JD.com's Bold Foray into Food Delivery: Can the 'Fourth E-commerce Giant' Stage a Comeback?

![]() 02/20 2025

02/20 2025

![]() 475

475

On February 11, JD.com announced its foray into the food delivery market with a '0 commission' strategy, aiming to lure high-quality dine-in merchants. By the 19th, it further pledged to offer 'five social insurances and one housing fund' for its full-time food delivery riders.

However, this seemingly aggressive new venture is hardly withstanding market scrutiny.

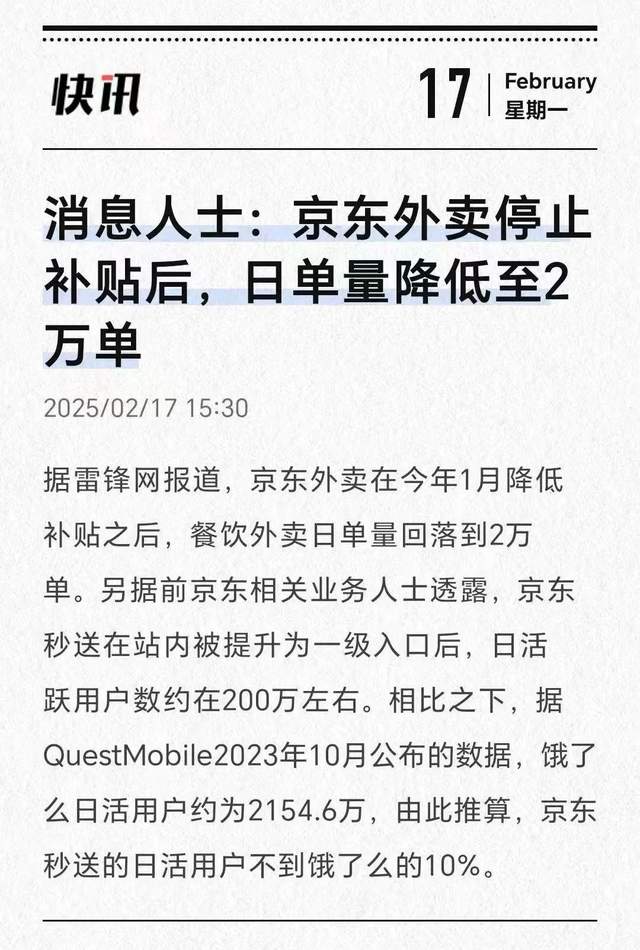

According to media reports, JD.com's instant delivery service currently boasts about 2 million daily active users, a fraction of Ele.me's user base. Moreover, after JD.com halted subsidies for its food delivery service in January 2025, daily order volume plummeted to 20,000 orders. This 'post-subsidy collapse' mirrors Douyin's initial experience in the food delivery market.

Concurrently, the high-profile announcement of providing social security for food delivery riders excludes the 1.3 million active riders of Dada, JD.com's core logistics arm. Instead, JD.com plans to establish a new full-time food delivery rider team, with the first batch potentially numbering around 10,000, who will sign new contracts and receive social security benefits.

On the 19th, Meituan announced that it had formed a preliminary pilot program for riders' social security last year, anticipated to be implemented in the second quarter of 2025, gradually covering full-time and stable part-time riders.

The number of riders expected to be covered by JD.com's social security initiative falls short of Meituan's, and the market remains skeptical of this high-profile strategy. Multiple international investment banks, including Citigroup, UBS, and Morgan Stanley, generally hold a cautious stance, believing it will have limited short-term impact on the industry landscape and JD.com's performance.

More crucially, the hastily launched food delivery business hardly conceals the anxiety surrounding JD.com's core e-commerce business. Just four days later, 36Kr reported that Douyin's e-commerce business surged to become the third largest in the industry in 2024. This signifies that JD.com's e-commerce business has been overtaken by Pinduoduo and Douyin, slipping to fourth place.

With its core business on the decline, JD.com's new food delivery venture faces a protracted battle for market share, competing with Ele.me and Douyin's food delivery services for top spots. This long-distance race, requiring massive subsidies and resource investments, promises to be challenging for JD.com.

01 E-commerce and Food Delivery: A Difficult Merger

Shortly after the new year, JD.com's e-commerce business slipped to fourth place, undoubtedly adding to the company's developmental anxiety.

According to 36Kr, Douyin's e-commerce GMV reached approximately 3.5 trillion yuan in 2024, a 30% year-on-year increase. As Douyin's strong competitor, Taobao Tianmao Group's GMV stood at around 8 trillion yuan last year, while Pinduoduo's GMV was approximately 5.2 trillion yuan.

On February 13, ByteDance held its 2025 All-hands meeting, where Kang Zeyu, head of Douyin's e-commerce business, revealed that Douyin's e-commerce market share had risen to third place in the industry.

The challenges extend beyond this.

Furthermore, the 'low-price strategy' emphasized by Liu Qiangdong upon his return has yet to yield significant results. JD.com Group's latest financial report revealed a 5% year-on-year increase in operating revenue for the third quarter of 2024, lower than the e-commerce industry's overall growth rate during the same period.

A detailed analysis of the financial report also shows that while JD.com's overall financial position is stable, the growth of its core business is nearly stagnant.

JD.com's retail business revenue reached 224.986 billion yuan, a 6.1% year-on-year increase, with profit margins up 5.2 percentage points. This progress is largely attributed to innovative measures such as integrated services of 'delivery, installation, disassembly, and cleaning' and 'trade-in'. However, focusing on the core category of 'electronics and household appliances', revenue only increased by 2.7% year-on-year.

Against this backdrop, JD.com is eager to explore the food delivery market, seeking business diversification and new growth avenues.

Nevertheless, it's worth noting that JD.com's e-commerce traffic, logistics, distribution, and supply chain infrastructure cannot effectively merge with food delivery.

On one hand, JD.com's e-commerce traffic is already weak in the industry, and national online traffic is ill-suited for food delivery businesses heavily reliant on local transactions.

On the other hand, JD.com's strengths in city warehousing, distribution, and supply chain are difficult to repurpose for local supply and instant delivery.

Moreover, from a traffic resource allocation perspective, despite being promoted to a first-level entry, JD.com's instant delivery service does not have a significant advantage. According to 36Kr, after being promoted to a first-level entry, JD.com's instant delivery service had approximately 2 million daily active users. In comparison, Ele.me had approximately 21.546 million daily active users as of October 2023, indicating that JD.com's instant delivery service has less than 10% of Ele.me's daily active users.

▲ Image source: 36Kr

From a traffic perspective alone, diverting scarce e-commerce traffic from the main site to food delivery is not a viable option. Food delivery has unique local supply and fulfillment characteristics, differing from the traditional e-commerce business model of 'traffic * conversion = GMV'. The advantage of large-scale traffic in the e-commerce realm does not translate well, especially considering Douyin's failed attempt to shake up the market landscape despite its massive traffic.

If food delivery is seen as a new high-frequency traffic entry, this chain is too long. Food delivery requires rebuilding distribution and supply networks based on local cellular supply, with profits far lower than those of the main site's 3C digital products and POP platform commissions. From an input-output ratio perspective, it is not a cost-effective venture.

A Morgan Stanley report posits that JD.com's food delivery business will have a limited impact on the market landscape, noting that the food delivery market has high barriers and significant losses are expected in the early stages.

02 Food Delivery: A Prolonged Offline Battle of Attrition

JD.com's interest in the food delivery business is not new.

Dating back to 2014, Dada's emergence was a strategic move by JD.com in the instant delivery market, paving the way for its foray into food delivery.

In 2022, Xin Lijun, then CEO of JD.com Retail, publicly stated that JD.com was considering entering the food delivery market, garnering widespread industry attention. In 2023, JD.com further renamed its instant retail business to 'Hourly Delivery'.

▲ Image source: Dada's official Weibo account

Notably, Dada, as a logistics service provider under JD.com, has grown into the main transportation force for JD.com's food delivery. According to public information, Dada currently has approximately 1.3 million active riders. Moreover, when Douyin and Kuaishou announced their entry into the food delivery market in the previous two years, Dada was also one of the main logistics service providers.

Dada's meal delivery business can effectively leverage its existing transportation capacity. Simultaneously, considering the growing demand for delivery services in the instant retail market, JD.com's support for Dada is crucial to its layout in the instant retail sector.

However, it's crucial to recognize that the food delivery sector is a resource-intensive battle, with cities, business districts, and even catering businesses as the smallest units. Judging from JD.com's past endeavors, it is not adept at this kind of prolonged battle of attrition involving repeated tugs and pulls.

First, the food delivery business differs from e-commerce. Its transaction model is a typical cellular network, with fulfillment highly dependent on local cities, and the supply side being extremely fragmented. It's a long-term battle of attrition requiring 'building strong forts and fighting stubbornly'. JD.com's logistics and supply chain advantages in the e-commerce realm are difficult to repurpose, with its strengths lying in city-level warehousing and distribution capabilities.

Furthermore, re-engaging millions of catering businesses nationwide poses a significant 'supply replenishment' challenge. Based on externally disclosed progress, JD.com's food delivery service did not adopt a direct sales model in its initial promotion but instead promoted through service provider agents, focusing on entering 39 cities and offering agents commissions ranging from 120 yuan to 200 yuan per new store. This means JD.com's food delivery service has fallen into the same ground battle as Ele.me and Meituan's food delivery services, forcibly grabbing supply through stacking manpower and resources.

Second, the daily active user count of the instant delivery entry is insufficient, and e-commerce traffic from the main site is also hard-pressed to provide effective support for the food delivery business.

From a DAU perspective, JD.com's instant delivery service has only about 2 million daily active users as a first-level entry, with even more limited distribution to the food delivery entry in the second-level channel. Additionally, Guosen Securities' research report analysis suggests that from a traffic perspective, JD.com's main site has 600 million annual purchasing users, while JD.com Home has less than 100 million users, with a penetration rate of less than 20% for instant retail. JD.com App users' mindset towards near-field retail/food delivery is still relatively weak compared to Meituan, and traffic reuse efficiency is low.

Third, there are significant challenges in 'switching from low frequency to high frequency'. JD.com first launched instant delivery and then food delivery, adopting a reverse strategy of 'low frequency driving high frequency'. Unlike Meituan and Ele.me, which entered non-food categories from food in the past, JD.com is doing the opposite. In the local fulfillment sector, it first entered relatively low-frequency daily necessities and then attempted to enter high-frequency catering. This process of replenishing supply and filling transportation capacity will be extremely lengthy and require huge resource investments.

03 New Business Cannot Cure JD.com's 'Anxiety'

JD.com is neither the first nor the last to enter the food delivery market.

Over the past decade, companies such as Baidu, Didi, Alibaba, SF Express, Douyin, Kuaishou, and WeChat have all sought a piece of the food delivery pie, investing resources and funds. However, most internet companies made a lot of noise but little action, treating food delivery as a supplementary business and strategically scaling back or shutting down operations gradually.

In 2018, Didi entered the food delivery sector to consolidate its ride-hailing business, claiming to have secured the top share of the local food delivery market on the first day of its launch in Wuxi. However, this diversification attempt was short-lived, as Didi slowed down its expansion within less than a year and officially announced the termination of its domestic food delivery business in early 2019.

Following closely, Douyin laid out its food delivery strategy in 2022, initially exploring through cooperation with Ele.me and subsequently launching the 'Group Purchase Delivery' service, relying on a third-party delivery system. In 2024, Douyin further upgraded its food delivery business, integrating 'Group Purchase Delivery' into 'Random Group', achieving a unified entry for both dine-in and takeout services, and continuing to explore and adjust in the food delivery field. However, recently, Douyin's food delivery strategy has been scaled back, moving from the local life department to the e-commerce department.

With many failed precedents, why is JD.com still entering the market?

From a motivational standpoint, JD.com has been eager for high-frequency businesses in recent years. The food delivery business, with its high frequency and high repurchase rate, has caught JD.com's attention. Additionally, recent media reports have revealed that JD.com has launched an online ride-hailing business on its App, entering the equally high-frequency ride-hailing sector through an aggregation model and cooperation with third parties.

Putting ourselves in JD.com's shoes, by continuously expanding into high-frequency businesses, transforming itself into a super entry App, and broadening its service boundaries to complement the main site's business, this is a typical scale-first approach in the era of e-commerce competition.

However, the real issue is that behind these seemingly high-frequency entries lie substantial investments. Ride-hailing and food delivery, akin to each other, also require starting from scratch to compete for transportation capacity and replenish supply. JD.com will inevitably stumble into the same pitfalls encountered by Didi and Douyin.

Furthermore, today's internet competition has long surpassed the 'scale-first' mentality of the high-growth era. This approach is clearly inadequate for the current landscape of stock competition. Notably, following JD.com's core e-commerce business slipping to fourth place, one must wonder: How sustainable is this relentless expansion of business boundaries, traffic acquisition, and resource investment? Moreover, what is JD.com's threshold for enduring a protracted war of attrition that necessitates 'prolonged financial infusions'?

These challenges necessitate JD.com to embark on a journey of trial and error, continually validating its strategies.