![]() 02/08 2025

02/08 2025

![]() 529

529

The "Tesla of Trucks" Teeters on the Brink

Author | Wang Lei

Editor | Qin Zhangyong

Following Canoo's bankruptcy, another US new energy vehicle startup finds itself on the verge of collapse.

Nikola, once hailed as the "Tesla" of trucks, is now grappling with severe financial challenges.

According to The Wall Street Journal, Nikola is working with the law firm Pillsbury Winthrop Shaw Pittman to explore various strategic transformation options, including the sale of core assets, comprehensive reorganization, and even filing for bankruptcy protection.

The underlying reason is clear: a lack of funds.

As early as last October, Nikola admitted that the company's funds would soon be depleted and that it would be unable to sustain operations beyond the first quarter of 2025 without securing new financing.

Affected by the possibility of bankruptcy, Nikola's share price plummeted to a 54-week low, dropping over 40% in after-hours trading. As of press time, the share price stood at $0.44, with a market value of $37.43 million.

Since its listing in 2020, Nikola's share price has dwindled by over 99%. The stock has repeatedly dipped below the $1 mark, necessitating multiple reverse stock splits to comply with Nasdaq listing rules; otherwise, it would have been delisted long ago.

Once valued at $24 billion, Nikola's dream has now turned into a pipe dream. More than a year after its founder's imprisonment, even the "Tesla of trucks" must face its demise.

01 Market Value Erosion by Billions

Nikola's heyday was captured in June 2020.

At that time, Nikola successfully listed on Nasdaq with a valuation of $12 billion, raising $700 million in funds without delivering a single vehicle. This made it the world's first hydrogen fuel vehicle manufacturer to go public.

Founder Trevor Milton announced the start of pre-orders for its hydrogen-powered pickup truck, the Badger. Fueled by capital, Nikola's share price surged by 104%, and its market value reached $26.3 billion, surpassing industry veterans like Ford and General Motors.

However, this glory was short-lived, and Nikola soon encountered a series of setbacks and doubts. Now, Nikola's share price has plummeted by 99%, and its cash reserves are "barely enough to last until April this year."

There are numerous reasons for Nikola's impending bankruptcy, but the core factor is its excessive spending. Nikola has been incurring losses since its listing.

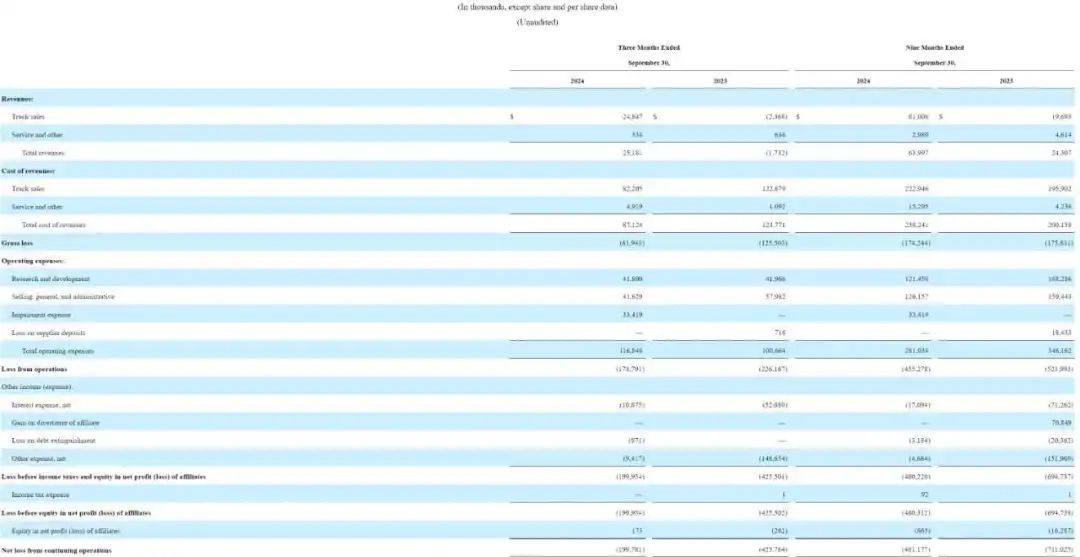

According to the latest financial report, Nikola's revenue for the first nine months of 2024 was $64 million, compared to $24.31 million in the same period last year, representing a significant year-on-year increase. However, its operating loss was $455 million, compared to $522 million in the same period last year, and its net loss amounted to $481 million.

Especially in the third quarter of 2024, Nikola's revenue was only $25.18 million, with an operating loss of $179 million and a net loss of $200 million, compared to a net loss of $426 million in the same period last year.

As of September 30, 2024, Nikola's reported cash and cash equivalents had dropped to $188.3 million, down from $464.7 million at the end of 2023. Chief Financial Officer Thomas Okray also acknowledged that the company's monthly cash burn rate is $30 million to $40 million.

At Nikola's current burn rate, these funds cannot support the company's operations for more than six months.

In a mandatory warning letter to the U.S. Securities and Exchange Commission, Nikola admitted, "Our existing financial resources can only cover predicted operating costs and fulfill related obligations until the first quarter of 2025."

To alleviate financial pressure, Nikola laid off 15% of its employees, or about 153 people, in October last year, with further layoffs planned this month to downsize the company.

Notably, its recent round of layoffs has halted production on its controversial hydrogen fuel cell semi-truck line.

Meanwhile, Nikola has also taken several self-rescue measures, such as raising funds through transactions with noteholders, but has only obtained $65 million so far. At Nikola's current burn rate, this fund can only sustain operations for about a month.

In addition, Nikola has announced plans to raise $100 million by selling more shares, but given Nikola's current share price level, this is clearly not an easy task.

Especially since it has been less than seven months since Nikola completed a 1-for-30 reverse stock split on June 25, 2023, another split or merger in the short term is unlikely.

As of now, Nikola's market value is only $37.43 million, making it more challenging for the company to execute its plan to raise $100 million through share sales.

Moreover, the US market has lost patience with companies like Nikola that burn cash and fail to effectively commercialize their products. Nikola will find it difficult to obtain financing in the capital market.

Seemingly facing an irreversible situation, Nikola's latest filing with the U.S. Securities and Exchange Commission has been quite candid, stating, "If we are unable to raise sufficient funds when needed, we may be forced to further downsize or cease operations, which will have a significant adverse impact on our financial condition, operating results, business, and prospects, and may result in a loss of your investment."

02 Fraud and Deception

Capital does not lose trust in a company for no reason. Nikola itself also has many issues.

This company was once called the "Tesla of trucks," and the combination of Nikola and Tesla is the name of American inventor Nikola Tesla.

The company's founder and CEO, Trevor Milton, was a former senior engineer at Tesla. Milton named his truck company Nikola and regarded Tesla as a competitor, with the rivalry evident in his actions.

However, the founder who aspired to "surpass Musk" is now in prison, convicted of defrauding investors and sentenced to four years in prison at the end of 2023, marking the first such case among new energy vehicle startups at that time.

Moreover, Nikola's success and failure are closely tied to this founder.

In 2014, under the leadership of Trevor Milton, Nikola, a new force focused on hydrogen energy heavy trucks, was established. In 2016, two years after its inception, Nikola launched its first hydrogen energy truck, the Nikola One.

With Tesla serving as a successful precedent in the US, investors could indeed reap significant returns if Nikola grew as big as Tesla in the even more niche field of hydrogen energy vehicles.

However, what they didn't anticipate was that they were waiting for a shocking scam.

In June 2016, Nikola announced that it had received a total of 7,000 truck orders one month after opening pre-orders for the Nikola One. In reality, from Nikola's establishment in 2015 to its listing in 2020 as the world's first hydrogen heavy truck stock with a valuation of $12 billion, Nikola had not sold a single truck.

In 2020, Nikola also reached a $2 billion cooperation agreement with General Motors. GM obtained $2 billion in common shares issued by Nikola, owning an 11% stake. Additionally, GM announced that it would produce the hydrogen fuel cell electric pickup truck, the Badger, for Nikola by 2022.

However, almost simultaneously, a bombshell report released by the US short-selling firm Hindenburg Research completely shattered Nikola's development dreams.

The report mercilessly pointed out that Nikola's so-called hydrogen fuel cell vehicle technology was nothing more than a carefully woven scam, alleging that everything from the trucks to the hydrogen energy technology was fake. The new truck order data, battery technology breakthroughs, and other content were all false claims. "We have never seen a scam of such a large scale in a listed company before."

Hindenburg Research primarily accused Nikola of two points:

In July 2020, Milton claimed that five Nikola Tre trucks had rolled off the production line in Ulm, Germany. However, Bosch, the partner responsible for producing these trucks, confirmed that no Nikola products had been fully produced.

In 2018, Nikola released a promotional video titled "Nikola One Driving," claiming that the prototype of the hydrogen fuel cell truck Nikola One had traveled 500-1,000 miles. However, the truth was that the Nikola One was simply rolling down a relatively flat hill, and Nikola deliberately tilted the camera angle to make it appear as if the truck was driving on its own.

This fake video completely altered the development trajectory of Nikola. Interestingly, Nikola readily admitted the falsification, and founder Milton issued a statement saying, "It just rolled down by itself."

The release of this short-selling report caused an uproar, prompting GM to suspend its dealings with Nikola, and Nikola's share price subsequently plunged, shrinking by nearly half from its peak. Since then, it has been on a continuous downward spiral.

Under the pressure of public opinion stemming from the "fraud" and investor lawsuits, Milton "resigned in disgrace," taking with him $3.1 billion (approximately RMB 22 billion) worth of company stock. With Milton's departure, various related negative news emerged, including revelations that Nikola's initial design drawings were purchased by Milton for a few thousand dollars.

Subsequently, GM withdrew its investment in Nikola, Bosch reduced its stake, and large orders were canceled. The US Department of Justice launched an investigation, and Milton was indicted on fraud charges. Ultimately, Nikola's founder, Trevor Milton, was convicted of fraud and sentenced to four years in prison on December 18, 2023.

In fact, Nikola's dire situation is not unique in the US. Recently, not only Nikola but also Canoo, another US new energy vehicle startup, has filed a voluntary petition with the US Bankruptcy Court in Delaware seeking relief under Chapter 7 of the US Bankruptcy Code.

Earlier, other US new energy vehicle startups such as Fisker and Lordstown Motors also filed for bankruptcy protection.

In reality, besides Tesla, other new energy vehicle companies in the US are also in deep water. The reshuffle in the domestic automotive industry has reached a critical stage, and overseas, the priority is to survive first.