Cross-border E-commerce's 2024 Reflection: Sellers' Competition, Market Expansion, and Tariff Tightrope

![]() 01/21 2025

01/21 2025

![]() 515

515

China is no longer merely the world's factory; the world has become China's market.

This year, competition among cross-border e-commerce platforms intensified as they vied for Chinese industrial belt merchants. Platforms like Temu, Shein, and TikTok Shop stepped up their efforts to attract these merchants. International giants like Amazon and Walmart also began to focus on Chinese merchants, aiming to draw more Chinese sellers into their ecosystems. Leveraging mature supply chains and efficient productivity, Chinese sellers have emerged as a significant force in the global e-commerce market that cannot be overlooked.

However, as more merchants flood the market, competition has grown fiercer, and the pressure of price wars and rising costs has significantly squeezed many sellers' profit margins. Balancing the need to maximize profits in the crowded red ocean markets while grasping opportunities in emerging blue ocean markets will be crucial for breaking through development bottlenecks and driving profit growth.

This year, the global expansion of Chinese cross-border e-commerce platforms accelerated further, gradually reshaping the global e-commerce competitive landscape. In terms of sales, in 2024, Temu's sales in the US market ranged between $20 billion and $25 billion, ranking third, surpassing Walmart and trailing only Amazon and eBay.

Yet, this global expansion was not without challenges. Intensifying market competition and tightening regulatory policies have added uncertainty to the future of Chinese cross-border e-commerce. In this wave of globalization, addressing challenges such as stricter regulations and rising costs, and seizing opportunities in emerging markets and branding have become significant issues that Chinese cross-border e-commerce platforms and sellers must jointly face.

I. Focusing on Industrial Belts and Competing for Chinese Sellers

2024 was a year of intense competition for Chinese sellers among major cross-border e-commerce platforms.

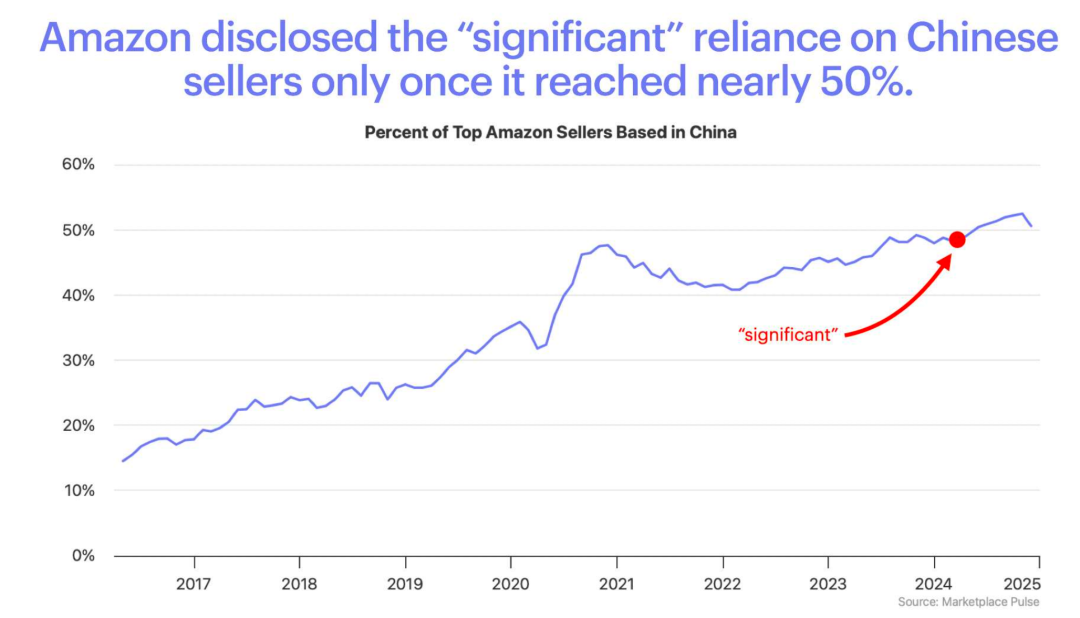

In February, Amazon acknowledged the significant position of Chinese sellers on its platform for the first time in its annual 10-K form filed with the U.S. Securities and Exchange Commission. According to Marketplace Pulse research, Chinese sellers now account for over 50% of Amazon's top sellers, with American sellers comprising about 45%, and the rest from the UK, Canada, or other countries.

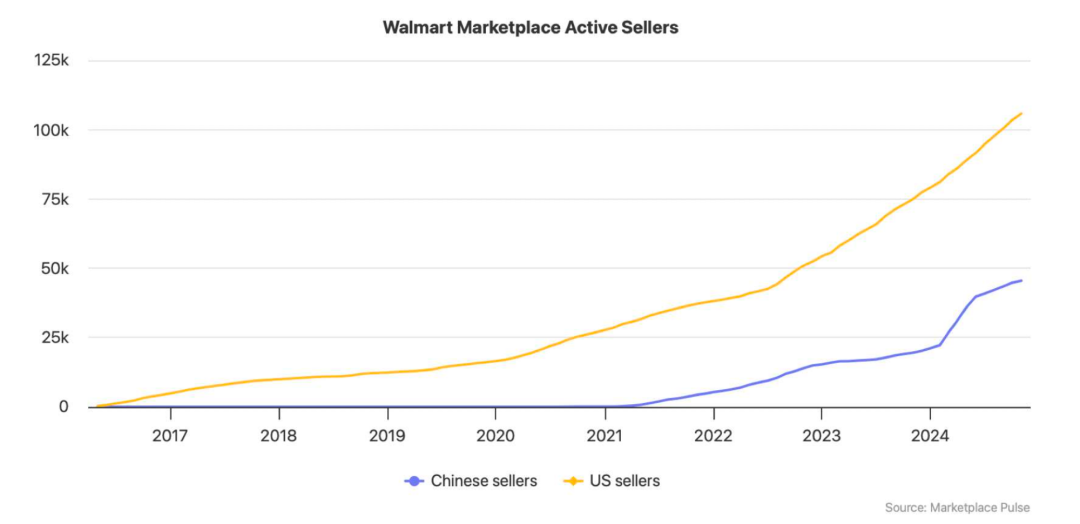

The number of Chinese sellers on Walmart's e-commerce platform also continued to rise, from 20% of active sellers a year ago to 30%.

Behind the continuous growth of Chinese sellers is the increasing attention paid by cross-border e-commerce platforms, who have begun to vigorously recruit them.

Amazon reassessed China's role as a source of overseas sales. Its China Vice President told the media in May, "In 2024, we will hold dozens of events for thousands of sellers." Over the past year, Amazon actively recruited sellers on its official WeChat account, holding live seminars almost daily for those considering listing products.

Walmart launched a Chinese version of its seller center in February and began allowing sellers to submit support cases in Chinese. In March, it held its first seller summit in Shenzhen. In June, it launched the "Wave in 10 Cities" 2024 offline city tour recruitment activities in ten cities, including Hangzhou, Shanghai, Quanzhou, Xiamen, Wuhan, Guangzhou, Suzhou, Zhengzhou, Chengdu, and Yiwu, to communicate face-to-face with local cross-border sellers and share platform policies and rules on onboarding, operations, logistics, etc.

Similarly, Chinese cross-border e-commerce platforms were also vigorously recruiting last year, primarily targeting industrial belt merchants.

Initially, Temu sent multiple first- and second-level executives to lead multiple recruitment teams, forming a recruitment team of nearly a thousand people, adopting a racing mechanism for unclassified and unlimited category competition recruitment. In October, Temu adjusted its organizational structure, merging the recruitment team and buyer team into category operations and redividing them into more than ten groups according to product categories. This shift from racing recruitment to refined category management aimed to improve recruitment conversion rates.

TikTok Shop launched the "Industrial Belt 100 Plan" in February last year, planning to enter more than 100 industrial belts in 2024 to help merchants create more than 10,000 global best-sellers. Meanwhile, TikTok Shop has been relaxing entry thresholds, notably by no longer mandating prior experience operating on third-party e-commerce platforms, which was initially required.

Last June, Shein held nearly 20 recruitment and cooperation events in 13 cities and more than 20 key industrial belts in manufacturing hubs such as Guangdong, Fujian, Jiangsu, Zhejiang, and Shandong, covering categories like apparel, home appliances, home decoration, toys, pet accessories, etc. It expected to hold more than 150 recruitment events in national industrial belts throughout the year.

Similarly, AliExpress launched the "10 billion subsidy brand going overseas" plan, where merchants can participate in a fully managed or semi-managed POP model. The "10 billion subsidy brand going overseas" project is AliExpress's top priority for 2024, targeting cross-border large sellers, Tmall brand merchants, etc.

After being refined by domestic e-commerce, industrial belt merchants are now going overseas alongside the expansion of cross-border e-commerce platforms.

II. Chinese Cross-border E-commerce Platforms Reshape the Global E-commerce Landscape

In 2024, the four emerging dragons of overseas expansion developed more rapidly, impacting the global e-commerce market environment and competitive landscape.

Taking Black Friday as an example, due to the substantial online marketing funds invested by Temu and Shein, the advertising costs for other retailers and brands on Black Friday increased. In the US, Temu bid on paid search ad keywords such as "Walmart Black Friday Deals" and "Kohl's Black Friday." Shein bid on keywords like "Walmart Clothing," "Zara Jeans," and "Mango Dresses."

From August 2022 to August 2024, the cost per click for "Walmart Clothing" increased by 16 times. Simultaneously, the prices of general keywords such as "cheap clothing online" and "shopping" also increased rapidly. This coincides with the rapid overseas expansion of Chinese cross-border e-commerce platforms.

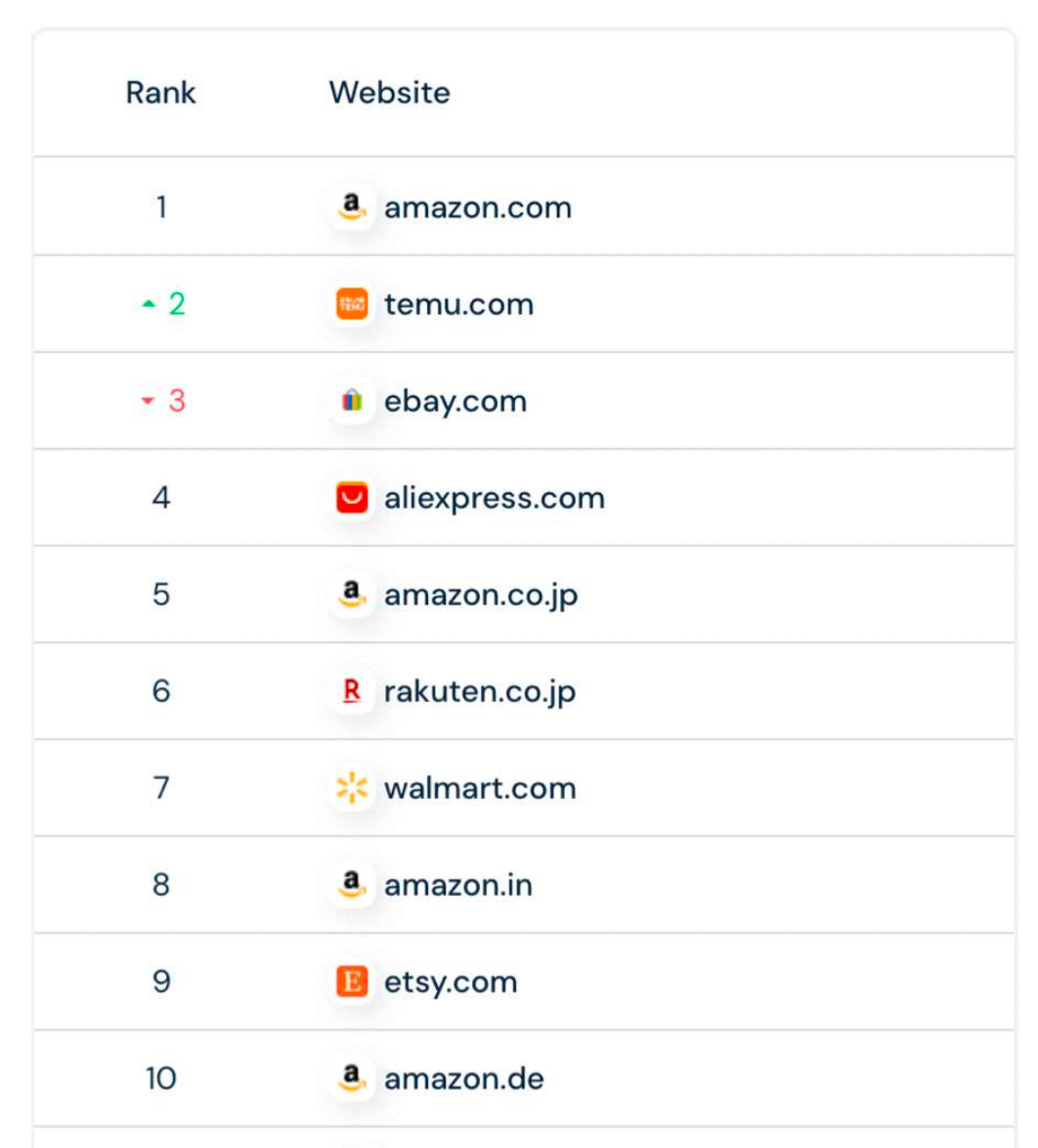

Data further confirms this trend. In 2024, Temu's downloads increased by 69% month-on-month, with a cumulative global download volume of nearly 900 million, ranking first in the overall mobile app download charts in more than 40 countries and winning the championship in global e-commerce app download and growth charts. Currently, Temu has surpassed eBay to become the second most visited e-commerce website globally.

TikTok's rise has driven rapid growth in US social e-commerce. eMarketer data shows that by 2024, the number of social buyers in the US will exceed 100 million. TikTok Shop, launched in the US in September 2023, became the largest contributor to the growth of social buyers and sales in 2024.

According to statistics from video e-commerce data analysis company Tabcut.com, TikTok Shop's global GMV reached approximately $32.6 billion. Among them, the US became TikTok Shop's largest market, with a GMV of approximately $9 billion; Indonesia was the second-largest market, followed by Thailand.

In terms of sales, in 2024, Temu's sales in the US market were between $20 billion and $25 billion, ranking third, surpassing Walmart and trailing only Amazon and eBay. TikTok Shop ranked fifth. If the two companies can operate smoothly in the US, Temu is expected to surpass eBay in sales after already surpassing it in traffic, while TikTok Shop is expected to surpass Walmart. These two companies are gradually altering the competitive landscape of the US e-commerce market.

In response to the rise of Chinese cross-border e-commerce platforms, international e-commerce platforms have made corresponding moves.

The most notable example is Amazon's launch of the low-price mall Amazon Haul in November last year, aimed at countering the impact of Temu's low-price e-commerce. Currently, it is in the internal testing phase for the first batch of sellers, with large-scale recruitment planned for 2025.

The Wall Street Journal quoted insiders as saying that Amazon began to view Shein and Temu as greater threats than retailers such as Walmart. Amazon Haul is almost a direct competitor to Temu, focusing on white-label goods priced below $20 and weighing less than 1 pound, aiming to attract consumers who want to save money and are willing to wait longer. Amazon Haul surged during Black Friday due to 50% discount promotions and recommendations on the app's homepage.

Walmart also updated its Walmart Cross-Border Ocean Shipping Solution, beginning to provide ocean shipping services from selected Chinese loading ports to managed Walmart Fulfillment Services (WFS) facilities in the US.

Additionally, to address the impact of social e-commerce, in 2024, Amazon opened the beta version of Consult-a-Friend to more sellers and added the in-app, social commerce, and sharing feature "Inspire." Consult-a-Friend allows Amazon shoppers to solicit product feedback from friends and view replies directly within the Amazon app.

Whether it's the increase in advertising costs, the development of social e-commerce, or the emphasis on Chinese sellers, it all points to Chinese cross-border e-commerce platforms changing the global e-commerce market.

III. Over 60% of Sellers' Profits Decline; Breaking Through the Red Ocean and Tapping into the Blue Ocean

In 2024, cross-border e-commerce sellers generally faced pressures such as rising costs and price wars, leading to bottlenecks in net profit growth.

According to an AMZ123 survey, more than 60% of sellers in 2024 reported a decline in net profit compared to 2023, with 32% of sellers experiencing a decline in net profit of more than 50%. Additionally, over 50% of cross-border sellers in 2024 did not meet their revenue and profit expectations. From a cost perspective, the increase in logistics and warehousing fees and marketing advertising fees was the main reason for compressing sellers' profit margins.

Among overseas markets, Southeast Asia, Europe, and the US are the main battlegrounds for cross-border merchants, but with the influx of merchants, they are gradually facing red ocean competition. On the other hand, emerging markets such as Latin America and Africa are becoming new gold-digging spots for cross-border merchants.

For example, many Shenzhen cross-border large sellers with years of experience in Southeast Asia, Europe, and the US have begun to explore logistics and market opportunities in South Africa.

A cross-border seller deeply rooted in the African market said that over a month ago, the head of a domestic logistics company visited South Africa on business. He had led many e-commerce sellers into Brazil, Mexico, and Southeast Asian markets and was now preparing to launch the South African market next year after confirming the feasibility of the logistics plan.

"The Southeast Asian market was indeed very profitable a few years ago, but now market competition is fierce, and costs are rising, leading to shrinking profits. Therefore, some cross-border merchants have begun to explore the African market." In contrast, emerging markets offer large traffic volumes, low competition, and a lack of products and merchants. For instance, doing cross-border e-commerce in South Africa has an average advertising ROI of over 40 times, with a single click cost as low as a few cents to one or two yuan.

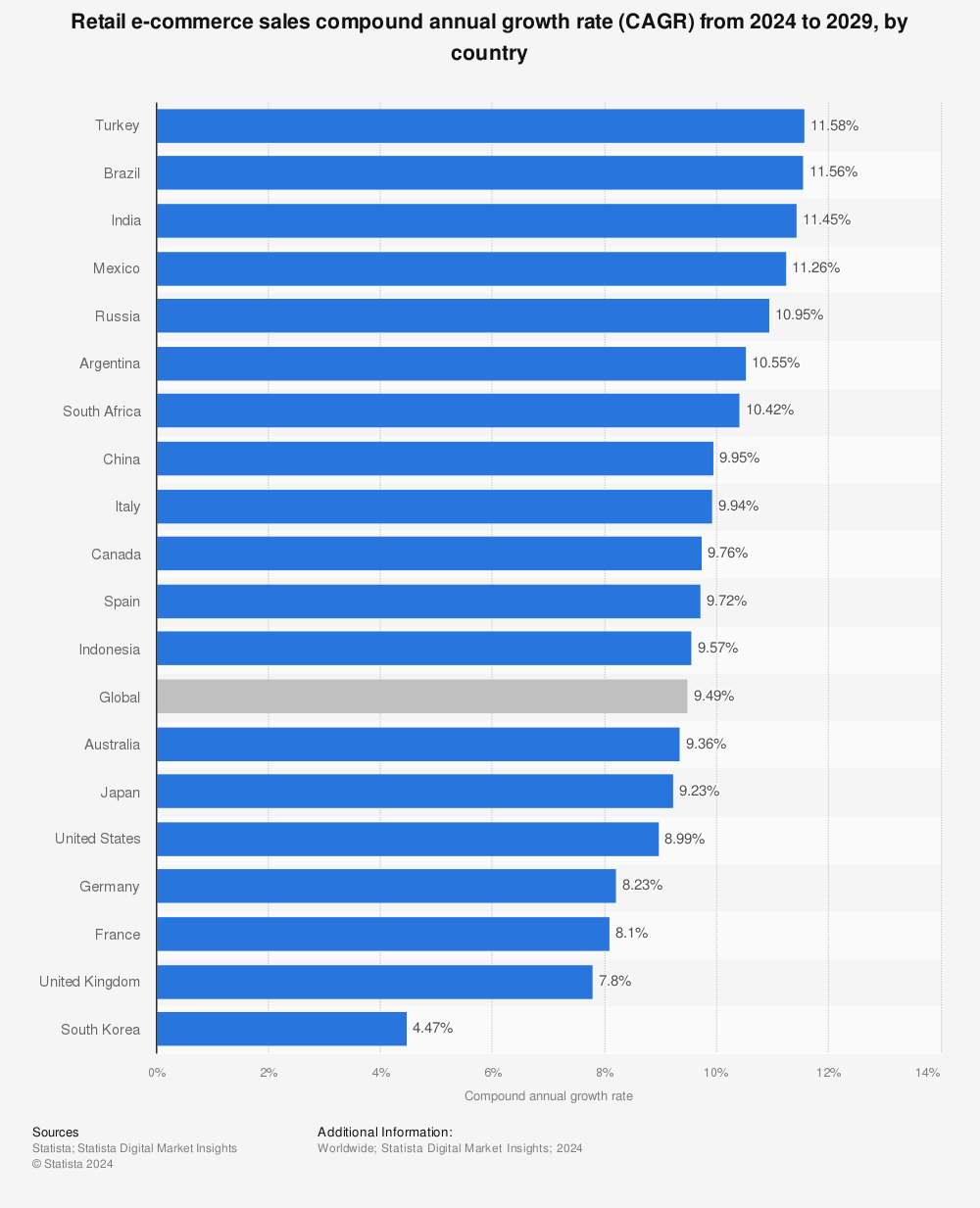

The same applies to Latin America. According to Statista statistics, the five countries with the fastest projected growth in e-commerce sales from 2024 to 2029 are Turkey, Brazil, India, Mexico, and Russia. Among them, Brazil and Mexico belong to Latin America.

For cross-border sellers, balancing the need to maximize profits in the red ocean market while grasping opportunities in emerging blue ocean markets will be crucial for breaking through development bottlenecks and driving profit growth.

IV. Facing Regulatory Challenges, Increasing Uncertainty

In 2024, Chinese cross-border e-commerce platforms faced regulatory challenges in multiple countries.

The most notable was TikTok's operation in the US. Around 9:30 am PDT on the 19th (1:30 am Beijing time on the 20th), after TikTok voluntarily announced the cessation of service, it issued a statement on the social media platform X stating that it was restoring service to US users and would work with US President-elect Trump to develop a long-term solution to keep TikTok "in the US."

Temu and Shein also encountered regulatory issues in Vietnam. In December, Temu and Shein were almost simultaneously paused in Vietnam. Currently, orders on the Temu platform cannot be processed for customs clearance into Vietnam. Vietnam's Ministry of Industry and Trade stated that customs authorities would not clear goods traded through the platform until Temu obtained the required approvals.

In an official statement, Vietnam announced that Temu has submitted a registration application, which is currently under review. Consequently, Temu's operations in the country will be temporarily suspended until the relevant agency "completes the registration process." To date, neither Temu nor Shein has resumed operations in Vietnam.

Moreover, as global trade protectionism intensifies, an increasing number of nations are adjusting their tariff policies and implementing stricter import and export controls.

Specifically, these tariff policy adjustments are targeting China's cross-border e-commerce platforms.

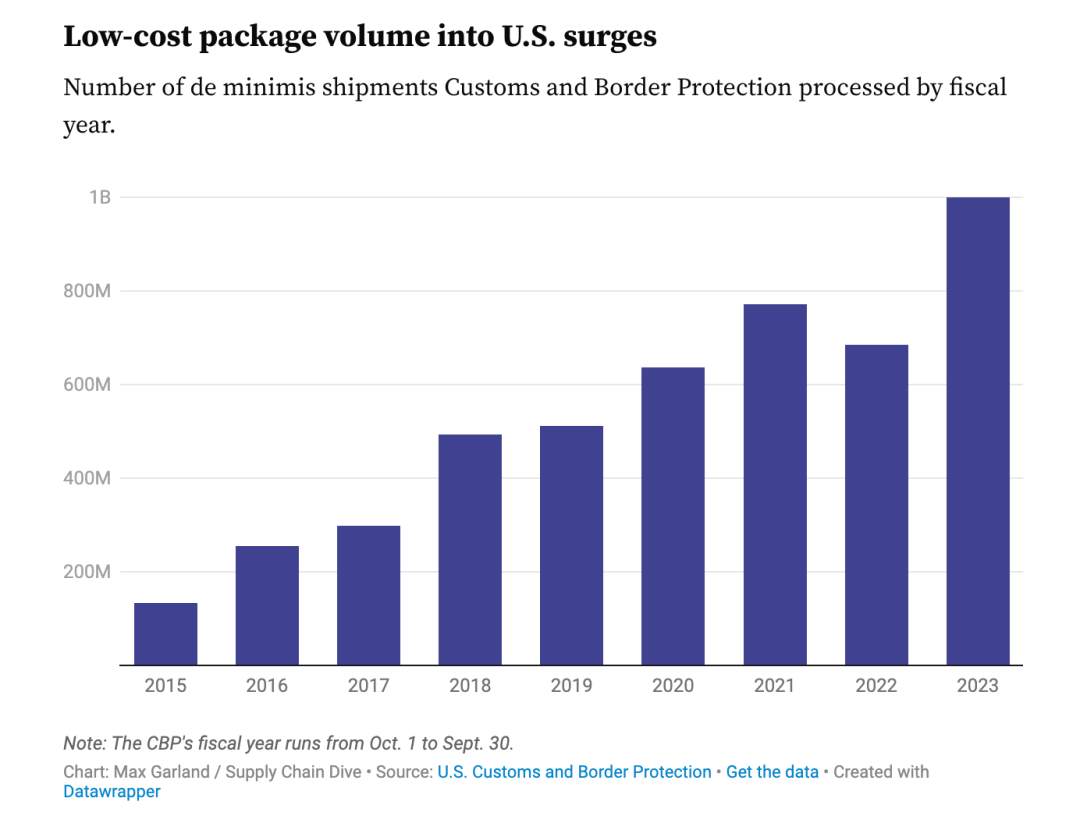

For instance, in the United States, the number of goods applying for exemption policies has surged from approximately 139 million in fiscal year 2015 to over 1 billion in 2023. American officials have highlighted that Chinese online retailers Shein and Temu are significant contributors to this increase. In Europe, in 2023, 2 billion packages with a declared value of less than 150 euros entered the EU from overseas. The Financial Times reported that the EU intends to focus on low-cost imports from Chinese online retailers such as Temu, Shein, and AliExpress.

For cross-border e-commerce platforms and merchants, the future holds growing uncertainty regarding regulatory policies, particularly the gradual phasing out of the "de minimis exemption" tariff policy. This shift is likely to result in higher operating costs and reduced price competitiveness, thereby impacting the competitiveness of Chinese cross-border e-commerce platforms and merchants in international markets.

However, this shift also presents an opportunity for China's cross-border e-commerce sector to transform, focusing on overseas supply chains, product exports, and brand expansion. In the future, the competitive edge of China's cross-border e-commerce will be more pronounced in supply chain efficiency, product innovation, and brand value, rather than solely relying on price advantages.