Lexus Embraces 'Localization' in Production: Will It Go Independent and Focus Solely on Electric Vehicles?

![]() 02/08 2025

02/08 2025

![]() 415

415

"You emerged before my time, I after yours. You resent my tardiness, I yours."

The sentiment of this ancient Tang Dynasty poem seems to resonate with the current market dynamics between Lexus and China. Indeed, Lexus has recently announced that Toyota has decided to establish a LEXUS electric vehicle and battery R&D and production facility in Jinshan District, Shanghai. In simpler terms: Lexus will localize its production, embarking on a solo venture akin to Tesla, albeit a bit later, not until 2027.

Consequently, Lexus' 'localization' move has sparked industry discussions: 1. With the domestic traditional luxury market continuing to shrink, is it too late for Lexus to 'take root' in China and make a significant push in 2027? 2. Will Lexus reduce prices after setting up in China? 3. What are Lexus' objectives in entering China now?

Trading price for volume while staying put – is Lexus too late?

Firstly, it is certain that Lexus aims to capture a larger share of the Chinese market through localization. However, it is highly unlikely that simply 'harvesting' the Chinese market through 'localization' by 2027 will suffice.

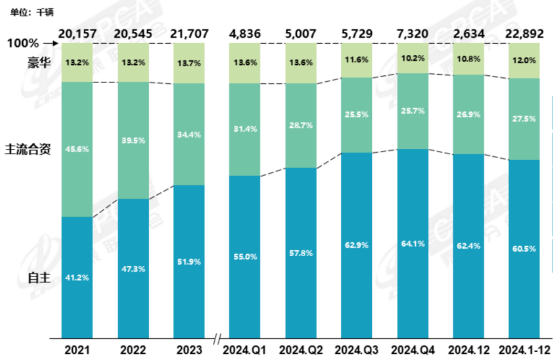

Data indicates that the domestic luxury car market share was 12% in 2024, a decline of 1.7% compared to 2023; sales amounted to 2.7421 million units, a year-on-year drop of 7.8%. Imported car sales for the entire year were approximately 700,000 units, a 12% decrease year-on-year, marking a seven-year consecutive decline since 2017. Therefore, some predict that by 2027, the market share of traditional luxury brands may dip below 10%.

Concurrently, domestic luxury brands have successfully established themselves in the 300,000-500,000 yuan market segment, with Li Auto surpassing 500,000 sales and Thalys reaching 426,800 units, with the Wenjie M9 becoming the sales champion among luxury SUVs in the 500,000 yuan category. In contrast, traditional luxury brands are caught in a price war vortex, with BMW suffering a devastating defeat, experiencing a 13% sales decline and a 61% profit plummet.

It can be argued that the overall environment is unfriendly towards foreign luxury brands, and Lexus has also begun trading price for volume. Reports indicate that in 2024, Lexus offered discounts of up to 100,000 yuan, with the price floor of its main sales model, the Lexus ES, falling to just over 210,000 yuan. Many car owners purchased their cars for 220,000-230,000 yuan, and there were even more extreme cases of bare-metal purchase prices of 190,000 yuan – comparable to the Toyota Camry.

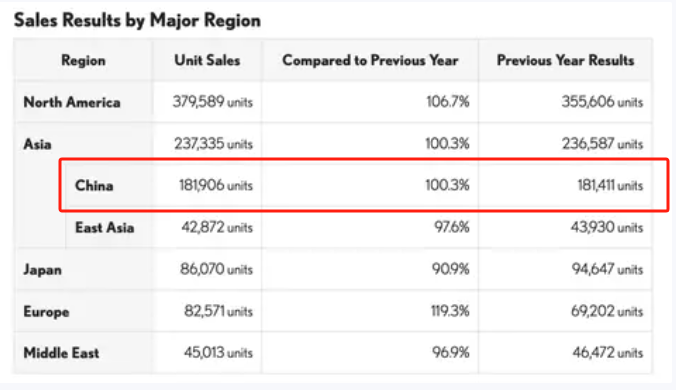

However, the effect of such strategies has been minimal. In terms of data, Lexus' sales in China in 2024 reached 181,900 units, making it the only luxury brand to achieve positive year-on-year growth. The Lexus ES also surpassed 100,000 units to become the sales champion among imported cars. Yet, the embarrassment lies in the fact that it is still far from the 600,000-700,000 unit volume of ABB, and the so-called year-on-year growth rate is merely 0.3%...

In other words, Lexus gives the impression of probing its vehicle price floors low enough to attract more 'entry-level car owners'. Even though Lexus' profitability remains considerable at this stage, its premium space has shrunk, and its brand power has shown a downward trend. Moreover, the more pressing issue is that its new energy models lack marketing and are virtually ignored in the Chinese market, so even localization will struggle to make them competitive unless prices are low enough.

Is Lexus merely eyeing the potential of China's new energy industry?

Indeed, from the current scenario, although the Chinese high-end market is posing challenges to traditional luxury brands, new energy and high-end smart home industrial chains have already taken shape. Therefore, it is an opportune time for Lexus to localize its production now, leveraging readily available industrial chains and achieving two objectives:

First, leverage China's new energy and high-end intelligent driving industrial chains and capacity to facilitate transformation. This can be seen in Toyota's recent actions: investments in autonomous driving with Momenta, a joint venture technology company established by GAC Toyota and Pony.ai, and a joint venture with BYD... These resources will propel the electrification and high-end intelligent driving transformation of Lexus.

Second, utilize China as an export base. This strategy should be learned from Tesla. Data reveals that in 2024, Tesla exported 259,500 vehicles from China. As of September 2024, Tesla's Shanghai factory had exported over 1 million vehicles. Consequently, some insiders predict that in the future, the Shanghai factory may undertake 50% of Lexus' global electric vehicle capacity. Coupled with its established brand power and the consumption habits cultivated by Tesla, there is still hope for it to gain a certain advantage in the global smart electric market in the future.

Regarding this situation, some insiders have expressed concerns: Lexus is eyeing the future of China's new energy industry, meaning that the stronger China's new energy industry becomes, the stronger Lexus will be. Ultimately, this may impact China's high-end new energy exports overseas. Additionally, some pessimistically believe that Lexus' localization may push traditional joint venture giants and luxury brands towards sole proprietorship, re-establishing their position in the Chinese market based on the current Chinese auto industry industrial chain. Will this pose a new challenge for Chinese brands?