"Who says new cars are getting cheaper and cheaper to sell?"

![]() 07/25 2024

07/25 2024

![]() 569

569

Introduction

The price war rages on, with the average retail price rising year by year.

Let me ask, what has been the overarching theme hovering over the Chinese auto market in the past two years? Personally, I would cast my vote without hesitation to – "price war".

It is undeniable that this war without smoke has caused much suffering for many OEMs, even accelerating the elimination of some weaker players. Of course, it has also made some "big bosses" rich, further consolidating their leading positions.

But why is there a "price war"?

The reason is actually quite simple. As the electric vehicle transformation intensifies, the rules and gameplay of the entire market have undergone fundamental changes compared to the traditional fuel vehicle era. With "new kings ascending the throne and old kings falling," the pricing systems of each market segment are being overturned and rebuilt.

From the perspective of end consumers, they undoubtedly become the biggest beneficiaries of this massive "price war." More bluntly put, "cars are getting cheaper and cheaper to buy" has become a consensus.

Think about it, a Toyota Camry for 140,000 yuan, a BMW 3 Series for 200,000 yuan, or a Volvo XC90 for over 400,000 yuan… In the past, these were unimaginable.

Not only have joint venture brands lowered their proud heads, but the internal competition among domestic brands has also intensified. Medium-sized sedans with an axle length close to 2.8 meters selling for only 100,000 yuan, or 6-seat mid-to-large SUVs with a length approaching 5 meters selling for only 150,000 yuan… Each is more aggressive than the next.

But just this week, I came across a research report on "prices" that contradicts the above perception: China's fiery "price war" in the auto market has actually made cars more expensive.

When New Energy Vehicles Become the Vanguard

Let's get straight to the results.

According to statistics from Cui Dongshu, Secretary-General of the China Passenger Car Association, the average retail price of domestic passenger cars was 142,000 yuan in 2019, rising to 153,000 yuan in 2020, slightly increasing to 155,000 yuan in 2021, and further increasing to 162,000 yuan in 2022. In 2023, there was a small year-on-year decline, ending at 160,000 yuan.

But in 2024, this figure exploded.

In the first quarter, the average retail price of domestic passenger cars was 176,000 yuan, reaching 180,000 yuan in April, further climbing to 182,000 yuan in May, and 186,000 yuan in June. For the first half of the year, it temporarily settled at 179,000 yuan.

That's 19,000 yuan more than the 160,000 yuan in 2023.

According to Cui Dongshu's analysis, the rising average retail price of domestic passenger cars is due to the structural pull of higher prices for hybrids and extended-range vehicles, coupled with a significant increase in sales of high-end new energy vehicles and a decrease in sales of low- and medium-priced models.

Specifically, taking the 200,000-300,000 yuan market segment as an example, its share of total sales was 10.2% in 2019, 13.6% in 2020, 15.4% in 2021, 16.3% in 2022, and remained at 16.3% in 2023. However, in the first half of 2024, it grew to 16.9%, even surpassing 20% in June, reaching 21.1%.

Similarly, the trend of the 150,000-200,000 yuan market segment's share of total sales closely mirrors that of the 200,000-300,000 yuan segment.

In contrast, the 50,000-100,000 yuan segment shows a completely opposite trend.

In 2019, this segment accounted for 30.5% of total sales, falling to 25.3% in 2020, 23.8% in 2021, 19.4% in 2022, and only 17.2% in 2023. In the first half of 2024, it continued to decline to 15.5%, with June seeing only 13.7%.

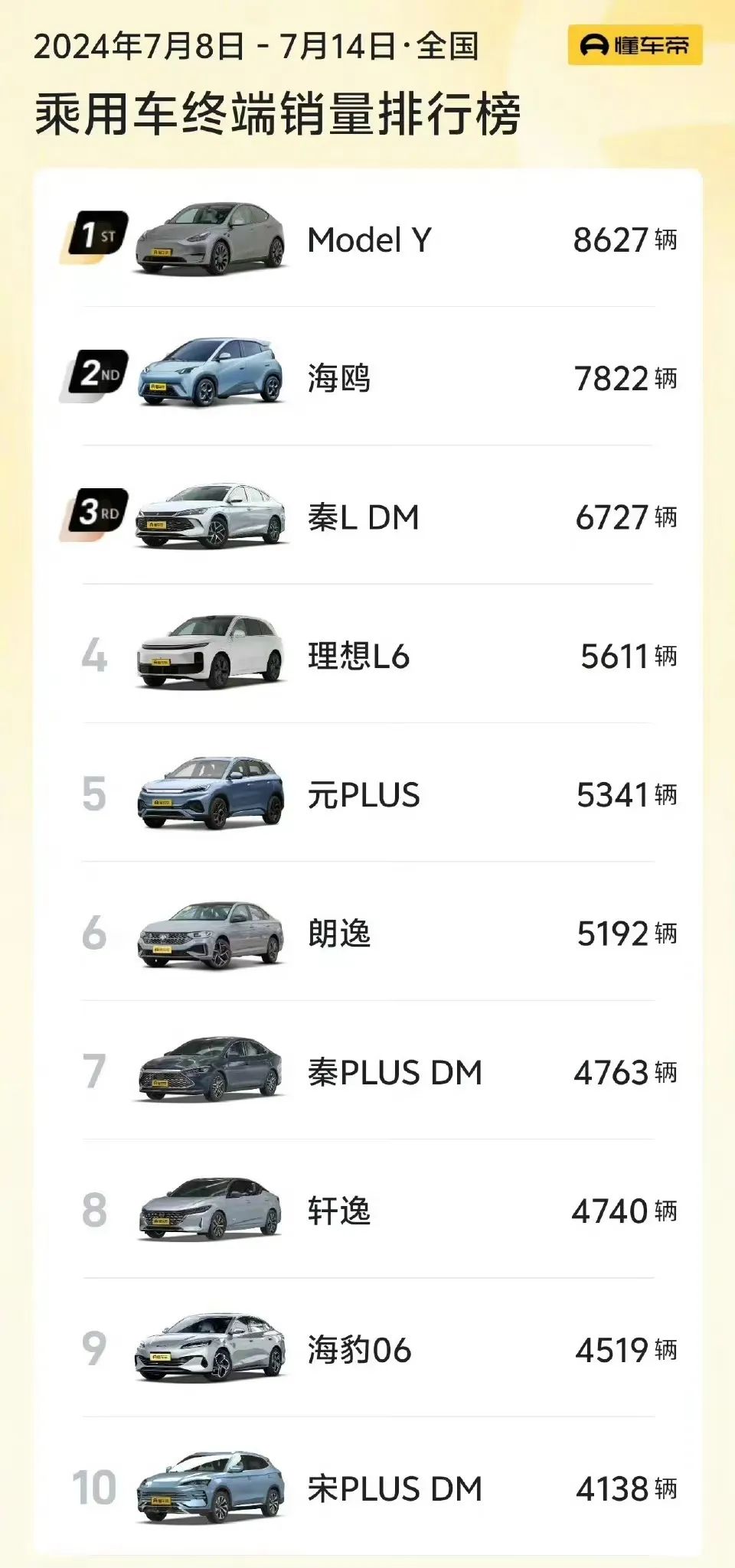

It is worth noting that in all the above-mentioned price ranges, new energy vehicles are gradually gaining the upper hand over traditional fuel vehicles, slowly becoming the "vanguard" of the Chinese auto market. As further evidence, let's focus on the domestic passenger car retail sales ranking from July 8th to July 14th.

The top ten were: Tesla Model Y with 8,627 units, BYD Seagull with 7,822 units, BYD Qin L DM-i with 6,727 units, Lixiang L6 with 5,611 units, BYD Yuan PLUS with 5,341 units, Volkswagen Lavida with 5,192 units, BYD Yuan PLUS DM-i with 4,763 units, Nissan Sylphy with 4,740 units, BYD Dolphin DM-i with 4,519 units, and BYD Song PLUS DM-i with 4,138 units.

Even though there are still "ace players" in the traditional fuel vehicle camp, the insane output of new energy vehicles that week is clear for all to see, and this is a typical microcosm of 2024.

In fact, in June, domestic new energy passenger car retail sales reached 856,000 units, an increase of 28.6% year-on-year and 6.4% month-on-month. From January to June 2024, retail sales reached 4.111 million units, up 33.1% year-on-year.

Correspondingly, the retail penetration rate also hit a new high of 48.4%, an increase of 13.5 percentage points from the same period last year, further approaching the 50% mark. Among them, the domestic retail penetration rate of new energy vehicles from domestic brands reached 72.5%.

To reiterate, "When the tide comes, no one can stop it."

Precisely against this backdrop, China's fiery "price war" in the auto market has paradoxically made cars more expensive to buy, which seems logical.

Domestic Brands Making Progress in Upgrading

At the beginning of this section, let me pose another question: Apart from proving that new energy vehicles have become the vanguard, what else can the rising average retail price of domestic passenger cars reflect?

In my opinion, it directly points to: domestic brands are making progress in upgrading.

Before elaborating, I would like to lay out a set of data. According to the China Passenger Car Association, the retail penetration rate of new energy vehicles from mainstream joint venture brands was only 7.4% in June, with retail sales of 480,000 units, down 27% year-on-year and 1% month-on-month.

Correspondingly, the retail share of German brands was 18.6%, down 2.6 percentage points year-on-year; the retail share of Japanese brands was 14.3%, down 3.5 percentage points year-on-year; and the retail share of American brands was 6.3%, down 2.9 percentage points year-on-year.

In contrast, domestic brand passenger car retail sales reached 1.03 million units, up 10% year-on-year and 5% month-on-month. In June, the domestic retail share of domestic brands was 58.5%, an increase of 9.3 percentage points year-on-year.

It is clear who is gaining power and who is losing it.

Facing such results, I can't help but recall the difficult years when domestic brands were constantly suppressed by joint venture brands in the traditional fuel vehicle era. Although everyone tried their best to break through the blockade and achieve so-called premiumization, the final results could only be described as minimal.

Fortunately, the rising tide of the "smart electric vehicle" era has given domestic brands the opportunity to "overtake on the curve." This time, they have not disappointed, grasping the defining and pricing power of hit products firmly in their hands.

With this foundation, the initial success of premiumization is evident.

Little did we know that yesterday, the luxury brand sales ranking in the Chinese market from July 15th to July 21st arrived as scheduled. While Mercedes-Benz, BMW, and Audi still occupy the top three positions, starting from fourth place with Lixiang, including sixth place with AITO, seventh place with NIO, and ninth and tenth places with ZEEKR and Tengshi, domestic brands' siege of BBA is not just empty talk.

The expensive new energy vehicles they have launched have undoubtedly won over end consumers who are willing to pay the price.

What's even more surprising is that the AITO M9, with a price range of 469,800 yuan to 569,800 yuan, achieved retail sales of 15,139 units in April, 16,462 units in May, and 16,525 units in June. Frankly speaking, such exaggerated performance has not even been achieved by large SUVs under BBA.

It must be acknowledged that "domestic brands have truly stood up."

As the article approaches its conclusion, I would like to add one final point: "The rising average retail price of domestic passenger cars also reflects the increasing purchasing power of consumers today, and consumption upgrading is the general trend in China's auto market."

Of course, while the low-end segment below 100,000 yuan is shrinking, it is not without potential benefits to be explored. For most OEMs, it is still necessary to consider how to rejuvenate and transform this segment and introduce products that are more suitable for potential customers.

After all, not everyone can easily spend hundreds of thousands of yuan. A healthy and well-balanced auto market must advance in multiple dimensions simultaneously…