Baidu AI: The Irony of Stagnation Amidst Innovation

![]() 02/20 2025

02/20 2025

![]() 449

449

Who reigns supreme in the realm of AI? The answer is unmistakable: DeepSeek.

When pondering this query, Baidu scarcely crosses anyone's mind.

As one of China's pioneering internet giants to venture into AI, the outside world once admired Li Yanhong's unwavering commitment and all-in approach.

Nevertheless, Baidu's business structure failed to undergo fundamental transformation, gradually falling behind after a period of aggressive expansion.

During the 2025 Spring Festival, DeepSeek skyrocketed in popularity, brutally widening the gap between it and Baidu.

Image Source: AI Generated

Conversely, ERNIE Bot's recent popularity pales in comparison to Doubao and Kimi. The embarrassment is not a primary concern; what's more alarming is the company's overall situation.

On February 17, Baidu's Hong Kong stocks plummeted by 6.94%, leading to a market value erosion of nearly HK$20 billion.

On February 18, Baidu released its 2024 financial report, followed by a roughly 2% decline in Hong Kong stocks on the 19th.

Certainly, some media outlets have noted Li Yanhong's evolving stance on open-source large models, transitioning from believing that open-source lacks competitiveness and is an "IQ tax" to the impending open-source release of the ERNIE Bot 4.5 version.

There's no need for skepticism; after all, business adaptation is nothing to be ashamed of.

In Baidu's financial report, the decline in its primary advertising business wasn't overly surprising. But are there any standout achievements in its AI-related endeavors?

01

Clear Trend in Main Business Transformation

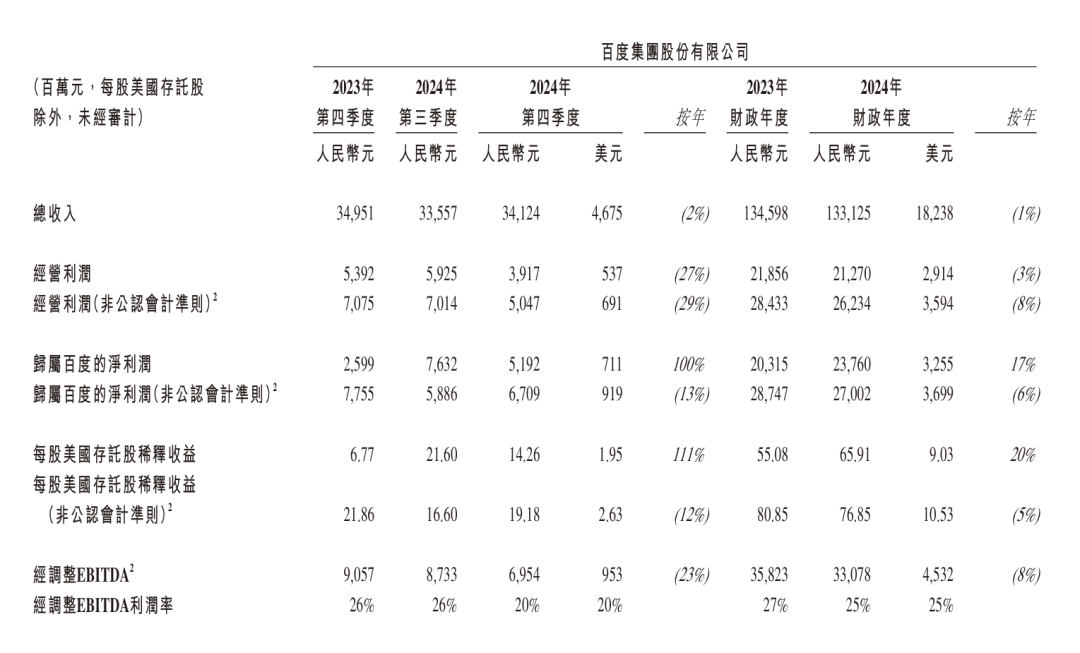

The financial report reveals that Baidu's 2024 revenue amounted to 133.1 billion yuan, marking a year-on-year decrease of 1%. Net profit attributable to shareholders stood at 23.76 billion yuan, a year-on-year increase of 17%.

However, using non-GAAP metrics, it was 27 billion yuan, indicating a year-on-year decline of 6%. Non-GAAP is generally employed to showcase the core financial indicators that the company's management trusts, offering a clearer picture of the company's operational health.

From this perspective, Baidu can be deemed to have had a stagnant 2024.

Among Baidu's core businesses, full-year online marketing revenue totaled 73 billion yuan, a year-on-year decrease of 3%; fourth-quarter online marketing revenue was 17.9 billion yuan, a year-on-year decrease of 7%.

Image Source: Baidu Financial Report

Certainly, the decline in advertising is understandable given the market environment and trends.

According to the "2024 China Internet Advertising Data Report," the internet advertising market witnessed a year-on-year growth rate of 13.55%. Short video, interest e-commerce, and social platform internet advertising revenue accounted for 46.13% of the total.

In contrast, Baidu, heavily reliant on search engine advertising, naturally saw a decline in its online marketing advertising business.

Moreover, there's the looming presence of AI, such as Baidu expanding its AI search territory.

Therefore, there are both passive and active factors at play, and the trend towards transformation and change in Baidu's advertising business is evident.

Non-online marketing annual revenue reached 31.7 billion yuan, a year-on-year increase of 12%; fourth-quarter revenue was 9.8 billion yuan, with a year-on-year increase of up to 18%. This growth was primarily fueled by the intelligent cloud business.

The financial report indicates that in the 2024 large model bidding projects, Baidu Intelligent Cloud led in the number of winning bids, industry coverage, and the number of winning bids from central and state-owned enterprises.

According to IDC data, in 2023, Baidu Intelligent Cloud captured 26.4% of the Chinese AI public cloud service market, ranking first and maintaining this position for five consecutive years.

However, the scenario differs in the broader Chinese public cloud service market. According to the same IDC data, in the first half of 2024, the top five players were Alibaba, Huawei, China Telecom, China Mobile, and Tencent, with these five accounting for 70.1% of the market.

Furthermore, every cloud business is integrating AI, making this market somewhat unpredictable. It remains uncertain whether Baidu Intelligent Cloud can sustain its rapid growth in 2025.

02

Open-Source Large Models Gain Renewed Popularity

On February 11, Li Yanhong attended the World Governments Summit 2025 in the United Arab Emirates and engaged in a dialogue with Omar bin Sultan Al Olama, the UAE's Minister of AI.

Foreigners tend to be more direct in their speech. Omar bin Sultan Al Olama initiated the conversation by asking Li Yanhong, "In your opinion, was the emergence of DeepSeek anticipated?" For this question, the seasoned internet tycoon opted to discuss innovation and steer clear of the topic.

Image Source: Baidu Official Account

In March 2023, Li Yanhong predicted in an interview with the media that China would essentially not witness another OpenAI.

He also stated that it wasn't very meaningful for startups to recreate a ChatGPT, emphasizing that there was no need to reinvent the wheel and that closed-source models would inevitably prevail over open-source models.

At the Baidu AI Developer Conference in April 2024, Li Yanhong reiterated that in the realm of large models, open-source is actually the most costly approach, and open-source models tend to become increasingly outdated.

At the World Artificial Intelligence Conference in July 2024, Li Yanhong argued that for an open-source model to match the capabilities of a closed-source one, it requires a larger parameter scale, which translates to higher inference costs and slower response speeds. In a fiercely competitive commercial environment, to achieve higher business efficiency and lower costs than peers, commercial closed-source models are the "most capable."

However, with the burgeoning popularity of the open-source large model DeepSeek, Baidu's strategy has shifted.

Li Yanhong stated during a recent earnings call that the ERNIE Bot 4.5 would be open-sourced, a decision rooted in confidence in technological leadership and aimed at further promoting the widespread application of ERNIE Bot.

Such a dramatic reversal of stance necessitates quoting a renowned saying from Mr. Luo Yonghao: "At every stage of life, he said what he believed in, so what do you want him to do?"

The primary reason behind this shift is that the evolution speed of Baidu AI hasn't kept pace with the industry's iteration speed.

The financial report shows that in December 2024, the daily average API call volume of the ERNIE series models reached 1.65 billion times, with an increase of 178% in external API call volume; the monthly active users of Baidu Wenku's AI functions reached 94 million, a year-on-year increase of 216%.

While these results are impressive, according to research firm QuestMobile data, in December 2024, among AIGC applications in China, Doubao, Kimi, and Wenxiaoyan ranked top in monthly active users, with 75.23 million, 21.01 million, and 12.24 million, respectively; in 2024, these three apps exhibited compound growth rates of 21.2%, 69.4%, and 4.7%, respectively.

Even the once-popular Kimi is now under immense pressure, let alone the others.

Currently, Tencent, Alibaba, government agencies, and others have embraced DeepSeek, and even Baidu itself has done so.

Catching up in 2025 won't be an easy feat, and it's hoped that this 180-degree turn towards open-source can prove beneficial.

03

Robotaxi: A Promising Venture

The future of autonomous taxis remains promising, with plenty of stories yet to be told.

According to a 2022 forecast by CICC, the global Robotaxi market space is expected to reach $2.44 trillion by 2030.

International consulting firm Frost & Sullivan predicts that the penetration rate of autonomous driving at level 4 and above in China is anticipated to reach 9.5% by 2030, with the Robotaxi market size expected to hit 488.8 billion yuan.

Baidu's financial report reveals that in the fourth quarter of 2024, Apollo Go's autonomous driving orders surpassed 1.1 million, a year-on-year increase of 36%; in January 2025, the total order volume exceeded 9 million, and at the end of last year, it was the sole company to obtain autonomous driving test licenses on open roads in Hong Kong.

Currently, Apollo Go has achieved 100% fully autonomous driving nationwide.

In mid-2024, Baidu stated that by the end of 2024, Apollo Go would achieve break-even in Wuhan and enter a period of comprehensive profitability in 2025.

Currently, Baidu hasn't mentioned the achievement of break-even for Apollo Go, and it's unclear whether the comprehensive profitability target for 2025 can be met as planned.

Image Source: Apollo Go Official Account

It's worth noting that Baidu's fourth-quarter financial report included a one-time loss of up to 1 billion yuan, estimated to be due to the collapse of Geyue Motors.

As Baidu's only C-end product for autonomous driving, and with Baidu being a major shareholder, it eventually had to clean up the mess alongside another shareholder, Geely.

During the earnings conference, Li Yanhong mentioned that 2025 would be a pivotal year of expansion for Apollo Go, seeking more partners to accelerate business expansion.

Baidu embarked on its driverless car layout in 2013, earlier than NIO, XPeng, and Li Auto; in 2017, it launched the Apollo platform, boasting 50 initial partners, including 13 Chinese automakers and two global automakers, Ford and Daimler.

Ultimately, only Geyue, a collaboration with Geely, reached the commercialization stage. The first batch of Geyue 01 was mass-produced in September 2023, but it too has now faltered.

For years, Baidu has been striving to diversify beyond its advertising business, with most investments encountering considerable hurdles. Some directions hold great promise, but it often seems that Baidu starts early but finishes late.

Li Yanhong stated in the 2024 financial report, "2024 was a crucial year for us to transition from being internet-centric to being AI-led."

Following this pivotal year, Baidu still needs to stay competitive in this crucial AI battle.