Horizon Robotics is about to go public. Can this autonomous driving chip giant break through the competition globally?

![]() 10/18 2024

10/18 2024

![]() 519

519

Lead

As a unicorn in the domestic autonomous driving chip industry, Horizon Robotics' listing on the Hong Kong Stock Exchange's main board has been basically confirmed. Horizon Robotics aims to leverage IPO financing to continuously expand its business scale and iteratively upgrade its technology.

Produced by | Heyan Yueche Studio

Written by | Zhang Chi

Edited by | Heyan

2,536 words in total

4 minutes to read

As a giant in the domestic autonomous driving chip industry, Horizon Robotics (9660.HK) began its share offering in Hong Kong on October 16.

Horizon Robotics plans to issue 1.355 billion shares globally for this IPO, with 136 million shares offered publicly in Hong Kong, accounting for approximately 10%, and 1.2196 billion shares allocated internationally, accounting for approximately 90%. An additional 15% over-allotment option is also available. The indicative price range for the offering is HK$3.73 to HK$3.99 per share, with a board lot size of 600 shares. The maximum amount of funds to be raised is approximately HK$5.4 billion, and the listing on the Hong Kong Stock Exchange is expected on October 24.

△As a giant in the domestic autonomous driving chip industry, Horizon Robotics is about to complete its listing in Hong Kong

IPO will provide Horizon Robotics with a stable financing channel

Benefiting from the wave of domestic automotive intelligence and orders from major domestic automakers, Horizon Robotics' revenue has shown rapid growth. According to the prospectus submitted by Horizon Robotics, its revenue from 2021 to 2023 was RMB 467 million, RMB 906 million, and RMB 1.552 billion, respectively, with a compound annual growth rate of 82.3%. In the first half of 2024, Horizon Robotics' revenue increased by 151.6% year-on-year to RMB 935 million, with Volkswagen China becoming its largest customer.

△Partnership with Volkswagen China accelerates Horizon Robotics' development

It is worth mentioning that Volkswagen and Horizon Robotics jointly invested €2.4 billion to establish a joint venture, COREIZON, through their respective subsidiaries CARIAD (Volkswagen's intelligent software company) and Horizon Robotics (with Volkswagen holding 60% and Horizon Robotics holding 40%). This partnership has been a key factor in Horizon Robotics' rapid revenue growth and successful listing. Starting in 2023, Horizon Robotics began earning revenue by licensing advanced driver assistance and autonomous driving solution algorithms and software to COREIZON. In the first half of this year, licensing revenue from COREIZON reached RMB 351 million, accounting for 37.6% of first-half revenue.

However, even with this growth, Horizon Robotics has not been able to escape losses. According to the prospectus, the company's adjusted net losses from 2021 to the first half of 2024 were RMB 1.1 billion, RMB 1.89 billion, RMB 1.64 billion, and RMB 800 million, respectively. The primary reason for these losses is the high upfront investment required for chip research and development. From 2021 to the first half of 2024, Horizon Robotics' research and development expenses were RMB 1.144 billion, RMB 1.88 billion, RMB 2.366 billion, and RMB 1.42 billion, respectively, accounting for 245%, 207.5%, 152.5%, and 151.9% of total revenue during the same periods.

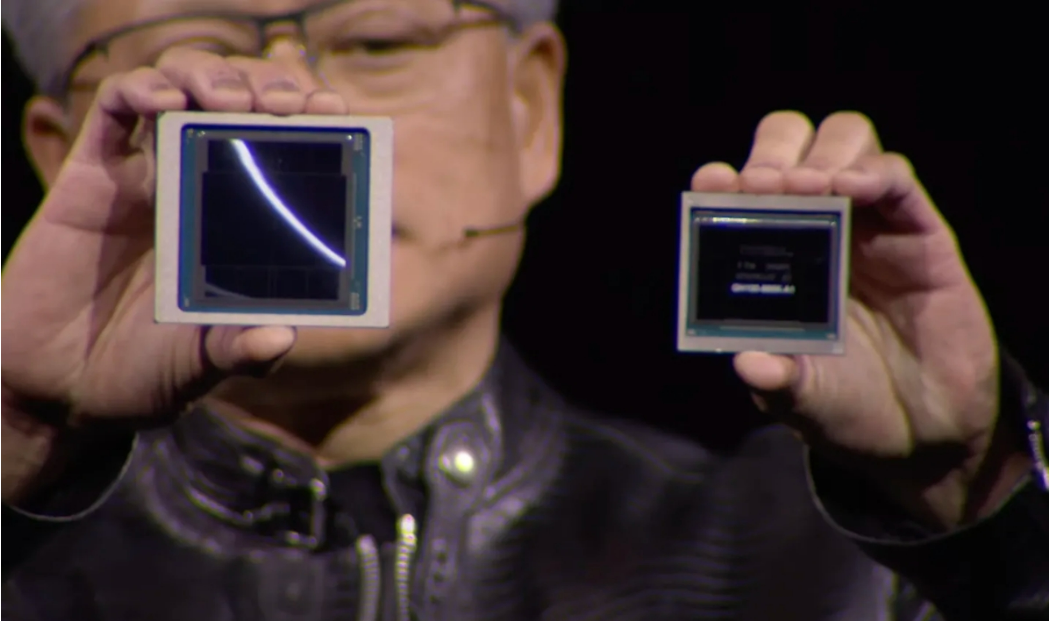

For start-ups in the autonomous driving space, initial losses are inevitable as they invest heavily in maintaining their technological leadership and expanding into new business areas. To sustain operations, securing a reliable and stable financing channel through an IPO on the Hong Kong Stock Exchange is crucial for Horizon Robotics. NVIDIA, Horizon Robotics' competitor, has set a benchmark with its soaring share price and market value exceeding US$3 trillion this year. The Hong Kong stock market also hopes that high-tech companies like Horizon Robotics will seek listings to further invigorate the market.

△NVIDIA, Horizon Robotics' primary overseas competitor, has a market value exceeding US$3 trillion

Where does Horizon Robotics' advantage lie?

In the current geopolitical climate, the United States is implementing a comprehensive strategic containment of China, with chips being a key area of focus. For domestic automakers, the threat of potential disruptions from the US looms large. In this context, Horizon Robotics' chips, as an alternative to NVIDIA and Qualcomm chips, have become an attractive option, explaining why they have garnered favor from many domestic automakers.

Moreover, Horizon Robotics' strategic transformation is noteworthy. From a chip design company at its inception, Horizon Robotics has evolved into a provider of comprehensive advanced driver assistance and autonomous driving solutions for automakers. In April this year, Horizon Robotics unveiled HorizonSuper-Drive, a new advanced autonomous driving solution based on its Journey 6 flagship chip. With a computing power of 560 TOPS, a single Journey 6P chip can handle full-stack computing tasks such as perception, planning, decision-making, and control, enabling it to cover mainstream autonomous driving scenarios like highway NOA, urban NOA, and autonomous parking. Scheduled for mass production in 2026, this solution has already secured partnerships with approximately seven OEMs and three tier-one suppliers. Horizon Robotics' integrated hardware and software solutions have been adopted by 27 OEMs (42 OEM brands) and are equipped in over 285 models, with all top ten Chinese OEMs as customers, marking significant achievements.

△Horizon Robotics is transforming from a chip design company to a provider of integrated hardware and software autonomous driving solutions

Another noteworthy aspect is Horizon Robotics' plan to expand its product offerings to a wider range of vehicles. At the Horizon Robotics Advanced Autonomous Driving Technology Open Day in August, CEO Yu Kai publicly stated that in the next three to five years, Horizon Robotics' products will be integrated into vehicles priced at over RMB 100,000, making full-scenario autonomous driving a standard feature in this price range. For China's automotive market, which sells over 20 million vehicles annually, this vision, if realized, would open up a vast market for Horizon Robotics.

△Horizon Robotics' future autonomous driving solutions will target the RMB 100,000 vehicle market

What are the hidden concerns in Horizon Robotics' business growth?

Despite the temporary challenge of turning a profit, Horizon Robotics faces several daunting obstacles.

For Horizon Robotics, which aims to transform into a provider of integrated hardware and software solutions, the market is highly competitive. New forces like NIO, Xpeng, and Li Auto are developing their own high-level autonomous driving systems. In particular, NIO and Xpeng have successfully taped out their autonomous driving chips and will prioritize their in-house solutions for high-end autonomous driving in their future models. Huawei also holds a significant share in the domestic high-level autonomous driving chip market, and automakers adopting Huawei's HarmonyOS smart mobility solution are likely to bundle Huawei's autonomous driving solutions as well. From the perspective of automakers, they hope to keep control of autonomous driving, especially high-level autonomous driving solutions, in their own hands. Outsourcing to third parties will only be considered if there is a significant performance gap in their in-house solutions. This undoubtedly raises the bar for Horizon Robotics' transformation. If Horizon Robotics limits itself to developing driving assistance solutions, its earnings potential will be significantly diminished.

△Domestic automakers aspire to maintain control over high-level autonomous driving technology

According to the first-half 2024 market share rankings for forward-facing integrated systems and autonomous driving computing solutions in China released by Gao Gong Intelligent Automobile Research Institute, Horizon Robotics topped both lists with market shares of 33.73% and 28.65%, respectively. However, in the high-level autonomous driving market, Horizon Robotics does not enjoy such a significant advantage. In the 2023 high-performance SoC shipment rankings, NVIDIA led with over 70% market share. In the high-level autonomous driving chip segment, global automakers tend to prioritize cooperation with foreign chip companies like NVIDIA, Qualcomm, and Mobileye.

For Horizon Robotics, it is currently more of an alternative solution for many domestic automakers to cope with US sanctions. To some extent, as a local chip company, Horizon Robotics can respond more quickly to customer needs and provide services. The next step for Horizon Robotics is to catch up technologically and narrow the gap with NVIDIA, whose Thor chip boasts a computing power of 2000 TOPS.

△NVIDIA maintains a significant lead in the high-performance SoC segment

Commentary

For all companies, completing an IPO is just the first step on a long journey. Going forward, Horizon Robotics will not be content with just domestic market share. Expanding globally and partnering with multinational automakers from Europe, Japan, and other regions to penetrate the global market will be crucial for Horizon Robotics' share price to continue rising in the next phase. Despite the numerous challenges and tests it faces, Horizon Robotics, as the strongest unicorn in the domestic automotive autonomous driving chip industry, is still highly anticipated.

(This article is originally written by Heyan Yueche and may not be reproduced without permission)