Manycore Tech Inc. Rushes to List on Hong Kong Stock Exchange Ahead of DeepSeek

![]() 02/18 2025

02/18 2025

![]() 451

451

Source | Yuan Mei Hui

The leading third-party player in the home furnishing industry is poised for a public offering.

Recently, Manycore Tech Inc., renowned alongside DeepSeek and Unitree Robotics as one of the "Hangzhou Six Little Dragons," officially submitted an IPO application to the Hong Kong Stock Exchange, aiming to become the "first global spatial intelligence stock." Notably, Manycore Tech Inc. is the sole member of the "Hangzhou Six Little Dragons" currently in the race to go public.

The prospectus reveals that Manycore Tech Inc.'s core offering is "Kuajiale," a SaaS software built on CAD tools. According to official website data, the Kuajiale platform has collaborated with over 32,000 branded merchants, with home furnishing large-client enterprises comprising the largest share of its current business.

"In the home furnishing industry, Kuajiale stands out as the most successful and prominent third-party player. Regardless of the niche within the sector, almost everyone has either used or heard of it. Numerous enterprises have been paying for its services for a significant period," shared an insider with Yuan Mei Hui.

Kuajiale's appeal to various home furnishing enterprises largely stems from its ability to significantly lower the design threshold. Through its intuitive design and selection features, it has effectively aided stores in customer acquisition and order promotion.

Despite possessing a vast user base and high-margin products, Manycore Tech Inc. has yet to turn a profit.

01

R&D Expenses Exceed 60%

Founded in 2011 by Huang Xiaohuang, Chen Hang, and Zhu Hao, Manycore Tech Inc. boasts a strong technical background. All three co-founders hold master's degrees in computer science from the University of Illinois at Urbana-Champaign (UIUC) in the United States and have worked for globally renowned companies such as NVIDIA, Microsoft, and Amazon, accumulating extensive technical expertise.

In the early stages of their venture, the founding team chose the direction of "using GPUs for rapid rendering of graphics and images in the cloud" and identified the decoration industry as their entry point, paving the way for significant growth.

In 2013, Manycore Tech Inc. launched its flagship product Kuajiale, which swiftly gained market recognition and emerged as a leading enterprise in the field of space design software.

In 2021, Manycore Tech Inc. attempted a US listing but was unsuccessful. Subsequently, the real estate market turmoil caused the entire home furnishing market to stagnate. However, as a third-party player, Manycore Tech Inc.'s performance defied the trend and showed growth.

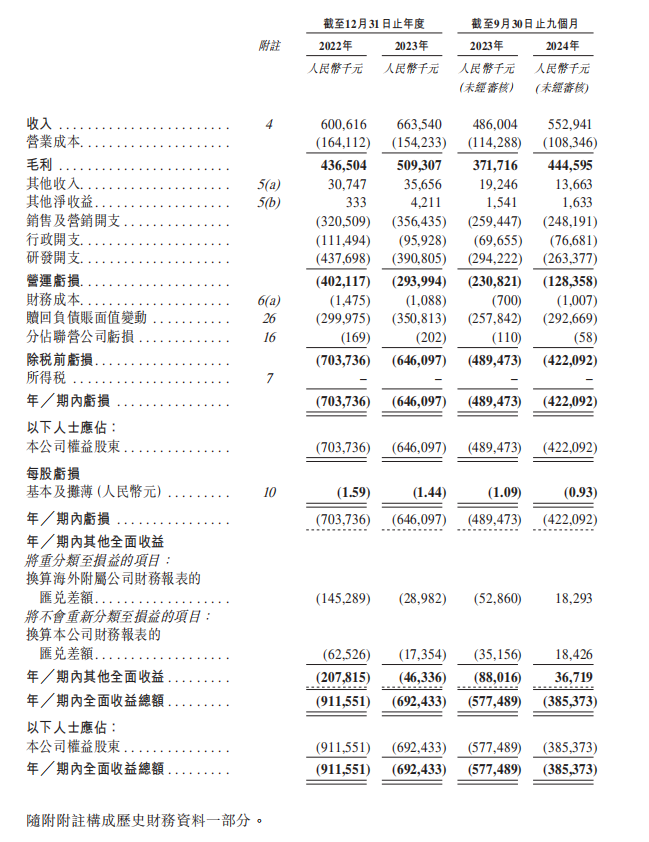

Data indicates that from 2022 to the first three quarters of 2024 (hereinafter referred to as the "reporting period"), Manycore Tech Inc. achieved revenues of RMB 601 million, RMB 664 million, and RMB 553 million, respectively, with gross profit margins of 72.7%, 76.8%, and 80.4%, respectively, showing an overall upward trend.

Image source: Manycore Tech Inc. prospectus

Despite the increase in revenue and gross profit margin, profitability remains elusive. During the reporting period, Manycore Tech Inc. incurred losses of RMB 704 million, RMB 646 million, and RMB 422 million, respectively, totaling RMB 1.772 billion.

Manycore Tech Inc. attributes these losses to high R&D expenses. For instance, during the reporting period, the company's cumulative R&D expenses amounted to approximately RMB 1.1 billion, accounting for roughly 60.51% of revenue.

Unlike DeepSeek, which is "not short of money," Manycore Tech Inc., which has yet to achieve profitability, now hopes to secure future development through listing and financing, leading to the submission of its prospectus to the Hong Kong Stock Exchange, as mentioned earlier.

02

Backed by Xiaomi, Hillhouse Capital, and Others

From a market potential perspective, Manycore Tech Inc. boasts broad business prospects.

Data suggests that by 2028, the global market for spatial design and visualization software, where Manycore Tech Inc. operates, will reach RMB 819.5 billion. With the rapid development of AI, AR/VR, robotics, and other technologies, its SpatialVerse platform is anticipated to achieve commercialization in an even wider array of fields.

In terms of market share, Frost & Sullivan data indicates that in 2023, Manycore Tech Inc. occupied approximately 22.2% of the Chinese spatial design software market, ranking first.

Image source: company announcement

Thanks to its impressive market performance, Manycore Tech Inc. has garnered the support of numerous capital investors. According to Tianyancha, from 2013 to the end of 2021, Manycore Tech Inc. completed a total of 8 rounds of financing, involving renowned investors such as Shunwei Capital, Hillhouse Capital, IDG Capital, and Matrix Partners China. Notably, Shunwei Capital is also a member of the Xiaomi ecosystem.

Having firmly established its domestic market share, Manycore Tech Inc. has set its sights on overseas markets. The prospectus indicates that the funds raised from this Hong Kong listing will primarily be used for international expansion strategies, brand promotion, and other purposes.

It is evident that expanding into overseas markets is one of the primary reasons behind Manycore Tech Inc.'s decision to list in Hong Kong.

Currently, Manycore Tech Inc., which has yet to achieve profitability, has chosen to go public at this juncture. If losses persist or technology commercialization falls short of expectations in the future, it could adversely impact market sentiment. Additionally, challenges such as competitive pressure from international giants and liquidity risks associated with high-valuation targets introduce uncertainties to its listing.

Regarding questions on how to turn around losses, Yuan Mei Hui sent a letter to Manycore Tech Inc. As of press time, no response had been received.

Some images are sourced from the internet. Please inform us of any infringement for prompt removal.