China's First-Quarter GDP Results Unveiled: Assessing the Foreign Trade Dependency of Its 31 Provinces

![]() 04/29 2025

04/29 2025

![]() 395

395

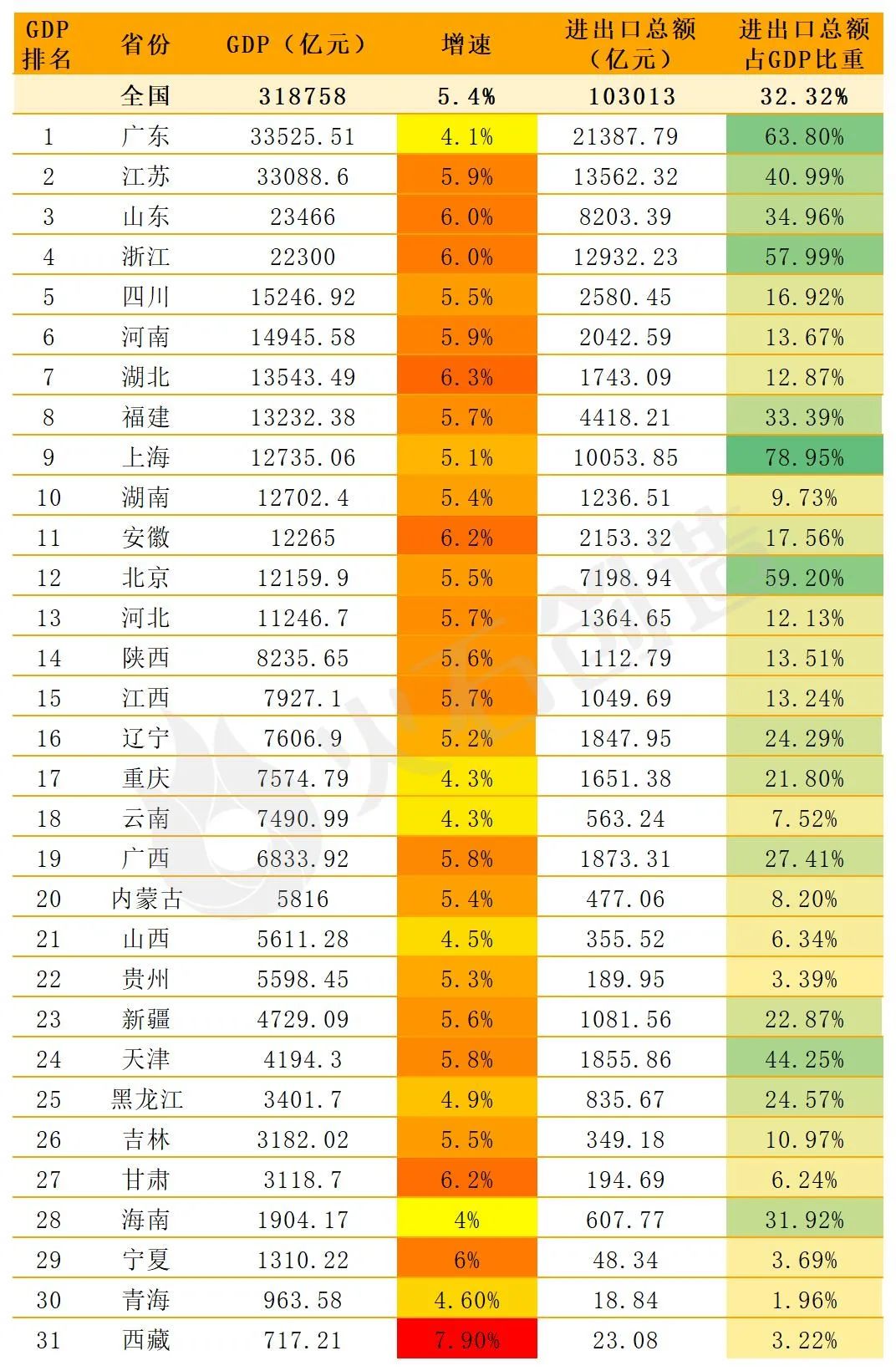

China's GDP for the first quarter stood at 31.8758 trillion yuan, marking a 5.4% year-on-year increase at constant prices. Across provinces, economic development was generally robust, with nearly 90% of them reporting faster growth compared to the entire previous year. Notably, 20 provinces achieved GDP growth rates at or above the national average of 5.4%.

Import and export are crucial economic indicators in China, with exports forming a pivotal part of the "three troikas" driving the country's economic growth. In the first quarter of 2025, the total value of goods import and export amounted to 10.3013 trillion yuan, a 1.3% year-on-year increase. Exports totaled 6.1314 trillion yuan, up 6.9%, while imports were 4.17 trillion yuan, down 6.0%. Amidst a complex and evolving global trade landscape, the stable growth in import and export was a significant contributor to the strong start of the national economy.

01

Provincial Foreign Trade Dependency

The ratio of total import and export trade volume to GDP, known as the "Foreign Trade Dependency Ratio," illustrates the impact and degree to which a region's economic development relies on its foreign trade activities.

In the first quarter, China's import and export volume accounted for approximately 32.32% of GDP. The following table summarizes the GDP and foreign trade dependency ratios of each province for the same period:

Table: GDP and Foreign Trade Dependency Ratio of 31 Provinces in the First Quarter

Source: General Administration of Customs, Firestone Creation Industrial Data Center. The degree of foreign trade dependency varies significantly among provinces due to factors such as geographical location, industrial base, and resource endowment.

Ultra-High Dependence (>50%): Shanghai (78.95%), Guangdong (63.80%), Beijing (59.20%), Zhejiang (57.99%). These economically robust provinces (or cities) have foreign trade dependency ratios far surpassing the national average, serving as benchmarks for export-oriented economies.

High Dependence (30%-50%): Tianjin (44.25%), Jiangsu (40.99%), Shandong (34.96%), Fujian (33.39%), Hainan (31.92%).

Medium Dependence (15%-30%): Liaoning (24.29%), Heilongjiang (24.57%), Xinjiang (22.87%), Chongqing (21.80%), Guangxi (27.41%).

From the perspective of final demand driving economic growth, the degree of foreign trade dependency also reflects a region's outward orientation. Overall, China's economic openness exhibits a dual structure of "extremely high along the coast and lower in the interior," with a 77-percentage-point difference between Shanghai, the most dependent, and Qinghai, the least. This underscores the importance of optimizing regional openness layouts and accelerating the formation of a comprehensive openness pattern featuring land-sea linkage and mutual support between the east and west.

02

Import and Export Situation of Major Foreign Trade Provinces

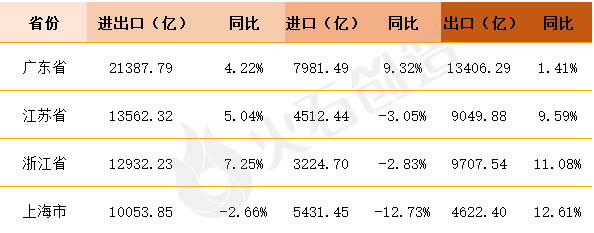

In terms of total import and export volume, Guangdong, Jiangsu, Zhejiang, and Shanghai ranked among the top four provinces in the first quarter, collectively accounting for 56.2% of the national total.

Table: Top 4 Provinces in Total Foreign Trade in the First Quarter

Source: General Administration of Customs, Firestone Creation Industrial Data Center. Guangdong led the pack with 2.14 trillion yuan, accounting for over 20% of the national total and increasing by 4.2% year-on-year. The nine cities in the Guangdong-Hong Kong-Macao Greater Bay Area recorded a total foreign trade value of 2.06 trillion yuan, up 4.7% year-on-year, contributing 96.2% to Guangdong's overall import and export value. Exports of computers and parts, electrical equipment, and household appliances performed strongly, while electric vehicles, motorcycles, and ships witnessed rapid growth.

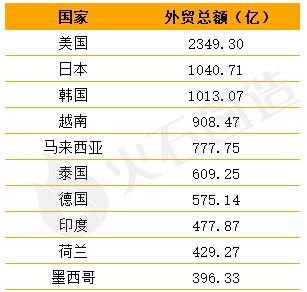

Table: Top 10 Trading Partners of Guangdong Province in the First Quarter

Source: General Administration of Customs, Firestone Creation Industrial Data Center. Jiangsu Province reported a total trade in goods of 1.36 trillion yuan, a 5% year-on-year increase, accounting for 13.2% of China's total import and export value. Exports amounted to 904.99 billion yuan, up 9.6%, while imports were 451.24 billion yuan, down 3%. Jiangsu's export competitiveness in high-end manufacturing (such as new energy, integrated circuits, and biopharmaceuticals) has surged, propelling high-value-added products into global markets.

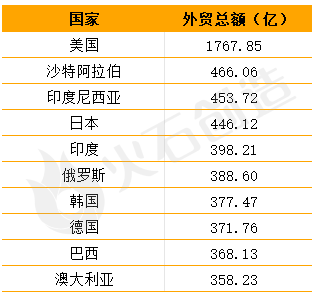

Table: Top 10 Trading Partners of Jiangsu Province in the First Quarter

Source: General Administration of Customs, Firestone Creation Industrial Data Center. Zhejiang Province's foreign trade import and export reached 1.29 trillion yuan, a 7.25% year-on-year increase, contributing 66.4% to national growth, ranking first nationwide. Private enterprises accounted for 1.05 trillion yuan in total import and export, up 8.4% year-on-year, comprising 81.1% of the province's total. Exports grew by 11%, driven by a 6.3-percentage-point increase from electromechanical products.

Table: Top 10 Trading Partners of Zhejiang Province in the First Quarter

Source: General Administration of Customs, Firestone Creation Industrial Data Center. Shanghai's total import and export value stood at 1.01 trillion yuan, a 2.66% decrease compared to the same period last year. Exports totaled 462.24 billion yuan, up 12.6%, but imports declined significantly year-on-year. Private enterprises in Shanghai expanded their import and export scale, leading in growth rates and becoming a crucial engine for the city's foreign trade development, with import and export reaching 377.22 billion yuan, up 20.1%. Notable growth was observed in exports of electronic products, general machinery and equipment, electrical control devices, wires and cables, as well as pharmaceuticals and medical devices.

Table: Top 10 Trading Partners of Shanghai in the First Quarter

Source: General Administration of Customs, Firestone Creation Industrial Data Center. Overall, the export performance in the first quarter was impressive. Despite tariff barriers, the high degree of dependency for some provinces reflects their export-oriented economy but also exposes them to risks of industrial chain transfer. Moving forward, it is imperative to foster a dual-wheel drive of openness and domestic demand through differentiated policies, strengthen the resilience of industrial and supply chains, and achieve high-quality development. From a regional openness perspective, leveraging the comparative advantages of various regions, creating diverse open highlands, and promoting coordinated openness between the interior and the coast remain crucial in establishing a new pattern of high-level openness to the outside world.

—END—

Author | Firestone Creation Weng Jianping

Reviewer | Firestone Creation Yin Li