Baidu's 2025 OKR Strategy: Streamlining Goals, Emphasizing Profitability, and Fostering Internal Rivalry

![]() 01/17 2025

01/17 2025

![]() 407

407

Author | Wu Xianzhi

Editor | Wang Pan

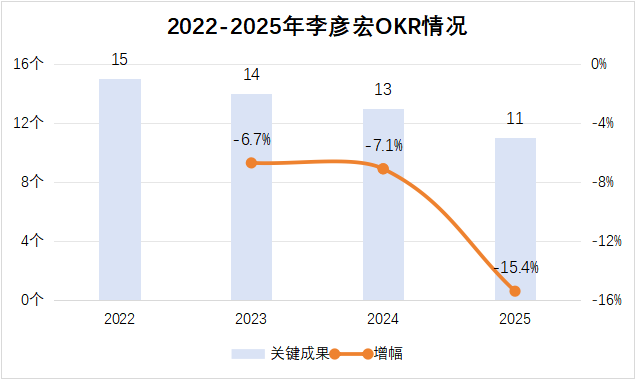

At the start of January, Baidu rolled out its 2025 Objectives and Key Results (OKR) from top to bottom. This year, CEO Robin Li's OKR witnessed the most significant changes in the past three years, featuring simplified goals, a reduced number of key results, and a substantial increase in committed targets.

The most notable change is the absence of corresponding descriptions for each goal. The four goals now solely include departmental descriptions without specific directions. In previous years, Robin Li would write a paragraph to set the tone for each of the four goals.

For instance, in 2024, O1 set the tone for the mobile ecosystem as "completing the AI-native transformation of the mobile ecosystem," and the year before that, it was "outperforming the market." This year, the goals are succinct, comprising nouns and types: O1 Mobile Ecosystem (Committed), O2 Intelligent Cloud (Committed), O3 Autonomous Driving (Aggressive), O4 Organizational Capability (Committed).

With simplified goals, the number of key results has also declined notably, and the proportion of aggressive targets has diminished. In 2023, there were 14 key results, with 7 committed and 7 aggressive. Last year, there were 13 key results, including 7 committed and 6 aggressive. This year, the number of key results has been reduced to 11, with 9 committed and only 2 aggressive.

The fluctuation in key results can be interpreted in various ways, either indicating a more focused organizational goal or suggesting a potential reduction in achievable outcomes. What truly warrants attention is the surge in committed key results from 50% to nearly 90%, signaling that Baidu's business strategy has gradually shifted from radical to conservative.

It's worth noting that domestic giants, such as ByteDance, which were among the first to introduce OKR, have successively abandoned their obsession with it. Combined with Robin Li's extremely streamlined OKR this year, it inevitably triggers various speculations.

"Old Tree Sprouts New Leaves"

As usual, Robin Li's first OKR goal involves the mobile ecosystem, with three key results focusing on overall revenue and profit, highlighting business directions, and commercial advertising strategies.

In 2025, the first key goal mentions that the cornerstone businesses of search, feed, and Baidu APP user data have all returned to positive growth. Due to inconsistencies in search data on PC and the lack of accuracy on mobile devices, it is challenging to provide precise market share data for the search market. However, it is undeniable that Baidu's search share is no longer as dominant as in previous years.

Photon Planet observed that this year's OKR statements have several points worth comparing with last year's, and a comparative analysis will be conducted later. Taking the statement of the first key result as an example, both "maintaining growth" in 2024 and "returning to positive growth" in 2025 convey a clear "stability-seeking" tone.

The second key result involves two well-developed business segments, one of which is Baidu Wenku, which has been deemed an "internal star project" in the past two years and has been included in the OKR for the second consecutive year.

Over the past three years, Robin Li has put forth numerous forward-looking views on the implementation of AI. The transformation of Baidu Wenku from marginalization to the center stage attests to this. Regarding the investment in and actual effects of Baidu Wenku, since Baidu's comprehensive AI transformation, Wenku has undoubtedly been the most successful business, transforming a marginalized business into a benchmark product with rapid user growth and significantly accelerated commercialization.

Official data shows that Baidu Wenku's paid users have surpassed 40 million, and the AI MAU of the restructured Wenku has reached 90 million. The AI DAU of Wenku has increased by 150% year-on-year, and the paid rate has increased by 60%. As of October 2024, the cumulative number of Baidu Wenku AI users exceeded 230 million, and the cumulative number of AI function uses surpassed 2.8 billion.

Apart from Wenku, Baidu Netdisk's B and C-end businesses were reclassified under MEG in September last year, and this cash cow business is also headed by Wang Ying. Wenku and Netdisk together constitute the two faces of Baidu's AI productivity tools - Face A is online storage and management, and Face B is online documents and PPTs. If it weren't for RuLiu falling behind, Baidu could theoretically form an AI collaborative office platform that is no less competitive than "Enterprise Nails".

A Baidu insider said, "MEG's performance has not been high over the past two years, and its business performance cannot be considered outstanding. However, Wang Ying is one of the few popular figures who has fought and won tough battles."

Although Wenku and Netdisk are performing well, their impact on overall revenue is far less than that of Baidu's marketing system. The reconstruction of AI for B-end applications is not as easily perceived as it is for C-end applications. In fact, while expanding content supply, Baidu is also gradually completing the generational adjustment of its marketing base, marked by Baidu Banfei.

Baidu's marketing system is complex and huge, and any change can affect the entire system. Therefore, it is much more cautious in the process of completing AI transformation than in other areas. For example, Yangji and Qingge have undergone a series of AIGC upgrades. At the end of last year, Baidu launched a new commercial system, "Baidu Banfei," based on previous efforts.

In the short term, Baidu Banfei and Baidu Fengchao will operate in parallel for some time. Gradually, they will be integrated with a series of AI marketing tools. "The future of Banfei and Fengchao will be a replacement relationship." Compared to mobile-era commercial systems like Fengchao, Baidu Banfei is actually closer to an OS, covering creative generation, recall and retrieval, as well as more deterministic advertising effects.

In previous years, the mobile ecosystem has had at least one aggressive key result, but all have become committed in 2025. Coupled with relevant statements that either seek stability or have clear revenue and profit indicators, it indicates that this year's strategy for the mobile ecosystem is quite conservative.

Fast-moving ACG, Strolling IDG

If Wenku and Netdisk are Baidu's "star secondary businesses," then intelligent cloud is undoubtedly the "star primary business" and has gradually become a new growth point amidst stagnant growth in Baidu's online advertising revenue.

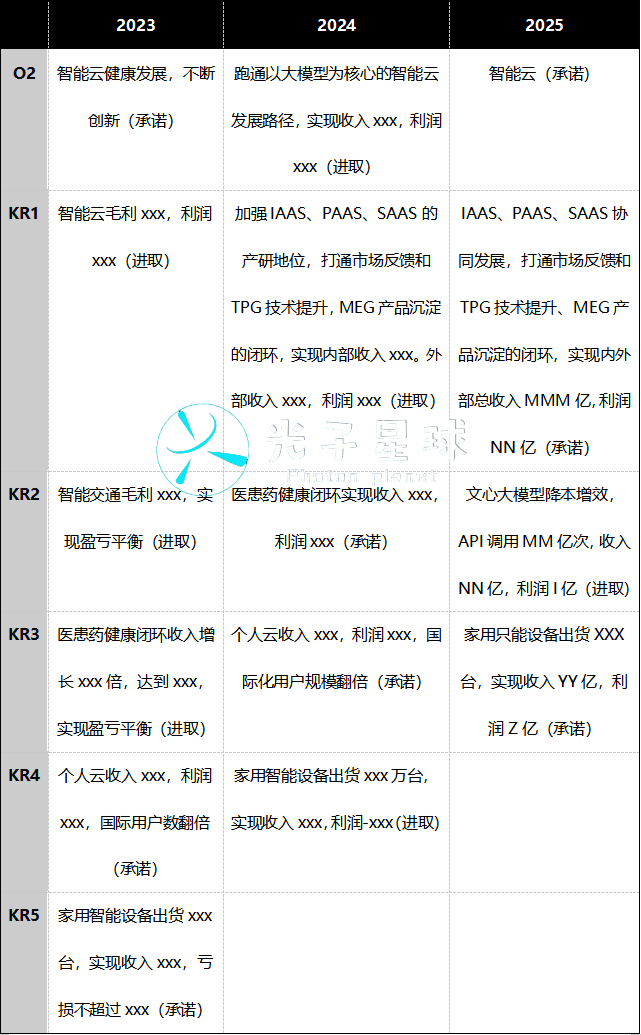

The cloud computing industry has entered a period of stable growth, and the pattern of the five leading players has stabilized. The main market for Baidu Intelligent Cloud, the government and enterprise sector, has been its primary customer in the past two years. Two positive factors have driven the growth of Baidu Intelligent Cloud's revenue. It should be noted that from 2023 to 2025, the number of key results under the second goal decreases by one each year, showing a trend of decreasing aggressive targets and increasing committed targets.

The reasons for the reduction in key results are complex.

Before 2025, the second goal of Robin Li's OKR involved many businesses, including three primary businesses of ACG, HCG (Baidu Health Business Group), and Xiaodu Technology, as well as the Baidu Netdisk Business Unit. The reduction in 2024 was due to intelligent transportation, as a toG business, not being included in the OKR after multiple considerations. The reduction in 2025 was because HCG and Netdisk were merged into MEG.

The statement of the first key result is essentially highly similar to last year's, with the only difference being that it previously only emphasized internal revenue and has now shifted to emphasizing both revenue and profit.

Baidu Intelligent Cloud started later than Alibaba Cloud and still lags behind top players in areas like IAAS, which require time to accumulate. As the first person in the industry to mention the concept of MaaS, Robin Li's venture is not the most profitable in this field.

The second key result involves ERNIE Bot. Robin Li not only has specific requirements for revenue and profit but also has specific scale requirements for API calls. It is crucial to note the first directional change regarding the ERNIE large model in the OKR statement, which begins to emphasize "cost reduction and efficiency enhancement." Obviously, Baidu's investment in the foundational large model is no longer as enthusiastic as in the past but has become more cautious.

Combined with the first key result and the increasing proportion of revenue and profit requirements, Baidu's OKR shows a high degree of KPI orientation.

OKR aims to stimulate employees to focus on results through output orientation, while KPI quantifies results to ensure that each position is filled. Toshitada Doi, former Managing Director and Head of Robot Development at SONY, said, "Performanceism destroyed Sony," referring to how KPI caused research and development to lose external motivation and internal innovation enthusiasm, with everyone's goal being to merely meet the minimum performance appraisal requirements.

In Robin Li's 2025 OKR, there are four clear statements on revenue and profit but do not provide more references for business orientation.

For example, the third key result for Xiaodu Technology has specific requirements for shipments, revenue, and profit. However, Xiaodu's performance in the education market has been somewhat surprising.

Data provided by the third-party institution Sandalwood shows that last year, the sales volume of learning machines increased by 25% year-on-year. In terms of sales share, iFLYTEK maintained the first position with a further increase in its share, while Xueersi's share remained stable with slight growth. Zuoyebang's share increased significantly in the second half of the year, jumping to third place. The share gap between the top three and the brands behind them gradually widened. Xiaodu's sales share has been falling since the second half of last year, with its ranking dropping from fifth at the beginning of the year to seventh in December, a year-on-year decline of over 50%.

The third goal has always been directed at IDG in previous years, and this year is no exception, with committed key results appearing for the first time.

At the end of 2024, after JiYue encountered financial issues, Baidu's autonomous driving business faced new challenges. Among the remaining businesses of IDG, only Luobo Kuaipao and Baidu Maps can be considered promising.

Baidu Maps emphasizes customer management (CM) as a means to achieve positive results with a C2B flavor. Photon Planet understands that at the beginning of this year, Baidu Maps planned to involve the public in its construction by connecting cycling routes, locations, points of interest, etc., within the map to enhance the product's commercialization capabilities.

Robin Li First Mentions "Internal Competition"

Every year, Robin Li's fourth goal points to organizational development, and this year is no exception.

Over the past three years, Robin Li has explored various directions for Baidu's organizational capabilities, from adapting to external changes and emphasizing adaptability in the early stages to emphasizing execution efficiency in the past two years. An insider mentioned that Robin is very puzzled why Baidu can always predict trends in advance but fails to seize opportunities well, ultimately failing to convert its first-mover advantage into sustained leadership.

Among the three key results for 2025, the views on youthfulness and enhancing organizational coordination capabilities are carried over from previous years. The new change comes from KR3, which advocates internal competition. On a professional social platform, many employees have mixed reviews about this.

Robin Li's proposal for "internal competition" has its rationale. Since 2023, Baidu has continuously restructured its existing businesses through AI, and the degree of adaptation, the progress of native transformation, and the organizational form and scale of each business are different. Old applications that have been rejuvenated, such as Wenku, Netdisk, and Banfei, new businesses like Wenxiaoyan, and the fusion of new and old, such as Free Canvas, exist in a situation of multiple lines advancing simultaneously and exploring separately in the short term.

At this time, running out some competitive products internally has the advantage of participating in market competition with lower resource investment and trial and error costs.

The disadvantage is that Baidu's internal organization is not fully connected, hindering the initial testing of businesses. For example, at the beginning of last year, the distribution of short dramas within the mobile ecosystem was not fully connected with apps, search, Baijiahao, Baidu Baike, Haokan Video, etc. By the end of the year, after all the above links were connected, Baidu short dramas achieved explosive growth.

Photon Planet has learned that Baidu short dramas have performed well in terms of commercialization and user activity, especially with user session time increasing by more than 5% - this is the best performance of Baidu APP user session time in recent quarters.

Youthfulness and organizational coordination have appeared multiple times in Robin Li's key results. In fact, youthfulness and internal job rotation are carried out alternately.

In the past year, MEG has undergone drastic personnel changes, from the head of the business group to the director level, and from advertising to content ecosystem leaders, all have new faces.

The recent cadre rotation at Baidu was directly sparked by the underperformance of its online advertising division. After stepping into the role as head of MEG, Baidu Group's Executive Vice President Luo Rong swiftly secured two prominent figures: Xiao Yang, the CTO of the mobile ecosystem, and Wang Fengyang, the head of the mobile ecosystem's commercial system.

An insider remarked, "This personnel adjustment is highly unusual for Baidu." Senior executives at the vice president level typically don't resign abruptly but are gradually marginalized before departure. "Both Xiao Yang and Wang Fengyang have over two decades of experience at Baidu. Their sudden departure suggests that Estaff is deeply dissatisfied with the advertising business's performance and necessitates a significant overhaul."

Compared to Li Zhenyu, who departed under different circumstances, these personnel changes appear more exceptional. Li Zhenyu ceased to serve as President of IDG in November 2023 and only left to venture into his own business after serving as CEO Assistant for nearly a year.

An employee commented on a professional social media platform regarding Baidu's advocacy of "internal competition," stating, "If the evaluation mechanism doesn't change, even replacing current employees with new ones won't alter Baidu's current situation." This observation hits the mark to some extent.

This year, Robin Li's "minimalist" approach to OKR may signal that Baidu's evaluation system is poised for change or even herald a fresh round of governance model transformation since 2019.