Exclusive: Temu Shifts Strategic Focus to South Korea, Bolstering Local Warehouse Infrastructure

![]() 02/20 2025

02/20 2025

![]() 456

456

By Leon Guo Chuyu

Edited by cc Sun Congying

Global trade policies, particularly the volatile tariff measures imposed by the United States, have introduced market risks and operational challenges unprecedented in the cross-border e-commerce sector. As a rising player in this domain, Temu is not immune to these pressures. Anticipating the impact of tariff adjustments on its market share and revenue fluctuations in the U.S., Temu has reoriented its strategic focus and is actively expanding into the Asian market, with South Korea emerging as a pivotal region for its growth.

According to Wall Street Tech Eye, which sourced information from authoritative channels within South Korea's local logistics industry, Temu has officially initiated a local warehouse bidding process in the South Korean market, thereby accelerating the localization of its supply chain. Local research by Wall Street Tech Eye reveals that while the South Korean market offers tariff cost advantages due to the absence of tax limits on small parcels, it faces significant bottlenecks in the customs clearance process. South Korea currently boasts only a handful of customs clearance facilities with limited equipment, and coupled with a dwindling workforce in customs, daily clearance capacity has reached its peak. Consequently, Temu merchants opt to ship goods to South Korea via general trade exports and leverage local warehouses for storage and distribution, adopting Temu's "local-to-local" logistics model aimed at optimizing supply chain efficiency and reducing logistics costs.

Temu's Officially Certified Local Warehouses Bolster Merchant Efficiency

To further enhance supply chain security and operational efficiency, Temu will implement a stringent official certification mechanism for third-party warehouses, ensuring standardization in storage, sorting, and distribution. In the South Korean market, warehouse resources of leading local logistics companies such as Hanjin and Seagate are highly favored. Additionally, locally operated warehouses by Chinese enterprises have become key focal points for Temu's supply chain layout due to their localized service advantages and deep understanding of Chinese merchants' needs. Among these, Yunda, based in South Korea, stands out with its competitiveness in local warehousing and logistics distribution, positioning itself as a strong candidate for partnership with Temu.

Last year, Temu merchants began recognizing the potential business opportunities in the South Korean market. However, due to cross-border capital repatriation issues, merchants initially envisioned transferring sales proceeds directly to their Chinese company accounts post-sales in South Korea, which contravened international general trade rules and South Korean tax regulations, rendering it unfeasible.

Currently, to overcome this policy barrier, major overseas enterprises are opting to register local companies in South Korea and enter the South Korean Temu platform through localized operation models, embarking on a new journey of market expansion. This strategic adjustment not only propels Temu's localization process in the South Korean market but also stimulates new demands for industrial chain services, such as assisting Chinese enterprises with company registration, tax planning, and compliant operations in South Korea, emerging as a new growth avenue in the cross-border service sector.

South Korea Market Emerges as a Lucrative Frontier, Temu Closes In On AliExpress

Temu launched in South Korea in July 2023, focusing on overseas shopping, and did not establish its South Korean subsidiary Whaleco Korea until February 2024, without hiring local employees. The potential adjustment of U.S. tariffs has spurred Temu to strengthen its commitment to the South Korean market.

According to Yonhap News Agency, Temu has been recruiting employees for core positions such as HR, general affairs, marketing, and logistics since the end of last year, widely interpreted as "preparing for a direct entry into the South Korean market." Currently, Temu has commenced inviting merchants, mandating them to register as South Korean companies, and will offer services such as 0-1 professional customer team guidance, product selection suggestions, and traffic support. Popular products may also receive additional efficient advertising exposure.

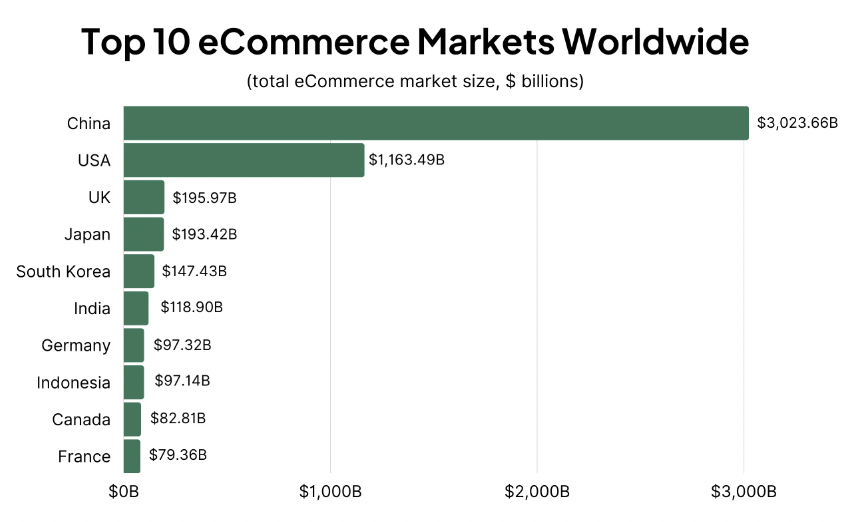

The Allure of the South Korean Market: An Analysis. The South Korean market's appeal can be analyzed from three perspectives: market size, market potential, and consumption structure. According to MobiLoud data, the top five e-commerce markets globally in 2024 are China, the United States, the United Kingdom, Japan, and South Korea. South Korea's e-commerce market sales in 2024 amounted to $147.4 billion (approximately RMB 1.07 trillion), roughly 5% of China's. Considering South Korea's population of approximately 51.32 million and its gross national income (GNI) of approximately $36,000 (approximately RMB 262,100), it underscores the robust purchasing power of the South Korean populace.

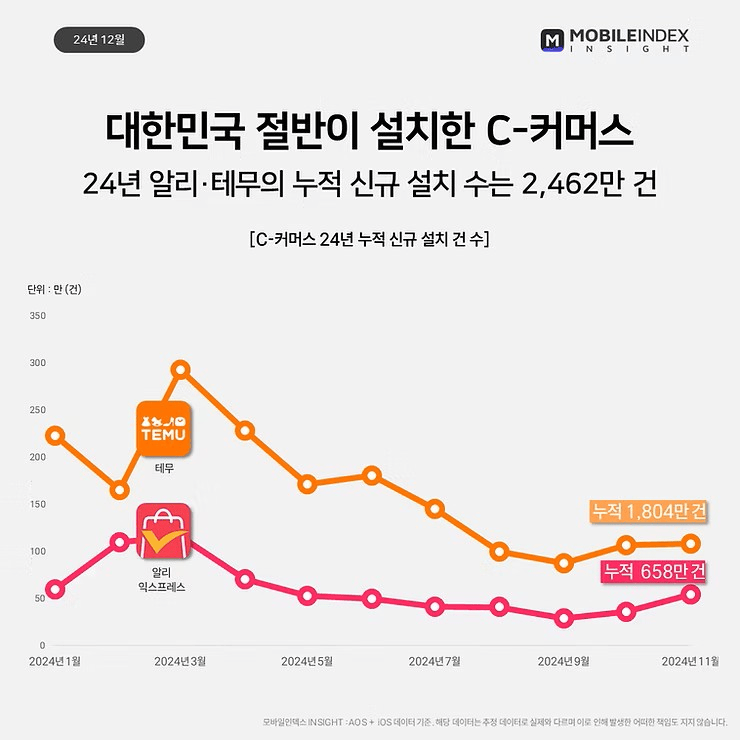

Furthermore, Temu's growth potential in the South Korean market is substantial. According to IGAWorks statistics, from January to November 2024, Temu topped the list of new app downloads across all age groups with 18.04 million downloads, nearly triple that of AliExpress during the same period. The latest data indicates that in January 2025, Temu's monthly active users reached 8.23 million, second only to South Korean local e-commerce giants Coupang and AliExpress.

Additional data reveals that Chinese cross-border e-commerce transactions in South Korea surpassed $2.7 billion (approximately RMB 19.7 billion) in 2024, a year-on-year increase of 85%, with the overall market share rising from 1.64% at the beginning of the year to 4.07%, indicative of a rapid growth trajectory. Notably, the average annual consumption of South Korean users on AliExpress in 2024 was KRW 88,601 (approximately RMB 447.43), while that on Temu was KRW 72,770 (approximately RMB 367.48), signifying a narrowing gap.

Regarding consumption structure, a Statista report highlights that the online shopping rate among users aged 20 to 49 in South Korea exceeds 90%, with those aged 20 to 29 reaching 98%, indicating a high dependence on online shopping among young and middle-aged groups. Among online shopping product categories, in addition to food, takeout, and travel products occupying the top three positions, household appliances & mobile phones (including accessories), clothing, household items, and fast-moving consumer goods closely follow, overlapping with Temu's main product categories.

Given these three factors, the South Korean e-commerce market undeniably holds strong appeal and is a strategic territory for Chinese cross-border e-commerce players. In this turbulent period, the expansion strategies of cross-border e-commerce platforms have evolved, shifting away from blind aggression towards compliance and refined operations.

Chen Yong, founder of Savance and a seasoned marketing expert in brand globalization, opines that in the past, cross-border trade featured numerous small parcels, such as fast fashion clothing and 3C accessories. These products had a vast number of SKUs (Stock Keeping Units), and merchants did not specifically stock them in overseas warehouses but adopted cross-border small parcel direct mail. In the long run, cross-border small parcels pose numerous risks. In this context, building or renting overseas warehouses has emerged as a major trend, with Temu's warehouse construction in South Korea serving as a prime example. "For merchants with overseas stocking capabilities and proficient inventory management and coordination, overseas warehouses will undoubtedly enhance their competitiveness. Because they utilize bulk shipping by sea or air, the cost is actually cheaper than cross-border small parcels," said Chen Yong. Additionally, overseas warehouses offer advantages in returns and exchanges.