Two multi-billion dollar giants "break up", who will stay and who will go?

![]() 09/20 2024

09/20 2024

![]() 450

450

Today, the situation has undergone a fundamental change.

"Thanks to Mercedes-Benz, Denza has been endowed with a luxurious foundation and gene since its inception."

At this year's Denza Auto Tech Day, Wang Chuanfu, Chairman of BYD, rarely expressed his deep gratitude to Mercedes-Benz and candidly admitted, "Denza is a brand that stands on the shoulders of giants."

A month later, according to the equity information disclosed by Qichacha, Denza Auto completed its equity change on September 15. Mercedes-Benz China sold its remaining 10% equity and withdrew from the shareholder list, while BYD became the 100% wholly-owned controlling shareholder of Denza Auto.

In other words, BYD and Mercedes-Benz have ended their 14-year partnership in automobile manufacturing, transforming Denza Auto from a joint venture to an independent brand automaker.

It can be said that Mercedes-Benz's exit is, to some extent, the result of market strategy adjustments. With BYD's increasingly sophisticated technical accumulation and market layout in the electric vehicle sector, Denza Auto is expected to maintain its competitiveness in the high-end electric vehicle market through its own capabilities.

However, this also directly reflects the growing independent innovation capabilities of China's automotive market and the dynamic adjustments of domestic and foreign automakers in market competition.

The fact that Denza Auto is now wholly-owned by BYD is one such testament.

From "unlucky timing" to "rising from the ashes"

As a brand born with a silver spoon in its mouth, Denza actually had an extraordinary starting point. In March 2010, after BYD and Daimler, the parent company of Mercedes-Benz, signed a memorandum of cooperation, BYD and Mercedes-Benz each held 50% of the shares in Denza Auto upon its official establishment.

To create a high-end electric vehicle under a Chinese brand, both parties brought their respective strengths to the table. BYD was responsible for battery and drive technology, while Mercedes-Benz was in charge of overall vehicle technology. In other words, BYD could learn from Mercedes-Benz's experience and automotive philosophy, while Mercedes-Benz could leverage BYD's new energy technology.

After Denza Auto's establishment, both shareholders focused on a policy of "rich nourishment," continuously increasing capital contributions. From an initial registered capital of just over 2 billion, Denza Auto reached 5.76 billion by 2020.

However, constrained by the then-prevailing new energy market environment, despite the formidable partnership between BYD and Daimler, Denza Auto failed to achieve good sales figures.

According to data from the China Passenger Car Association, Denza Auto sold 2,800, 2,287, 4,713, and 1,974 vehicles from 2015 to 2018, respectively. Even with the launch of models like the Denza 300, Denza 400, and Denza 500, cumulative sales over these four years amounted to only 11,774 vehicles.

In 2019, Daimler announced that Beijing Mercedes-Benz Sales Co., Ltd. would take over some of Denza Auto's business. Apart from product research and development and manufacturing, Denza Auto's sales, service, marketing, communication, and network construction operations were all merged into the Mercedes-Benz sales company. Subsequently, Denza Auto introduced a new model, the Denza X, available in both pure electric and hybrid versions.

Despite product innovations, the situation remained unchanged, with annual sales failing to exceed 5,000 vehicles, and Denza Auto's development momentum once again encountered a bottleneck.

Poor sales also kept Denza Auto in a state of continuous loss. According to BYD's financial reports, from 2016 to 2021, Denza incurred losses of 1.3 billion, 480 million, 890 million, 1.15 billion, 420 million, and 240 million yuan, respectively, for a cumulative loss of over 4 billion yuan over six years.

The continuous lack of hope also prompted Daimler to shift from strategic investment to assistance and support, ultimately taking on a backstage role. In December 2021, BYD and Daimler signed an equity transfer agreement to adjust Denza's structure. After the transfer, BYD's shareholding in Denza Auto increased from 50% to 90%, allowing it to fully dominate Denza Auto's development.

"BYD will inject its best new energy power and intelligent technology into Denza."

As Mercedes-Benz gradually withdrew, the story reached a turning point, and Denza, under BYD's sole responsibility, gradually reversed its decline. The transformation from a joint venture brand to a wholly-owned independent brand also means that Denza Auto will enjoy greater decision-making freedom and brand independence, enabling it to more flexibly adjust its strategies and product lines according to market demands.

Immediately after the equity transfer, BYD introduced the Denza D9, the first model under its new shareholding structure. Its launch not only changed the monopoly of the Buick GL8 in the MPV segment but also topped the MPV market with cumulative sales of 112,000 units in 2023.

As BYD continues to break through technical barriers in the new energy vehicle sector, it is also having a positive impact on Denza Auto. In addition to the D9, N7, and N8 models, the recently pre-sold Denza Z9GT and Denza Z9 are the first to feature BYD's new "Easy Tripartite" exclusive technology.

Previously, Wang Chuanfu stated that Denza Auto connects BYD's various brands. Downward, Denza Auto integrates resources from the Dynasty Network, Ocean Network, and Equation leopard ; upward, Denza Auto provides a solid foundation for the high-end brand Look.

If, ten years ago, Denza Auto existed for BYD as a means to leverage Mercedes-Benz's technology and branding to reach a higher-end market, then a decade later, with the disappearance of foreign technology barriers, Chinese automakers have entered a stage of reverse technology output.

According to plans, Denza Auto's equity adjustments will be completed within this year. However, in the future, Denza Auto does not rule out the possibility of renewed cooperation with Mercedes-Benz in other sectors.

"Thirty years ago the river flowed east; thirty years later, it flows west"

It can be said that the brutal market situation has reversed the positions of Chinese and foreign automakers.

Apart from BYD's wholly-owned ownership of Denza Auto, the joint venture model in China's automotive market has undergone profound changes.

In the past, foreign automakers contributed brands, technology, equipment, and even some components, while Chinese automakers provided land, capital, and human resources. Now, the situation has reversed, with Chinese automakers contributing brands and technology, and foreign automakers investing capital.

Last October, Stellantis Group and NIO Auto jointly announced the establishment of a global strategic partnership. In May this year, the joint venture NIO International was officially established, becoming China's first reverse joint venture in the automotive industry. According to the cooperation agreement, the joint venture exclusively owns the rights to export and sell NIO vehicles in global markets outside Greater China and to manufacture them locally.

This has been seen by the industry as a typical case of "if you can't beat them, join them."

Compared to the past era of joint ventures where Chinese automakers "traded markets for technology," this cooperation model has ushered in a new era of "trading technology for markets."

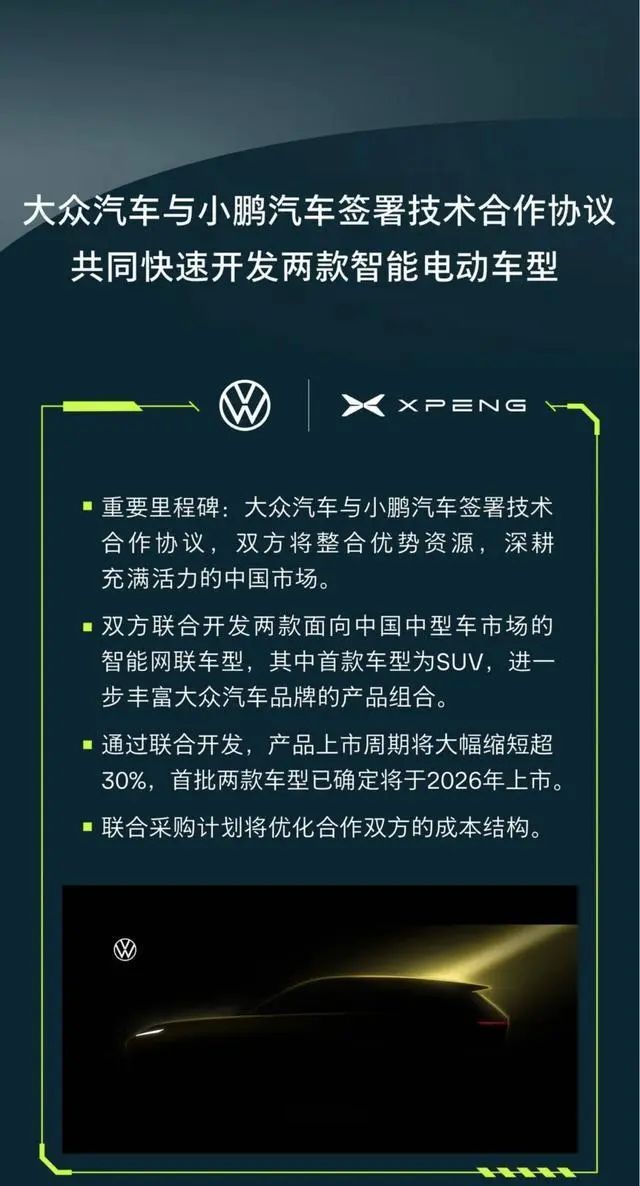

Other automakers that have invested in joint ventures include Volkswagen Group and XPeng Motors. According to their previous agreement, Volkswagen Group will invest approximately US$700 million (approximately RMB 5 billion) in XPeng Motors, acquiring approximately 4.99% of its shares at a price of US$15 per ADS (American Depositary Share). Upon completion of the transaction, Volkswagen Group will obtain one observer seat on the XPeng Motors board of directors.

However, the primary purpose of foreign automakers' current push for reverse joint ventures remains strengthening their capabilities in automotive manufacturing technology. More importantly, their cooperation has "abandoned" the traditional joint venture model of equal equity ratios and joint decision-making.

As is well known, the equal equity structure of joint ventures necessitates two decision-making systems, often leading to disagreements on product and strategic decisions and even accusations when problems arise instead of immediate problem-solving.

Therefore, at present, both XPeng and Volkswagen, as well as NIO and Stellantis Group, are aware of these issues.

According to Carlos Tavares, CEO of Stellantis Group, although Stellantis Group is a shareholder of NIO and holds a 51% stake in the joint venture, its role is more akin to that of a supporter, providing advice and perspectives during decision-making to achieve the best decision-making process. At the same time, it will leverage Stellantis Group's overseas market scale and influence to support NIO's rapid development.

Therefore, whether it is the cooperation between XPeng and Volkswagen or NIO and Stellantis Group, XPeng and NIO actually play a dominant role in operations, with foreign partners only involved at the board level. This cooperation model differs significantly from the traditional joint venture model of joint decision-making, joint definition, and equal equity ratios. Part of the cooperation between XPeng and Volkswagen involves only technology sharing, which is entirely different from a full-fledged joint venture.

Under this cooperation dynamic, there is no doubt that when the entire automotive industry stands at a new starting line, Chinese automakers have the opportunity to compete on an equal footing with foreign automakers.

Conversely, foreign automakers' localization process in the Chinese market has also entered a new stage, no longer focused solely on technology importation but rather on fundamentally reconstructing their systems.

For example, Mercedes-Benz's R&D center in Shanghai has been put into use and will further expand its R&D layout in China. The Shanghai R&D center will focus on areas such as intelligent connectivity, autonomous driving, software and hardware development, and big data, aiming to further enhance Mercedes-Benz's R&D capabilities in software and hardware. As early as October 2021, to focus on the needs of Chinese customers and accelerate the localization of new models, including electric vehicles, the new Daimler China Technology R&D Center was officially opened in Beijing.

At the end of last year, to continuously improve its R&D capabilities in China, Audi's China R&D Center also underwent a comprehensive upgrade. In addition, Audi's China R&D team focuses on research and development in areas such as smart cockpits, forward-looking user interfaces, digital connectivity services, Audi's exclusive new electronic architecture capabilities, and advanced driver assistance systems, accelerating technological innovation for the Chinese market.

"These collaborations demonstrate that advanced Western automakers are recognizing and demanding Chinese electric vehicle technology, just as Chinese automakers once needed Western internal combustion engine technology," reported The Wall Street Journal.

It is evident that under the new rules of competition, Chinese and foreign automakers seem to have swapped positions. In the past, joint ventures were about Chinese automakers trading markets for "technology," but now, foreign automakers' partnerships with Chinese automakers have become about shoring up their shortcomings in the field of intelligence.

The change in positions is just the beginning.

Note: Some images are sourced from the internet. If there is any infringement, please contact us for removal.