Can LeDao help NIO embark on the profitable 'path'?

![]() 09/22 2024

09/22 2024

![]() 581

581

Which would you choose: LeDao L60 or Tesla Model Y?

After being talked about for half a year, LeDao's new car has finally been launched.

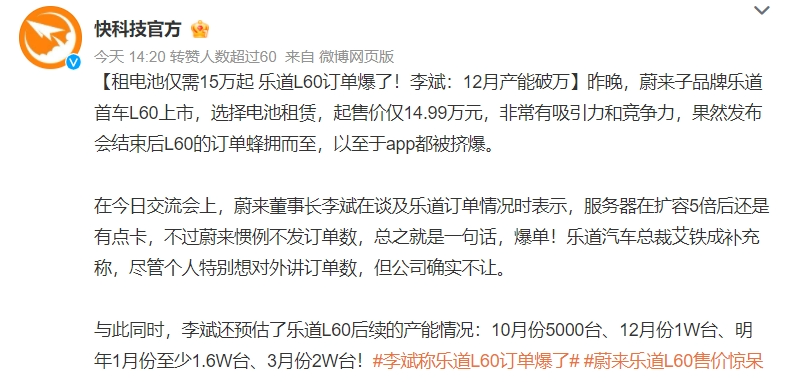

On the evening of September 19th, NIO's (NIO.US) subsidiary LeDao unveiled its first car, the LeDao L60. After nearly two hours of introducing various configurations such as range, space, and intelligent driving, the veil of the LeDao L60's price was finally lifted. With a starting price of 149,900 yuan for the battery rental plan, NIO's price range has been lowered to the 150,000 yuan level.

Image source: Weibo screenshot

However, making money from mid-to-low-end car owners can be challenging. Owners of cars priced in the tens of thousands of yuan are content as long as their vehicles run smoothly, while those who buy cars priced above 300,000 yuan have clearer demands for brand, luxury, and intelligence. Owners in the 150,000-200,000 yuan range, on the other hand, want it all.

NIO naturally understands user needs. The LeDao L60 launch event covered everything from batteries to intelligence, and even included a promotional video showcasing the refrigerator configuration, emphasizing the message that 'if others have it, we have it too.'

The day after the launch event, Li Bin told the media that orders for the LeDao L60 had "exploded," although specific numbers were not disclosed. However, order volume does not equal delivery volume, so whether LeDao can live up to expectations and deliver on schedule remains to be seen.

01. 'Wanting it all' with LeDao

'Starting price of 206,900 yuan, or 149,900 yuan with the battery rental plan.' After nearly two hours of livestreaming, the price of the LeDao L60 was finally announced.

The announcement sparked heated debate among consumers. Cao Xiaoyang (pseudonym), who attended the launch event, commented, 'The starting price of 149,900 yuan is quite cost-effective, especially since no other models in this price range offer battery swapping services. I think it's very competitive.' However, some budget-conscious netizens began to carefully calculate monthly expenses, noting that 'renting a battery costs an additional 400-600 yuan per month, and that doesn't even include charging or battery swapping fees. So you're looking at an extra thousand yuan or so per month. The wool still comes from the sheep.'

Image source: Photographed at the launch event

From its announcement as a new brand under NIO to the rollout of its first car and the official launch of the new model, LeDao Automobiles has been the topic of discussion for half a year. Perhaps due to the accumulation of too many expectations, the launch event inevitably felt a bit lengthy.

'The two-hour launch event invited singers, consumers, and recorded a bunch of videos, but I didn't feel like it captured the core selling points of the car,' said Sasha (pseudonym), describing her impression of the entire event. 'The car emphasizes low power consumption, intelligent driving systems, cost-effectiveness, the three-electric system, and even highlights the in-car refrigerator, interior space comfort, and even includes a diaper bag for mothers with babies. The car gives me the impression that 'if others have it, we have it too,' without a clear positioning or selling point.'

Cao Xiaoyang shared a similar sentiment, particularly regarding the new purple color introduced at yesterday's launch event. She commented, 'This color is similar to the purple of Xiaomi SU7. It feels like Xiaomi's purple SU7 received a good market response, so LeDao also adopted it.'

Image source: Weibo screenshot

Industry insiders believe that positioning a model in the 150,000-200,000 yuan range is inherently challenging, and it's difficult to make money from these consumers. They prioritize cost-effectiveness, but it's not the only factor. For example, I once took a taxi that cost over 100,000 yuan. The entire front screen was a large display, but it took half a minute to wake up. I asked the driver why he didn't buy a car without such complicated electronics, and he said, 'It's better to have it than not.' Consumers in this price range want it all, and cost-effectiveness is a must.

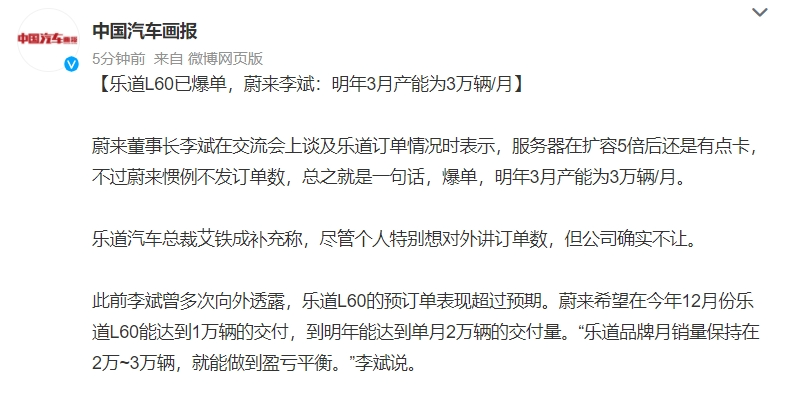

At a media briefing the day after the launch event, Li Bin revealed that orders for the LeDao L60 had "exploded," although specific numbers were not disclosed. Regarding LeDao's production capacity, Li Bin stated that 5,000 units could be achieved in October, breaking the 10,000-unit mark in December and reaching 20,000 units per month by March next year.

Image source: Weibo screenshot

To meet LeDao's production capacity, NIO announced during its financial report meeting that the F2 factory had initiated a two-shift system. Earlier online job postings from NIO's Hefei factory also mentioned the need for employees to work in two shifts, further confirming that NIO is striving to ramp up production quickly.

02. 'If you can't beat them, join them'?

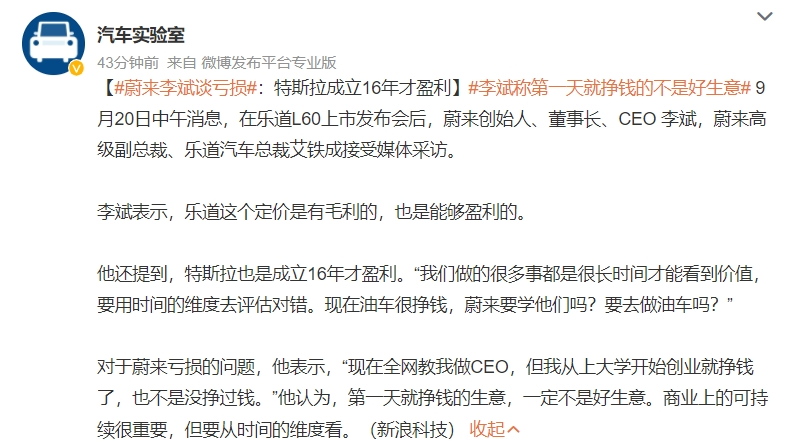

This year marks NIO's tenth anniversary, and despite this milestone, the company remains unprofitable.

From NIO's NYSE listing in 2018 to the end of 2023, the company incurred a cumulative loss of over 65 billion yuan in six years. When combined with the first two quarters of this year, the total loss exceeds 75 billion yuan.

Regarding NIO's losses, Li Bin noted at a media event that Tesla took 16 years to become profitable. 'Many of the things we do take a long time to see their value, and it takes time to assess whether they are right or wrong. Oil cars are very profitable right now. Should NIO follow suit and make oil cars?'

Image source: Weibo screenshot

However, continuous losses require funding to fill the gap, and NIO has continually announced financing news. According to NIO's 2023 financial report, the company's cash flow from operating and investing activities was negative, while cash flow from financing activities was positive. Taken together, NIO is still 'borrowing' to fund its expansion and operations.

As of the end of the second quarter of this year, NIO's cash reserves stood at 41.6 billion yuan, significantly less than Xpeng's 37.33 billion yuan but ahead of Lixiang's 97.3 billion yuan. However, this figure includes the recent infusion of 16 billion yuan from a Middle Eastern investor at the end of 2023.

Image source: Weibo screenshot

Competition in the electric vehicle market has intensified this year, with price wars leading the charge. However, NIO positions itself as a premium brand, putting Li Bin in a dilemma. Blindly cutting prices could affect the experience of existing customers and the confidence of potential customers, especially considering that one of NIO's main sales strategies is 'old customers bringing in new ones.' On the other hand, not cutting prices while others do so makes NIO seem less cost-effective.

In fact, NIO's average vehicle price has continued to decline. In 2022, the average price was 372,000 yuan, dropping to 308,000 yuan in 2023 and further to 273,000 yuan below the 300,000 yuan mark in the second quarter of this year.

Under various pressures, NIO has felt the awkwardness of being positioned in the high-end segment, where it seems stuck between 'can't go up or down.' From a branding perspective, having a mid-to-low-end, high-volume model is crucial. Establishing a subsidiary brand can maintain NIO's premium positioning while adding a high-volume model to the group's portfolio.

Image source: Canned image library

Just last month, Xpeng's MONA was officially launched. MONA and LeDao share many strategic similarities for their respective groups – after navigating positioning, pricing, and intense competition, both Li Bin and He Xiaopeng realized that their brands needed a high-volume model to scale up, increase gross margins, turn losses into profits, and achieve a 'positive cycle.'

On August 20th, Xpeng stated during its mid-year earnings conference that with the launch of its new product cycle, it expects to deliver approximately 41,000 to 45,000 vehicles in the third quarter of this year, significantly exceeding market expectations of 38,000 units. This indicates Xpeng's strong confidence in MONA's sales.

Similarly, NIO stated during its second-quarter earnings call that it hopes LeDao can achieve monthly sales of 10,000 units by December and 20,000 units per month next year. With the responsibility of driving volume, LeDao may directly determine NIO's breakeven point.

03. Can LeDao support 'the future'?

Will relying on LeDao to drive volume be a successful strategy?

Although LeDao L60 is positioned as a direct competitor to Tesla's Model Y, much like how Xiaomi's SU7 was positioned against Tesla's Model 3 but ended up 'sweeping' Xpeng and NIO upon its launch, NIO must also compete with domestic models priced around 200,000 yuan, such as IM Motors' all-new LS6, Zeekr 007X, and Xpeng G6.

From an external competition perspective, LeDao does have advantages in terms of hardware, software, and cost-effectiveness. The LeDao L60 is built on a 900V silicon carbide platform, resulting in a thinner battery pack and more spacious interior. With an ultra-long range of 1,000 kilometers and ultra-low power consumption of just 12.1 kWh per 100 kilometers, LeDao also offers NIO's battery swapping service, outperforming models in the same price range in terms of service.

Image source: Canned image library

However, while LeDao may outshine its competitors, it could also potentially cannibalize NIO's sales.

When the LeDao L60 was announced, consumers began discussing whether to choose NIO's EC6 or LeDao's L60. Subjectively, LeDao targets different price points and brands, but consumers see similarities such as NIO's battery swapping service (shared with LeDao from the third-generation stations onward, with over 1,200 stations currently in operation and another 1,000 planned for this year), lower power consumption than the EC6, similar exteriors, and the same platform. Some netizens even joked, 'If LeDao had launched a few years earlier, there wouldn't have been a need for the EC6.'

Image source: Redbook screenshot

A successful subsidiary brand should attract diverse consumer groups; otherwise, it risks becoming internally competitive. At the launch event, NIO's Senior Vice President and LeDao Automobile President Ai Tiecheng stated that by the end of this year, LeDao will open over 200 stores in 120 cities nationwide. Regarding concerns that LeDao may poach NIO customers, Ai noted that based on pre-orders, less than 5% of customers come from within the NIO ecosystem, with the vast majority being new customers.

The key for LeDao's future lies in how it differentiates and synergizes with NIO. Moreover, launching LeDao alone will not resolve all of NIO's overall issues.

Even if LeDao achieves high sales volumes, boosting gross margins through economies of scale, NIO still faces two hurdles to profitability: cost control and profitability from its battery swapping business.

According to NIO's second-quarter financial report, R&D expenses declined by 3.8% year-on-year, but marketing expenses increased by 31.5%.

Comparing NIO's financial results with those of Lixiang and Xpeng in the second quarter reveals that both competitors saw double-digit growth in both R&D and marketing expenses, with R&D expense growth slightly outpacing marketing expense growth. Lixiang's R&D expenses increased by 24.8% year-on-year, while marketing expenses rose by 21.9%. Xpeng's R&D and marketing expenses increased by 7.3% and 1.9%, respectively. In terms of the proportion of marketing expenses to total revenue, NIO (21.53%) had the highest among the three new energy vehicle brands.

Image source: Canned image library

On the other hand, NIO's battery swapping program continues to be a significant financial burden. This year, NIO plans to expand its network of battery swapping stations by 1,000, but as of the end of August, only around 200 stations had been added. The mass production of the fourth-generation battery swapping stations has also been delayed.

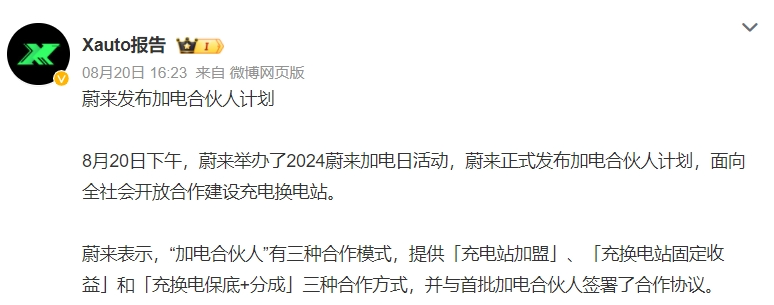

Battery swapping can be seen as Li Bin's 'bold bet.' Ideally, this program would not only boost car sales but also generate a new revenue stream for NIO.

However, realizing this ambition is a long and challenging road. Currently, NIO's battery swapping business is not yet profitable. Of the planned 1,000 new stations, only around 200 have been added as of August.

Battery swapping stations are a capital-intensive and long-term business. To alleviate cash pressure, NIO has launched the 'Charging Partner' program, opening up battery swapping stations to franchisees and seeking independent financing for the battery swapping business.

Image source: Weibo screenshot

'Distant water cannot quench a near thirst.' Despite NIO's accumulated efforts in battery swapping, the business has yet to enable the company to narrow its losses in the short term. For now, this responsibility falls on LeDao's shoulders.

In the fiercely competitive market for vehicles priced between 150,000 and 200,000 yuan, LeDao faces the real challenge of not only aligning with NIO's overall positioning but also outperforming competitors, thereby bringing both scale and cash flow to NIO.