Netflix: A Golden Safe Haven Amid Tariff Turmoil?

![]() 04/18 2025

04/18 2025

![]() 552

552

Netflix (NFLX.O) unveiled its Q1 2025 earnings report after market close on April 17, Eastern Time. Amidst President Trump's tariff threats, subscription streaming, with its relatively low sensitivity to macroeconomic factors, has emerged as one of the few safe havens for equity investments.

As the streaming kingpin with a steady stream of hit shows, will Netflix continue its dominant performance this year following its impressive Q4 2024 results? Amidst the drastic changes brought about by tariffs, the market will also be closely monitoring how management adjusts its guidance for the year.

Here's a detailed look:

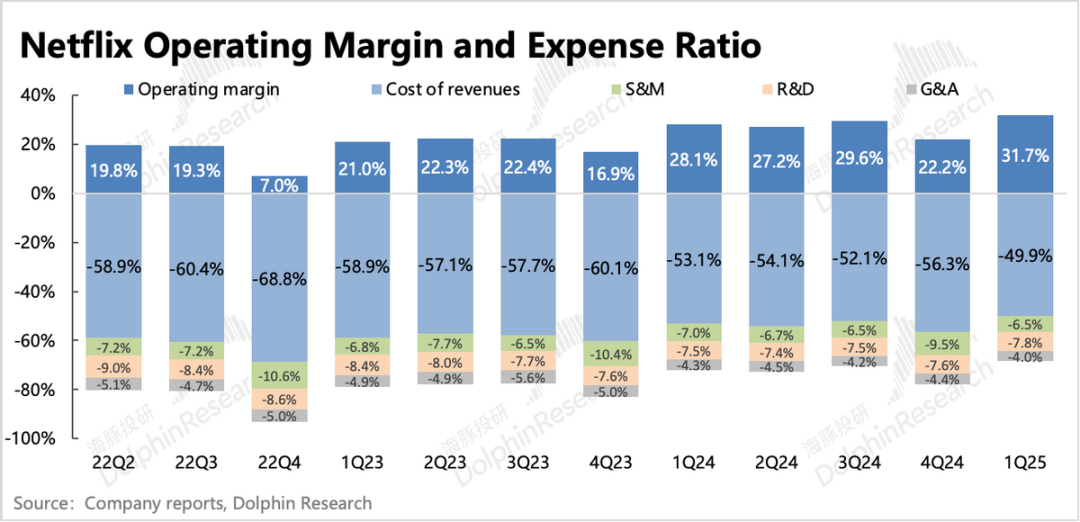

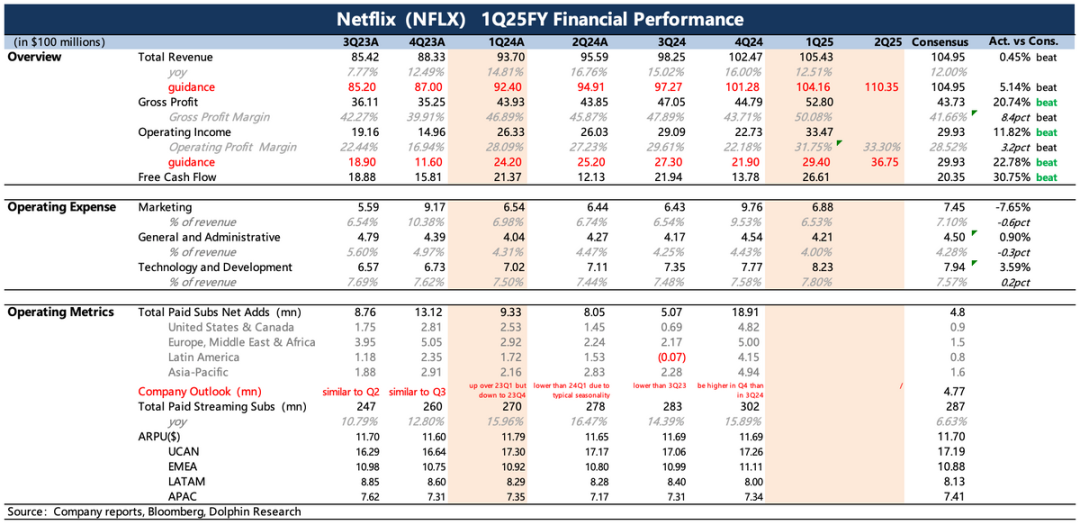

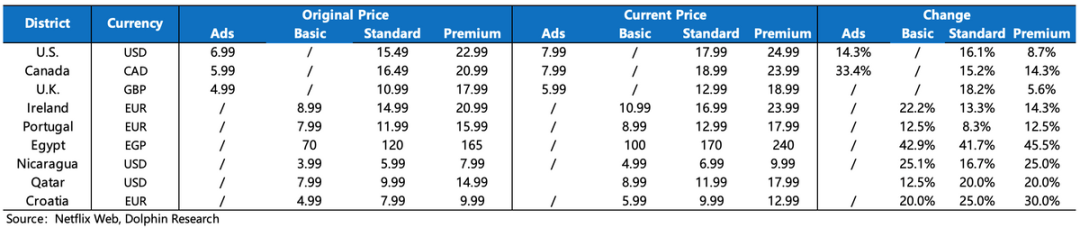

1. Significantly Better-than-Expected Profits

The primary surprise was in gross margins, which Dolphin believes was fueled not only by the ongoing popularity of hit shows but also by price increases in multiple regions and the advancement of high-margin advertising in Q1. Management provided even higher margin guidance for Q2, with the operating margin expected to rise to 33% (up 1.5 percentage points from the previous quarter). However, the full-year operating margin guidance remains at 29%, likely due to caution amidst current environmental changes, especially as pressure gradually builds in the second half of the year.

2. Estimated User Growth is Decent

While Netflix ceased disclosing subscription numbers starting in Q1, Dolphin roughly estimated the increment in subscription users in different regions based on actual revenue and price increases in each region. Overall, subscription revenue growth in Q1 was still driven by user additions (Dolphin estimates a net increase of 4.5 million users, higher than the latest adjusted institutional expectation range of 3-4 million).

Europe and Asia witnessed significant growth, primarily benefiting from locally popular content during the quarter (such as the lingering popularity of 'Squid Games 2' and European films like 'Ad Vitam' and 'Counterattack'). However, the core regions entered a new pricing cycle, which had a short-term impact on user scale, leading to a noticeable decline in revenue growth in North America, for instance.

Historically, these are short-term fluctuations. With a still robust content pipeline this year, Netflix is expected to gradually regain users and drive revenue growth back into double digits under the influence of price increases.

3. Continued Expansion of Advertising

Regarding the AVOD business, 2025 marks the year of formal scale-up. In Q1, Netflix launched its 1P advertising system, Netflix Ads Suite, in the United States and will continue to deploy it in other regions throughout the year.

The full-year revenue guidance of $43.5-$45.5 billion remains unchanged, which includes an expected doubling of advertising revenue. This means that advertising revenue is projected to approach $1.5 billion this year, accounting for 3% of total revenue. Although the turbulent macroeconomic environment this year may temporarily slow down Netflix's advertising growth beyond expectations, the direction and trend remain unchanged.

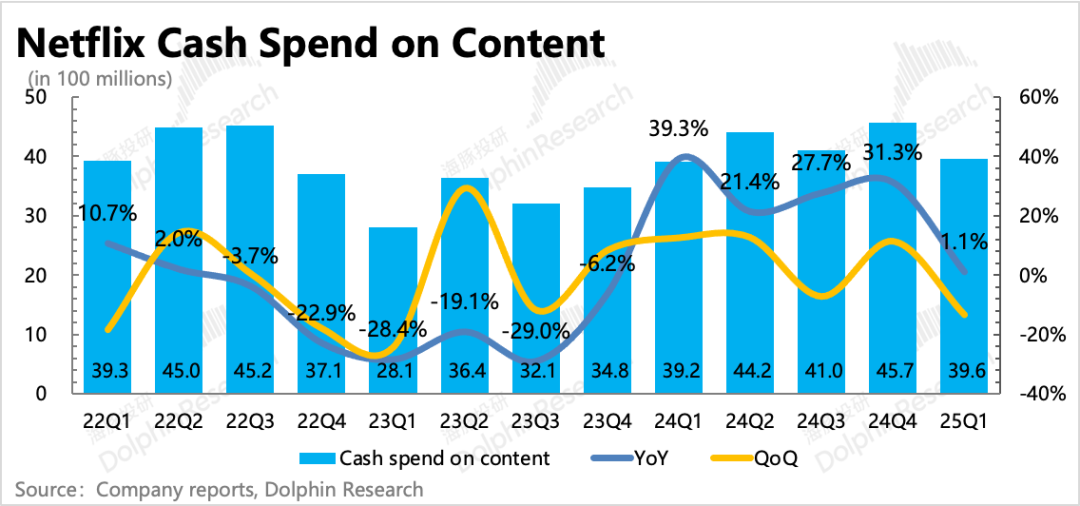

4. Slowdown in Content Investment Growth

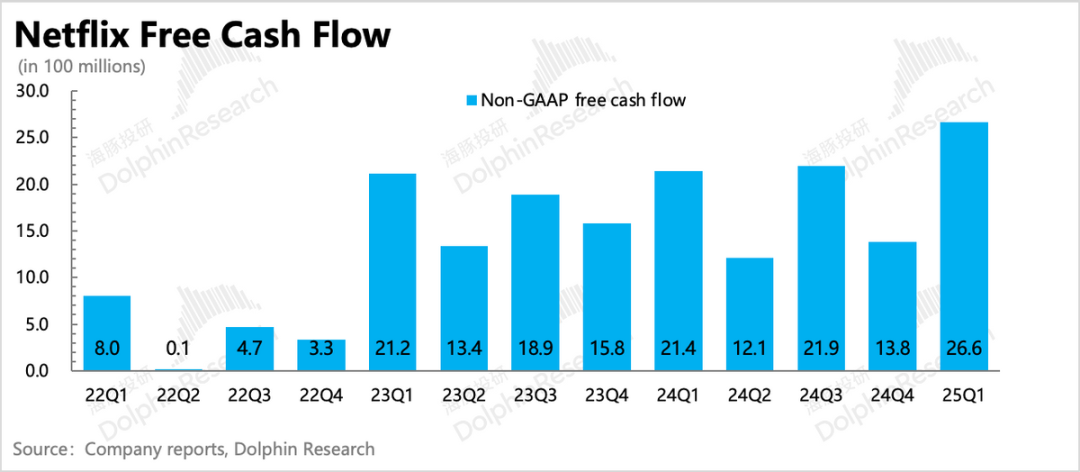

Free cash flow (Non-GAAP) in Q1 was nearly $2.7 billion, a year-on-year increase of 25%. As the monetization capacity peaks due to the content cycle, content investment growth slows down year-on-year.

Generally speaking, the second half of the year tends to accelerate relative to the first half. However, considering the relatively turbulent macroeconomic environment this year, Dolphin believes that the $18 billion content investment budget may not be fully utilized due to cautious control. This issue may also arise among peers, but generally speaking, this is more favorable for the current industry leader.

5. Increased Share Repurchases

With improved operating cash flow, the remaining cash is primarily used for debt repayment and share repurchases in addition to basic operations.

In Q1, Netflix repaid $800 million in notes and spent $3.5 billion to repurchase 3.7 million shares. The repurchase amount was higher than the previous single-quarter level of $1.5-$2 billion, with a remaining authorized repurchase amount of $13.6 billion.

6. Summary of Performance Indicators

Dolphin Investment Research Viewpoint

In the Q4 earnings report review, Dolphin highlighted two main focus points for Netflix this year: the accelerated push of AVOD and biennial price increases in core regions.

Although Trump's tariff threats have caused significant disturbances and downward pressure on the high-valuation Nasdaq, especially for stocks with high macroeconomic sensitivity, which face a double hit to both earnings and valuation, streaming media is relatively less sensitive. Its actual performance is more prone to fluctuations in the content cycle unless the world plunges into a deep recession.

Based on this logic, from a fundamental perspective alone, Netflix, which is in the middle of a content cycle and facing a pricing cycle in its core markets, is undoubtedly a preferred choice. Moreover, as macroeconomic uncertainties increase amidst the trade war, direct competitors are busy dealing with their main businesses (such as Amazon's e-commerce, Disney's parks, and Google's advertising), which may prompt them to tighten spending and control expansion, thereby damping competition that was expected to intensify this year. This undoubtedly reduces the defensive pressure on the current industry leader, Netflix.

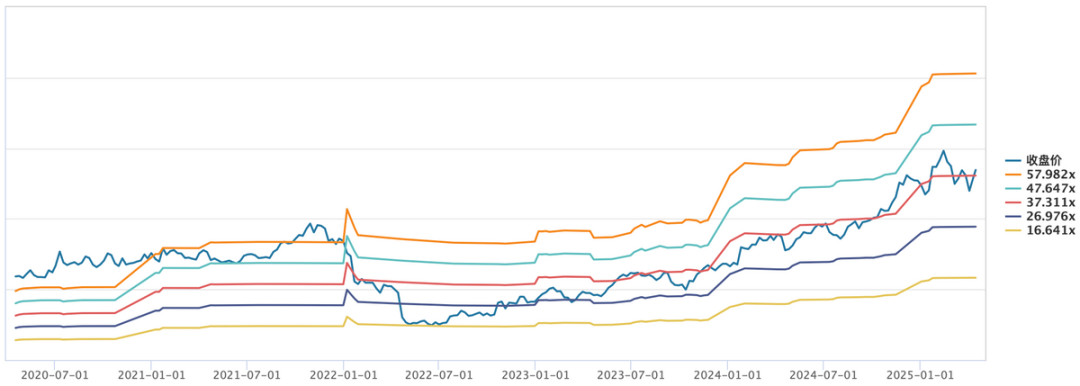

However, from a valuation perspective, Netflix still doesn't offer much opportunity (with limited recent valuation adjustments), primarily due to a lack of a substantial decline in market expectations. Before the earnings report, the market had lowered its expectations for Q1 subscriptions (net user growth expectations dropped from 5-6 million to 3-4 million), but due to price increases in multiple global regions, institutions also raised their expectations for ARM. As a result, final revenue and operating profit were only trimmed by 2% compared to February expectations. Market expectations for Netflix's full-year 2025 performance have not been adjusted downward.

Furthermore, the market emotionally views Netflix as a 'safe haven' and 'scarce asset,' resulting in a closing price of $416.2 billion as of April 17. After increasing the 2025 earnings forecast by 10%, the valuation still stands at P/E=35x, but during the tariff war, the valuation fell to a low of 33x P/E. Compared to the broader market, the Nasdaq has adjusted significantly by 15%, while Netflix, with its not-low valuation, has only fallen by less than 10%, demonstrating a strong Alpha advantage.

However, Dolphin also cautions that the uncertainty brought about by this trade war is too great (with tariff negotiations still fluctuating and the economic impact of tariff implementation not fully priced in), coupled with the fact that Netflix is now and will continue to rely heavily on international market performance (Q1 user growth was primarily driven by countries such as Japan, South Korea, Indonesia in Asia, Mexico in South America, and France in Europe). Therefore, compared to the previous quarter, when Dolphin believed that every round of valuation correction was an opportunity to buy, this time it is recommended to give oneself sufficient safety margins.

Assuming that the trade war does not involve service consumption and countermeasures such as digital taxes, Dolphin believes that one can focus on relatively safe opportunities when Netflix's valuation falls below 30x P/E amidst short-term market sentiment freezes (with expected profit growth CAGR exceeding 20% over the next three years), or choose an appropriate valuation range based on one's own risk appetite. The lowest P/E in history was in 2022, at only 17x, but at that time, Netflix was primarily facing more competitive pressures (with Disney+ gaining momentum) and the impact of the pandemic on content supply. Compared to the current situation, the circumstances then were more detrimental to short-term logic, so it is not suitable to directly use that as a reference now.

Here are the details:

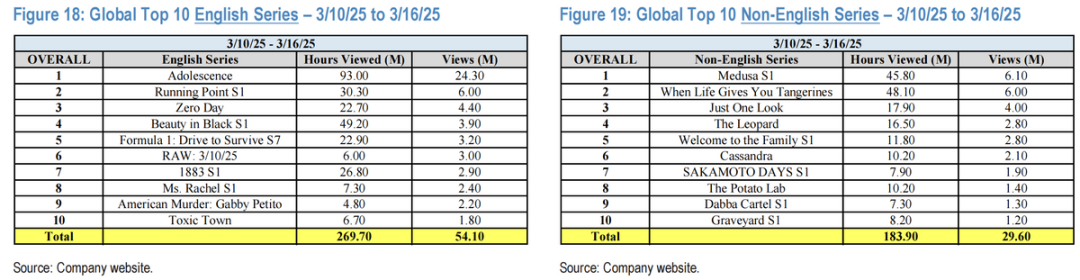

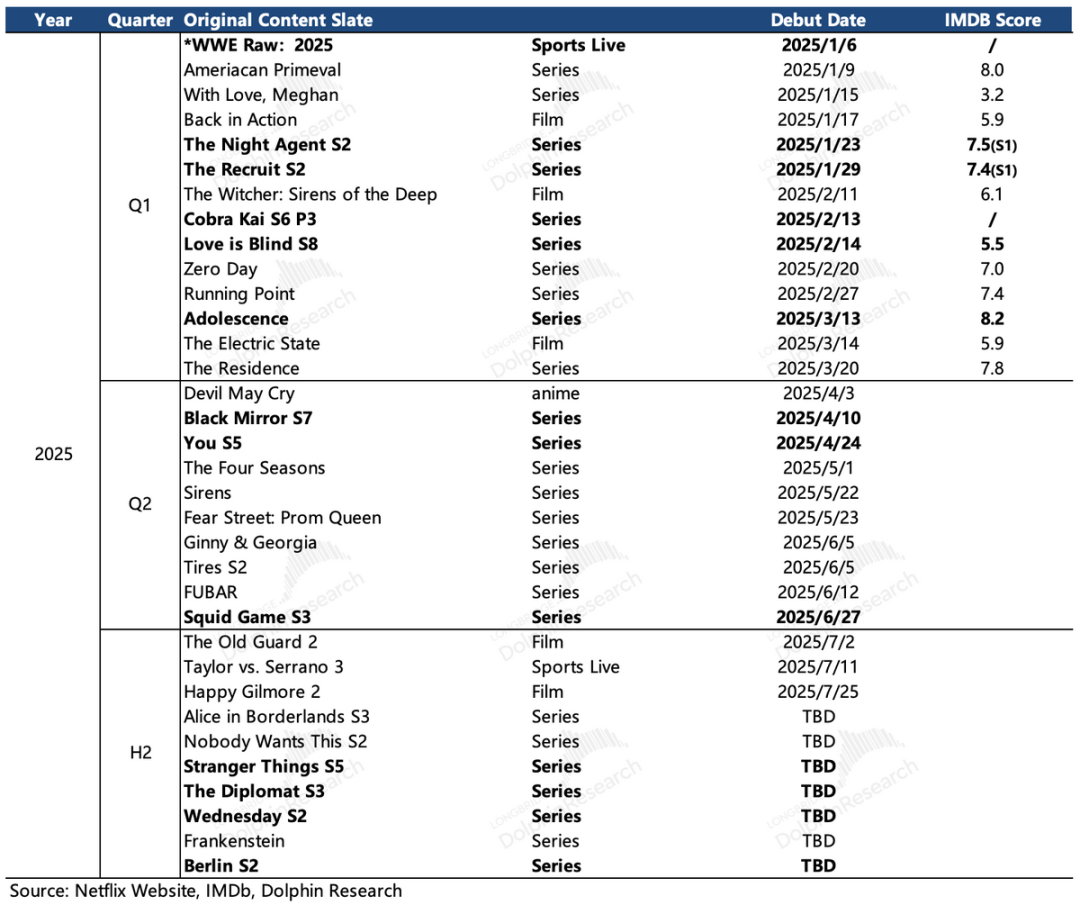

I. Ace Content Drives Growth

Although Netflix ceased disclosing subscription numbers starting in Q1, Dolphin roughly estimated the increment in subscription users in different regions based on actual revenue and price increases in each region.

Dolphin estimates a net increase of over 4 million subscription users in Q1, with a seasonal natural slowdown. User growth was still driven by hit content from the previous quarter, such as the Korean drama 'Squid Game 2,' the Indian 'NFL Cricket League,' the popular British drama 'Adolescence,' the American drama 'Beauty in Black,' the non-English 'Medusa S1,' the Korean drama 'Turning Point,' etc., combined with continued crackdowns on password sharing and the launch of advertising packages.

Due to the completion of the NFL in December, Indian user activity declined rapidly in Q1. Coupled with price increases in multiple core regions, which temporarily suppressed user demand, the net increase was lower than Dolphin's expectations in the Q4 earnings report review, which were based on the end of January.

However, since Netflix's user numbers can be tracked through Sensor Tower download data, most changes in user numbers have already been reflected in the stock price. As of before the earnings report, mainstream institutions had already lowered their expectations to 3-4 million, rather than the lagging Bloomberg expectation of 4.8 million. Based on Dolphin's estimates, Netflix's Q1 performance surpassed institutional expectations.

By region:

The core growth in Q1 was in Europe and Asia, with Europe benefiting from the AVOD push and Asia benefiting from content such as 'Squid Game 2.' In North America and Canada, a new round of price increases suppressed short-term net user growth.

In the Q4 review, we anticipated the pricing cycle in the North American market this year (based on the previous pricing frequency of 1-2 years and this year's rich content). Although there was indeed some short-term impact, coupled with the potential drag on the economy from tariffs, there may be some voices of concern in the market.

However, we believe that time will smooth out the impact of price increases on user growth, primarily due to the rich content pipeline this year, with multiple sequels of hit shows and stable competition, which can support strong user growth this year.

For Q2 2025, Dolphin expects net user growth to remain around 4 million, primarily driven by content such as 'Black Mirror S7,' 'You S5,' and 'Squid Games S3' at the end of the quarter. In the second half of the year, with the peak season and the release of more hit sequels such as 'Stranger Things' and 'Wednesday,' single-quarter user growth is expected to return to over 5 million.

II. Solid Competitive Advantage

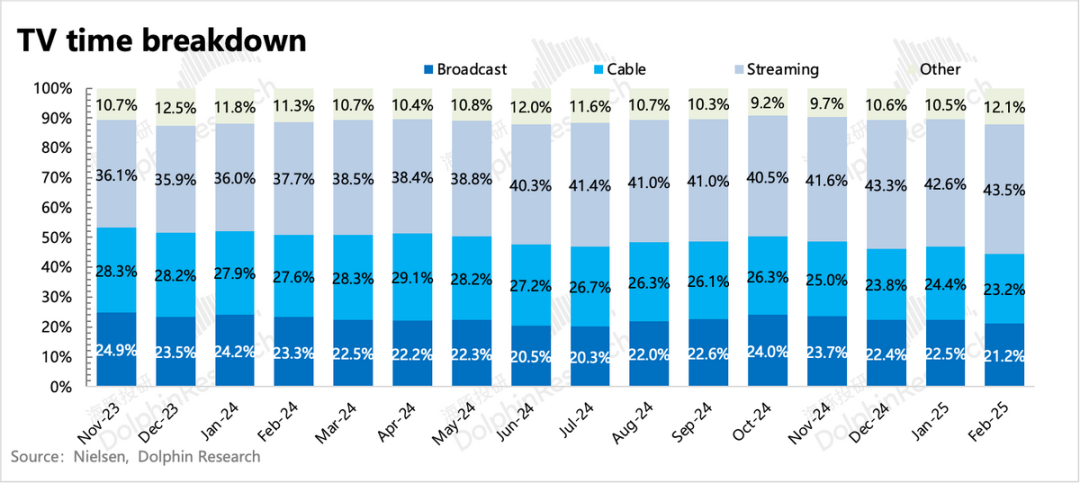

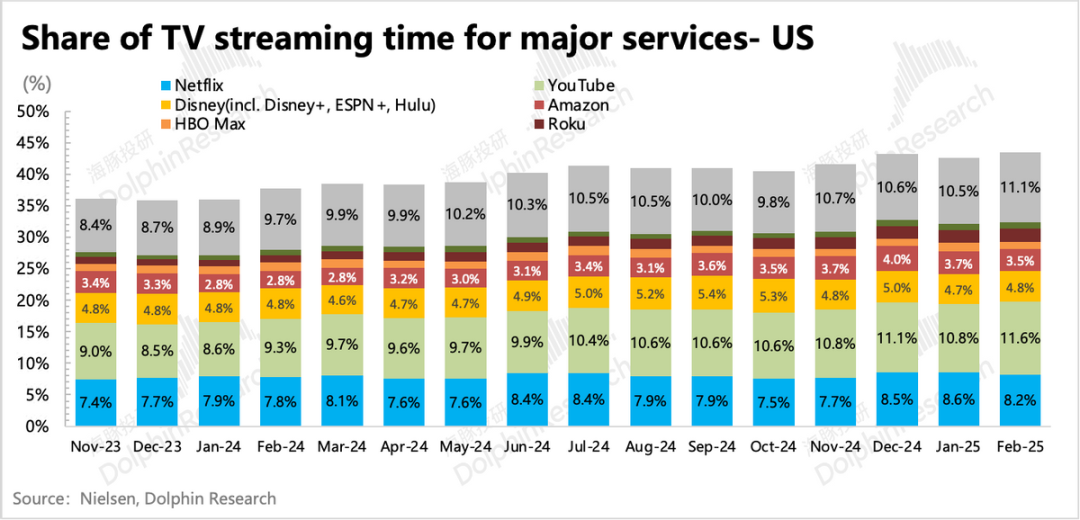

The core logic in the medium to long term is still the 'cord-cutting' trend and Netflix's ability to maintain a competitive advantage throughout this process. According to the latest data from Nielsen, from the end of last year to Q1 this year, as events and elections concluded, the U.S. streaming media share returned to a new high of 43.5%.

In the sub-segments, Netflix surged to 8.6% in December last year and January this year due to the NFL and 'Squid Games 2,' and then naturally declined in February. Among peers, YouTube's viewership share remains the leader, followed by Amazon Prime Video, which also hit a new high in December, while others remained stable or declined.

The competitive landscape for long-form video streaming has slowed down and stabilized for more than a year (triggered by the Hollywood strike). Originally, Dolphin expected it to intensify in the second half of this year, but the tariff threats have had a significant impact on the current macroeconomic environment, leading to some changes in our expectations:

-- The parent companies of Netflix's competitors, whether Google, Amazon, or Disney, have core businesses that are highly sensitive to macroeconomic changes. As the economic impact gradually materializes and drags down these companies' performance, Dolphin speculates that they may first postpone making too many investments in non-core branch businesses. This means that the competitive environment is expected to remain stable, a trend that is certainly favorable to the industry leader, Netflix.

III. The Impact of Price Increases in Core Regions is Only Short-Term

In Q1, Netflix generated $XX billion in revenue, a year-on-year increase of 12.5% and 16% at constant exchange rates, slightly exceeding guidance and expectations.

Revenue growth was driven by both quantity and price. Subscription revenue growth in Q1 was primarily driven by paid user growth, coupled with the expected price increases not only in core regions such as North America and Canada but also in some small European countries.

Regarding the AVOD business, 2025 marks the year of formal scale-up, primarily reflected in:

1) Accelerating the launch of Ad-support packages in new regions; in November last year, AVOD monthly active users reached 70 million, with 50% of new users in regions where advertising-supported packages were promoted choosing the Ad-support option. However, this was a short-term peak under unstable conditions, and as of now, Netflix has not updated its MAU data, so one can pay attention to the earnings call.

2) Advancing the 1P advertising platform (Netflix Ads Suite) in core regions (Canada, United States) to optimize advertising tracking and conversion efficiency. Netflix is collaborating with Nielsen and DoubleVerify to accelerate the development of 1P advertising measurement technology.

Market analysts anticipate that by the end of 2025, Netflix will maintain a stable base of 25 million monthly active users (exposed to advertising), generating an average monthly advertising revenue per user of $3.5 (similar to Meta's per-user revenue). Notably, long-form video pre-roll ads command a higher unit price, with Netflix's CPM at $55, outpacing Meta's combined CPM of $15. Despite modest growth compared to last year, primarily due to economic pressures, particularly impacting brand advertising, a significant surge in growth is projected beginning next year as advertising ROI improves.

Based on this assumption, despite economic challenges in 2025, advertising revenue is forecasted to reach $1.5 billion, accounting for roughly 3% of total revenue. When combined with the value of subscription fees included in advertising packages, the total revenue generated from ad-supported services is expected to exceed 5% of the overall revenue.

3. Will investments decelerate in an uncertain environment?

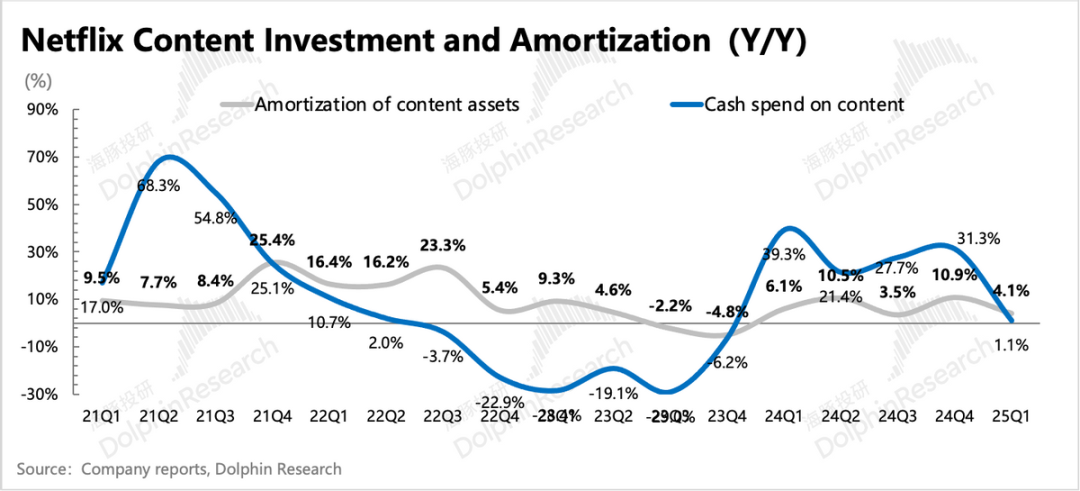

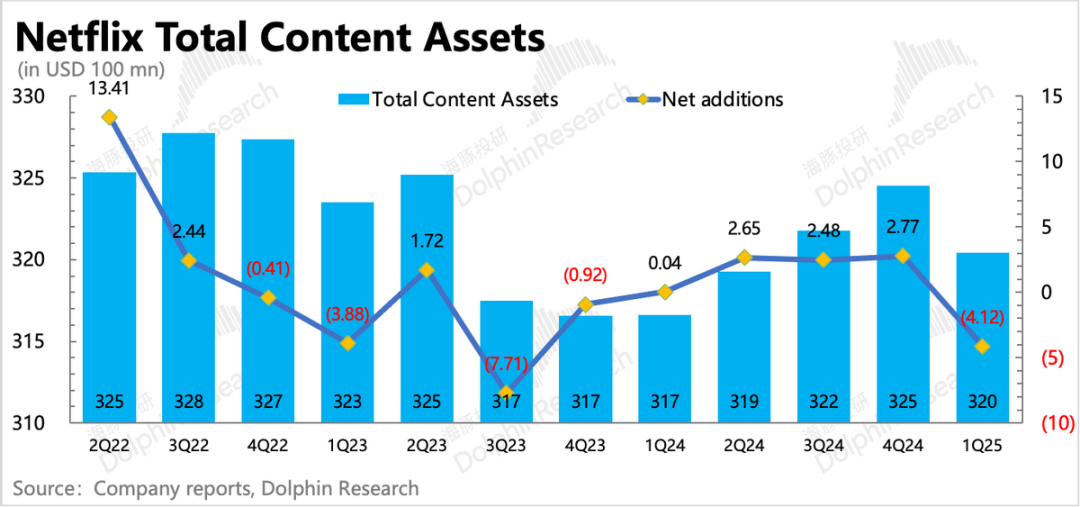

Content investment in the first quarter fell below $4 billion, marking a noticeable slowdown in year-over-year growth. Dolphin attributes this to both a higher base comparison and the potential influence of the ongoing tariff trade war.

Historically, investments tend to accelerate in the second half of the year compared to the first half. However, given the volatile environment this year, Dolphin believes that the $18 billion content investment budget may not be fully utilized due to prudent financial management. Competitors may also grapple with this issue, but such times typically favor the current industry leaders.

The change in the size of content assets at the end of the period further indicates that Netflix's current investment intensity is lower than the amortization rate.

In the first quarter, free cash flow amounted to nearly $2.7 billion, surpassing market expectations. However, the full-year guidance of $8 billion remains unchanged, possibly allowing for some buffer against potential pressures in the second half of the year. Additionally, the company repurchased shares worth $3.5 billion in the first quarter, exceeding last year's efforts.

4. Profits Exceed Expectations by a Significant Margin

Netflix recorded an operating profit of $3.35 billion in the first quarter, with a profit margin of 31.7% (up 3.5 percentage points year-over-year), representing a 27% year-over-year increase. While growth slowed due to a high base comparison, it still significantly outpaced market expectations.

Behind this growth, in addition to the ongoing popularity of hit series, Dolphin believes it is also tied to price hikes in multiple regions and the successful rollout of high-margin advertising in the first quarter, which primarily boosted the gross margin. In terms of expenses, aside from potential accelerated expansion of R&D expenses related to advertising system development, both selling expenses and administrative expenses grew at a minimal rate.

Despite this robust start, management refrained from raising the full-year target as they typically would. We believe this decision is likely due to continued concerns about macroeconomic deterioration, aiming to retain a certain buffer space.