Tariffs hit tech stocks hard, but this company raked in $10 billion on 'stay-at-home anxiety'

![]() 04/21 2025

04/21 2025

![]() 522

522

Author | Han Xiao, Editor | Yifan

The rules of the survival game are always changing, and only the adaptable can make it to the end.

Global stock markets have been volatile due to tariff turmoil, with a significant increase in the concentration of selling among the Big Tech Seven. According to Koyfin data, Apple's share price fell by 18% in early April, Microsoft and Google fell by nearly 5%, and Amazon fell by 7.8%.

However, one company that has bucked the trend under these circumstances is Netflix.

Economists say that when a recession looms, relatively inexpensive home entertainment resources become invaluable.

On April 17, Netflix released its Q1 2025 earnings report, with quarterly profits hitting an all-time high. Revenue for the quarter was $10.543 billion, up 12.5% year-on-year; net profit was $2.890 billion, up 24% year-on-year; and diluted earnings per share were $6.61. Both revenue and earnings per share exceeded Wall Street expectations. After-hours share prices rose by more than 4.3%.

During the subsequent earnings call, Netflix Co-CEO Greg Peters said that Netflix has been closely monitoring market dynamics, but so far, based on direct interactions with advertising buyers, there are no signs of market weakness. In fact, the opposite is true, as we approach the advertising upfronts, we are seeing positive signals from customers. He also noted that the entertainment industry typically shows strong resilience during economic downturns.

Looking back at Netflix's history, it has shown remarkable resilience, much like a squid in its natural environment, capable of regenerating its limbs after amputation.

In the business world, Netflix has repeatedly risen and fallen amidst industry shakeups.

Founded in 1997, Netflix initially started as a DVD rental company, gaining traction in the market with its innovative monthly subscription rental model. It went public on the Nasdaq in 2002. In 2007, Netflix pioneered streaming services and grew into a global streaming giant, repeatedly exceeding market expectations.

What has Netflix done right?

Netflix emerged from the pre-internet era, weathering the transition from traditional cable TV to the internet and the impact of the mobile internet era. In the streaming era, competition is fierce—after Disney entered the streaming market, it gained 10 million registered users on its first day.

However, behind this impressive earnings report, Netflix is once again facing a growth bottleneck. Market expectations for Netflix (NFLX) have already become more conservative.

A few years ago, Netflix was one of the Big Five (Facebook, Apple, Amazon, Netflix, Google) tech giants. However, in recent years, the market landscape has changed, with the Magnificent 7 replacing FAANG as the new focus of Wall Street. In addition to Netflix, the other four companies in FAANG have been included in the M7, along with NVIDIA, Microsoft, and Tesla.

By analyzing changes in Netflix's financial data over the years and its strategic adjustments, we aim to understand how Netflix has managed to maintain sustained growth despite the collapse of its growth myth since 1997.

The Collapse of the Growth Myth

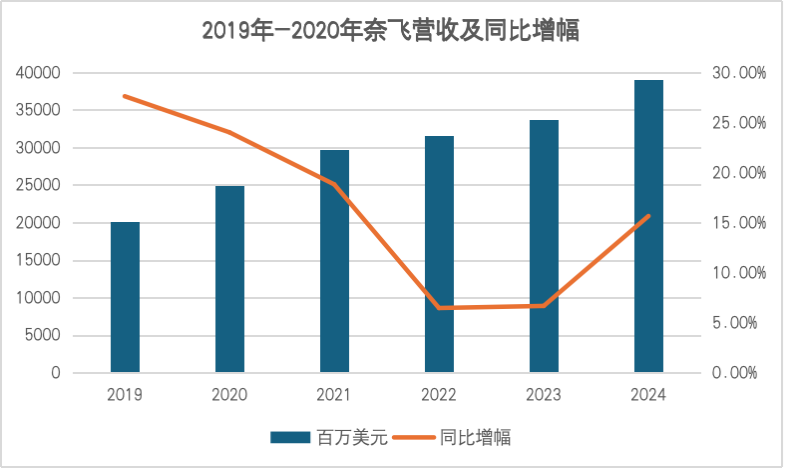

Netflix suffered a major setback in 2022. In 2020, the pandemic boosted many internet companies. Netflix also performed well during those years, with revenue reaching $20.2 billion in 2019 and $29.7 billion in 2021. However, from another perspective, the industry believes that the pandemic over-consumed some market demand and Netflix's growth expectations.

Netflix's revenue from 2019 to present

Data Source: Wind, Chart by Han Xiao

Netflix's global subscriber growth from 2019 to present

Data Source: Wind, Chart by Han Xiao

In the Q1 earnings report released in April 2022, Netflix reported a loss of 200,000 global subscribers on a quarter-over-quarter basis (the market expected an increase of 2.5 million), marking the first time in a decade that Netflix had lost subscribers. After the earnings report was released, Netflix's share price plummeted by 25% in after-hours trading and further declined by 35% the next day, erasing $170 billion from its market cap and making it the worst-performing stock in the S&P 500 index.

At that time, Netflix attributed industry competition as one of the factors behind the decline in subscribers. A report by research firm Kantar said that the overall penetration rate of streaming media in the UK declined in the latest quarter, and consumers had more choices. Hollywood and Silicon Valley are aggressively entering the streaming market, intensifying competition for customers and content—newcomers include content masters like Disney and HBO Max, as well as tech giants like Amazon and Apple. These changes in the industry are all impacting Netflix's growth.

For a long time, Netflix has focused on producing high-quality content, with revenue mainly coming from paid subscriptions. Its performance depends on the growth of subscriber numbers and average revenue per membership (ARM). However, it has been relatively passive in advertising and IP commercialization, as Netflix had long refused ads, believing that they could limit creative freedom and cannibalize existing subscribers.

Under pressure, Netflix's response can be summarized in two directions: cracking down on password sharing and actively expanding diversified businesses, including ad-supported tiers, gaming, and e-commerce.

From Password Sharing Crackdown to Ad-Supported Tiers: Netflix's Dual-Engine Growth Strategy

In March 2017, the thriving Netflix said, "Love is sharing a password." Password sharing was once very common among Netflix subscribers. According to Guardian data, in 2022, account sharing rates in major European markets exceeded 40% in Spain and Germany, 35% in France, and 27% in the UK. In February 2023, Netflix estimated that it had over 100 million shared accounts globally, which "impacted our ability to invest in new TV shows and movies."

Under growth pressure, Netflix chose to target its "existing user base." In February 2023, Netflix rolled out a new policy globally: stipulating that "Netflix accounts are for use by one household only," and allowing sharing only for accounts that log in at least once a month on the same home WiFi. Netflix said that cracking down on sharing may cause some negative reactions, but the long-term benefits of people paying for additional accounts will lead to "overall revenue increases."

Beyond reorganize shared accounts, Netflix began exploring diversified businesses. Currently, advertising revenue is already substantial, while gaming and e-commerce are still in the testing phase.

In November 2022, Netflix launched an "ad-supported tier" (Basic with Ads), inserting 15- or 30-second ads during episodes and movies, totaling about 4-5 minutes per hour.

In terms of pricing, the ad-supported tier currently costs $7.99 in the US market, significantly lower than the standard tier ($17.99) and the premium tier that supports 4K ($24.99). Additionally, both the standard and premium tiers can add extra members, with a monthly fee of $8.99 for an ad-free plan and $6.99 for the ad-supported tier.

Netflix believes that the advertising model first provides consumers with a lower-priced option and secondly creates additional revenue and profit sources. In November 2024, according to Netflix's statistics, its ad-supported tier had 70 million monthly active users globally, nearly doubling from 40 million in May. In its Q2 2024 earnings report, Netflix projected that the ad-supported tier would begin to scale in 2025 and become a new driver of revenue growth after 2026.

Content is King: Netflix's Global Production and IP Development

As a giant in the content entertainment industry, Netflix is exploring more possibilities around its accumulated IPs.

In 2021, Netflix Games was launched, introducing games based on popular Netflix IPs such as "Stranger Things" and more casual titles. Games are included in subscription packages and are ad-free (even for users who subscribe to the ad-supported tier). In the second half of 2021, Netflix acquired several renowned studios, including Night School Studio and Next Games, to enhance its original production capabilities. Recently, Netflix is also experimenting with using generative AI to transform game development and gaming experiences, expanding its AI game team.

Based on the same logic of IP commercialization, Netflix is also exploring e-commerce, launching Netflix.Shop in June 2021. The current store primarily incubates IP-related merchandise, such as hoodies and T-shirts themed around "Squid Game."

While cracking down on password sharing and advertising have immediate effects on subscriptions and revenue, they are still short-term solutions to some extent. In the long run, Netflix's characteristics remain distinct. Whether it's high-quality original content, globalization strategies, or technological roots, these are the moats that Netflix has built over time.

Netflix's management team recognized the importance of original content early on. In 2013, "House of Cards" debuted, becoming a phenomenon that brought both fame and fortune to Netflix: subscriptions surged by 3 million that season, and it also won an Emmy Award.

This was not just a commercial victory but also a bold content experiment. The production cost of each episode of "House of Cards" was as high as $4 million, far exceeding the industry average of $2 million at the time, with a total investment of $100 million for the first two seasons. Since then, Netflix has transformed into a "dream factory" with a plethora of original content: from "The Crown" set in the Victorian era to "Stranger Things" in an Indiana town, or the revenge flames of "Dark Glory," and the much-talked-about "The Three-Body Problem." Netflix has gradually built its own cultural empire.

"Squid Game," which debuted in September 2021, became a global sensation once again. Netflix revealed in its earnings report that 142 million global users watched the show within four weeks of its release, accounting for about two-thirds of Netflix's global users during the same period. Due to its strong appeal to global users, "Squid Game" brought considerable profits to Netflix. According to Bloomberg, "Squid Game" will generate value exceeding 40 times its cost. The production cost of the show was approximately $21.4 million, equivalent to $2.4 million per episode, while Netflix internally estimates its revenue at about $891 million.

An interesting detail is that compared to the "House of Cards" era, Netflix's hit production line has quietly shifted—with production bases expanding from the US to South Korea.

In 2016, Netflix launched its globalization strategy, providing it with a larger supply and demand market. Currently, Netflix's business covers over 190 countries/regions, offering content in over 60 languages. As of the end of 2024, revenue from the US market accounted for 41%, Europe, the Middle East, and Africa accounted for 32%, while Latin America and Asia-Pacific accounted for 12% and 11% respectively. Some analysts believe that future membership growth in international markets will be the main driver of growth.

Since "Kingdom" in 2019, Netflix has gradually established its own content brand in South Korea, leveraging this to strengthen its presence in the Asia-Pacific market and enhance its global influence. "Squid Game" in 2021 was a major turning point, with Korean dramas reaching a global audience through Netflix. The cooperation between Netflix and the Korean cultural industry has so far been a win-win situation.

The Korean content industry has shone on the international stage. The first season of "Kingdom" was named one of the top ten "Best International TV Shows of the Year" by The New York Times. The second season of "Squid Game" was released on December 26, 2024, and within six days, it had been viewed 87 million times, taking the top spot for viewership in the second half of 2024. According to Netflix data, Korean content has topped the non-English content viewership chart for two consecutive years since 2023. Meanwhile, Netflix's performance in the Asia-Pacific region has been thriving: in 2019, revenue in the Asia-Pacific region was $1.47 billion, accounting for 7.5% of total revenue; by 2024, revenue in the region had increased to $4.42 billion, accounting for 11.3% of total revenue.

On the other hand, while globalization has provided Netflix with new markets and more diverse content, it has also stabilized Netflix's supply on the production side. During the 2023 Writers Guild of America strike, Netflix was still able to deliver impressive financial results. Ted Sarandos, Netflix's Co-CEO, said he was "not too concerned about" the writers' strike.

Global production has become another moat for Netflix. In fact, Netflix seems to be prepared for strikes and has actively deployed overseas production. In April 2023, Sarandos announced that the platform plans to invest $2.5 billion in Korean content over the next four years.

For Netflix, overseas production has another advantage: cost reduction. The first season of "Squid Game," produced in South Korea in 2021, had a production cost of $2.4 million per episode, compared to $4 million for "House of Cards" in 2013.

Algorithm Wins: Netflix's Technological DNA

Netflix's technological DNA and data-driven capabilities are also crucial to its competitiveness. Founder Reed Hastings has a background in both mathematics and computer science. As early as 2000, he proposed the concept of "algorithm as a service," optimizing DVD inventory scheduling through data modeling to improve distribution efficiency.

The technological DNA has been further strengthened in the streaming era. In 2006, Netflix held a recommendation algorithm optimization competition with the goal of improving the accuracy of its existing recommendation system by 10%, offering a prize of up to $1 million. This event gained widespread popularity and brought significant media coverage and attention to Netflix.

For Netflix, the data accumulated on the platform is a treasure trove. The creative team behind "House of Cards," including lead actor Kevin Spacey, was determined based on user data. Netflix has long used data to predict actors' market appeal, as well as the production costs and potential returns of content. This data-driven industrialization of content has built a competitive barrier for Netflix beyond its content offerings.

In 2024, Netflix announced that starting from 2025, it would only release data when user numbers reached key milestones, and would no longer disclose the number of subscribers and average revenue per user. The official explanation was that as the business diversifies, focusing too much on user numbers is not scientific. However, the market is concerned: the North American market is nearly saturated, and while there are many users in emerging markets, their per capita consumption is lower than that in the United States.

Public companies never stop pursuing growth. As the industry transitions from rapid expansion to refinement, whether Netflix can maintain its lead in content production and new business exploration will determine its direction in the next decade. Just like "Squid Game": the rules of the survival game are always changing, and only the adaptable can go the distance.

Background Information: (Source in parentheses)

Financial Reports: Q1 2022 Financial Report; Q4 2024 Financial Report; 2024 Annual Report

More than a quarter of Netflix's UK subscribers share passwords (The Guardian)

An update on sharing (Official Information)

Netflix Subscription Plans (USA) (Official Information)

Expanding Our Games Team With the Acquisition of Night School Studio (Official Information)

Netflix to Acquire Finnish Mobile Game Developer Next Games (Official Information)

GenAI for Games (Business Leader's Linkedin Post)

House of Cards Awards (IMDB Information)

Netflix stock soars on subscriber growth led by ‘House of Cards’ (Los Angeles Times)

Netflix Has Almost Already Paid for 'House of Cards' in New Subscribers (The Atlantic)

Netflix's Risky Strategy For 'House Of Cards' (Forbes)

'Big Data' Becomes a Gimmick for 'House of Cards,' Domestic Video Still Outside the 'Big Data' Threshold (Wen Hui Bao)

'Squid Game' Production Cost Far Lower Than Other Netflix Hits, at Only 130 Million Yuan (Jie Mian)

Netflix Estimates ‘Squid Game’ Will Be Worth Almost $900 Million (Bloomberg)

Netflix CEO Ted Sarandos Isn’t Concerned About the Writers’ Strike (Observer)

Netflix to invest $2.5bn in new South Korea films and TV shows (BBC)

Netflix Prize (Wikipedia)

Netflix to stop reporting subscriber tally as streaming wars cool (Reuters)

Korean Works Top Netflix's Non-English Content Viewership Rankings for Two Consecutive Years (Yonhap News Agency)

What We Watched the Second Half of 2024 (Official Information)