From 'Autonomous Driving' to 'Assisted Driving': The 2025 Shanghai Auto Show Showcases a Pragmatic Shift in Technology Deployment

![]() 04/29 2025

04/29 2025

![]() 480

480

In 2025, the National Exhibition and Convention Center in Shanghai once again emerged as the epicenter of the global automotive industry. As the spotlight of the Shanghai Auto Show fell upon exhibition vehicles equipped with state-of-the-art intelligent driving assistance systems, industry insiders privy to the enterprises' strategies detected a subtle yet significant shift: automakers are transitioning their narrative from 'disruptive innovation' to 'pragmatic evolution'.

Huawei's ADS 3.0 underscores 'systematic safety redundancy design,' while NIO's NOP+ introduces 'full-scenario assisted driving subscription levels.' This collective shift in discourse serves as a prism, reflecting the profound transformation underway in China's new energy vehicle market, driven by the intertwined forces of policy, demand, and technology. It signifies a move away from technological gimmicks towards value essence, from disruptive narratives to systematic reconstruction—a silent industry revolution in progress.

▍From Unchecked Growth to Rule Redefinition

Over the past five years, China's intelligent assisted driving sector has witnessed a period of near-unchecked expansion. Automakers employed marketing buzzwords such as 'comparable to L4 autonomous driving,' 'hands-free in all scenarios,' and 'sleep in the car and arrive at your destination' to indoctrinate consumers. Simultaneously, local governments vied to open test roads, and capital flooded into 'unmanned delivery' and 'vehicle-road coordination.' For a time, it seemed that the era of 'universal intelligent driving' was imminent.

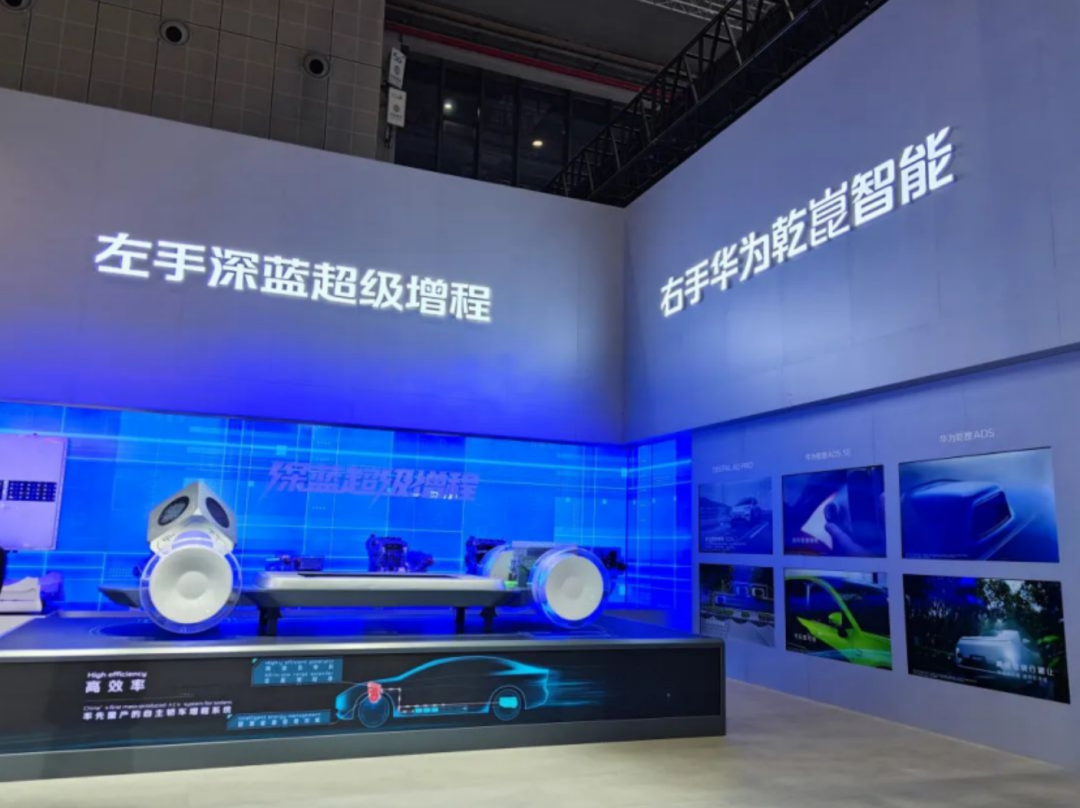

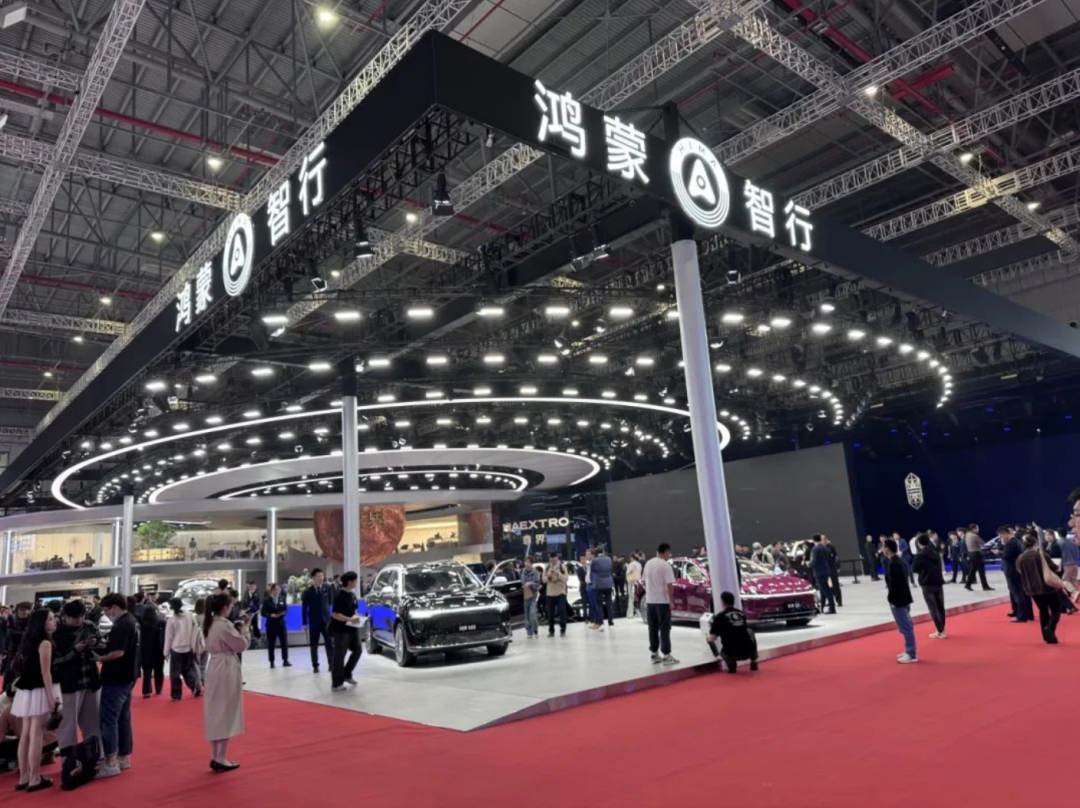

However, recent policy introductions and tightened regulations have compelled automakers to adjust their technical pathways. At the 2025 Shanghai Auto Show, many companies proactively shifted their promotional focus from 'steering wheel removal' to 'safety redundancy.' Despite Huawei's Qiankun ADS 4.0 system claiming 'conditions for mass production,' it prioritized showcasing its millimeter-wave radar redundancy design and emphasizing AEB (Automatic Emergency Braking) performance in extreme weather at the show, rather than full autonomous driving capabilities. NIO, through its 'Infinity Mode' pilot, limited the assisted driving function in mapless areas to a small-scale user test to avoid overpromising.

Under the rigid constraints of policy, 'safety' has supplanted 'aggressiveness' as the core of the technology narrative. Johann Wieland, BMW Group's board member responsible for customer, brand, and sales business, echoed this sentiment, stating, 'For BMW, if we must prioritize between the feeling of highly automated driving and the guarantee of safe driving, safe driving must be paramount.'

Notably, the Ministry of Industry and Information Technology recently explicitly prohibited companies from using misleading terms like 'autonomous driving' and 'driverless driving.' This signals a forced realignment of the industry's discourse system within regulatory bounds.

Another significant change under regulatory pressure is the surge in test and validation costs. A leading emerging force engineer revealed to Auto Market Insight that merely to meet the new requirement of 'extreme scenario coverage,' their test team needed to collect tens of millions of additional kilometers of road test data, directly leading to the exit of small and medium-sized players from the competition. According to incomplete statistics, seven autonomous driving technology companies ceased operations in the second half of 2024. As the boundaries between policy red lines and technical capabilities become clearly defined, industry reshuffling presents an unprecedented level of severity.

▍From Technology Adoration to Value Reevaluation

Early intelligent assisted driving marketed 'hands-free' as its main selling point, but frequent system misjudgments and inadequate high-precision map coverage in practical use gradually eroded user trust. If the past competition in intelligent driving technology was a race dominated by engineers' thinking, today's consumers are voting with their wallets, reshaping market logic.

This rational return of demand stems from the collision of two forces. Firstly, the continuous exposure of real accident cases has heightened consumers' awareness of technological limitations. Recent major accidents caused by assisted driving have exacerbated consumer distrust.

Secondly, in today's environment, users are increasingly considering the frequency and cost of using intelligent assisted driving. A car owner's forum post is illustrative: 'Spending 40,000 yuan to install advanced intelligent driving is not as beneficial as buying two more years of insurance.' Behind this meticulous calculation lies a shift in automobile consumption from 'performance adoration' to 'pragmatism.'

Automakers have likewise received these signals. In exhibition booths, indicators such as 'scenario coverage' and 'takeover frequency' have replaced traditional parameters like computing power and pixels. Automakers are no longer striving for 'full road coverage' but are focusing on high-frequency usage scenarios. AITO's M8's Huawei ADS 3.0 system optimizes following logic and ramp merging efficiency in urban congested road segments through multi-sensor fusion. Buick's L2 urban-area assisted driving technology, in collaboration with Momenta, enhances intersection negotiation capabilities through an end-to-end large model architecture.

Li Auto's i8's 5C super-fast charging technology leverages '400 kilometers of range in 10 minutes' as its core selling point, directly addressing users' range anxiety pain points. Marelli's pixel taillights enhance road communication efficiency through dynamic interaction design, transforming technology into tangible safety value.

The trend towards 'de-autonomous driving' at the 2025 Shanghai Auto Show will not halt the technological research and development of intelligent assisted driving but rather usher this technology into a period of calm following rapid development. The rigid constraints of policy regulation, the rational awakening of user demand, and the value reevaluation of technology deployment collectively drive the industry to return to the original intention of safe technology research and development. In the future, as 'assisted driving' becomes the norm, what determines success may no longer be the stacking of parameters. Instead, core competitiveness will hinge on whether it can be accomplished within the policy framework, with the user at the center, transforming from a 'technology show' to a 'travel partner' worthy of user trust.

Typesetting 丨 Yang Shuo