Encircling and besieging BBA, BYD and Denza are also ready to contribute

![]() 09/20 2024

09/20 2024

![]() 434

434

In the Chinese market, BBA was once both a source of pride and substance. However, starting from the beginning of this year, the fuel-powered luxury vehicle camp led by BBA has embarked on an unprecedented "promotion season".

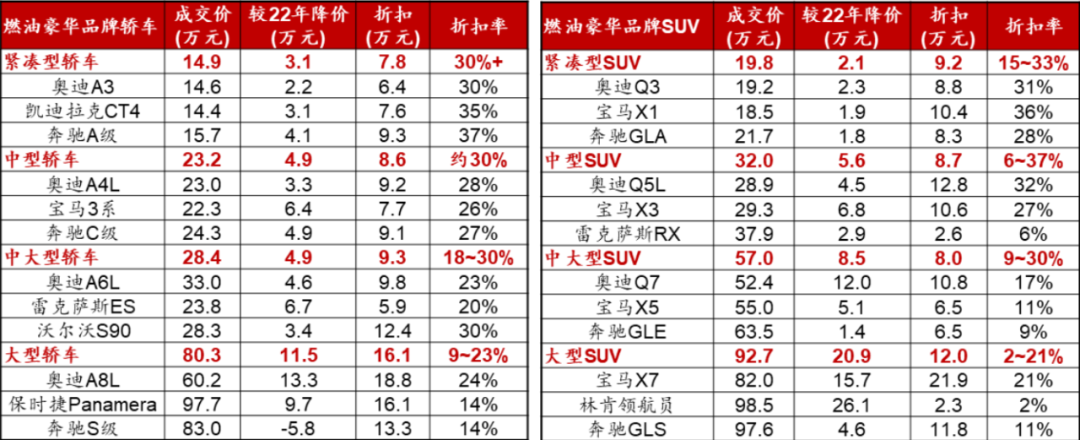

In the BBA quotation sheets circulating on the internet in mid-year, the average price reduction for 25 BMW models after landing reached a staggering 161,400 yuan. Meanwhile, Mercedes-Benz, from its entry-level A-Class sedans to the large GLE SUV, saw an average price reduction of 140,000 yuan across its 13 models.

Audi is no exception, with the landing price of the A4L, which starts at a guide price of 321,800 yuan, now falling below the 200,000 yuan mark. Beyond BBA, Cadillac's 1.5T, entry-level CT4 is available for as little as 130,000 yuan barebones, and some dealers have even launched the slogan "Buy an XT5, Get a CT4 Free."

The price war in the automotive market has become particularly intense this year, with 146 models joining the price reduction ranks in just the first five months, exceeding the level for all of last year (139 models).

Among these, luxury brands once contributed the largest annual price drops. For example, the landing price of the BMW i7, with an official guide price starting at 949,000 yuan, dropped by 360,000 yuan, while Mercedes-Benz's GLC, with a guide price of 427,800 yuan, fell to 334,200 yuan. The saying "Only poor people buy BBA" is no longer just a joke.

However, price reductions have not stopped the loss of market share. From January to May 2021-2024, the market share of luxury fuel-powered vehicles in China fell from 15.1% to 13.1%, even with the collective price reductions aimed at maintaining volumes. Statistics show that high-end brand models priced above 200,000 yuan (including BBA, Cadillac, Volvo, etc.) have seen an average price reduction of over 50,000 yuan compared to 2022, with discount rates reaching over 30%.

Luxury brands' loss of market share in the Chinese market is the result of concerted efforts by all domestic brands and new forces.

Taking BYD as an example, its sales share of models priced above 200,000 yuan rose from 3.1% to 8.1% between 2021 and 2023, mainly driven by the Han, Tang, and Denza D9 models. Analysts optimistically predict that as more high-end models are launched, BYD's sales share above 200,000 yuan is expected to further increase.

However, even BYD has only taken the first step towards premiumization in this regard.

1

BYD has yet to establish a strong presence in the premium segment

In terms of price ranges, BYD's current four brands are the main Dynasty and Ocean series, focusing on prices below 200,000 yuan; the FANGCHENGBAO positioned at 200,000-300,000 yuan; and the Denza positioned above 300,000 yuan. The last is the NIO, positioned as a luxury car costing millions of yuan.

BYD's premiumization began in 2023, with the launch of the FANGCHENGBAO Leopard 5, Denza N7/N8, and NIO U8/U9. In terms of its premiumization strategy, BYD has chosen to emulate Toyota's approach with Lexus, with NIO focusing on technology advancement to elevate its image and Denza/FANGCHENGBAO focusing on volume sales.

In 1983, Toyota proposed creating a premium brand, investing over $1 billion and taking six years to launch its flagship LS400 and volume-oriented ES250 in the United States in 1989. In 1991, it introduced more volume models such as the ES 300 and SC 300, surpassing Mercedes-Benz and BMW in sales in the US.

Drawing on Toyota's approach with Lexus, among BYD's three current premium brands, NIO is positioned as a luxury brand, elevating the company's overall brand image. By incorporating cutting-edge and premium technologies (such as Cloud Suspension and iTAC), it provides users with an ultimate driving experience while serving as a technology reserve that can be deployed to other brands as needed.

FANGCHENGBAO and Denza are positioned as premium brands but also focus on volume sales. Due to cost considerations, they utilize some technologies downscaled from NIO, such as in chassis/power performance, where NIO applies iTAC while Denza uses a similar but more cost-effective technology, ensuring a balance between pricing and configuration.

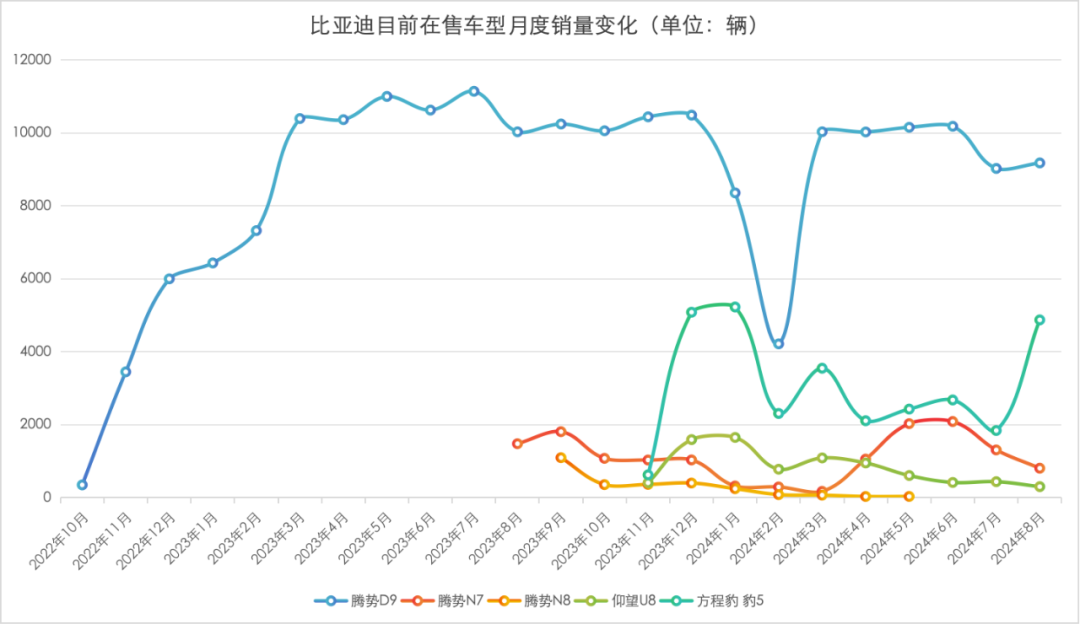

However, BYD's presence in the premium market remains relatively weak. On the one hand, its product offerings are limited, and apart from the Denza D9, which sells consistently around 10,000 units per month, the other models are not selling well.

While the NIO U8 occasionally surpasses 1,000 units per month in sales, it typically hovers around three digits. The Leopard 5, which was expected to be a volume model, only sells around 3,000 units per month on average, prompting BYD to reduce prices by 50,000 yuan to boost sales. The Denza N7 has only exceeded 2,000 units per month in May and June this year since its launch, falling back to three-digit sales thereafter. The Denza N8 has essentially fallen below 100 units per month this year.

On the other hand, BYD lacks products in the mainstream SUV/sedan segments. Recognizing this, BYD will launch new models under NIO, FANGCHENGBAO, and Denza starting from the second half of this year.

In 2024, BYD's premium brands are expected to launch a total of seven new models (including the facelifted Denza N7, which adopts a new design language for its front fascia). Among them, NIO will deliver the supercar U9 and introduce the coupe U7. The volume-oriented Denza and FANGCHENGBAO brands will launch models such as the Denza Z9/Z9GT, Denza N9, FANGCHENGBAO 8, and FANGCHENGBAO 3.

BYD will undoubtedly continue its brand upward breakthrough. According to analysts, after filling in the premium SKU gap, BYD is expected to strengthen its market perception in the premium segment.

However, the issue is that BYD's current success in the premium segment is limited to the NIO U8 and Denza D9, and even the former's sales are declining. In the million-yuan luxury car rankings, NIO U8 sold 715 units in February this year but fell to 422 units in July, dropping from 6th to 11th place.

Considering NIO U8's positioning as a million-yuan luxury car and its non-discounting strategy, sales figures cannot fully represent the rise or fall of its premium brand. Instead, the volume-oriented FANGCHENGBAO and Denza can provide a clearer indication.

Apart from the successful Denza D9, Denza's other models are not volume-oriented. The key to D9's success lies in its targeting a gap in the high-end plug-in hybrid MPV market, representing the success of a single product positioning rather than the premiumization of the brand as a whole.

After the Leopard 5's failure, the Leopard 8, billed as the "youth version" of the NIO U8 and priced in the 500,000 yuan range, had to introduce Huawei as its intelligent driving supplier to stabilize its positioning as a luxury brand. However, the hardcore off-road market where the Leopard 8 is positioned is niche, and the market is not optimistic about its volume potential.

2

The Second Half for Denza

During an interview with the media in August, Wang Chuanfu described Denza as "an important link connecting the past and the future," referring to NIO as the connection between the past (NIO) and the future (BYD's main brand).

Such a high evaluation suggests that BYD places great importance on Denza, and the answer can be glimpsed in Denza's new products.

With a pre-sale price starting at 339,800 yuan, the Denza Z9GT can be seen as BYD's replication of Lexus's initial success with the LS400: over-specification + cost-effective pricing → hot sales.

For example, in terms of technology accumulation and power performance, the Denza Z9GT boasts nearly 1,000 horsepower, and BYD's plug-in hybrid engine technology is leading (with a thermal efficiency of 44.13%). Coupled with independent three-motor drive and self-developed silicon carbide technology, it delivers better speed performance. The iTAC and Cloud Suspension systems enhance driving capabilities in challenging scenarios and with road preview and air suspension.

In terms of cabin comfort, the Denza Z9GT is equipped with features such as a liftable sound tower, wireless fast charging, dual zero-gravity seats, and front and rear refrigerators.

In terms of design, the Denza Z9GT and subsequent models feature a distinctive design language crafted by former Audi design director Egger, setting them apart from the Dynasty and Ocean series.

Having learned from the Denza N8's lessons, Denza has made significant efforts in the upcoming N9, set to be released in Q4, in terms of exterior design, body size, and configuration. It aims to match the high standards and cost-effectiveness of the Z9GT in terms of powertrain technology, cabin features, exterior and interior design, and pricing.

Based on current information, the N9 is priced in the 400,000-500,000 yuan range, positioning itself against the LIXIANG ONE L9 and WENJIE M9. This will pit the three "9" series models against each other in direct competition.

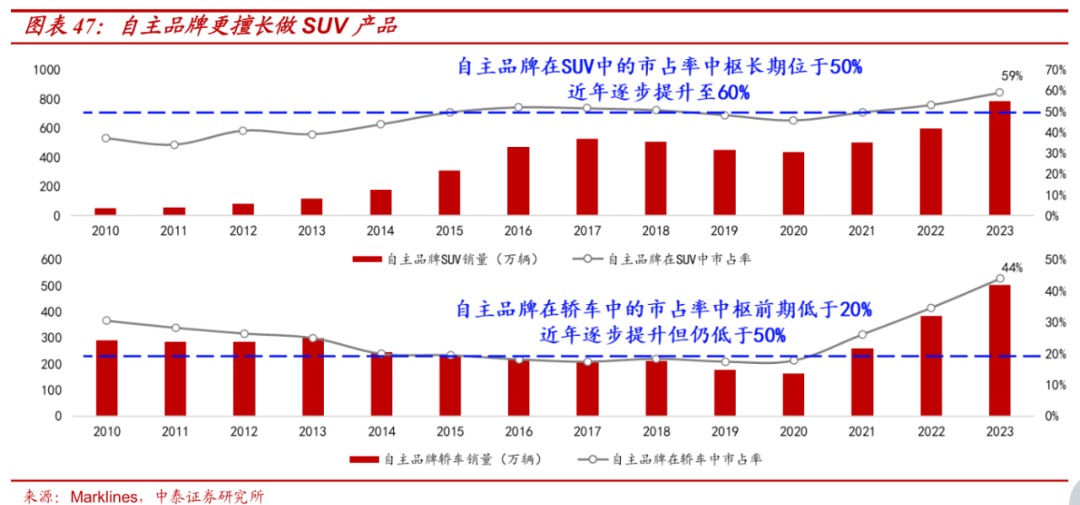

The high-end SUV market targeted by the Denza N9 has proven to be a promising segment for domestic brands aiming to enter the premium car market. Reviewing the domestic auto market, domestic brands are more adept at creating SUV products. Since 2014, the market share of domestic brands in the sedan segment has fluctuated around 20%, while in the SUV segment, it has consistently hovered around 50%, demonstrating that domestic brands are more proficient in creating SUV products compared to sedans.

There are three specific reasons for this:

First, the SUV segment is relatively easier than the sedan segment. Compared to sedans, domestic consumers prefer SUVs with larger interior space (in the over 300,000 yuan market in 2023, approximately 1.94 million SUVs were sold compared to 1.31 million sedans), making it more likely for SUVs to achieve high sales volumes.

Second, targeting industry-leading products. BBA is deeply entrenched in consumer perceptions. As latecomers, merely targeting their ordinary premium products (such as the Mercedes-Benz GLE) may not convince consumers. Sufficiently powerful product capabilities are needed to change market perceptions in a short time.

Third, offering significant price advantages. The LIXIANG ONE L9 and WENJIE M9 offer configurations comparable to or exceeding those of the Mercedes-Benz GLS but are priced to compete with the GLE, successfully capturing shares from traditional luxury brands through high-end configurations at lower prices.

In summary, hybrid/extended-range large SUVs are relatively easy for domestic brands to produce as premium car products, and once they achieve high sales volumes, they can significantly elevate brand perceptions. This can be observed in the cases of the WENJIE M9 and LIXIANG ONE L9.

3

Conclusion

In the past, it was joked that BBA's electric vehicles were struggling in China. Now, it seems that their fuel-powered vehicles are following suit.

BMW blamed dealers for overcharging in 4S stores, a divisive approach that may have been a necessity.

Some automotive media accurately described this situation: a few years ago, paying extra for a BMW might have been due to the brand's appeal, but now, it seems more like arrogance.

Whether BBA is arrogant or not is evident to consumers, just as it is clear that domestic brands are making rapid progress. From imitation to following and finally surpassing, domestic brands took 20 years to catch up in the fuel-powered era, with companies like Chery and Great Wall producing quality products. Now, it remains to be seen how long it will take for domestic brands to catch up with BBA in the electric vehicle transition, given the latter's lag in this area.

In the meantime, what domestic brands need to do is to replace BBA's lead in the fuel-powered era with electric vehicle technologies, such as battery power and the much-talked-about intelligence, based on cost and scale. These will form the foundation for domestic brands in the coming 20 years.

Disclaimer: This article is based on publicly available information or information provided by interviewees, but Decode and the article's author do not guarantee the completeness or accuracy of such information. Under no circumstances should the information or opinions expressed in this article be construed as investment advice to any person.