Great Wall Motor partners with Huawei! Traditional automakers increase their 'Huawei factor' to avoid falling behind?

![]() 09/24 2024

09/24 2024

![]() 397

397

Embracing Huawei's intelligence does not equal 'selling one's soul'.

Recently, at Huawei Connect 2024 held in Shanghai, Great Wall Motor signed a comprehensive agreement with Huawei for the digitization and intelligence of marketing.

The cooperation between the two parties revolves around the entire scenario experience of Great Wall Motor's user marketing domain. Leveraging Huawei's technologies in cloud services, AI, intelligent connectivity, and interaction, they will engage in in-depth cooperation in key areas such as 'marketing market insights, advertising public domain placement, user interaction, after-sales service, vehicle usage service, and market ecosystem service.'

At the same time, the brand-new 'Great Wall Motor App,' which aggregates five brand models from Great Wall Motor's portfolio - Haval , Wei Pai , Tank , Euler , and Great Wall pickup truck , has officially launched on the HarmonyOS AppGallery, making Great Wall Motor one of the first OEMs to embrace the HarmonyOS app ecosystem.

Indeed, Huawei is a representative enterprise, and it's not just HarmonyOS cockpits and HUAWEI ADS advanced driver assistance systems that attract automakers. Its achievements in big data, AI algorithms, and other fields are quite convincing in the industry.

Although the official announcement did not explicitly mention the introduction of product technologies, it primarily focused on upgrading service systems and marketing. However, it is widely believed that this may be a step towards Great Wall Motor proactively embracing Huawei's intelligent strategy. Perhaps in the future, we will see HarmonyOS cockpits or HUAWEI ADS driver assistance technology integrated into Great Wall Motor vehicles.

Let's imagine in this direction: when traditional automakers collaborate with Huawei's intelligence and market it as a selling point in the future, is it the automakers 'selling their souls,' or is it the inevitable trend of the 'second half of the automotive race'?

Increasing the 'Huawei factor': Great Wall Motor opts for a multi-pronged approach

In November 2023, Changan Automobile and Huawei signed a Memorandum of Investment Cooperation, in which the latter intended to establish a company engaged in the research and development, design, production, sales, and service of automotive intelligent systems and components solutions. According to the plan, Huawei's automotive BU business would be injected into this company.

This company, later known as Shenzhen Yingwang Intelligent Technology Co., Ltd., essentially spun off Huawei's automotive BU 'technology pool' and attracted automakers to invest and utilize these technologies.

Returning to Great Wall Motor, this renowned automaker signed the 'HUAWEI HiCar Integrated Development Cooperation Agreement' with Huawei as early as June this year, becoming one of the first automotive companies to obtain in-depth development resources such as HUAWEI HiCar source code and development tools.

Unlike simply projecting HiCar onto the vehicle's infotainment system, Great Wall Motor's move directly integrates HUAWEI HiCar deeply into the vehicle cockpit system, enabling deeper vehicle control capabilities beyond navigation, entertainment, and communication. Additionally, Great Wall Motor has developed a higher level of software development capability, deeply customizing based on HUAWEI HiCar's source code and more deeply integrating hardware and software resources.

For example, the top-end model of Great Wall Motor's Tank brand, the Tank 700 Hi-4T, features a deeply integrated HiCar system. It not only has a customized UI interface but also enables direct vehicle control while retaining HiCar's connectivity capabilities.

It can be seen that Great Wall Motor and Huawei have had in-depth cooperation experience in the field of intelligent cockpits, enhancing the cockpit intelligence level of Great Wall Motor's models and simultaneously providing a channel for mobile phone and vehicle interconnection. In contrast, FAW Software has initially integrated HUAWEI HiCar's core connectivity capabilities on the Hongqi·Jiuzhang intelligent platform.

Therefore, from a cooperation perspective, the further deepening of the relationship between Great Wall Motor and Huawei may also convey a message that the former may integrate Huawei's intelligent technologies into its vehicles at some point in the future, potentially gaining more autonomy in development. Huawei's software combined with Great Wall Motor's hardware gives it a competitive edge in the subsequent market.

However, at present, this argument mostly remains speculative.

For Great Wall Motor, which still has considerable influence in sales, Huawei's intelligent vehicle integration may still take some time. After all, Great Wall Motor has a solid foundation in intelligent cockpit interaction and advanced driver assistance systems. Switching to HarmonyOS cockpits and HUAWEI ADS would mean abandoning the company's accumulated expertise and achievements in these areas, which is a conversation for another day.

Even if Great Wall Motor does introduce Huawei's intelligent solutions, the primary motivation is likely to 'walk on multiple legs,' providing an additional option for the market. Pursuing parallel development strategies is a common approach among most automakers as they navigate the market, with subsequent decisions on whether to 'go all in' or 'optimize.'

Traditional automakers cling to Huawei for fear of falling behind

From another perspective, traditional automakers' urgency to 'enter Huawei's ecosystem' may stem from necessity.

In the race towards automotive intelligence, traditional automakers lag behind due to a lack of software development experience and technical reserves, as well as differing ideologies from new-energy vehicle startups. This has resulted in slow progress in intelligence and a long-standing reliance on the 'three major components' of the internal combustion engine era as their core competitiveness. The growing market demand for intelligent vehicles has added pressure on traditional brands.

Moreover, the success of AITO and the impressive performance of HarmonyOS cockpits and HUAWEI ADS advanced driver assistance systems have bolstered Huawei's automotive BU model, leading traditional automakers to embrace this trend.

To narrow the gap with mainstream levels, traditional automakers have begun leveraging Huawei's automotive BU capabilities to address their shortcomings. BYD's sub-brand FAW-Volkswagen's second mass-produced model, the Leopard 8, is confirmed to be equipped with Huawei's high-level driver assistance capabilities. JAC Motor's Refine RF8 HarmonyOS Edition features HarmonyOS cockpit technology. The newly launched HOMM Dreamer also boasts HarmonySpace cockpit and HUAWEI ADS 3.0 capabilities in its Qiankun Edition.

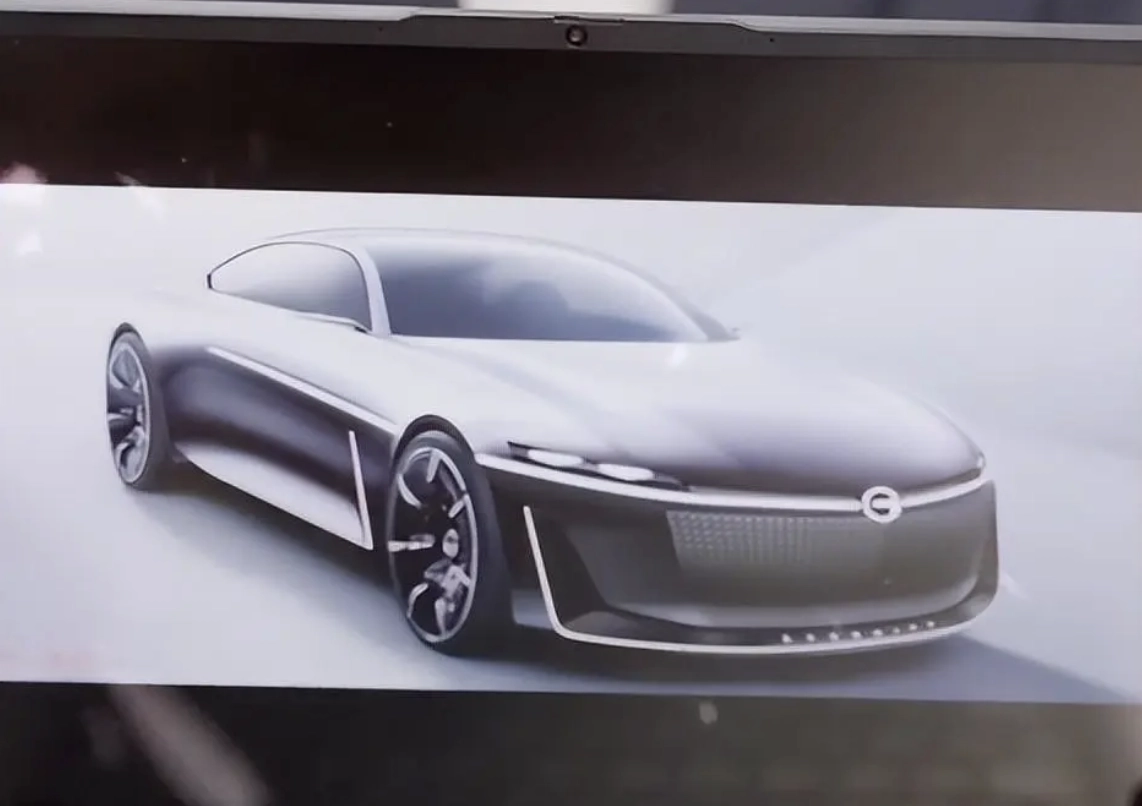

Recently, GAC Motor also confirmed that it will launch its first concept car in collaboration with Huawei tomorrow (September 24), with plans for market delivery in the first quarter of 2025. This model will be equipped with core technologies such as the new-generation HarmonyOS cockpit and Huawei's Qiankun intelligent driver assistance system ADS 3.0.

Various traditional automakers have joined forces with Huawei in different modes. There were even rumors that the all-new Audi A5 would be the first to adopt Huawei's intelligent driving solution in China, though this has not been officially confirmed or denied.

These cooperation signs underscore Huawei's influence in intelligent technologies within the industry. It is speculated that after leveraging Huawei's technologies to complete its marketing digitization transformation, Great Wall Motor may still introduce vehicles equipped with HarmonyOS cockpits and Qiankun intelligent driver assistance systems in the future.

It's not that these automakers lack the ability to build their intelligent systems; rather, the resources and time required to establish a software service system exceed traditional brands' expectations. Time is of the essence, and delay could result in missed opportunities. Collaborating with Huawei allows traditional brands to compete favorably in the era of intelligent vehicles.

Embracing Huawei's intelligence: How can automakers avoid 'selling their souls'?

In 2023, SAIC Motor and Audi partnered to jointly develop high-end smart electric vehicles, with the first model scheduled for launch in 2025. Despite Audi China's President denying rumors of a 'white-label cooperation' with SAIC, the partnership couldn't shake off accusations of 'selling one's soul.' Of course, some brands may also view external collaborations as a lack of confidence in their technologies and products.

Cases of such 'reverse joint ventures' have increased this year, with Toyota partnering with GAC Motor and BYD to co-develop two new bZ series pure electric vehicles scheduled for launch next year. Similar to traditional brands eagerly collaborating with Huawei, TechInsights believes this stems from automakers' recognition of domestic mature solutions and their desire to accelerate their electrification and intelligent transformation. This is a normal cooperative relationship and does not equate to 'selling one's soul.'

Ultimately, it is up to the OEMs to integrate the purchased mature solutions, ensuring that the final product retains a certain brand identity.

The combination of traditional automakers' years of manufacturing expertise and Huawei's intelligence undoubtedly forms a powerful alliance. TechInsights naturally supports such moves by automakers. As market trends shift, no one can afford to be complacent.

However, TechInsights has noticed that some automakers may overemphasize Huawei's role in their new vehicle promotions, inadvertently magnifying its contribution and neglecting their efforts and achievements. This can give consumers the impression of 'Huawei cars.'

While intelligence is crucial, it is not the sole aspect of a vehicle. Not only do some vehicles equipped with HarmonyOS cockpits and Qiankun driver assistance systems come at a higher price, but overemphasizing Huawei's role may obscure the automakers' mechanical quality and material advantages, potentially backfiring from a marketing perspective.

After all, many traditional automakers are far from reaching a point where they cannot survive without Huawei.

While Huawei's intelligence and joint development efforts undoubtedly enhance traditional brands' offerings, TechInsights hopes automakers will gain more confidence in the era of intelligent vehicles. HarmonyOS cockpits and Qiankun driver assistance systems are essentially general-purpose intelligent solutions. Maintaining a brand's unique identity is what constitutes its 'soul.'

As for Great Wall Motor, there is still much room for improvement in its comprehensive intelligence. The latest Coffee intelligent cockpit system and advanced driver assistance technologies are currently concentrated in the latest WEY Blue Mountain intelligent driver assistance edition. Accelerating the rollout and iteration of proprietary technologies or integrating Huawei's intelligence are both favorable moves towards the era of intelligent vehicles.

2025 or 2026 is widely recognized as the year of the explosion of intelligence in the industry. It is said that vehicles without intelligent cockpits or advanced driver assistance systems will face accelerated elimination. Traditional brands are eager to transform and accelerate their layouts, perhaps believing in this narrative. Some brands are indeed taking concrete actions, and next year's automotive market may see significant changes.

Source: Lei Technology