Analog Devices' Fiscal 2025 Q1 Financial Report: Navigating Structural Opportunities

![]() 02/24 2025

02/24 2025

![]() 478

478

Produced by Zhineng Zhixin

Analog Devices (ADI) unveiled its financial report for the first quarter of fiscal year 2025 (ending February 1, 2025) on February 19, 2025, revealing a mixed performance across core financial indicators.

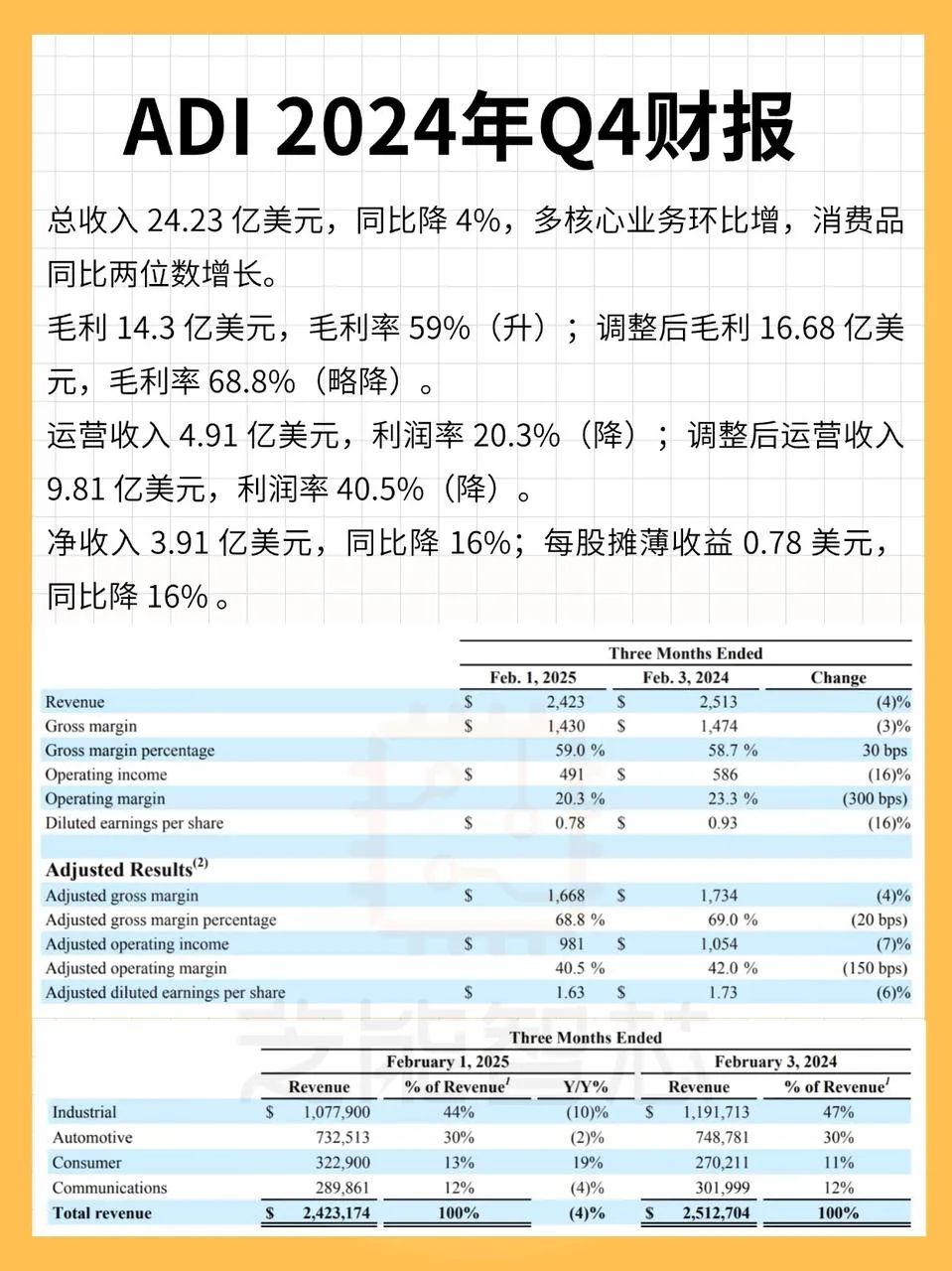

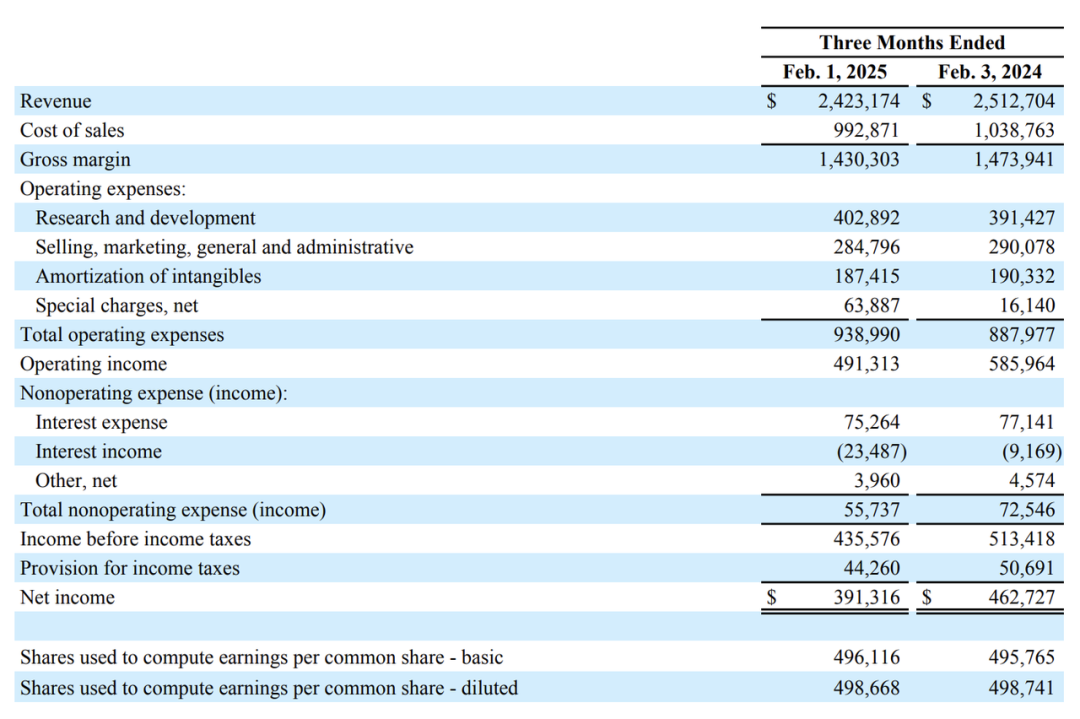

● Total Revenue: $2.423 billion, down 4% year-on-year, yet witnessing quarter-on-quarter growth in several key segments and double-digit growth in consumer products year-on-year.

● Gross Profit: $1.43 billion, representing a gross margin of 59% (up from previous year); adjusted gross profit stood at $1.668 billion, with a margin of 68.8% (marginal decline).

● Operating Income: $491 million, marking a profit margin of 20.3% (down); adjusted operating income amounted to $981 million, with a margin of 40.5% (down).

● Net Income: $391 million, a 16% decrease year-on-year; diluted earnings per share were $0.78, down 16% year-on-year.

Part 1

Q4 2024:

Cost Reductions and Efficiency Gains Bolster Profitability

● Fiscal 2025 Q1 (November 1, 2024, to February 1, 2025)

◎ ADI's total revenue amounted to $2.423 billion, a 4% decline from $2.513 billion in the same period last year. The company achieved quarter-on-quarter growth in core segments (industrial, automotive, and communications) and double-digit growth in consumer products year-on-year.

◎ Gross profit was $1.43 billion, reflecting a gross margin of 59%, an improvement from 58.7% in the prior-year period. Adjusted gross profit stood at $1.668 billion, with a margin of 68.8%, slightly lower than 69.0% in the same period last year.

◎ Operating income was $491 million, yielding an operating margin of 20.3%, down 300 basis points from 23.3% in the same period last year. Adjusted operating income was $981 million, with an adjusted margin of 40.5%, down from 42.0% in the previous year.

◎ Net income was $391 million, a 16% decrease from $463 million in the same period last year. Diluted earnings per share were $0.78, down 16% from $0.93 in the prior-year period.

● Sector-specific Performance

◎ Industrial: Contributed 47% of annual revenue but declined 10% year-on-year. Fourth-quarter revenue was $1.192 billion, bolstered by structural demand in industrial automation and energy management.

◎ Automotive Electronics: Accounted for 30% of annual revenue, with a slight decrease of 2%; fourth-quarter revenue was $749 million. ADI's presence in electric vehicle powertrains and sensors continued to grow, yet weakness in the traditional internal combustion engine market hindered overall growth.

◎ Consumer Electronics: Represented 13% of annual revenue, surging 19% year-on-year; fourth-quarter revenue was $323 million. The recovery in demand for smartphones, wearable devices, and smart homes served as a key driver.

◎ Communications: Contributed 12% of annual revenue, down 4% year-on-year; fourth-quarter revenue was $290 million. Growth was fueled by emerging scenarios such as 5G base station construction and satellite communications, but demand for traditional telecommunications equipment remained weak.

Zhineng Commentary: Despite a slowdown in revenue and profit growth in 2024, ADI demonstrated robust profit resilience through stringent cost control, a high-margin product mix (with industrials and automotives comprising over 70% of revenue), and effective cash flow management. The unexpected resurgence in consumer electronics stood out, yet cyclical fluctuations in industrials and automotive markets warrant continued vigilance.

Part 2

2025 Outlook:

Navigating Dual Opportunities from Technological Advancements and Market Recovery

The semiconductor industry, known for its cyclical nature, has entered and is sustaining a recovery phase, according to ADI. While the macro environment still influences the pace of recovery, indicators such as reduced channel inventory and gradually improving order books suggest that the industry has moved past the cycle's trough.

Positive demand growth across various business areas, coupled with new design wins, presents growth opportunities in industrial automation, surgical robots, healthcare, automatic test equipment, aerospace and defense, automotive, and communications.

Employing a hybrid manufacturing model, ADI is proactively addressing geopolitical challenges and aims to achieve dual-source supply for at least 95% of its products by the end of 2026 to early 2027, thereby enhancing supply stability and resilience.

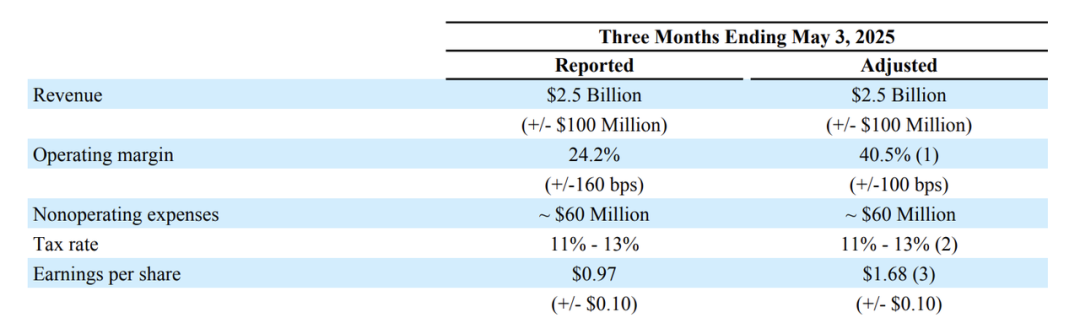

Looking ahead to fiscal 2025, ADI remains optimistic, with an expected Q2 revenue of $2.5 billion, an increase of approximately 3% from Q1, and an operating margin of around 24.2%, with an adjusted operating margin projected at 40.5%.

● In terms of market demand, ADI anticipates continued recovery in industrials and automotive sectors, with orders in these sectors growing steadily, providing strong growth momentum for the company. The consumer business is also poised for robust growth, fueled by competitiveness in consumer electronics and other end markets.

● Revenue Guidance: Expected Q2 revenue of $2.5 billion (±$100 million), up 1.5% year-on-year and 2.8% quarter-on-quarter.

● Margin Targets: GAAP gross margin of approximately 24.2%, adjusted gross margin of 40.5%;

Focusing on AIoT, edge computing, and power management, ADI will introduce a new generation of smart sensors and data converters, reinforcing its core position in Industry 4.0 and new energy vehicles.

The integration of the Maxim acquisition is deepening, with 75% of cost savings targets expected to be achieved by 2025, unlocking synergies.

By establishing its own wafer fabs and expanding capacity in Malaysia and the Philippines, ADI aims to mitigate the risk of global chip shortages.

However, price wars in the analog chip sector between Texas Instruments (TI) and STMicroelectronics (ST) may compress ADI's profit margin.

Zhineng Commentary: ADI's growth in 2025 will hinge on the differentiated advantages stemming from technological upgrades, increased penetration in emerging markets, and enhanced supply chain resilience. While short-term growth rates may be moderate, its strong positions in industrial automation, new energy vehicles, and edge intelligence are poised to support long-term development.

Summary

Analog Devices' performance in 2024 underscores its defensive moat in the analog chip sector, with its strategic focus for 2025 shifting towards higher-value-added innovative products and a global layout. With the increasing penetration of AIoT and new energy vehicles, ADI is anticipated to experience a performance inflection point in the second half of 2025.