Europe's pure electric vehicles face 'darkest hour'

![]() 09/23 2024

09/23 2024

![]() 371

371

Introduction

With declining consumer demand and the cancellation of subsidy policies, pure electric vehicles have cooled off in the European market.

This year, the penetration rate of domestic new energy vehicles has repeatedly hit new highs, with the August penetration rate approaching 54%; in the first eight months of this year, cumulative sales of new energy passenger vehicles exceeded 6 million, up 35.1% year-on-year, with a market penetration rate of 44.6%. In the retail structure of new energy vehicles, pure electric vehicles account for 57% of sales, making them a significant force in the new energy vehicle market.

However, compared to the booming pure electric vehicle market in China, Europe's pure electric vehicle market is facing its 'darkest hour.'

Recently, according to data released by foreign media, EU pure electric vehicle sales in August fell by 43.9% year-on-year, marking the fourth consecutive month of decline for European pure electric vehicles. Among them, Germany and France, the two largest electric vehicle markets in the EU, saw their electric vehicle sales decline by 68.8% and 33.1% year-on-year, respectively.

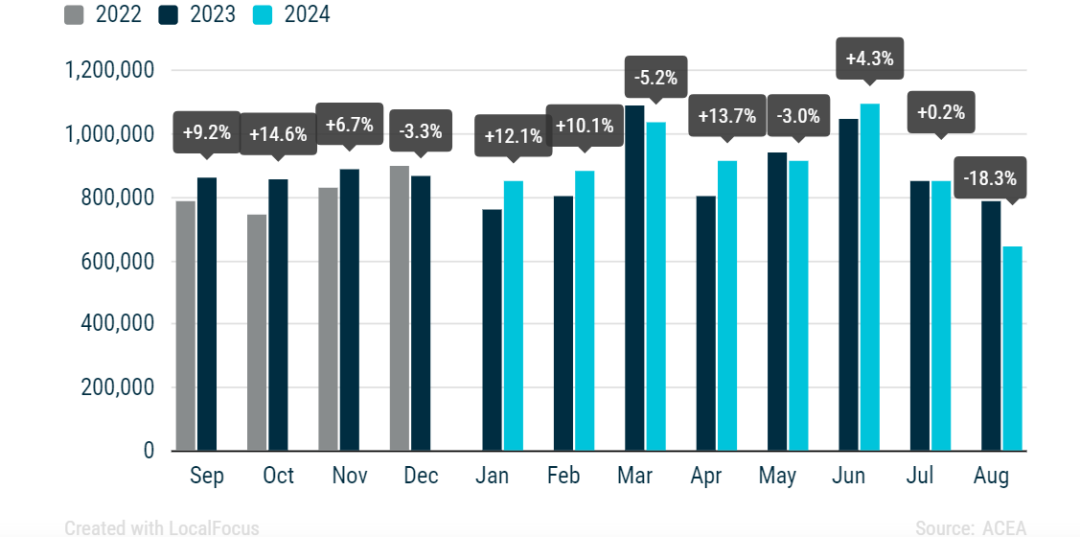

Amid the sluggish sales of pure electric vehicles, EU new car sales fell 18.3% year-on-year in August, also falling to their lowest level in nearly three years. Major markets like Germany, France, and Italy all saw double-digit declines in sales, with declines of 27.8%, 24.3%, and 13.4%, respectively.

Given the significant investments made by European automakers in recent years towards electrification, such as Volkswagen Group, which has invested a cumulative 89 billion euros in electrification over the past few years and plans to invest an additional 180 billion euros from 2023 to 2027, the current sales performance of pure electric vehicles is clearly disproportionate to these investments.

Market decline hits automakers hard

As early as July this year, pure electric vehicle sales in Europe declined by more than 10%, accounting for only 12.1% of new car sales for the month, down from 13.5% in the same period last year. In the first seven months, EU new car registrations increased by 3.9% to over 6.5 million. It is evident that while new car registrations have increased, Europe's pure electric vehicles have declined significantly.

In contrast, Europe's hybrid vehicle market share increased from 25.5% last year to 32%, with conventional hybrids and mild hybrids growing rapidly, even surpassing gasoline vehicles in July new car registrations.

In August, this sales trend continued in Europe. Data showed that sales of pure electric vehicles and plug-in hybrids declined by 43.9% and 22.3%, respectively, while hybrid vehicle sales increased by 6.6% year-on-year, accounting for 31.3% of the market.

In fact, with the decline in pure electric vehicle sales, hybrid vehicles have been steadily increasing their market share in the EU in recent months, as many consumers view them as a compromise between gasoline vehicles and pure electric vehicles, serving as a transitional option.

However, the growth in hybrid vehicles cannot fully offset the decline in pure electric vehicles, resulting in overall European car sales falling far below pre-pandemic levels. Many automakers, including Volkswagen, believe this trend will not change in the short term.

Amid the overall decline in car sales, European automakers are struggling.

Data shows that registrations of new vehicles from Volkswagen, Stellantis, and Renault, Europe's top three automakers, declined by 14.8%, 29.5%, and 13.9% year-on-year, respectively. Tesla's sales also fell by 43.2%... These figures reflect the current state of pure electric vehicles in the European market to some extent.

Specifically, the Dacia Sandero, Volkswagen Golf, and Volkswagen T-Roc consistently rank at the top of sales charts, while Tesla's Model Y is the only pure electric vehicle in the top ten, albeit in ninth place. Among them, the highest-ranking Chinese brand model is the MG ZS from SAIC Motor, which sold 63,000 units in the first seven months, ranking 33rd.

The significant decline in pure electric vehicle sales has hit automakers that have long bet on electrification and invested heavily in product upgrades.

Take Volkswagen as an example. According to Volkswagen's financial report, its net profit in the first half of 2024 fell by 14% year-on-year, primarily due to a 15% decline in electric vehicle sales in Europe and the United States. Similarly, Stellantis, BMW, Renault, and Mercedes-Benz also saw varying degrees of decline in earnings in the first half of the year.

The situation is even more challenging for electric vehicle component manufacturers.

Currently, Valeo is seeking buyers for two of its factories facing severe order shortages. Reports indicate that electric vehicle component production is approximately twice lower than initially anticipated. Finally, LG Energy Solution, Europe's largest battery supplier, is even considering the possibility of shifting to the production of stationary batteries to enhance its competitiveness.

Subsidy cuts weaken demand

One of the reasons for the significant decline in EU electric vehicle sales is the EU's disagreement on environmental incentive policies.

Take Germany as an example.

Since Germany began subsidizing electric vehicles in 2016, it has set different levels of subsidy amounts based on the vehicle's price. During this period, Germany has paid approximately 10 billion euros in subsidies for over 2 million electric vehicles, significantly promoting the development of the country's electric vehicle industry. In 2019, Germany even included plug-in hybrids in its subsidy scope and increased subsidy amounts.

However, in recent years, Germany has begun reducing subsidies for electric vehicles. In 2022, Germany announced that subsidies for pure electric vehicle consumers purchasing vehicles priced below 40,000 euros would be reduced from 6,000 euros to 4,500 euros from January 1, 2023, and further reduced to 3,000 euros in 2024. The original plan was for this policy to continue until the end of 2024, with a gradual phasing out of electric vehicle incentives.

When subsidies were removed and market demand returned to normal, Germany's electric vehicle sales experienced a significant year-on-year decline this year.

In May this year, German electric vehicle sales declined by 30.6%. In July, German electric vehicle sales were approximately 30,000 units, a year-on-year decrease of 36.8%, and the market share of electric vehicles fell from 20% in 2023 to 12.9%.

Neighboring Switzerland experienced a similar situation, with electric vehicle sales declining by 19% in July. In Sweden, sales fell by 15%... Industry insiders believe that the primary reason for declining interest in electric vehicles among European consumers is their high prices. As subsidies are phased out and product prices increase, consumer interest decreases accordingly.

Moreover, factors such as a lack of charging infrastructure, range anxiety, rising electricity prices, and declining incomes have all dampened European consumers' enthusiasm for purchasing electric vehicles. Meanwhile, the EU is attempting to block more cost-effective Chinese electric vehicles by imposing high tariffs, which is also a significant blow to the European electric vehicle market and indirectly makes more cost-effective gasoline and hybrid vehicles the preferred choice for European consumers.

In addition to subsidy cuts, the overall decline in demand in Europe is also a factor contributing to the sharp drop in pure electric vehicle sales. After all, overall European car sales are well below pre-pandemic levels, with approximately 2 million fewer vehicles delivered than at their peak. Consequently, automakers have warned that the downward trend in demand may not change in the foreseeable future.

As European consumers begin to lose interest in electric vehicles, automakers' willingness to pursue electrification is not as strong as it was a few years ago.

Mercedes-Benz Group announced at its annual financial report conference that it would no longer adhere to its plan for full electrification by 2030 while ensuring continued improvement in gasoline vehicle production. Similarly, luxury automakers BMW and Audi have stated that they will not abandon gasoline vehicle production; Stellantis Group has also updated its product planning for the European market, planning to launch 30 mild hybrid models in Europe this year and an additional six by 2026...

In summary, both the current sales bottleneck and automakers' slowing pace of electrification are not good news for the development of electric vehicles in Europe. If European electric vehicles want to emerge from their 'darkest hour,' the road ahead will not be easy, and they must first consider how to regain the hearts of European consumers.