From “Design Location” to “Tape-Out Location”: Jen-Hsun Huang's Journey in a Suit

![]() 04/21 2025

04/21 2025

![]() 501

501

This week's review of auto stocks reveals various trends in the automotive market.

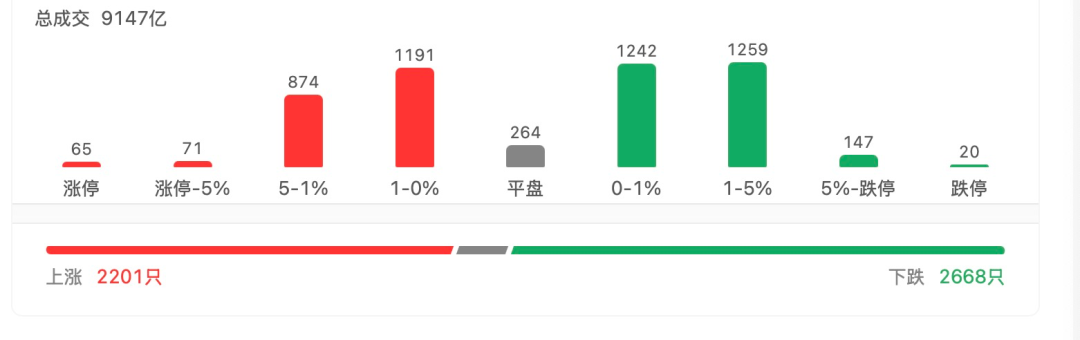

Over the past few days, A-shares have exhibited a pattern of opening low and closing high. Small-cap growth stocks have been particularly active, with indices such as the CSI 1000 and the Beijing Stock Exchange 50 Index surging more than 1% intraday, while market trading volumes have remained stable.

Notably, sub-sectors including MCU chips, automotive chips, memory chips, and advanced packaging have also witnessed significant gains. Stocks like Guofeng New Materials, Watton Technology, Ruineng Technology, and Sanfu have hit daily limit ups.

Recently, the China Semiconductor Industry Association issued an emergency notice clarifying rules for determining the "country of origin" of semiconductor products, a move seen as directly challenging the dominance of American companies in the mid-to-low-end chip market.

According to these new rules, if wafers are taped out in China, they can be labeled as "Made in China" regardless of their design origin. This means that analog chips produced by Texas Instruments at its Chengdu factory will now compete with Chinese local products.

Data from the Center for Strategic and International Studies (CSIS) shows that 85% of TI's packaging and testing capacity is in Asia, with minimal capacity in the United States. Under the new rules and tariff rates, products from American IDM manufacturers such as Texas Instruments and Intel, even if packaged outside the US, are still considered to have a US origin.

These regulations will significantly increase the cost of American IDM manufacturers' products in the Chinese market, with chips manufactured in the US facing tariffs of up to 125%. This "origin is identity" rule puts American companies in a dilemma: either transfer capacity or lose the market.

Considering the statistics, of the 123 billion yuan worth of chips imported from the US by China in 2024, 72% were designed by American companies but manufactured overseas. The shift from "design location" to "tape-out location" as the criterion means the rules of the game will be rewritten. The market generally believes that these new regulations are likely to accelerate the localization of analog chips and promote the construction of independent wafer production lines.

Li Liang, founding partner of Hillhouse Capital, noted that Chinese technology assets have been revalued by global investors this year. Institutional research indicates that the new tariff policy has increased the price of imported chips, reducing their competitiveness and providing opportunities for domestic chips, which may accelerate the process of domestic substitution. Therefore, the tariff policy presents a rare opportunity to accelerate companies' entry into mid-to-high-end application markets.

Under the influence of the tariff policy, let's focus on two leading chip companies in the Chinese and American markets: Horizon Robotics and NVIDIA.

As a leading domestic chip company, Horizon Robotics held a 33.97% market share of intelligent driving computing solutions for Chinese independent brand passenger vehicles in 2024. This means that for every three smart cars sold in China over the past year, one was equipped with a Horizon Robotics product.

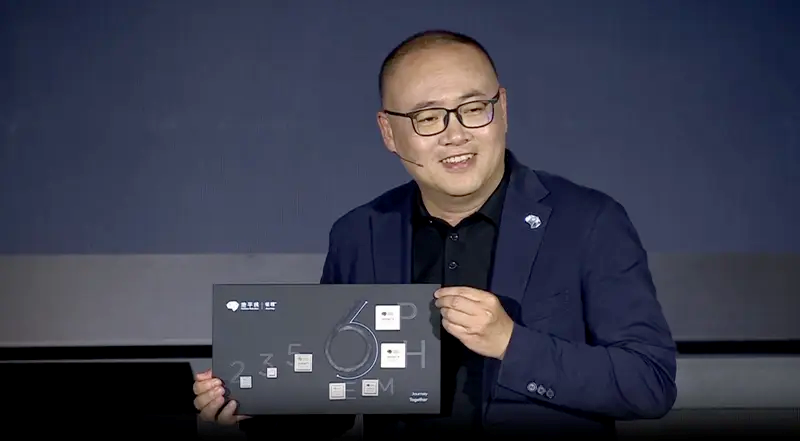

To further expand its business and achieve technological equity, Horizon Robotics officially launched the Journey 6P and 6H intelligent driving chips at the 2025 High-Level Intelligent Driving Product Launch Event, expanding its Journey series product line. Additionally, it released the Highway Smart Driving (HSD) system, which adopts a generative end-to-end technology architecture and modular design, supporting cross-model reuse.

HSD is a full-scenario intelligent driving solution featuring the country's first city NOA technology integrated with reverse capabilities, enabling automatic U-turns on narrow urban roads without manual intervention. Horizon Robotics and Chery announced a global first mass production cooperation for the HSD, which will debut on Chery's Starway models and enter mass production in September 2025.

Yu Kai, CEO of Horizon Robotics, revealed that the company recently obtained the world's first and only road vehicle safety and artificial intelligence certificate, SO 8800 AI functional safety certification, which will serve as a "passport" for its safety and trust in the global market and lay the foundation for regulatory compliance.

The consecutive launch of two chips and a high-level intelligent driving system underscores Horizon Robotics' emphasis on the intelligent driving market. As of the first quarter of this year, Horizon Robotics has cumulatively delivered 8 million chips and been integrated into over 200 mass-produced vehicle models.

Yu Kai said, "The combination of software and hardware is Horizon Robotics' core technical belief." Before computing performance fully meets user needs, the combination of software and hardware in each generation of in-vehicle computing systems will bring higher efficiency. Before the demand for L5 autonomous driving is met, intelligent driving must follow the path of combining software and hardware.

Horizon Robotics' lock-up period will end on April 24. At this point, important investors in Horizon Robotics, including Source Capital, Hillhouse Capital, and Huangpu River Capital, have stated that they will not rush to reduce their shareholdings after the lock-up period ends and will support the company in the long term.

Liu Qin, founding partner of Source Capital, said that intelligent driving is currently experiencing a critical inflection point from technological breakthroughs to large-scale implementation, and its value in reshaping the travel ecosystem is far from fully realized. "We are optimistic about the long-term value of Horizon Robotics and will not rush to reduce our holdings due to the end of the lock-up period. We will evolve together with this new generation of technological innovation enterprises."

Unlike Horizon Robotics, which is experiencing "mutual progress" with the capital market, NVIDIA has faced a "stormy rain."

A few days ago, the US stock market experienced a "Black Wednesday," with the three major indices closing lower collectively, and technology stocks suffering heavy losses.

On that day, the Dow Jones Industrial Average plummeted 699.57 points, closing at 39,669.39 points, a decline of 1.73%.

Amid this plunge, the chip sector was devastated, with the Philadelphia Semiconductor Index falling sharply, down 4.1%. As a leading company in the chip industry, NVIDIA's share price plunged 6.86% under the impact of multiple negative news, erasing $188.1 billion in market value overnight. Additionally, GlobalFoundries fell 5.45%, Skyworks Solutions fell 5.31%, and TSMC fell 3.22%. Chip stocks collapsed across the board, causing heavy losses for investors...

The chip sector has fallen by about 25% over the past two months. Investors were expecting a breather during the earnings season, but JPMorgan believes that the bottom may not have been reached yet. Due to Trump's tariff policy and global trade tensions, chip companies' customers have started to cut orders or delay purchases.

On April 17, JPMorgan issued a research report stating that chip stock valuations need to be revised downward, and the second half of this year will be more difficult. The US government's strengthened chip export controls have had a significant impact on NVIDIA's business.

The US government has included NVIDIA's AI accelerator H20, specifically for the Chinese market, on the export control list, requiring a license for export to China. This move directly led to NVIDIA recognizing a $5.5 billion loss (approximately RMB 40 billion), involving inventory, procurement commitments, and reserve costs.

H20 is an AI accelerator card launched by NVIDIA in late 2023 specifically for the Chinese market. In the first quarter of 2025, Chinese enterprises' emergency purchases of H20 amounted to $16 billion, with major customers including ByteDance, Tencent, Alibaba, and other technology giants. Jen-Hsun Huang stated that the US government's strengthened chip export controls have had a significant impact on NVIDIA's business.

"NVIDIA must adjust its strategy in the Chinese market quickly. After all, the H800 cannot enter, so how long can it rely on older models? With the rise of domestic chips, NVIDIA's market share is likely to be eroded." NVIDIA's crisis in the Chinese market is clear.

After already experiencing a significant decline in share price, on April 16, local time, NVIDIA's share price plummeted another 6.9%. Under such circumstances, NVIDIA CEO Jen-Hsun Huang made an emergency visit to Beijing on April 17. This was Huang's second visit to China in three months. Over the past three months, NVIDIA's share price has fallen by nearly 25% cumulatively.

Upon arriving in Beijing, Jen-Hsun Huang first met with Ren Hongbin, President of the China Council for the Promotion of International Trade. In the evening, he met with He Lifeng, member of the Political Bureau of the CPC Central Committee and Vice Premier of the State Council, at the Great Hall of the People. Jen-Hsun Huang, usually seen in his iconic leather jacket, appeared in a suit and tie for this occasion.

Jen-Hsun Huang's visit to China sent a strong signal that NVIDIA will not abandon the Chinese market amid complex and difficult circumstances. Jen-Hsun Huang stated that NVIDIA will continue to spare no effort in optimizing its product system to comply with regulatory requirements and unwaveringly serve the Chinese market.

Jen-Hsun Huang has repeatedly stated that China is a very important market for the global technology industry. He has also warned the US government to think twice before further restricting trade with China, stating, "If we are deprived of the Chinese market, we have no contingency plan because there is only one China."

Recently, Morgan Stanley's analyst team downgraded their revenue forecast for NVIDIA, citing concerns that Trump's trade policy will have a more destructive impact than expected. Morgan Stanley analysts estimate that in April this year, H20 chips accounted for 12% to 13% of NVIDIA's data center revenue. In the coming quarters, NVIDIA's data center revenue is expected to decline by 8% to 9%.

However, Morgan Stanley stated that NVIDIA's stock remains their "top pick" in the US stock market, maintaining a target price of $162 for NVIDIA, as the company will still benefit from the growing demand for AI hardware.

Although the capital market still maintains considerable confidence in NVIDIA, Jen-Hsun Huang dare not take it lightly. Because he knows that the Chinese market he relies on will not be overly dependent on NVIDIA.

"If they can't buy from us, they'll create it themselves."

Note: Some images are sourced from the internet. If there is any infringement, please contact us for removal.