ASIC Competition: Marvell Versus Broadcom - Who Will Prevail?

![]() 01/23 2025

01/23 2025

![]() 505

505

*Note: This article contains hidden valuation sections not fully displayed here. Interested readers can access the Longbridge App and search for "Dolphin Investment Research" to view the full article with complete content.

In our previous article, we analyzed Marvell's overall business situation, with a focus on its core data center business. This article delves into Marvell's performance projections and compares them with Broadcom. Using specific data, we assess Marvell's business outlook and current investment value. When reviewing Marvell's financial reports, one may notice "abnormal values" due to factors like asset amortization, prompting the company to make financial adjustments. After stripping these adjustments, Marvell's operational data remains consistent.

Dolphin Investment Research first adjusts Marvell's financial report and then makes assumptions and projections for its main business revenue, gross profit margin, and operating expense ratio to calculate the company's specific operational performance.

Considering the company and industry scenarios, the following assumptions are made:

1) The ASIC market Marvell operates in is expected to maintain a compound annual growth rate of 45% (2023-2028), with the company's market share increasing from 5% to approximately 20%.

2) Marvell's optoelectronic products, switching chips, and storage products are expected to grow at or slightly above industry rates.

3) Due to ASIC products' relatively low gross profit margin, the company's gross profit margin is projected to decline by a low to mid-single digit to the range of 55-60%, with combined R&D and sales/management expense ratios falling to 20-25%.

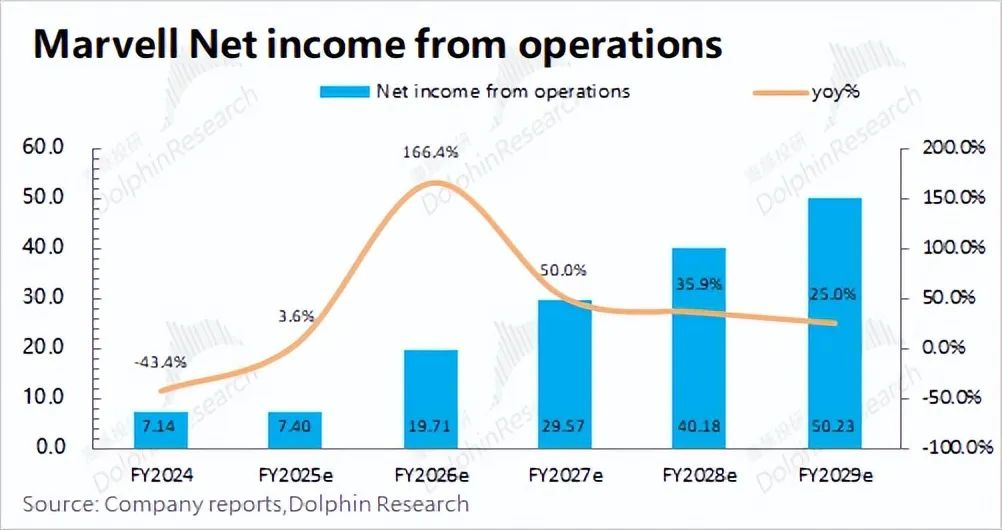

As a result, Marvell's operating net profit is expected to reach $5 billion by 2028 (FY 2029), with a compound annual growth rate of around 60%.

Since both Marvell and Broadcom are key players in the ASIC field, Dolphin Investment Research compares their performance outlooks for 2026. Considering their current market capitalizations, the PE valuations of their respective operating net profits in 2026 are xxxx... (The valuation details are hidden. Please visit the "Dynamics - Investment Research" section of the Longbridge App to view the full article).

Broadcom and Marvell's performance outlooks are based on current company and industry conditions. If ASIC industry growth exceeds expectations, both companies will benefit. If driven by downstream customers, Marvell's market share exceeds expectations, it will benefit more.

Regarding the choice between Marvell and Broadcom, Dolphin Investment Research believes it depends on investors' preferences. Broadcom appeals to those who prefer market leaders, while Marvell offers better performance elasticity.

Below is a detailed analysis:

I. Unveiling Marvell's Financial Report

Before projecting performance, let's examine Marvell's financial report. As the company is still affected by asset amortization, the reported data does not fully reflect its operational situation.

After adjusting Marvell's financial report, Dolphin Investment Research found significant differences. For instance, Marvell's adjusted gross profit margin stabilizes around 60%, while the original report shows frequent fluctuations, directly impacting expectations.

Adjustments like asset amortization mainly impact gross profit, operating expenses, and taxes. Adjusting each component separately provides a clearer view of the company's actual operations.

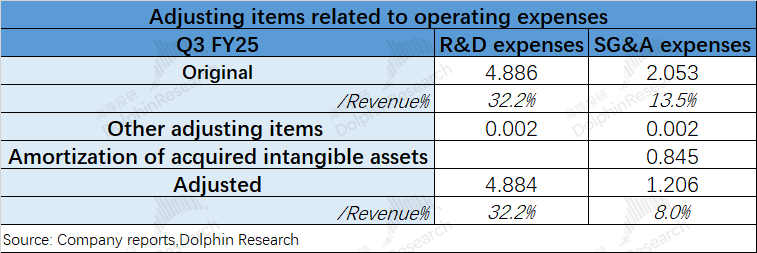

1.1 Operating Expense Adjustments

Marvell's operating expenses are mainly affected by stock-related compensation, amortization of acquired intangible assets, and other items. Stock-related compensation is stable and a long-term expense, so it's included in operating expenses.

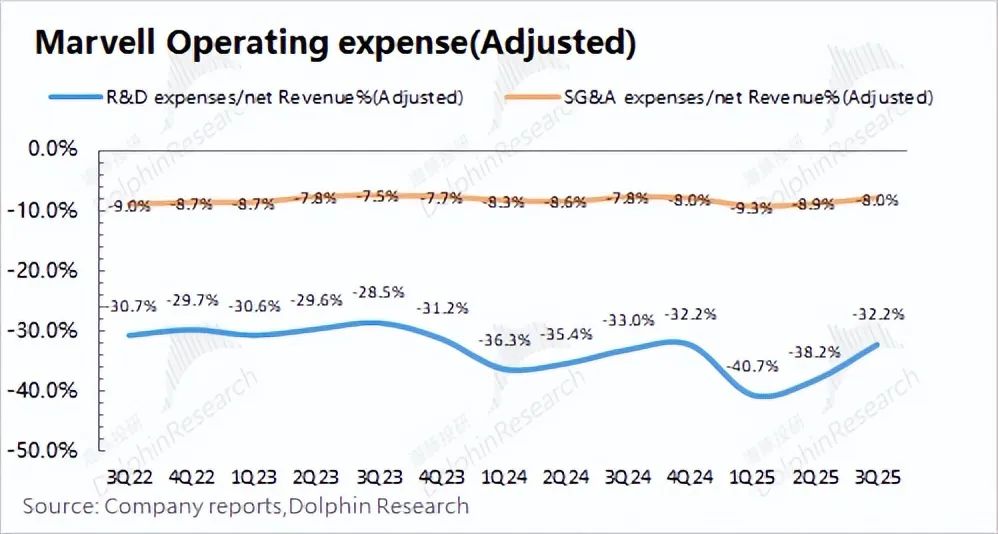

Currently, R&D expense adjustments are minimal. As intangible asset amortization is also included in sales expenses, the adjusted sales expense ratio falls to around 8%.

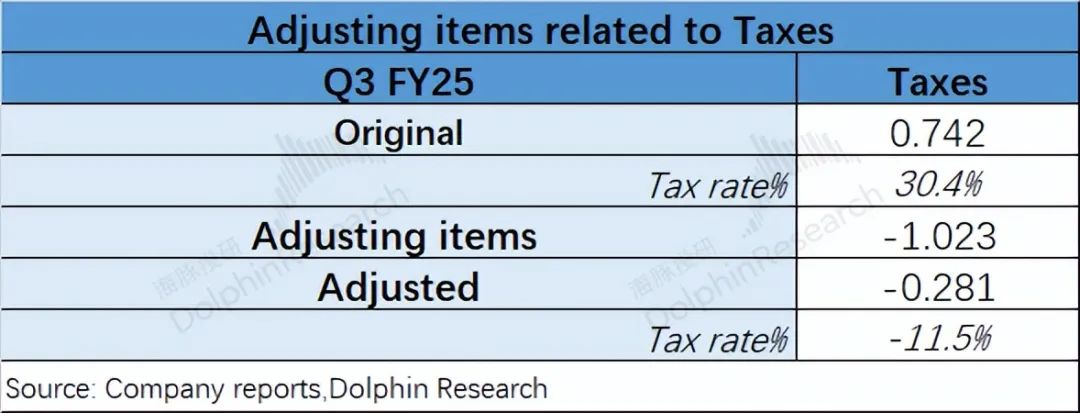

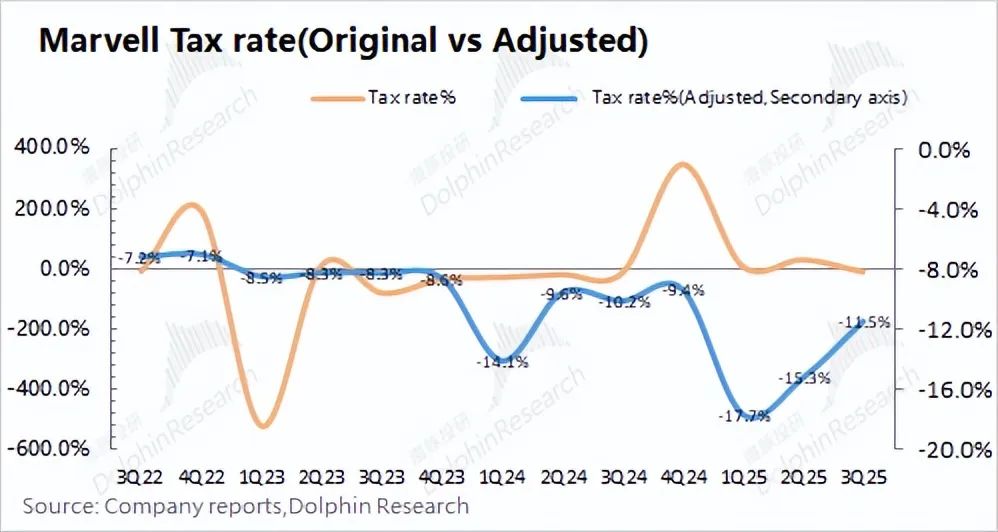

1.2 Income Tax Adjustments

Marvell frequently adjusts its income tax data, causing significant tax rate fluctuations in the original report. Using adjusted data, the current income tax rate remains around 10%.

1.3 Operating Net Profit Situation

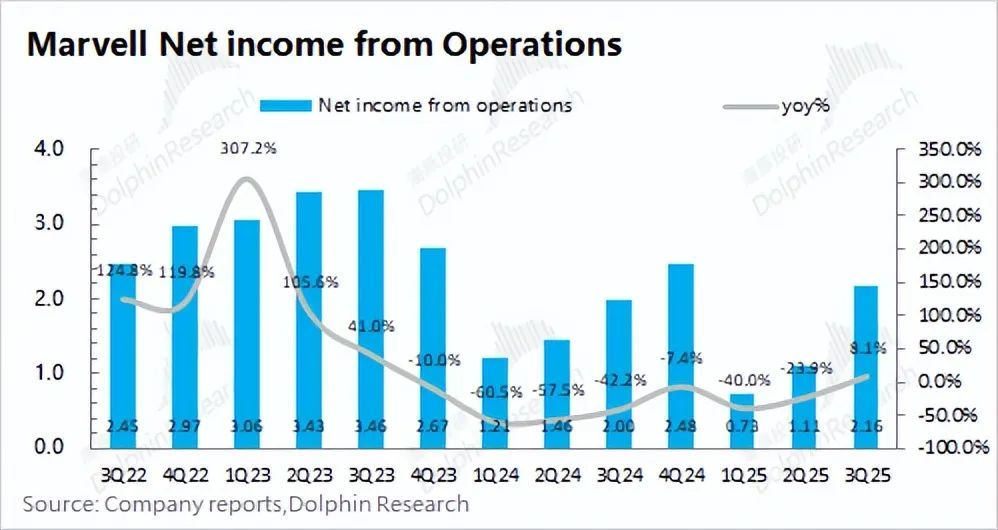

Adjusting Marvell's gross profit, operating expenses, and income tax reveals the true state of its operations. Previously impacted by the decline in 5G operator infrastructure, operating profit fell but recovered due to data center development.

II. Marvell's Revenue Breakdown Expectations

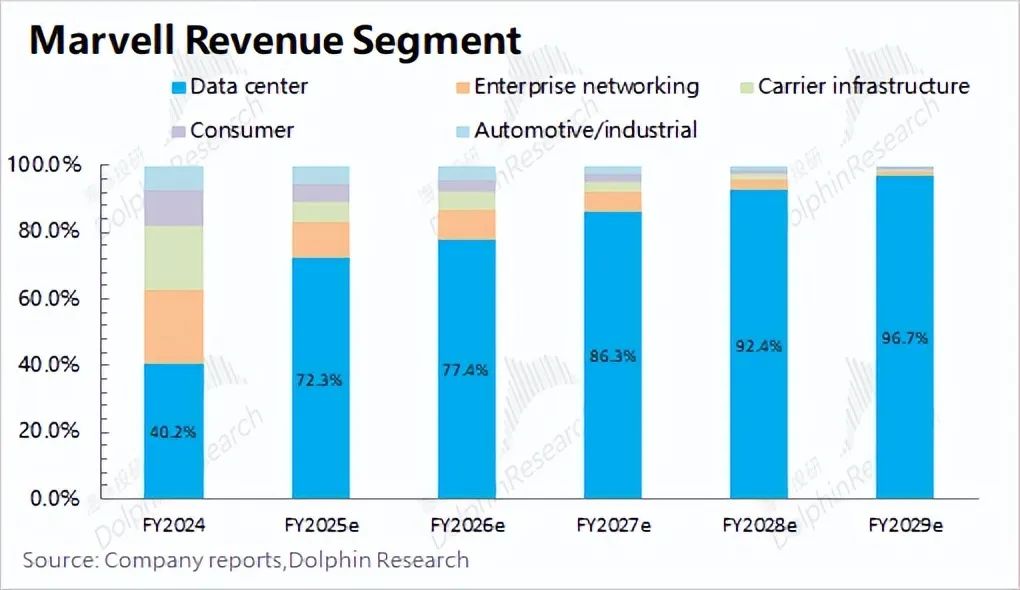

Marvell's operational performance projections are based on adjusted financial report data and revenue/expense ratio projections. As data center business accounts for over 70%, it will be emphasized.

2.1 Data Center - ASIC

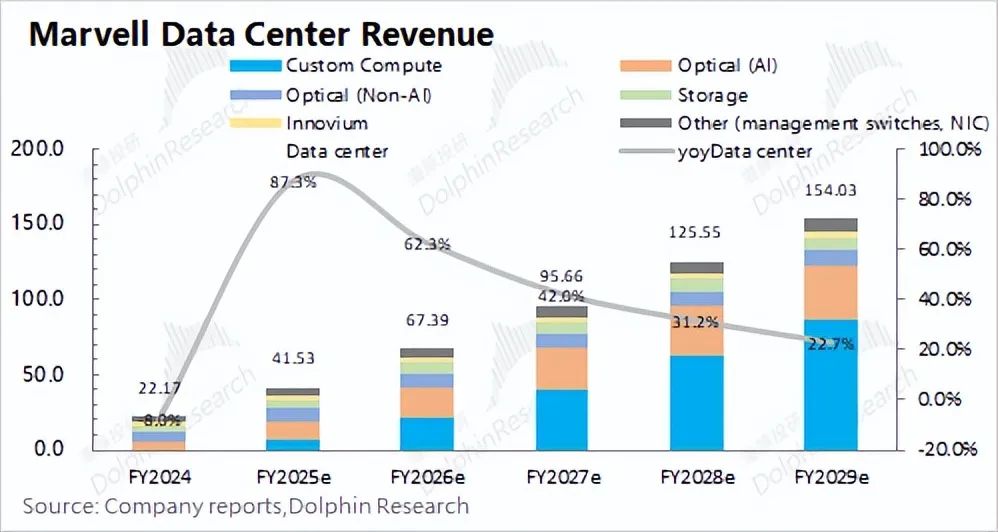

Marvell's data center business includes ASIC, optical modules, switching chips, and storage internal control chips. ASIC is expected to be the main growth driver.

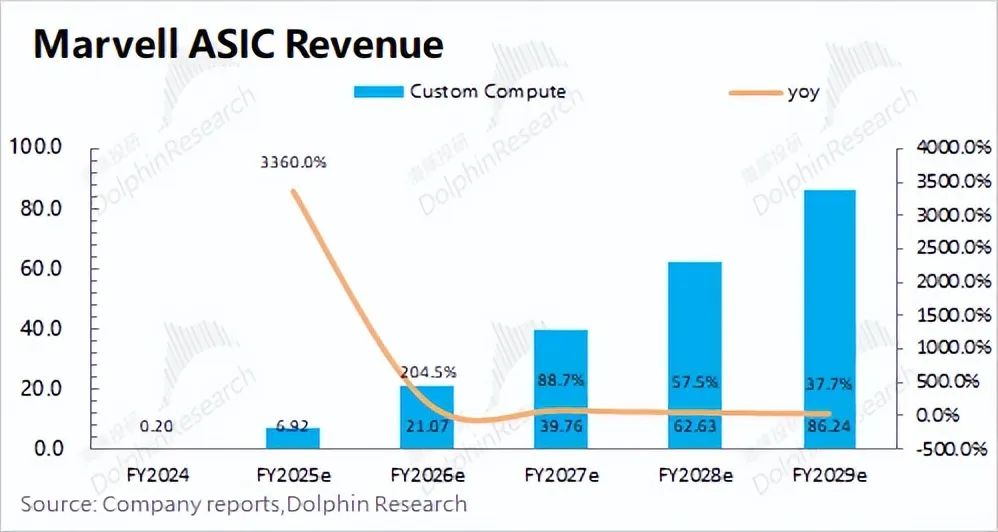

The ASIC industry where Marvell operates is projected to grow to $42.9 billion by 2028 (FY 2029), with a 45% CAGR. Dolphin Investment Research expects Marvell's ASIC revenue in FY 2025 to be $600-700 million, with a 5% market share (Broadcom at 80%, others at 15%). With increased demand, Marvell's market share is expected to reach 20%.

Overall, Dolphin Investment Research expects Marvell's ASIC revenue to grow to $8.6 billion by FY 2029, with an 88% CAGR, exceeding industry growth and increasing market share to 20%.

2.2 Data Center - Other Businesses

Besides ASIC, other data center businesses will also benefit from AI server shipments but with weaker growth than ASIC.

1) Optical Module Optoelectronic Products: Including DSP for AI servers and other optoelectronic products. The market is expected to grow to $13.9 billion by 2028 (FY 2029), with a 27% CAGR.

Dolphin Investment Research expects high-end optoelectronic products to drive growth, with annual revenue exceeding $3 billion. Non-AI products will grow steadily, maintaining around $1 billion. Together, optoelectronic products are expected to grow to over $4 billion by 2028 (FY 2029), with a 20%+ CAGR. Marvell leads the DSP market (over 50%), with product growth close to industry rates.

2) Ethernet Switching Chip Products: Capabilities from acquired Innovium. The market is expected to grow to $12 billion by 2028 (FY 2029), with a 15% CAGR.

Dolphin Investment Research expects Innovium's current annual revenue to be around $200 million, with a 3% market share. With increased shipments, revenue and market share will grow. Innovium is expected to reach around $400 million by 2028 (FY 2029), with a CAGR slightly above industry growth.

3) Storage Products: Focusing on HDD controllers and enterprise SSDs. The market is expected to grow to $5.9 billion by 2028 (FY 2029), with a 7% CAGR.

Dolphin Investment Research expects current annual storage revenue to be around $600 million, with a 10%+ market share. Driven by data center demand, storage revenue is expected to exceed $800 million by 2028 (FY 2029), with a CAGR slightly better than industry growth.

Overall, driven by AISC and AI servers, Marvell's data center business is expected to grow to $15.4 billion by 2028 (FY 2029), with a 40% CAGR.

2.3 Marvell's Traditional Businesses

Marvell's traditional businesses account for a smaller proportion. After 5G infrastructure investments declined, these businesses will remain stable.

Dolphin Investment Research expects: ① Enterprise network and operator infrastructure: Single-digit growth post-recovery; ② Consumer business: Mainly home broadband routers, with single-digit growth; ③ Automotive and industrial: Driven by IoT demand, double-digit CAGR.

Combining data centers and traditional businesses, Dolphin Investment Research expects Marvell's operating revenue to grow to $15.9 billion by 2028 (FY 2029), with a near-30% CAGR. Driven by AI demand, data center business will account for over 95% of revenue, transforming Marvell's business structure.

III. Marvell's Operating Performance Outlook

Besides revenue projections, gross profit margin and operating expenses must also be projected to infer performance. Adjusting Marvell's financial report reveals its current gross profit margin and expense ratios.

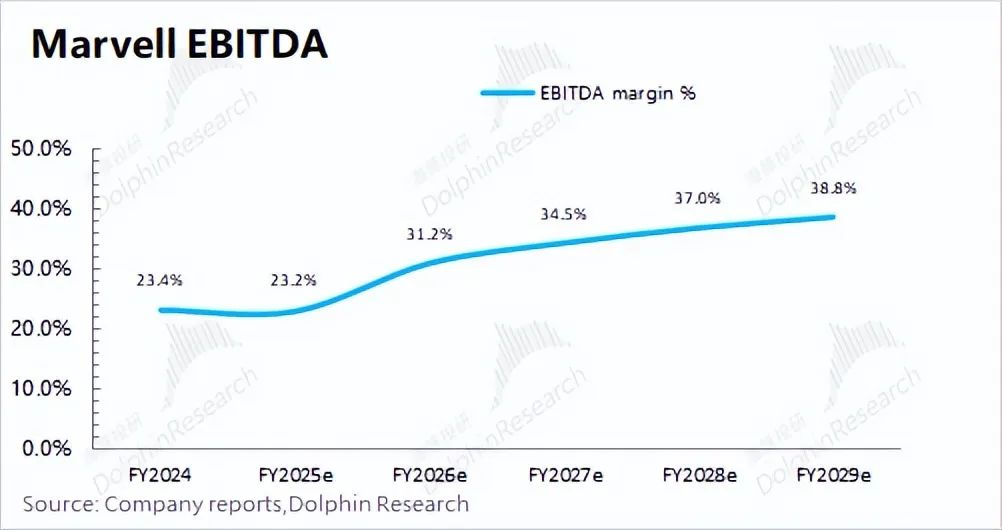

Dolphin Investment Research projects future gross profit margin, R&D expense ratio, sales/management expense ratio, and tax rate. ① Gross profit margin: After adjustment, the overall operating gross profit margin remains above 60%. Due to ASIC's lower margin, it will impact the overall margin. With data center growth, the gross profit margin is expected to fall to 55-60%.

② R&D and sales/management expense ratios: After adjustment, these ratios are around 34% and 8%, respectively. Dolphin Investment Research expects continued investments but with high revenue growth, these ratios will decline to 20-25%.

③ Income Tax Rate: Upon adjusting the financial report data, it becomes evident that the company's income tax rate has consistently hovered between 8-12%. Dolphin Investment Research anticipates that this rate will remain stable at approximately 10% in the foreseeable future.

In this hypothetical scenario, Dolphin forecasts the company's net profit to surge to $5 billion by 2028 (fiscal year 2029), reflecting a remarkable compound annual growth rate of up to 60%. As the data center business expands and expense ratios decline, the company's EBITDA is also projected to experience sustained improvement.

IV. The Marvell vs. Broadcom Dilemma

In the AISC market, Marvell and Broadcom stand as pivotal players. By supplying products to major cloud service providers, both companies' AI data center-related businesses are poised for substantial growth, serving as the primary catalyst for revenue expansion.

1) Core Clientele and Market Concentration

Marvell and Broadcom each boast their own ASIC core clientele. Marvell's key customers encompass Amazon, Google (for CPU products), and a potential client in Microsoft. On the other hand, Broadcom's major clients include Google (for TPU products) and Meta, with ByteDance as a potential prospect. Although some cloud vendors have collaborated with Taiwan-based suppliers like World Semiconductor, the latter's product capabilities still trail those of Broadcom and Marvell. Consequently, it is anticipated that cloud vendors will continue to collaborate with Broadcom or Marvell for the joint development and production of core products in the years to come. With the successive launch and mass production of major clients' products, the ASIC market's influence is expected to further concentrate on these two companies.

2) Marvell's Enhanced AI Focus

Based on company and industry dynamics, Dolphin projects Marvell's data center business to reach $15.4 billion, accounting for over 95% of total revenue. Meanwhile, Broadcom's data center-related networking business is also experiencing rapid growth, surpassing $50 billion. However, Broadcom still maintains a significant presence in other businesses, with its networking business proportion anticipated to increase to 80%. While Broadcom boasts a larger revenue base and a higher market share, Marvell's data center-related revenue comprises a greater proportion of its total revenue, underscoring its stronger focus on AI.

3) Performance and Valuation Comparison between Marvell and Broadcom

Given that Marvell and Broadcom are currently heavily influenced by ASIC growth, market share prices have already partially incorporated expectations for future AI growth. With ASIC market growth expected to stabilize from 2026 onwards, this comparison focuses on the companies' situations in 2026. Considering company and industry conditions, Dolphin anticipates both Marvell and Broadcom to achieve revenue growth of approximately 30%, primarily driven by data center-related businesses (ASIC).

The following data exclusively considers operational conditions, excluding the impact of amortization, depreciation, and other factors. Broadcom's gross margin significantly outpaces Marvell's, primarily due to Broadcom's software business, which boasts a higher gross margin, thereby elevating the overall gross margin. By 2026, Broadcom's operating net profit is forecasted to reach $39.1 billion, substantially exceeding Marvell's $2.96 billion. However, Broadcom's growth rate is slightly lower than Marvell's, primarily attributed to Marvell's higher AI revenue proportion and greater potential for a decline in operating expense ratios (current expense ratios: Marvell 42% vs. Broadcom 27%).

Considering Broadcom's ($1.056 trillion) and Marvell's ($99.6 billion) current market values, the companies' corresponding 2026 PE valuations are xxxx... (Valuations are hidden content. Please access the Longbridge App's "Dynamics - Investment Research" section to view the article with the same name for detailed figures).

Regarding the choice between Marvell and Broadcom, Dolphin believes it primarily hinges on market preferences. If you prioritize market leadership, Broadcom's position is more entrenched. Conversely, if you seek the flexibility of performance improvement, Marvell's performance may be relatively superior.

Dolphin Investment Research Broadcom-related articles review: In-depth: December 4, 2024 company in-depth "Broadcom (AVGO.O): Winning Both in Software and Hardware, An Alternative Winner in the Era of AI Computing Power" September 13, 2024 company in-depth "Broadcom: 'Buying and Buying' Paves the Way to 'Trillion Dollars'? Tencent and Alibaba, Take Note!" Financial Report: December 13, 2024 financial report review "Will ASIC Surpass GPU? Broadcom's Best Days Are Yet to Come" September 6, 2024 financial report review "Broadcom 'Gone Wild'? AI Can't Support the Collapse of Traditional Semiconductors"