Huawei's Triumphant Return Reshapes Market: Honor and Apple Face Significant Challenges

![]() 04/10 2025

04/10 2025

![]() 514

514

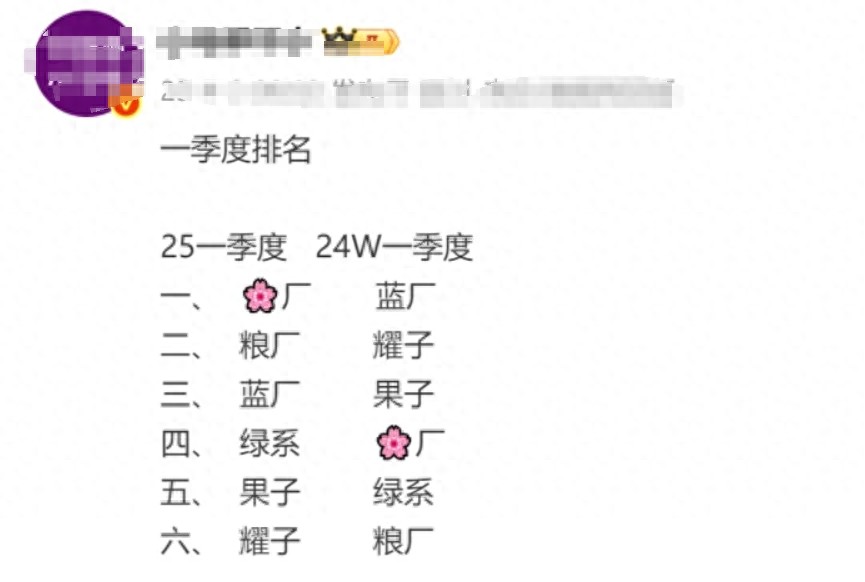

The Chinese mobile phone market in the first quarter of 2025 has revealed a surprising turn of events.

According to data leaked by an anonymous blogger (veracity uncertain), Huawei has reclaimed the top spot in market share, followed by Xiaomi, VIVO, OPPO, Apple, and Honor.

In comparison to the same period last year, Apple and Honor have experienced the most notable declines among the top six brands: Apple slipped from third to fifth place, while Honor dropped from second to sixth.

These shifts in rankings may signal that the Chinese mobile phone market is undergoing a fresh wave of profound transformations.

High-End Market: Apple's Comfort Zone Disrupted

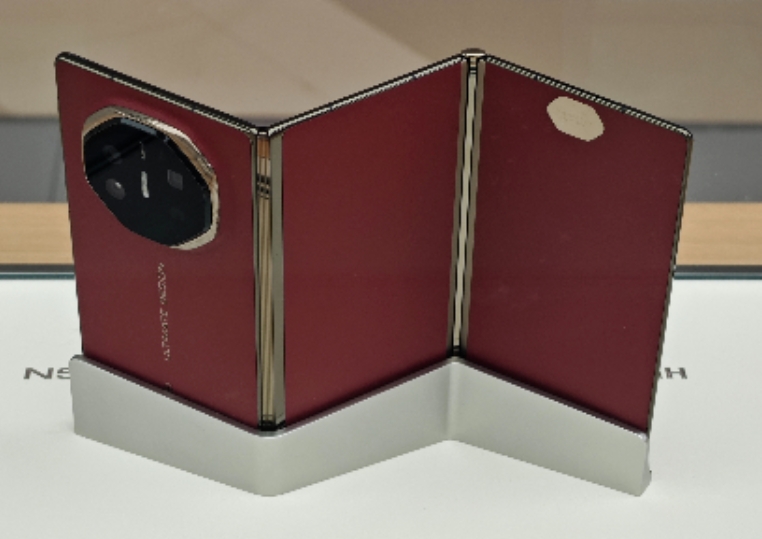

For the past three years, the high-end market segment above 6000 yuan has been Apple's stronghold. When Huawei temporarily withdrew from competition due to chip shortages, domestic high-end users had limited choices beyond Apple and Samsung, with minimal market share for other domestic premium phones.

However, the robust return of Huawei's Mate60 series, equipped with Kirin chips, has begun to shift the balance. A retail dealer acknowledged: "Two years ago, out of every 10 high-end phones sold, 8 were iPhones. Now, it's 4 Huaweis and 4 Apples, followed by brands like Xiaomi and Honor."

This change stems from a shift in genuine consumer demand. A consumer who switched from iPhone to Huawei remarked: "I chose Apple before because there were no other reliable options. Now, Huawei's technological innovations, like satellite communication, offer a differentiated experience."

A third-party teardown report indicates that the localization rate of Huawei's Mate series has surpassed 90%, and this technological breakthrough is reshaping consumers' perceptions of domestic high-end products.

Honor: The Fate of a Substitute

Compared to Apple's territorial battle, Honor's situation is more dramatic. This brand, once tasked with carrying Huawei's "spark," indeed inherited a substantial number of Huawei users in the early stages of its independence.

Offline channel data from 2022 reveals that 40% of Honor buyers explicitly stated that they "originally wanted to buy Huawei" but switched to Honor for reasons everyone understands. After all, Honor was once a sub-brand of Huawei. However, with Huawei's production capacity recovering, this substitution effect is quickly diminishing.

Manager Wang, a channel vendor in Shenzhen's Huaqiang North, analyzed the numbers: "Last year, when Huawei was severely supply-constrained, we recommended Honor to customers, and three out of ten agreed. Now that Huawei has sufficient stock, eight out of ten people directly choose Huawei." This user return highlights that post-independence, the Honor brand has yet to establish an irreplaceable core competitiveness.

The Underlying Logic Behind the Market Restructuring

In contrast to the significant fluctuations of Apple and Honor, the ranking changes of Xiaomi, OPPO, and vivo are relatively modest. This reflects that the market impact of Huawei's return has clear boundaries, primarily concentrated in the mid-to-high-end market above 4000 yuan. In the mainstream price segment of 2000-4000 yuan, each brand maintains a dynamic balance through differentiated positioning: Xiaomi emphasizes cost-effectiveness, vivo focuses on imaging, and OPPO bets on AI interaction.

Notably, during this reshuffle, the average selling prices (ASP) of all domestic brands have increased. Huawei's return not only introduces competitive pressure but also spurs technological advancements across the entire industry. As a supply chain insider noted: "When Huawei proves that domestic mobile phones can also thrive in the high-end market, the entire industry gains confidence in making upward breakthroughs."

The current market upheaval is essentially a necessary step in the maturation of China's mobile phone industry. As "substitute options" fade, the "true value" emerges, potentially marking a turning point for the industry to escape homogeneous competition and progress towards healthier development.