Identifying the Most Lucrative Enterprise in AI Computing Infrastructure

![]() 02/24 2025

02/24 2025

![]() 481

481

AI computing power boasts a vast array of applications, spanning natural language processing, computer vision, speech recognition, machine learning, and more. The current landscape features numerous providers, encompassing traditional chip manufacturers, cloud computing service providers, and AI algorithm providers. Domestic manufacturers are actively advancing the evolution of AI chips, achieving commercial success across various sectors such as telecommunications, the internet, finance, and energy. As AI applications continue their rapid development, the localization of AI computing power is also accelerating.

The AI computing infrastructure industry chain encompasses several key segments: upstream (hardware and chips, including computing chips and servers), midstream (networks and platforms, such as all-in-one computing machines and scheduling networks), and downstream (applications and leasing, including computing leasing, state-owned clouds, data centers, and related infrastructure and services). This article focuses on the [Profitability] section of our enterprise value series, analyzing 113 AI computing infrastructure enterprises using metrics like return on equity (ROE), gross profit margin, and net profit margin. Note that the data presented is historical and does not predict future trends; it serves as a static analysis and should not be construed as investment advice.

Top Ten Most Profitable Enterprises in AI Computing Infrastructure:

10th. Chuanhuan Technology

Industry Segment: Chassis and Engine Systems

Profitability: ROE 13.25%, Gross Margin 24.83%, Net Margin 13.87%

Performance Forecast: ROE has steadily risen to 15.50% over the past three years, with the latest forecast averaging 17.09%

Main Products: Cooling system hoses, contributing 55.92% of revenue with a gross margin of 24.56%

Company Highlights: The company specializes in data center liquid cooling pipeline systems, already supplying small batches to a major data server company.

9th. Suzhou Tianmai

Industry Segment: Consumer Electronics Components and Assembly

Profitability: ROE 21.66%, Gross Margin 29.06%, Net Margin 13.20%

Performance Forecast: ROE has fluctuated between 20%-23% over the past three years, with the latest forecast averaging 20.60%

Main Products: Vapor chambers, accounting for 66.42% of revenue with a gross margin of 40.11%

Company Highlights: Suzhou Tianmai's product portfolio includes heat pipes, vapor chambers, thermal interface materials, and graphite films.

8th. Invicta

Industry Segment: Other Special Equipment

Profitability: ROE 14.13%, Gross Margin 30.50%, Net Margin 9.43%

Performance Forecast: ROE has continuously risen to 15.03% over the past three years, with the latest forecast averaging 18.80%

Main Products: Data center temperature control and energy-saving products, contributing 49.96% of revenue with a gross margin of 30.62%

Company Highlights: Invicta's temperature control solutions aid data centers in achieving efficient heat dissipation and energy savings, fostering data center construction and upgrades.

7th. Shanghai Stock Exchange Electronics

Industry Segment: Printed Circuit Boards

Profitability: ROE 16.80%, Gross Margin 29.54%, Net Margin 15.78%

Performance Forecast: ROE has fluctuated between 15%-18% over the past three years, with the latest forecast averaging 21.86%

Main Products: Enterprise communication market boards, accounting for 70.58% of revenue with a gross margin of 41.59%

Company Highlights: The surge in demand for AI servers due to the growth of AI computing power has significantly increased PCB order demand for Shanghai Stock Exchange Electronics.

6th. Tai Cheng Guang

Industry Segment: Communication Network Equipment and Devices

Profitability: ROE 10.68%, Gross Margin 30.03%, Net Margin 15.73%

Performance Forecast: ROE has fluctuated between 6%-15% over the past three years, with the latest forecast averaging 16.57%

Main Products: Optical device products, contributing 97.15% of revenue with a gross margin of 31.92%

Company Highlights: Tai Cheng Guang's optical device products are widely utilized in the construction of telecommunication networks and data centers globally.

5th. Guanghe Technology

Industry Segment: Printed Circuit Boards

Profitability: ROE 19.47%, Gross Margin 26.22%, Net Margin 10.65%

Performance Forecast: ROE has continuously risen to 25.60% over the past three years, with the latest forecast averaging 22.57%

Main Products: Printed circuit boards, accounting for 94.24% of revenue with a gross margin of 30.80%

Company Highlights: PCBs in AI servers are used more extensively and hold higher value. Guanghe Technology's AI server PCBs provide robust support for the hardware foundation of AI computing power.

4th. Runze Technology

Industry Segment: Communication Application Value-Added Services

Profitability: ROE 30.67%, Gross Margin 50.84%, Net Margin 42.25%

Performance Forecast: The highest ROE over the past three years was 38.80%, with the latest forecast averaging 21.53%

Main Products: AIDC business, contributing 57.46% of revenue with a gross margin of 22.14%

Company Highlights: Runze Technology's business comprises IDC and AIDC. Currently, the AIDC business is expanding rapidly to capitalize on the transformative opportunities AI presents in the IDC field.

3rd. Shenghong Electric

Industry Segment: Other Power Supply Equipment

Profitability: ROE 23.17%, Gross Margin 42.79%, Net Margin 13.70%

Performance Forecast: ROE has continuously risen to 31.80% over the past three years, with the latest forecast averaging 24.66%

Main Products: Electric vehicle charging equipment, contributing 38.87% of revenue with a gross margin of 38.07%

Company Highlights: Shenghong Electric's mainstream power quality products, including APF, SVG, and UPS, are all applicable in large data centers.

2nd. Baosight Software

Industry Segment: IT Services

Profitability: ROE 23.05%, Gross Margin 34.16%, Net Margin 17.86%

Performance Forecast: ROE has continuously risen to 24.65% over the past three years, with the latest forecast averaging 22.65%

Main Products: Software development and engineering services, accounting for 75.44% of revenue with a gross margin of 32.24%

Company Highlights: Baosight Software's Baozhi Cloud (computing center) deploys computing and cloud computing nodes, offering users integrated services such as high-quality data centers, cloud computing, and network security.

1st. Zhongji Xuchuang

Industry Segment: Communication Network Equipment and Devices

Profitability: ROE 12.28%, Gross Margin 29.29%, Net Margin 14.97%

Performance Forecast: ROE has continuously risen to 16.58% over the past three years, with the latest forecast averaging 27.50%

Main Products: Optical communication transceiver modules, contributing 97.42% of revenue with a gross margin of 33.51%

Company Highlights: Zhongji Xuchuang has been developing optical modules for data centers for years, suitable for both telecommunication long-distance transmission and data center DCI interconnection requirements.

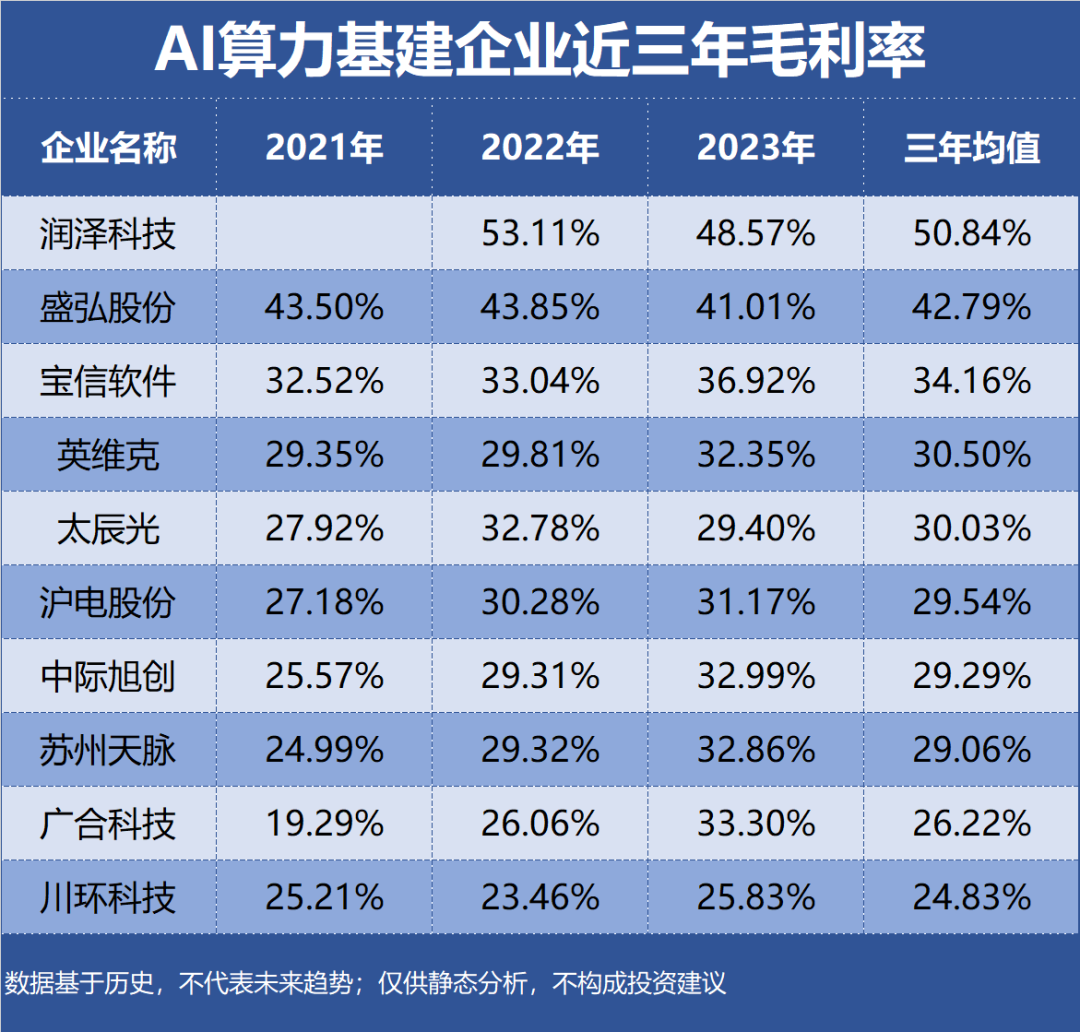

ROE, Gross Margin, and Net Margin of the Top Ten Profitable Enterprises in AI Computing Infrastructure Over the Past Three Years: