FSD's Entry into China Enters "Countdown" Phase: Can Tesla Regain Lost Ground?

![]() 07/26 2024

07/26 2024

![]() 562

562

In April this year, Tesla CEO Elon Musk made a lightning visit to China, sparking discussions and speculations about Tesla's Full Self-Driving (FSD) technology entering the Chinese market.

Tesla first struck a deal with Baidu to obtain a map license for collecting data on public roads in China. Then, in June, rumors surfaced that Tesla had obtained a road test license from the Shanghai Autonomous Driving Demonstration Zone, but Tesla quickly denied the news.

In reality, FSD's entry into China faces numerous challenges, including data and privacy protection, whether domestic users will accept a paid model, and approvals from relevant departments. There are still many unknowns surrounding this matter.

However, just as the new energy vehicle industry was planning to enhance its intelligent driving capabilities while waiting for FSD's entry into China, Musk announced during Tesla's second-quarter earnings call that FSD is expected to be approved in China and Europe by the end of this year.

This means that FSD's entry into China is no longer just a "pie in the sky" but has officially entered a "countdown" phase. If things go smoothly, Tesla owners in China can expect to pay for FSD access in half a year, potentially helping Tesla reverse its declining sales in the domestic market.

01

Tesla's Profit Margin Under Pressure

While the outside world focuses on FSD's entry into China, Tesla recently released its second-quarter financial results for 2024. The report showed that Tesla's total revenue increased slightly by 2% to $25.5 billion, but after excluding carbon credit income, actual automotive sales revenue was only $18.5 billion, down 7% year-on-year and slightly below market expectations of $18.7 billion. Net profit was $1.494 billion, a significant 45% drop from the same period last year.

Facing such a report of increased revenue but no corresponding profit increase, Tesla's share price plummeted by over 8%. However, for Tesla, whose share price has been soaring since the second half of the year, the current adjustment is only a minor fluctuation.

Since July, Tesla's share price has risen by over 25%, with the first week of July alone erasing all losses from the first half of the year.

The "good news" behind Tesla's share price surge is partly due to its second-quarter delivery volume of 444,000 vehicles, which, although down 4.8% year-on-year, was up 14.7% quarter-on-quarter. Considering the relatively weak global electric vehicle market, this performance has exceeded Wall Street expectations.

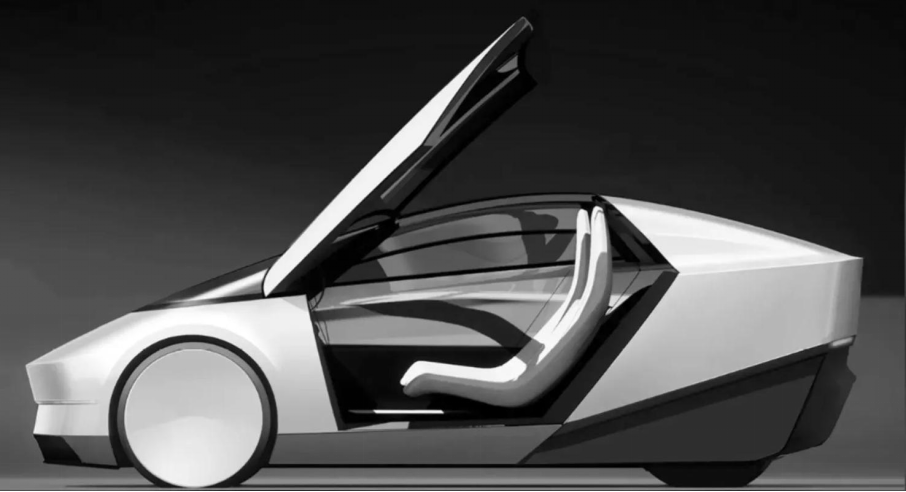

On the other hand, what attracts capital to vote with its feet is Tesla's "new story" in artificial intelligence (AI) and autonomous driving. In April, Musk announced that Tesla will release its Robotaxi product on August 8 this year (now confirmed to be postponed to October). In July, Musk said that Tesla will "produce in small batches" humanoid robots next year.

Moreover, as the world's first "end-to-end" AI autonomous driving model, FSD V12, released at the end of last year, is also a trump card for Tesla. Industry insiders point out that Tesla may be the most undervalued "AI investment target" on the US stock market. Some analysis teams estimate that the valuation of Tesla's FSD business could reach up to $1 trillion, exceeding Tesla's market value of around $800 billion.

However, to support such a vast imagination space, tangible support is naturally necessary. Tesla stated in a press release that the second-quarter profit was primarily affected by "AI projects" and "restructuring costs," the latter referring to the costs incurred by Tesla's 10% workforce reduction in April this year.

Apart from the increased investment, the key factor affecting Tesla's performance is the downturn in its automotive business. The decline in revenue is mainly due to a drop in car sales, while the "halving" of profits is a result of the continuous shrinkage in per-car profit. The price war brought on by the intensified competition within the industry equally impacts every automaker.

In the second quarter of this year, Tesla's overall gross margin was 18%, an improvement over the past three quarters. However, the gross margin on car sales dropped to 13.9%. This means that Tesla's gross profit per car was $5,784, whereas two years ago, this figure was $13,809.

02

FSD to Act as a Catalyst Again

Therefore, the introduction of FSD (Full Self-Driving) in China has become a critical step for Tesla to regain its foothold in the Chinese market. This move is not only aimed at driving product iteration and boosting sales in China but also likely reflects an ambition to take the lead in the intelligent connected vehicle market.

It is well known that Tesla has always been a "minority" in the field of intelligent driving. Unlike most domestic autonomous driving solution providers who opt for the lidar route, Tesla’s insistence on a pure vision-based approach has never been the mainstream solution.

However, since last year, the "intelligent driving route" in China has quietly shifted. On one hand, the rise of large models has introduced new variables. Elon Musk mentioned that with the adoption of end-to-end technology, FSD can replace over 300,000 lines of code with just 3,000 lines.

On the other hand, more and more car manufacturers are actively promoting urban NOA (Navigate on Autopilot). Compared to highway scenarios, urban road conditions are exponentially more complex. If carmakers continue to rely on the traditional method of hand-coded rules by engineers, it will not only increase development costs but also slow down their progress in deploying urban autonomy.

Xia Yiping, CEO of Jiyue, has stated that any company that fails to achieve nationwide intelligent driving this year will fall behind in the wave of intelligentization. The competition in intelligentization within the new energy vehicle sector has reached a fever pitch, and every automaker is naturally striving to move faster rather than slower.

Therefore, the introduction of FSD in China has accelerated the competition in intelligent driving among automakers. However, FSD may not be an invincible opponent for these companies.

For instance, the chairman of XPeng Motors recently went to California to experience the FSD V12.3.6 version and gave it a "very good" evaluation. However, when discussing the introduction of FSD in China, he mentioned that FSD would face more complex road conditions in the country.

Furthermore, Yu Chengdong, Chairman of the Intelligent Automotive Solutions BU, welcomed Tesla's FSD into the Chinese market but emphasized that Huawei has enhanced its perception capabilities by using lidar. This has allowed Huawei’s intelligent driving system to outperform Tesla in the Chinese market.

However, compared to the car manufacturers’ optimistic attitudes, those with no direct competition with Tesla seem more conservative. Some industry insiders have pointed out that Tesla's chips and algorithms are tightly integrated, making their costs only a third of their competitors.

In contrast, domestic automotive products focusing on intelligent driving have not yet optimized the integration of hardware and software. More hardware investment will be needed in the future to achieve similar results. Additionally, Tesla has a significant data advantage. Reports indicate that Tesla's FSD has accumulated over 1.6 billion kilometers of driving mileage.

Of course, whether Tesla is ultimately a "wolf" or a "sheep" in the realm of intelligent driving will only be determined once FSD (Full Self-Driving) is deployed and domestic automakers can compete directly with Tesla. Until then, Tesla has clearly already become a "catfish," stimulating the growth of the entire intelligent driving industry in China.

Tesla can also accelerate its learning through competition. By acquiring more urban driving data from Chinese cities, Tesla might carve out a share in the Robotaxi sector and further accelerate its development in the intelligent connected vehicle space.

03

Tesla Looks to Boost Sales

Of course, compared to the potential explosion of advanced driver-assistance systems, the more pressing task for Tesla might be whether it can boost domestic market sales through FSD.

It is certain that the market has high expectations for the new version of FSD. If the rollout in the Chinese market is impressive, it could not only reshape the entire autonomous driving industry but also create a "novelty effect," driving up Tesla's sales.

However, there are still many uncertain factors regarding FSD's performance in the domestic market. First, given the differences in road conditions and training scenarios between China and abroad, it's still hard to say whether FSD, the "tiger," can outperform local competitors.

Second, there's the issue of willingness to pay. A study of the credit card data of approximately 3,500 Tesla owners who participated in FSD trials found that fewer than 2% decided to purchase FSD after the trial. It's worth noting that FSD is priced at RMB 64,000 in China, and in a market where the concept of paying for autonomous driving features has yet to be fully developed, how many fans can FSD actually garner?

The most crucial factor is that intelligent driving has never been the sole factor influencing consumers' car-buying decisions. For Tesla, the lack of new models in its lineup is the fundamental reason it has been mired in a price war recently. With insufficient product innovation, the only way to attract consumers is by adjusting prices.

It is reported that Tesla's new model is scheduled to begin production in the first half of next year and will be produced on the same production line as the current models. However, sharing production lines means that the cost reduction for this new model may not be significant. If it can't compete on price, the new model's differentiation capabilities will be even more crucial.

It's worth mentioning that Tesla also discussed "pricing" during its earnings call. The company acknowledged that many auto manufacturers are offering sufficiently attractive price discounts, but in the long run, a price war is not considered an issue for Tesla.

So far, Tesla's gross profit margin remains among the highest in the automotive industry. While Tesla has room to cut prices further, it has not opted for a drastic reduction. This decision likely considers factors such as product lineup and market reactions. Rather than adopting a "scale over profit" approach, Elon Musk might prefer to invest profits into accelerating the development of artificial intelligence and autonomous driving technologies.

As Musk has stated, "If someone does not believe Tesla can solve the problem of autonomous driving (FSD), they should not be a Tesla investor." This sentiment perhaps reflects Tesla's "long-termism" for the future.

However, as intelligent driving assistance rapidly advances towards autonomous driving and even fully driverless vehicles, the question remains: Are users truly ready to embrace the "era of driverless cars"?