Chery turns to Hong Kong stock market, valuation shrinks by two-thirds?

![]() 10/12 2024

10/12 2024

![]() 475

475

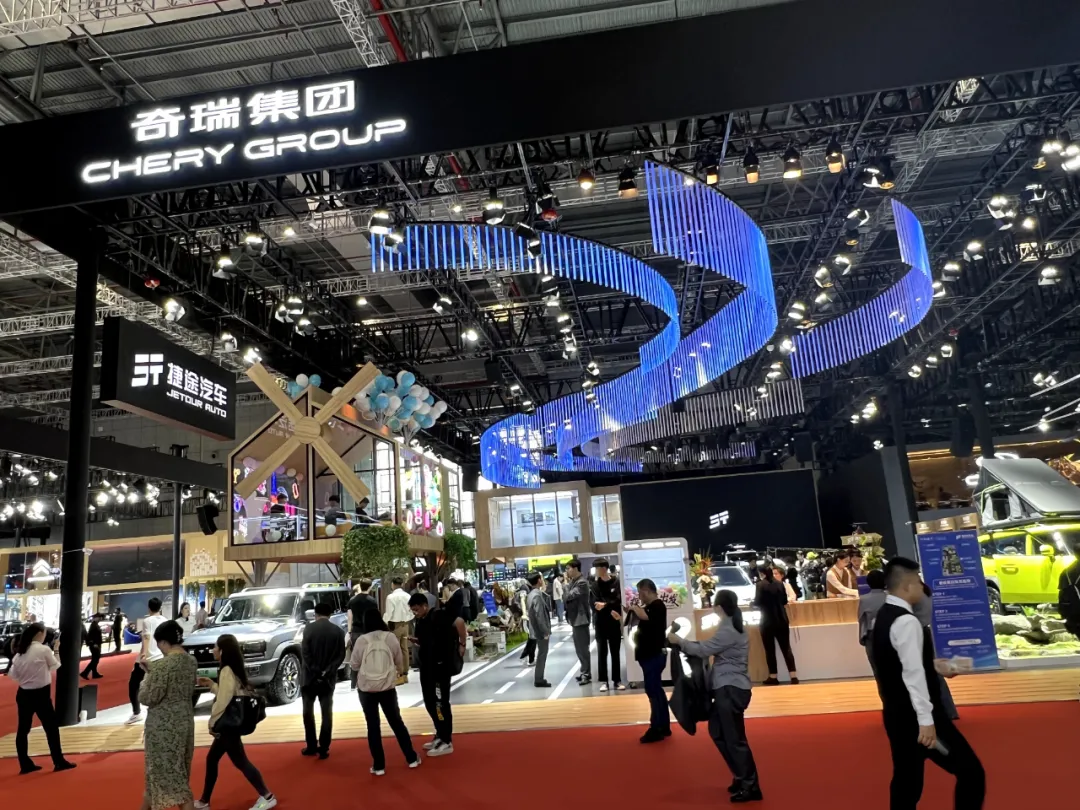

Photo source: Dugou

Photographed at the Shanghai Auto Show in April 2023

After waiting for 20 years to go public, is Chery finally going to fulfill its dream?

Recently, there were reports that Chery Holdings Limited is considering listing its automotive division in Hong Kong, with an estimated valuation of approximately US$7.1 billion (equivalent to approximately RMB 50.225 billion). Currently, Chery is seeking bank support to facilitate its initial public offering (IPO), but discussions are ongoing, and details such as the specific scale of the IPO may change.

Chery has not yet responded to this news. However, it is unlikely to be unfounded, as failing to go public has always been a concern for Chery. Among state-owned automotive groups, Chery is the only remaining "lone wolf" that has not gone public. Since it was first reported in 2004 that Chery was planning to go public, there have been intermittent updates on its IPO progress over the past 20 years, but it has never materialized.

Late last year, there were also media reports that IDG Capital was considering acquiring shares in Chery Holdings Limited from existing shareholders. The subsidiary, Chery Automobile, was also considering filing an IPO application as early as 2024, with an estimated valuation of up to RMB 150 billion. Compared to the latest news, it appears that Chery, which was previously looking at the A-share market, may now turn to the Hong Kong stock market, with its valuation shrinking to one-third of what it was before.

Even so, for Chery, advancing its IPO is the preferred choice for the company to accelerate its expansion, although it is unclear how long it will take this time around.

1

20-year IPO marathon ●

Among the major traditional automakers in China, Chery is a relatively unique presence. Apart from accounting for half of its sales through exports, another reason is that despite once carrying the banner of the rise of Chinese independent automotive brands, Chery has repeatedly encountered obstacles on the path to going public.

Relevant data shows that Chery's plans for going public can be traced back to 2004. According to reports in the China Business News at the time, Chery had already expressed its intention to go public in early 2004, and the Anhui Provincial Government had also urged Chery to go public to raise funds, with Guoyuan Securities and Guotai Junan Securities participating as well.

However, due to Chery's early efforts to obtain a "birth certificate" and its abnormal "marriage" with SAIC Motor, leading to complex equity issues, coupled with the downturn in the automotive industry at the time, Chery's listing plans had to be temporarily shelved.

This did not deter Chery, however. In August 2007, at the offline ceremony for Chery's 1 millionth new car, Yin Tongyue, Chairman of Chery Holdings Limited, publicly stated that Chery would expedite its plans for going public to raise funds. Unfortunately, this attempt also ended in failure due to the outbreak of the financial crisis at the end of the following year.

Then, in June 2009, Chery sold a 20% stake to five enterprises, including Huarong Asset Management, CDH Investments, Bohai Capital, Shenzhen Zhongkechuang, and Rongde Asset Management, for RMB 2.9 billion. After introducing these strategic investors, the market believed that Chery's IPO restart was imminent, but in the end, it was yet another disappointment that eroded Yin Tongyue's confidence. In 2011, he stated that due to issues such as related-party transactions, Chery would temporarily not consider going public.

Fast forward to 2016, when Chery New Energy attempted to go public through a backdoor listing via Hailu Profiles, but the plan ultimately fell through due to Chery New Energy's lack of production qualifications for new energy vehicles.

In 2018, Chery began a series of mixed-ownership reforms. The following year, the capital increase and share expansion projects of Chery Holdings Limited and Chery Automobile Co., Ltd. were completed, with the investor Qingdao Wudaokou New Energy Automobile Industry Fund Enterprise (Limited Partnership) investing a total of RMB 14.45 billion to become the controlling shareholder of Chery.

It was thought that this capital increase and share expansion would finally bring Chery's listing to fruition. Unfortunately, changes occurred. Due to issues with Qingdao Wudaokou's own funding, the mixed-ownership reform with Chery was not fully completed, and there was no substantive progress in the listing.

Until the Yao Guang strategy conference in 2022, Yin Tongyue mentioned going public again: to complete the IPO by 2025; IDG Capital made an appearance in media reports at the end of last year; and on October 7, it was revealed that Chery was considering an IPO in Hong Kong, once again drawing attention to its tumultuous listing progress.

It can be said that over the past 20 years, "going public" has been a seemingly unattainable dream for Chery and Yin Tongyue, who have struggled to make it a reality.

2

Significant valuation shrinkage ●

It is understandable for a company to pursue a listing, as it can not only solve the funding needs for development and provide stable long-term financing channels but also facilitate a virtuous cycle of funds and add a layer of security for the industry's increasingly fierce market competition. However, we notice that compared to previous reports, Chery has this time turned to the Hong Kong stock market.

The reason behind this may be the stricter regulatory environment for A-share IPOs this year. Since April, with the announcement of the "Nine Policies to Boost the Capital Market," a series of supporting policies have been introduced, accelerating the implementation of the "1+N" policy system for the capital market, and a new IPO market ecosystem is gradually taking shape.

Under a series of intensified strict regulatory signals, such as stricter listing access controls, on-site inspections of IPO applicants, and optimized share reduction systems, the A-share IPO market has shown a trend of narrowing, thereby boosting the demand for overseas listings among many mainland companies.

Due to Hong Kong's unique geographical location, financial status, and special relationship with mainland China, the Hong Kong Stock Exchange has become one of the best alternatives for many Chinese companies outside of the A-share market. Compared to the A-share market, the Hong Kong Stock Exchange has lower listing thresholds, higher listing success rates, and lower implicit costs.

Turning to the Hong Kong stock market is a good option for Chery, which is eager to enter the capital market. After all, as Yin Tongyue stated at the Yao Guang strategy conference in 2022, "Chery Automobile aims to complete its IPO by 2025," and time is running out.

However, it is unclear how Chery's share price will perform after a successful Hong Kong IPO. Hong Kong stocks have long suffered from poor liquidity and significant market influence, and IPO valuations in Hong Kong are generally lower.

Taking this news as an example, Chery Holdings Limited is currently considering listing its automotive division in Hong Kong with an estimated valuation of approximately RMB 50.225 billion. However, at the end of last year, it was reported that IDG Capital was considering acquiring shares in Chery Holdings Limited from existing shareholders, and that the subsidiary, Chery Automobile, would consider filing an IPO application as early as 2024 with an estimated valuation of up to RMB 150 billion.

Obviously, compared to the valuation rumored at the end of last year, Chery's valuation for its Hong Kong IPO has shrunk by two-thirds.

Compared to other automotive giants, Chery's valuation is also on the lower side. For example, the current market capitalization of Geely Automobile on the Hong Kong stock market is HK$129.7 billion, while Changan Automobile's market capitalization is RMB 114.4 billion, and Guangzhou Automobile Group's market capitalization is RMB 68.6 billion. The significant shrinkage in Chery's rumored financing scale may be related to the more intense competition in the current automotive market than expected.

3

The time is ripe ●

Although there has been no official response to the news of a Hong Kong listing, the market generally believes that the time is ripe for Chery to restart its IPO, as its sales trends, financial situation, and technological accumulation are all on a positive development trajectory.

In terms of sales and performance, Chery Holdings sold a record 1.2327 million vehicles in 2022, an increase of 28.2% year-on-year. Among them, 451,300 vehicles were exported, an increase of 67.7% year-on-year, maintaining Chery's position as the top Chinese brand for passenger vehicle exports for the 20th consecutive year; and 232,800 new energy vehicles were sold, an increase of 112.9% year-on-year.

Chery Holdings stated in a press release: "In 2022, the group achieved countercyclical growth through transformation and breakthroughs, achieving the best levels in various key operating indicators and setting four 'historical firsts' – annual revenue exceeding RMB 200 billion for the first time, annual sales exceeding 1 million vehicles for the first time, annual exports reaching a new milestone of 450,000 vehicles for the first time, and annual new energy sales exceeding 200,000 vehicles for the first time."

Entering 2023, Chery's performance improved even further. Chery Holdings achieved a "twelve-month consecutive sales growth," selling a total of 1.8813 million vehicles, an increase of 52.6% year-on-year. Exports reached 937,200 vehicles, an increase of 101.1% year-on-year, maintaining Chery's position as the top Chinese brand for passenger vehicle exports for the 21st consecutive year.

Among them, Chery, Starway, and Jetu all achieved year-on-year high-speed growth in overall sales, with cumulative sales increasing by 47.6%, 134.9%, and 75% to 1.3413 million, 125,600, and 315,200 vehicles, respectively.

The strong market performance also contributed to Chery Holdings' excellent revenue growth last year, with annual revenue exceeding RMB 300 billion for the first time, an increase of over 50% year-on-year, marking a "big leap" of RMB 100 billion in just one year.

Celebrating its continued success, Chery has performed remarkably well this year as well. In the first three quarters, Chery Holdings sold a total of 1.7528 million vehicles, a year-on-year increase of 39.9%. For three consecutive quarters, Chery has been the only automaker in the industry to achieve "double growth" in both the new energy and gasoline vehicle segments, as well as in both domestic and overseas markets.

Furthermore, Chery's layout in technology and new energy may also facilitate its faster entry into the capital market. Relying on the foundation of "Technology Chery," it adheres to a product strategy of "oil-electric synergy and advantage integration," with concentrated launches of new gasoline, hybrid, extended-range, and pure electric vehicles. Successive launches include the Fengyun A8, iCAR 03, Jetu Shanhai T2, Star Age ET, 2025 Star Age ES, Fengyun T10, Zhijie R7, and other models.

This year, Chery has added two new milestones to its globalization journey: the group made its debut on the Fortune Global 500 list, ranking 385th; and its cumulative global users exceeded 14.9 million, with overseas users exceeding 4.1 million, making it the first Chinese brand to surpass 4 million in cumulative overseas sales.

With these achievements, Chery seems closer than ever to securing an IPO. Can this 20-year-long journey to go public finally turn a corner?

Author | Li Li

Source | CarVisibility

Disclaimer

This account is dedicated to sharing more knowledge about the automotive industry for readers' reference and exchange, and does not constitute investment advice for any individual or institution.

Please do not make investment decisions based solely on the information in this publication. If any direct or indirect losses are incurred due to improper use of the information, full responsibility must be borne by the individual.

This article is an original work of CarVisibility and all rights are reserved. For reprint requests, please contact us for authorization.