This year's sprint started 130 days earlier

![]() 09/27 2024

09/27 2024

![]() 461

461

Introduction

The fourth quarter is not only a sales season but also a battle for survival.

Recently, an image began circulating on the internet with the following text:

Open your eyes, start competing. No pain, no gain, life is bland. No struggle, no progress, life is wasted. Burn your boats, fight till dawn and dusk. Fight to the death, leave no regrets. Stand firm or die trying!

Beneath this bold text reads: "Work hard for 100 days."

At first glance, one might think this is a car dealership trying to motivate its salesforce, but in reality, it's Chery Automobile's year-end sprint conference. Many saw this image without much reaction, but others noticed a typo: "stand firm" was mistakenly written as "resist." It's clear that automakers are under immense pressure this year.

Traditionally, automakers' year-end sprints occur around the Guangzhou Auto Show in November, with intense efforts during the last 30 days of December. However, this year's sprint has started earlier. Chery's 100-day sprint is actually late compared to Chang'an Automobile, which declared a "130-day battle" to achieve its annual goals as early as August.

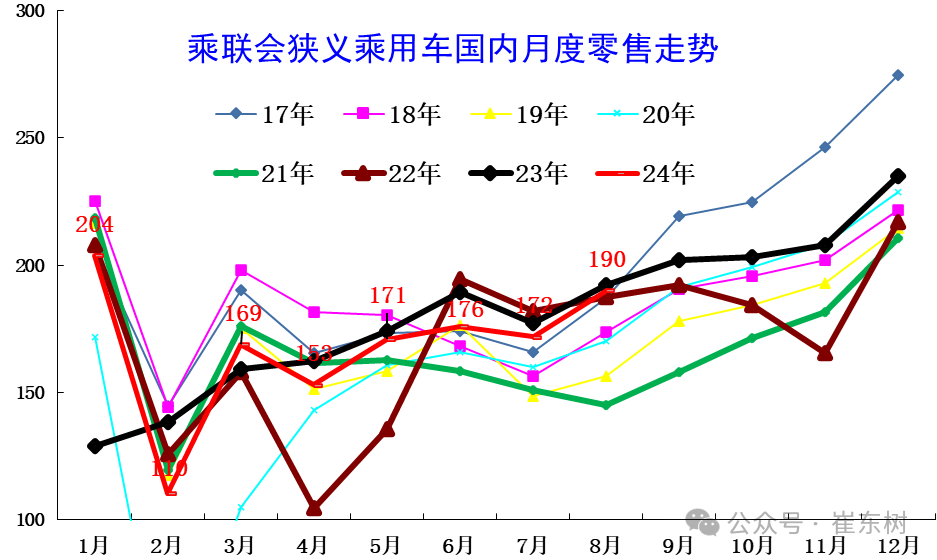

Data shows that nationwide narrow-sense passenger car retail sales have reached 13.45 million units since the beginning of the year, up 2% year-on-year. This slight increase has been hard-won, reflecting the extraordinary efforts of automakers. Facing exhaustion, they've had to start their annual targets a full quarter early.

The Mad September Auto Market

I vividly remember the bleak outlook for the Chengdu Auto Show at the end of August, before it even began. Surprisingly, after the show's successful conclusion, it was revealed that an impressive 33,621 vehicle orders were placed. This achievement belies earlier pessimism and demonstrates automakers' resilience in the face of market challenges.

In the run-up to and aftermath of the Chengdu Auto Show, a wave of new car launches and test drives swept through the automotive market. Automakers scrambled to announce new models, aiming to capitalize on the traditional sales peak of "Golden September, Silver October" and lay a solid foundation for annual sales performance.

September saw automakers go even crazier. Earlier, Auto Society had reported that over 40 new cars would be launched in September, but in reality, more than 50 new models debuted, with roughly two models per day. On September 10, five new cars hit the market, and on September 26, an astonishing six.

Breaking it down by automaker, Dongfeng Motor held seven events in the week of September 19-25, including the launch of the all-new Voyah Dreamer, the rollout of its 60 millionth vehicle, and the unveiling of the Voyah Xiaoyao cockpit, among others.

Similarly, Chang'an Automobile didn't lag behind, announcing six new model launches or debuts in the week of September 20-26 under the slogan "New Models Every Week, Chang'an Always on the Road."

This underscores the intense competition in the automotive market, with automakers rushing to introduce new models during the fall, especially in September, to grab a larger market share.

This strategy reflects the seasonal nature of automotive sales, with autumn being a golden period. However, it also intensifies competition as automakers strive to attract consumers with innovative models.

On the other hand, the concentrated release of new models is a double-edged sword. Only those with high brand recognition and market appeal can stand out, while lesser-known or poorly positioned models may struggle.

Consumers, faced with a plethora of new models, configurations, and brands, enjoy diverse options but also face challenges in making informed decisions. They must weigh the pros and cons carefully to find the best fit.

The No-Turning-Back Fourth Quarter

This year, the automotive market has faced significant challenges, with many automakers lagging behind schedule in achieving their annual targets. The vast majority of automakers have failed to keep pace with their sales targets, putting immense pressure on them.

To turn things around, September, as the start of the fourth quarter, became a peak period for new model launches. Automakers hoped to Stimulate car buying enthusiasm by unveiling new models, aiming to boost sales before year-end and narrow the gap with their targets.

Despite automakers' hopes for sales boosts from new model launches, market feedback has been mixed. For some brands, even introducing new models or adopting aggressive pricing strategies may not easily win over consumers.

Buick's recent announcement is a case in point. It assured customers that if they couldn't purchase an Envision Plus for 169,900 yuan, they could lodge a complaint. This reflects the brand's frustration with market price confusion and highlights the limited appeal of price advantages alone in a competitive market.

The fourth quarter is crucial for automakers, seen as a lifeline amidst unmet sales targets and annual pressures. It not only affects annual sales performance but also market position, brand image, and future development plans. Automakers are intensifying new model launches to attract consumers and stimulate demand during this final sales golden period.

However, turning the fourth quarter into a lifeline isn't easy. Intense competition and consumer rationality pose challenges. Even with efforts in product quality, after-sales service, brand reputation, marketing, innovation, and service upgrades, some automakers may still struggle to achieve satisfactory sales due to market competition, diverse consumer demands, and their own limitations.

Regardless of the outcome, automakers are in a no-turning-back position, driven by market competition and annual sales targets. The fourth quarter is not just a sales season but a battle for survival.