Huawei Clones "Wenjie," Will BAIC Take Over Seres?

![]() 07/25 2024

07/25 2024

![]() 554

554

Once the "only unprofitable business" of Huawei, the Automotive BU may have shed its poverty label.

In March this year, Yu Chengdong announced at the China Electric Vehicle Hundred People Forum that the Smart Selection Vehicle Business (HarmonyOS Smart Mobility) had achieved profitability in the first three months of the year, and the Automotive BU was close to the break-even point.

In July, media reports claimed that Huawei's Automotive BU had generated revenues of 10 billion yuan in the first half of the year, a stark contrast to last year's revenue of just 4.7 billion yuan, indicating that profitability for the Automotive BU this year is a foregone conclusion.

The major contributor to this success has undoubtedly been Seres, Huawei's closest partner. Of the 194,200 vehicles delivered by Huawei's Automotive BU in the first half of the year, over 90% were from the Wenjie series.

However, this certainly isn't Huawei's goal. According to CITIC Securities' sales forecast of 600,000 units, relying solely on Seres is clearly insufficient.

After last year's adjustments, Huawei's Automotive BU has undergone a rebirth, both organizationally and product-wise. Especially after the split of the Automotive BU, carmakers seeking collaboration have been flocking to Huawei's door.

But can Huawei replicate the success of Seres, its die-hard fan?

1

"Left and Right Combat"

Following Wenjie, Huawei has collaborated with Chery, BAIC, and JAC to create three more "Jie" series vehicles. When asked if there would be more, Yu Chengdong responded directly in a forum in June this year: "Many major automakers have come to collaborate with HarmonyOS Smart Mobility on Smart Selection Vehicles, but Huawei does not have the resources to support more than four automakers and is currently only working with these four."

Two key points here: first, the Smart Selection model has proven successful, allowing Huawei to establish a firm footing in the automotive industry; second, had resources not been limited, there would have been more "X Jie" series.

The issue is that Huawei has always claimed it "doesn't make cars," aiming to be the Bosch of the smart car era. However, it seems that Huawei is the only Tier 1 supplier that controls both channels and marketing in the automotive industry.

Rather than a lack of resources, it could be argued that Huawei is intentionally restraining itself. If "X Jie" were allowed to expand unchecked, it would only be a matter of time before Huawei breached its "no car manufacturing" commitment.

In fact, Huawei's initial intention in entering the automotive sector was to be a component supplier. Upon the establishment of the Automotive BU, Huawei began promoting the Hi mode, initially collaborating with BAIC BJEV's ARCFOX brand, introducing its full-stack intelligent driving system to the ARCFOX Alpha S. At the time, the then-responsible person Wang Jun mentioned that the Hi mode was not the goal but a means to sell more components.

Unfortunately, the Hi mode got off to a rocky start. The monthly sales of the first Hi model, the ARCFOX Alpha S Hi, were merely in the hundreds, leading to low revenue and limited brand recognition.

This led to the emergence of the Smart Selection model under Yu Chengdong's leadership, but it too was beset by setbacks.

After Huawei and Seres first confirmed their Smart Selection collaboration in 2021, questions about the "soul" of the vehicle arose in the automotive industry. The following year, when the Wenjie M7 was launched, it first performed poorly in the C-NCAP crash test and then faced fierce competition from Lixiang Auto. Coupled with frequent strategic adjustments to Huawei's Smart Selection vehicle within the company in the first half of 2023, the M7's market presence quickly diminished, gradually becoming a backdrop in the mid-to-large-sized new energy SUV market.

Fortunately, in June last year, Huawei and Seres promptly adjusted their channels and adopted a more aggressive pricing strategy to launch the new Wenjie M7, coupled with the popularity of Huawei's mobile phone stores, ultimately creating a hit with the new M7.

Building on the success of Wenjie, Huawei expanded its portfolio with Chery (Zhijie), BAIC BJEV (Xiangjie), and JAC (Zunjie), covering a product matrix of family + business SUVs, family sedans, business sedans, and business luxury vehicles. In November 2023, the Smart Selection model was upgraded to HarmonyOS Smart Mobility, with all "X Jie" series models now sold and delivered through the HarmonyOS Smart Mobility channel.

Recently, monthly sales of the entire HarmonyOS Smart Mobility lineup have consistently exceeded 30,000 units, and Seres achieved unexpected profitability through large-scale deliveries of the Wenjie series in Q1 this year.

Behind the Smart Selection model's exceeding expectations, Huawei has indeed put in a lot of effort, but to some extent, this deviates from its strategic positioning as a Tier 1 supplier.

However, after the resounding success of the Wenjie series in collaboration with Seres, Huawei has presented a dilemma to automakers seeking cooperation: either Smart Selection or Hi. Automakers with strong cooperation intentions have already secured their spots, such as BAIC BluePark, which quickly shifted gears after the ARCFOX Alpha S's failure and collaborated with Huawei on the Xiangjie S9.

Automakers that missed out on these spots and need to quickly address their intelligence shortcomings through Huawei can only choose the Hi mode silently. While this officially preserves flexibility in channel and product planning, the lack of Huawei's launch events and store traffic means that new brands relying on self-built channels and brand power to acquire customers will take longer to build brand recognition and convert sales.

Another issue is that as Huawei's Smart Selection vehicles and sales increase, the traffic and market attention attracted by the Hi mode will diminish marginally.

In other words, Huawei's Smart Selection and Hi modes are, to some extent, engaged in a "left and right combat," with either mode taking away share from the other as it grows.

2

Can "Wenjie" Be Replicated?

Regardless of whether it's a black cat or a white cat, a cat that catches mice is a good cat, and Wenjie is now a "good cat."

In the first five months of 2024, Wenjie's sales surged 670.6% year-on-year to 140,000 units, ranking it among the top new-energy vehicle brands in China.

Some summarize Wenjie's success as stemming from factors such as model positioning, traffic effects, and Seres' high level of cooperation. Now that Huawei wants to nurture more "good cats," who can take over from Seres?

Seres' rise to prominence with Huawei's help was due to both its early struggles with brand transformation and its later pursuit of change through active cooperation and communication with Huawei to quickly absorb industry innovation experience.

Of course, there was also an element of gambling on Seres' part, as Huawei was entering the automotive business without prior success, so the two were essentially huddling together for warmth.

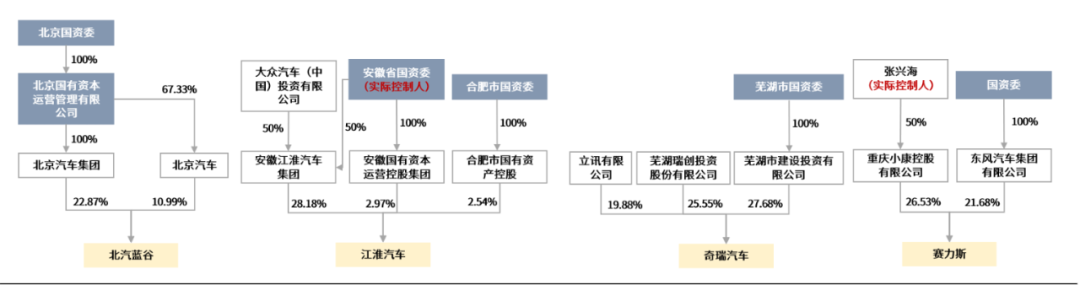

But another factor to consider is that Seres is the only private enterprise among the four "Jie" series.

Equity Structure of Smart Selection Brands

From an equity structure perspective, private enterprises have stronger profitability demands compared to state-owned enterprises and possess more flexible operating mechanisms, allowing them to adjust their organizational structures more quickly to meet market demands, making them more suitable for collaboration with Huawei.

In terms of communication and coordination, while all automakers maintain close exchanges with Huawei, only Seres has borrowed Huawei's efficient management experiences, including employee stock ownership, wage standards, and supply chain control, fully mobilizing employee enthusiasm.

Both equity structure and communication and coordination are tangible manifestations of cooperation willingness, and there is a logical sequence to them. In terms of willingness, among the current three automakers, BAIC BluePark and JAC Motor have stronger cooperation intentions with Huawei.

Chery, on the other hand, may prioritize its independent new energy brand due to overlapping cooperation models with Huawei; BAIC BluePark is one of the early adopters of new energy vehicles but currently has limited ability to create hits; JAC Motor's passenger car sales rely on exports, and it has ample OEM experience, making both potentially strong candidates for sales conversion through collaboration with Huawei.

Beyond cooperation willingness lies the distinction in market segments chosen by Huawei for its Smart Selection brands.

Overall, the Smart Selection brands are anchored in the luxury segment, but there are positioning distinctions within it.

Wenjie targets family + business full-size SUVs, competing with independent, first/second-tier joint venture brands, and BBA; Zhijie targets mid-to-high-end business + family sedans, competing with independent and first/second-tier joint venture brands; Xiangjie targets high-end business sedans, competing with the BBA market; JAC's corresponding Smart Selection brand targets the segmented luxury market.

There are differences in market space and competition intensity among the target markets of each brand, and based on current product planning, the market for BBA luxury sedans corresponding to Xiangjie S9 is relatively vast and has limited competition intensity, providing a foundation for volume sales.

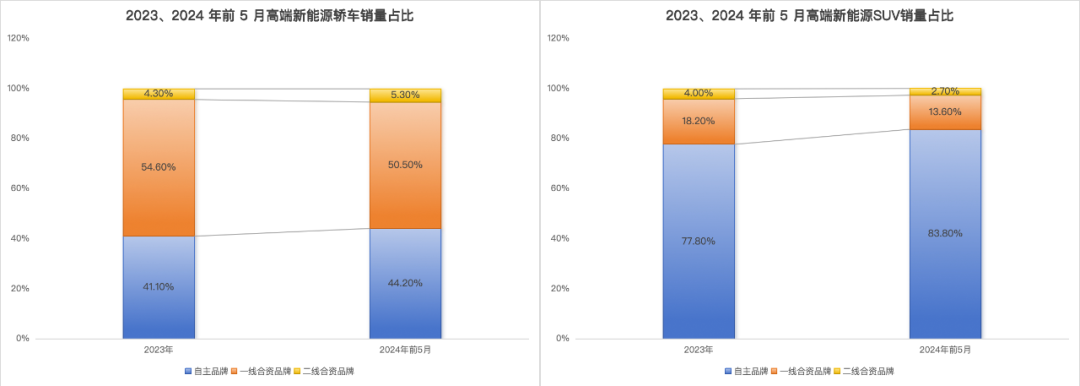

On the one hand, there is a significant gap in the penetration rates of SUVs and sedans in the high-end new energy market. From January to May 2023-2024, SUV sales above 300,000 yuan were approximately 1.567 million and 620,000 units, with new energy penetration rates of 43.6% and 44.0%, respectively.

The core reason for the higher penetration rate of new energy SUVs is the rapid sales growth of Li Auto's large-space SUVs, followed by independent brands' layout, further compressing the market share of joint venture brands.

In the high-end new energy sedan market, sales of sedans above 300,000 yuan from January to May 2023-2024 were approximately 993,000 and 363,000 units, with new energy penetration rates of only 14.3% and 10.3%, respectively. Joint venture brands account for more than 50% of the new energy market and are dominated by oil-to-electric models, while independent brands have limited layouts and relatively blue ocean markets.

The high-end sedan market is still at a relatively oligopolistic stage, with low penetration rates of independent new energy vehicles but high barriers to entry. There is a demand for differentiated technologies for vehicle models, and Xiangjie S9, empowered by Huawei's technology, is one of the few competitive models in this market.

Currently, the market share of high-end sedans is highly concentrated, with Audi A6L, BMW 5 Series, and Mercedes-Benz E-Class accounting for more than 45% of the market share in the first five months of 2024. Referring to the process of independent substitution in the SUV market, if sales of Xiangjie S9 climb rapidly after its launch, it is expected that the market share of the entire joint venture luxury brand will be affected, with weaker brand power and product strength models being more significantly impacted.

By comparing the current cooperation status of Smart Selection automakers from multiple angles, BAIC BluePark, backed by state-owned capital and with strong sales growth aspirations and experience in collaborating with Huawei in the automotive sector, may be more conducive to advancing the cooperation between the two parties.

3

Epilogue

Whether BAIC BluePark can take over from Seres is uncertain for now, but today's BAIC BluePark resembles Seres of old.

From 2020 to 2023, BAIC BluePark incurred losses of 6.48 billion yuan, 5.24 billion yuan, 5.47 billion yuan, and 5.4 billion yuan, respectively, for a cumulative loss of over 22 billion yuan in four years. The half-year performance forecast released on July 9 predicts a net loss of 2.4 billion to 2.7 billion yuan for the first half of the year, representing an expansion of losses year-on-year.

The official explanation is that the intensification of price wars has squeezed profit margins, and the company's continuous investments in technology research and development and brand building have impacted short-term performance.

While this explanation is official, it is closely related to Huawei. There's no need to elaborate on R&D and brand investments, but the pre-sale price of the upcoming Xiangjie S9, set for launch in August, is 450,000 to 550,000 yuan, essentially freeing it from the quagmire of price wars. In other words, BAIC BluePark has set its sights on a bright future, not without hope.

For Huawei, ushering the "Jie" series into adulthood as soon as possible is likely its core mission, as ultimately, being a solid Tier 1 supplier is the ultimate goal. As for the losses incurred in the past few years, they can be fully recovered through the sale of components and intelligent driving solutions in the future.

China Everbright Securities conducted a profitability assessment of Huawei's intelligent driving solutions based on information disclosed by the Automotive BU, concluding that the total cost of a single set of intelligent driving solutions is approximately 110,000 to 115,000 yuan, enough to purchase a BYD Qin L DM-i.

Disclaimer: This article is based on publicly available information or information provided by interviewees, but Decode and the author do not guarantee the completeness or accuracy of such information. Under no circumstances should the information or opinions expressed in this article be construed as investment advice to anyone.