Price War Reignites, Joint Ventures Battle Fiercely at Year's Dawn

![]() 02/08 2025

02/08 2025

![]() 380

380

Introduction

If discounts can drive sales, then go all in.

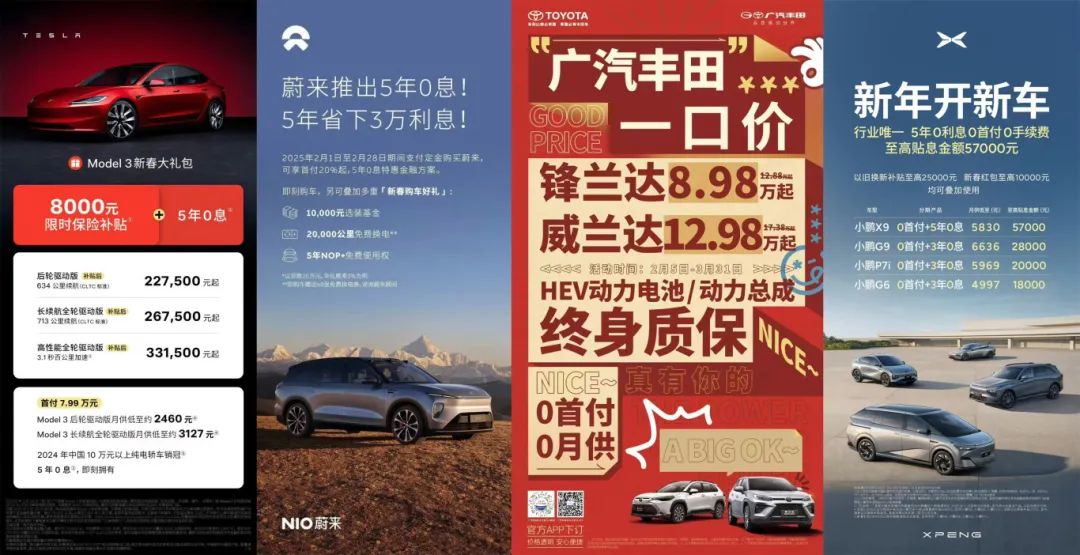

Having experienced the brutal price war in 2024, observers have noted the unprecedented pace of change in China's automotive market. As the festive spirit of the Spring Festival lingers, and companies like Tesla and NIO reignite their pricing offensives, the seemingly calming disputes are thrust back into the spotlight.

Should we engage in this battle? The answer is now clear.

No one can evade another round of ranking reshuffles in China's automotive market, nor can anyone secretly adhere to a so-called value system. If one understands this, to survive, it is imperative to follow in the footsteps of predecessors and boldly enter the price war, leaving no room for hesitation.

Yesterday, GAC Toyota released a promotional poster confidently asserting its Fenglanda and Weilanda models' competitiveness, but behind the starting prices of 89,800 yuan and 129,800 yuan, respectively, lies a microcosm of China's automotive market's future trajectory in 2025.

Regarding price wars, is the attitude of automakers unequivocally positive? At a juncture when sales continue to decline, weaker companies choose to play by these rules, while those steadfast in value wars may hold their ground. However, as the entire industry is trapped in a vicious cycle of price cuts to stay afloat, alternatives are scarce.

And this year, unlike independent brands that command the high ground of public opinion, joint ventures' precarious situation implicitly warns peers to abandon stubbornness, straighten their posture from the outset, and jointly cultivate the market with independent brands as the right approach.

Unstoppable Price War

Speaking of price wars, anyone with a cursory understanding of the 2024 automotive market knows that, amidst an underwhelming economic environment and weak policy-driven consumption, "price" is undoubtedly the only trump card that can compel consumers to spend.

Thus, as the market enters a stage of disordered competition, the price war, regardless of how painful the process, has not waned in intensity among automakers, becoming a pervasive theme throughout the past year. Today, with no change in market trends, the resurgence of the price war is bound to become more common.

However, joint ventures and independent automakers ultimately belong to two different camps. In terms of pleasing consumers, every step slower means a further shrinking sphere of influence as sales decline. This necessitates seizing the pricing initiative.

Take GAC Toyota, which kicked off the price war at the beginning of the year, as an example. Amidst a period of adjustment, it reduced the prices of its mainstay models like Fenglanda and Weilanda. Isn't its core objective, based on market forecasts, to avoid being passive in the new round of market competition?

Since late 2023, the pressure brought by changes in the entire automotive market has been evident after a year's evolution. Even for leading joint ventures like GAC Toyota, the sharp decline in its profit contribution to the group in 2023 is evident from quarterly financial reports alone.

That is to say, despite reluctance to accept its current state, GAC Toyota has no reason to slacken its efforts in the slightest.

Perhaps in the general perception of consumers, joint venture SUVs like Fenglanda and Weilanda should not be priced at mere 89,800 yuan and 129,800 yuan, respectively. However, from the enterprise's perspective, no matter how well the product's pricing system is maintained, if sales do not increase, the impact cannot be mitigated with grandiose but empty explanations.

Ultimately, the automotive market in 2025 will not show signs of improvement merely because market shuffles have reached a certain intensity. For those in the game, especially joint ventures under pressure from all sides, it is crucial to grit their teeth and get things done.

I still recall that last year, some joint venture automakers, due to their obsession with premium pricing for their brands, positioned new car launches at previous high levels or resisted significant price cuts and promotions.

The result was that these companies not only failed to gain recognition from potential consumers but also lost the momentum of new car launches and preferential purchase periods.

If so, I believe that starting with GAC Toyota's move, joint venture brands' willingness to participate in the price war will only grow stronger. After all, in the current involutional development trend of China's automotive market, any operation that emphasizes value without mentioning price is meaningless.

Staying in China, Everything is Worth It

Looking at last year's overall market situation, almost all joint ventures encountered unprecedented developmental challenges. In terms of sales, despite significant price concessions in the terminal market, companies including Volkswagen, Toyota, and Honda still tasted bitter defeat. Cases of year-on-year declines of 20% or even higher abound.

Reality is harsh. What should joint venture automakers do to address this pressing issue? For now, low-price promotions are the right path. In fact, since the second half of last year, there have been signs of official price reductions led by companies like GAC Toyota.

Forced by the rapid sales decline, Buick, under SAIC-GM, once initiated a fixed-price model, and Cadillac simply offered a sufficiently surprising and low official guiding price for the market when the all-new XT5 was launched.

Regardless of whether such a method tarnishes joint venture brands' reputation, the effect after "taking the medicine" is quite significant.

First, the official announcement of sales results indicated that the price reduction offensive was effective. Then, as users' inherent perceptions of the brand changed, the sales of models like the all-new XT5 have stabilized at a highly satisfactory level.

With such achievements in mind, GAC Toyota's choice to officially lower the prices of its mainstay models to a certain level does not seem like a desperate move.

Indeed, after the core voice in the public opinion field began to focus on Chinese brands, everything related to joint ventures seemed very negative. Some said they were not working hard enough on the transition to electrification and were too stuck in their old ways; others claimed that the product capabilities of existing models were outdated, emblematic of the automobile industry's lack of progress.

But do you really think joint venture brands will turn a blind eye to these criticisms?

From now on, starting with GAC Toyota using such a low-key approach to significantly reduce prices and compete on the same level as independent new cars, the answer is clear.

To be rooted in China, if price reductions are what the market demands, then go all in. And joint ventures are essentially still Chinese companies. Between shrinking business to mere profit-making and maintaining market position through price reductions, I believe they have no reason to choose the former, a more short-sighted behavior.

2025 can be said to be the year that all major joint venture brands need to remember most vividly.

As China's automotive market is increasingly dominated by leading Chinese automakers like BYD and Geely, as well as technology companies from other industries like Xiaomi and Huawei, stubbornly clinging to past glories is definitely not a wise decision. On the contrary, whether through price reductions or seeking Chinese companies' guidance on deconstructing current consumer trends, joint ventures choosing to bow their heads is the right path to survival.