BMW sales plummeted 41% in August, leading the way for Chinese-made vehicles is the way out for luxury brands

![]() 09/19 2024

09/19 2024

![]() 434

434

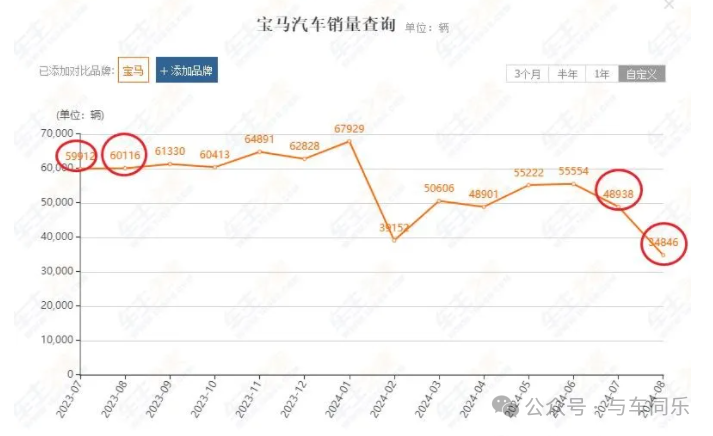

Two months ago, BMW China announced its withdrawal from the price war and subsequently adjusted prices upwards, with some cases even ignoring deposits and arbitrarily increasing prices. As a result, BMW experienced continuous sharp declines in sales in China in July and August.

In July, BMW sold a total of 48,938 vehicles in China, a decrease of nearly 20% from the same period last year, with a reduction of over 10,000 units. In August, sales dropped significantly by 42%, selling only 34,846 vehicles compared to 60,116 in the same period last year, representing a decrease of over 25,000 units. BMW's mainstay model in China is the 5 Series, which used to easily sell over 10,000 units per month but only sold 5,600 units in August, marking a significant decline.

Due to insufficient product competitiveness, BMW offered significant discounts in the first half of the year, leading to sustained losses for many dealers. Just as dealers were on the verge of rebellion, BMW abruptly halted the price war and readjusted prices, temporarily sparing dealers from sharing the burden of manufacturer losses. However, this led to a sharp decline in sales, a clear case of 'be careful what you wish for.' It appears that Chinese consumers' attitude towards BBA (BMW, Benz, Audi) has shifted from 'pursuit' to 'nostalgia' in recent years. Yet, while nostalgia may work well in marketing, it translates poorly into product development, indicating that these brands are falling behind market trends.

In developed countries like Europe and the United States, BBA can still maintain its product advantage due to policy protection and a slower product refresh cycle of every 5-6 years, with each update offering incremental improvements. However, China's new energy vehicle startups are fiercely competitive, often iterating their models 2-3 times within five years, rapidly closing the technological gap. For BBA to maintain its edge in non-Chinese markets, it must incorporate the concepts of China's new energy startups into its new products. While traditional features like refrigerators, TVs, and large seats may have originated with established brands, integrating them into a 350,000 RMB vehicle involves much more, including energy solutions and spatial design. Foreign traditional automakers lack these core technologies and supply chains and are hesitant to fully commit to research and development.

It is challenging for any automaker to independently address technological and supply chain issues in a short period. However, there is a shortcut: partnering with China's new energy startups by establishing joint ventures in Europe. This way, competitors become partners, ensuring a win-win situation. Car Review Commentary: By forming joint ventures with Chinese companies in Europe, automakers can leverage advanced technologies at minimal cost, thereby eroding the market share of Japanese and American brands.

In the realm of technological competition, it is far safer to lead the way with advanced technologies than to resist them.